The residential mortgage services market is one of the most established and competitive segments of the global BPO industry. Most of the major service providers have been in this market for a considerable time providing services across the process chain of mortgage origination, mortgage servicing and the (sadly more significant these days) area of loan default and foreclosure management.

It used to be that most service providers were simply providing domestic or offshored labor to augment the capacity needs of the large lenders, but that old operating model is being changed as a result of the consequences of what happened to our global economies post 2008 – and especially in the US. Whereas before the crash the entire mortgage industry was going through such a “gold rush” that volume took precedence above all else, now, as a result of increased regulations and reduced volumes that have driven up the cost of completing a loan origination, the focus is elsewhere.

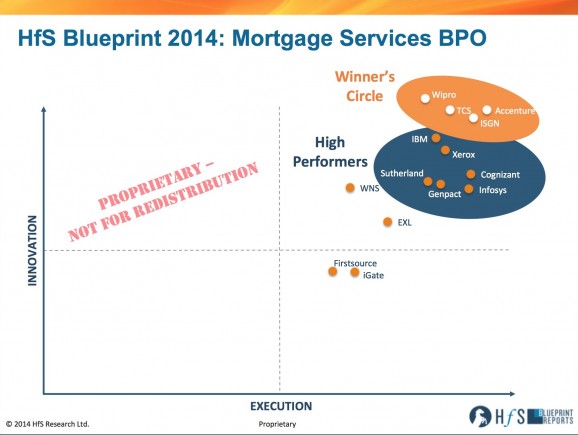

Today, this is an industry looking closely at the processes and technologies that underlie the business and turning to industry savvy service providers which can provide cost effective, compliant delivery that increasingly includes a significant component of sourced technology solutions as well. This mature market is changing and, as a result, so too is the roster of BPO service providers who are meeting those evolving client needs. So let’s take a closer look at the innovation and execution capabilities of the leading service mortgage services BPO providers:

HfS has evaluated the innovation and execution capabilities of service providers catering to the origination, servicing and default/foreclosure management processes of residential mortgage lenders. We asked our EVP of Research, Charles Sutherland, who led this blueprint initiative, to share some of his insights arising from this Blueprint Report.

Charles, what are some of the key challenges facing lenders today?

This is a market segment undergoing a profound level of change. First, of all there is a dramatic fall in customer demand for new loans as post-crash engine of refinanced loans is coming to an end. Second, is the rise in the overall costs of originating a loan, which are now up several thousand dollars versus where they were before the crash as a result of new regulations and closer scrutiny over the origination processes. Third, has been huge growth in defaults and foreclosures which has brought increased costs, risks and scrutiny to part of the industry leading to a need for new solutions, technology and insights as to how to move forward with a reduced risk profile. Fourth, regulatory changes and large fines for procedural misconduct have led to a fundamental re-examination of processes and in some cases to all out exits from the market as well. Finally, gaps and weaknesses in the legacy loan origination and servicing platforms of major lenders have also been identified which requiring either all out replacement of these technologies or at the very least new tools and enablers to cover these shortfalls in functionality and effectiveness.

And how are service providers adding value to lenders after the global real estate meltdown of 2008-09?

More than anything else, service providers are adding value by changing their core offering. They have moved away from a model that was often based on providing just labor to cover demand peaks to one, which is consultative, technology driven and analytics based. Service providers are working with their lending and servicing clients to identify and re-think broken processes, to bring technology solutions into even the most entrenched of legacy application platforms and they are building up their rosters of industry experienced staff to provide insights based off the increasingly sophisticated analytics engines and tools which are being included in the service provider solution sets.

How did they winners shake out?

The Winner’s Circle features recent entrants, pure-plays, globally scaled players and visionaries

The leaders in our analysis all have the capability to support the most demanding of mortgage lending institutions but approach the market in very different ways:

- Accenture who was a late entrant into this market when they purchased Zenta in 2011 but who have come on strong with an additional acquisitions and an offering that seeks to transform the processes of the largest lenders first in the US and now in Brazil as well.

- ISGN who are the only pre-play mortgage services provider in our Blueprint and who have differentiated through their flexible technology solutions in all areas but especially in Origination.

- TCS who have built a global scale out of their core Citibank N.A. relationship and supplemented it with nearly 6,000 person strong delivery capability

- Wipro who have sought to especially address the needs in the default and foreclosure management process and recently purchased Opus CMC to add leading capabilities to assess mortgage risk and meet the due diligence needs of investors in the mortgage market.

All of these service providers have built global delivery capabilities, invested in supporting technologies, brought their considerable continuous investment capabilities to bear from areas to fix broken processes, realized the emerging value of analytics, and have undertaken exceptional account management and client engagement efforts. We recognize Accenture, ISGN and TCS for leading overall Execution, while Wipro leads Innovation although it should be noted that all four Winner’s Circle members lead the market in Innovation criteria.

High Performers Represent Strong Competition. High Performing service providers including Cognizant, Genpact, IBM, Infosys, Sutherland GS and Xerox have strong execution skills and are also innovating to respond to the changing requirements of their buyers.

And finally, Charles, what is your key takeaways from this study?

» Most buyers are ready to look at new solutions. Our client interviews highlighted the change in mindset amongst lenders in the years since 2008-09. Yes, they are still sourcing labor to cover demand above the baseline levels of their own operations but they need and want more today. They want service providers who bring a vision for the market, solutions that address significant market challenges and which reduce both their direct costs but also their risks. For a mature BPO market like mortgage services that represents a fairly fundamental shift in mindset as to what is being sourced and valued by buyers today.

» That Service Providers are re-upping their investments in this market. We saw across the board from the largest service providers to the smallest that they see a real opportunity to help their clients today and going forward by investing in deeper capabilities. Its not just about minor investments either, service providers are really stepping up with acquisitions and technology investments to build their capabilities to meet the increased demands on their clients.

» That the next frontier is global for mortgage services. Service providers are moving even faster than their clients to become global service providers. It’s not just about meeting the needs of US based lenders now, it’s about Canada, UK, Australia, India and now Brazil as well and we expect to see this move to global capabilities accelerate in 2014 and beyond.

HfS subscribers can click here to download their copy of the 2014 Mortgage Services BPO Blueprint Report

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Financial Services Sourcing Strategies, HfS Blueprint Results, HfSResearