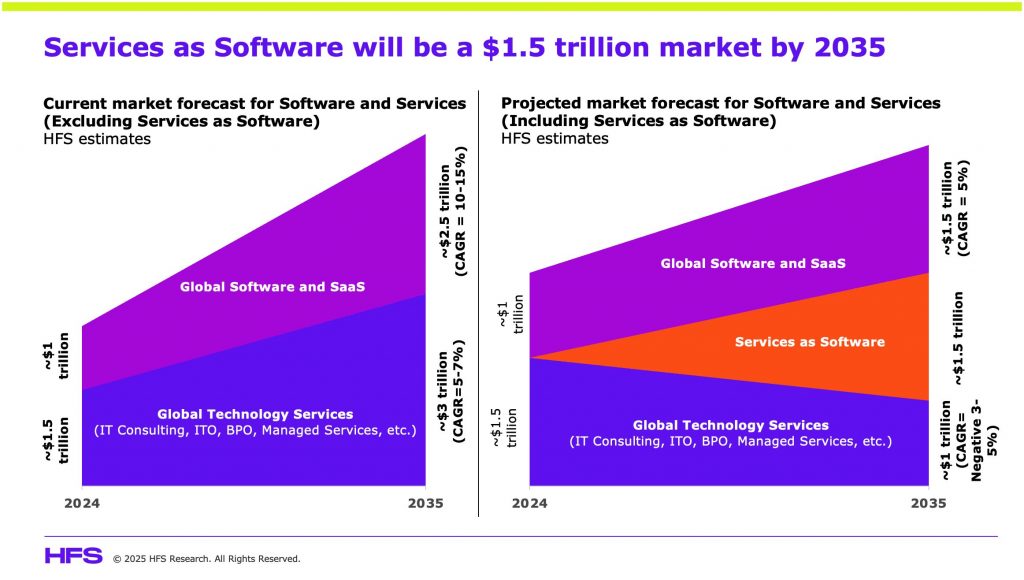

As speculation of a Capgemini takeover of WNS heats up, you have to question the future of BPO specialist firms as the worlds of services and software continue to blend together in this rapidly emerging $1.5 trillion market, which HFS last year termed “Services-as-Software”.

It’s been years since there has been such a significant merger of services at this scale, in fact, you have to look back exactly a decade to the Capgemini acquisition of iGATE to compare a services marriage at this scale and market impact. However, this potential acquisition is different as it represents a BPO powerhouse adding significant process domain and scale to one of the major IT services firms, which would boast one of the largest BPO portfolios in the industry, estimated at more than $3.5 billion.

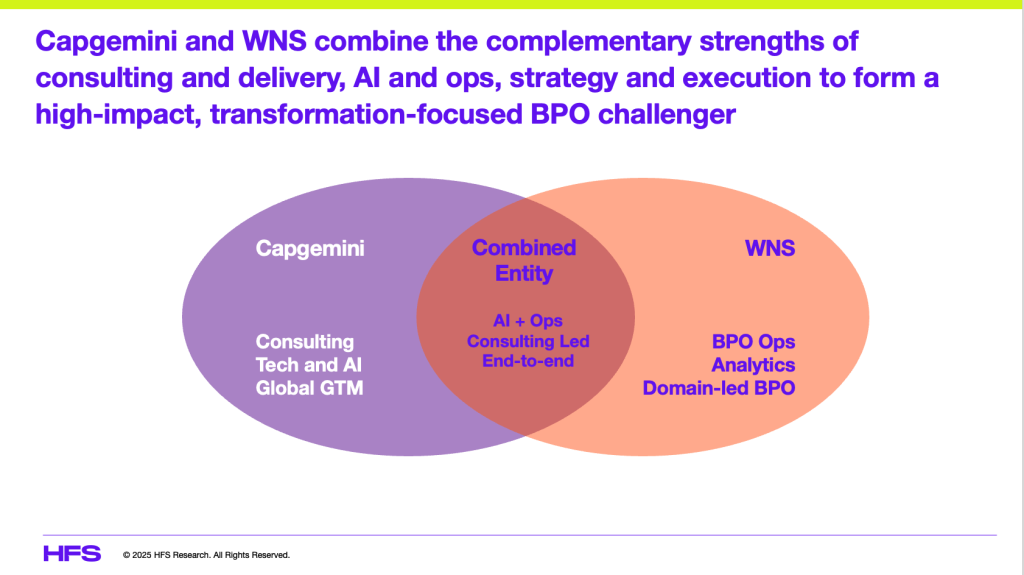

With Capgemini’s sheer global scale and depth of technical capabilities, the addition of WNS could create an ideal incubation business to develop leading-edge Services-as-Software solutions to attack this huge emerging marketing opportunity:

Enterprises’ adoption of Generative and Agentic AI solutions eliminates manual efforts, which threatens the revenues of pure-play BPO companies.

However, the technical sophistication required to deploy enterprise-class Services-as-Software requires substantial technology expertise not traditionally found among BPO specialists.

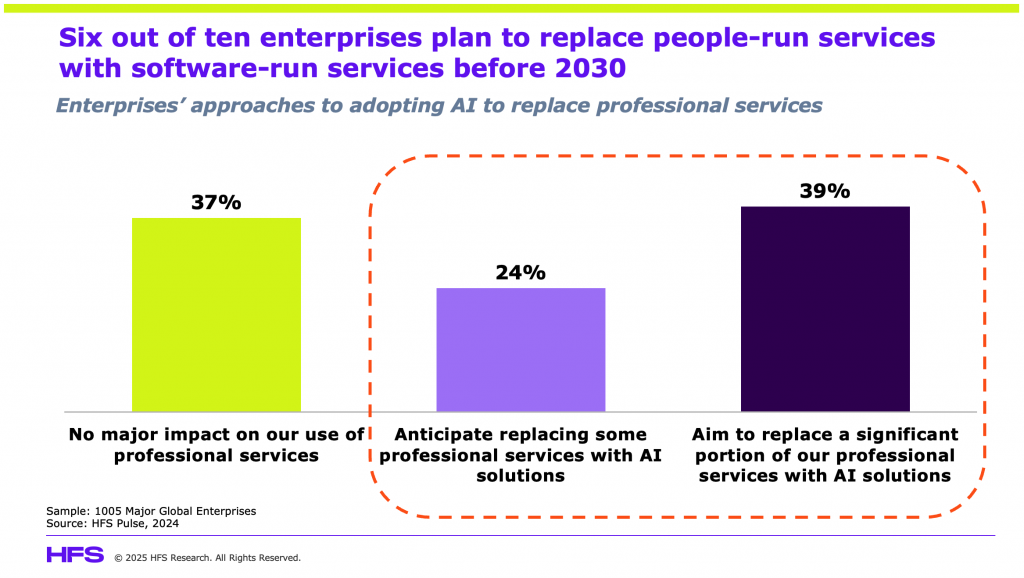

Enterprise appetite for pure-play BPO solutions is rapidly waning as enterprises advance Services-as-Service agendas with lesser dependency on armies of people to execute processes. Our recent research of over 1000 major enterprises already shows 6-out-of-10 enterprises expect to replace professional services with AI-driven solutions over the next five years:

Likely seeing the strengthening preference for technology-centric solutions over cheap “butts-in-seats”, WNS’s potential purchase by Capgemini provides shareholders with a perfectly timed exit. In turn, Capgemini acquires WNS’s deep vertical process experience and the ability to mine WNS’s vast client base for sales opportunities focused on buyers’ strongest preference: replacing BPO solutions with Services-as-Software, one of Capgemini’s emerging strengths.

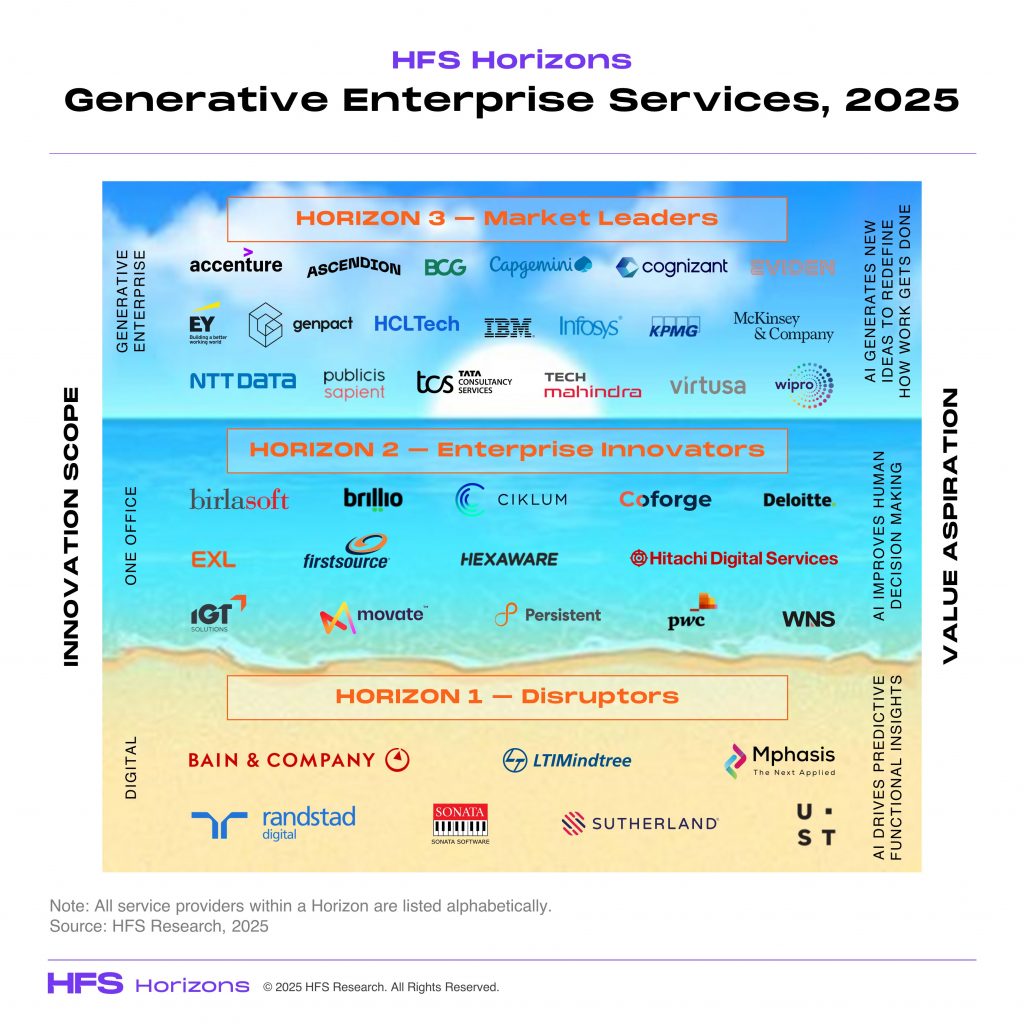

Extending Capgemini’s class-leading Generative Enterprise capabilities

Capgemini has always stood out for its global consulting capabilities, and it strengthened its US presence and technology capabilities with its 2015 $4B acquisition of iGATE. Since then, Capgemini’s technology leadership has accelerated. In 2023, Capgemini announced a 3-year €2B investment in AI capabilities, leading to the development of the Reliable AI Solution Engineering (RAISE) operational accelerator, IDEA, and the “Trusted AI framework” for the industrialization of GenAI projects. In 2022, 2023, and 2024, Capgemini acquired Quantmetry, BTC, and Syniti, respectively, to bolster its AI and data capabilities. Further, Capgemini built class-leading ecosystem relationships with hyperscalers, data management firms, and AI-specific companies (like Mistral AI and Liquid AI). By early 2025, these capabilities had won the firm 350+ projects with large enterprise customers spanning all major industries. HFS Research placed Capgemini squarely in the Horizon 3 tier in our 2025 Generative Enterprise Horizon study:

Yet, winning new enterprise customers in a tightly competitive market has become more competitive and challenging. Business process expertise is required to fully implement Services-as-Software capabilities. Thus, Capgemini’s potential acquisition of WNS is focused on two key strategic factors: WNS’s vast industry-specific process experience and the opportunity to mine WNS’s piles of legacy BPO deals that enterprise leaders want to convert into Services-as-Software.

WNS offers enterprises deep domain expertise and operational excellence

WNS is a clear leader in providing domain-specialized BPO services, with crown jewels in BFS, insurance, healthcare, TMT, procurement, F&A, and travel and hospitality, leading to a $1.3B BPO client portfolio mix of large and medium-sized clients. Enterprise customers laud WNS’s flexibility and creative commercial contracts that align innovation incentives, and clients have confirmed WNS soundly delivers on its skin-in-the-game promises. That said, WNS’s advancements in Generative AI have not been as substantial as those of other competitors. While it has invested in 80+ AI assets and partnerships, its capabilities only earned it a Horizon 2 rating in our 2025 Generative AI Horizon (see above). As a largely BPO-centric firm, WNS’s technology and Generative AI capabilities just aren’t as deep as those of other companies.

To a firm like Capgemini, WNS’s high-quality client base is a gold mine of sales opportunities: client operations executives who want to replace BPO services with Services-as-Software. Further, WNS’s deep domain expertise, the cornerstone of its client growth rate, provides Capgemini, which has historically lagged behind other companies in terms of domain-specific operational BPO delivery, with both a vast BPO capability and thousands of industry business process experts that can be teamed with its consulting and technology staff to deliver next-generation client solutions.

Capgemini + WNS Would Be More than the Biggest IT + BPO deal in a decade

At $1.3B in revenue, Capgemini’s potential acquisition of WNS would result in a paltry 5% increase in Capgemini’s $25.5B business. Yet, the total headcount increase of the combined entity is a whopping 19% – which speaks to the underlying manual nature of WNS’s client-base. Capgemini’s industry-leading consulting teams will have the opportunity to mine WNS’s clients for transformational opportunities while also leveraging WNS’s class-leading process domain expertise to expand Capgemini’s largely consulting and technology-centric client base to operational capabilities clients, where clients are focused on slashing people-centric costs and improving process outputs through technology-centric solutions. It’s an AI + Operations win-win for the collective client base of both firms, positioning Capgemini as the incumbent for hundreds of operations clients looking for Services-as-Software solutions.

From a competitive perspective, another potential big win for Capgemini is its new positioning against the Big 4 (Deloitte, PwC, EY, and KPMG), which have traditionally dominated consulting and technology services. With WNS’s operational expertise integrated into its offerings, Capgemini could deliver end-to-end transformation services that the Big 4 cannot – and at lower price points.

In some cases, like procurement services, Capgemini acquires a well-established strategic sourcing capability built on WNS’s 2017 Denali acquisition, strengthening Capgemini’s F&A and procurement capabilities. Finally, WNS’s North American and UK-centric client base allows Capgemini to expand its geographic footprint.

Can pure-play BPO players take on consulting-led, technology-centric transformations?

The potential of a Capgemini acquisition of WNS also highlights the challenge all pure-play heritage BPO providers have: can BPO-centric providers, like Genpact and EXL, take on the Services-as-Software transition? Lacking deep consulting and technology chops of Capgemini, Accenture, IBM, and the Big 4, how can companies lacking best-in-class capabilities win the hearts and minds of enterprise customers hell-bent on slashing operating costs through Services-as-Software capabilities?

The big deals of the future won’t be focused on 500-1000 seat ITO and BPO deals. Rather, the enterprises’ focus on real transformation will force service providers to come to the table with deeper skills and capabilities than ever before. This may leave traditional BPO companies picking up smaller BPO-centric deals while losing their larger client base, which is making a dramatic shift towards Generative and Agentic AI solutions.

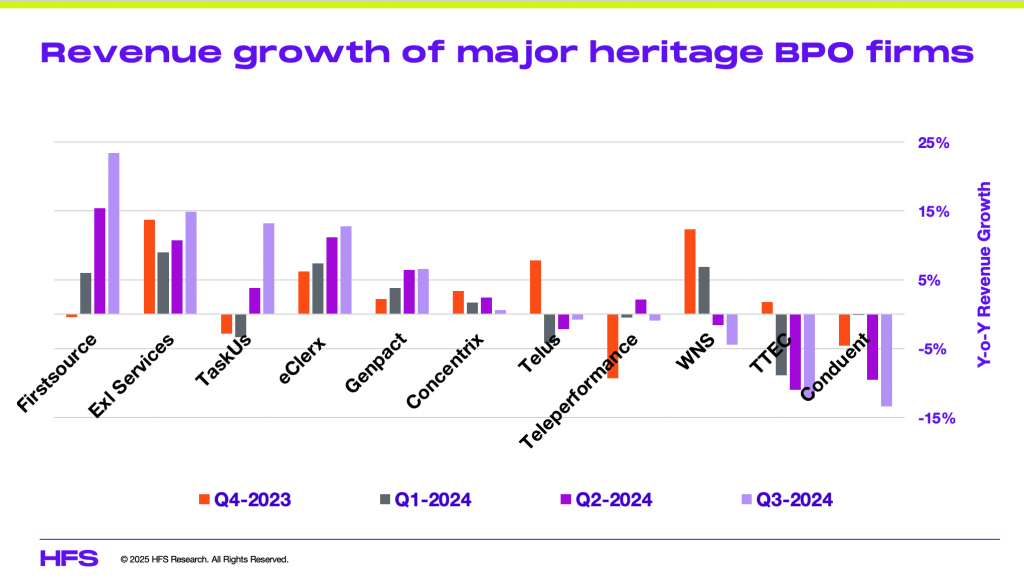

As the following chart exhibits, only a handful of these heritage BPO firms are continuing to operate in growth scenarios and desperately need to reinvent themselves to evolve in the Services-as-Software era:

WNS’s evaluation of a strategic exit may be the dying canary in the coal mine, announcing the death of BPO-centric deals and pressure from existing clients at renewal time on true transformation. Given the shift in demand, their potential valuation may never be higher, which may put yet more pressure on BPO pure plays.

The Bottom Line: Capgemini + WNS is a bold statement about enterprise demand shifting from FTEs to Services-as-Software, creating a combined entity that could compete on an equal footing with Accenture and outcompete the Big 4.

The Capgemini-WNS acquisition is a pivotal opportunity to lead the shift to Services-as-Software. By combining consulting, technology, and domain-driven BPO, Capgemini + WNS has the potential to lead AI-powered business transformation, with a robust incumbent WNS client base hungry to replace FTEs with technology solutions.

If Capgemini succeeds, it will send a chilling message to the BPO market: without consulting and technology capabilities, you’ll be left picking up table scraps. And to the Big 4, Capgemini sends a message of operational savviness and incumbent positioning that the Big 4 simply don’t have.

Posted in : Agentic AI, Analytics and Big Data, Artificial Intelligence, Automation, Business Process Outsourcing (BPO), GenAI, Generative Enterprise, IT Outsourcing / IT Services, OneOffice, Services-as-Software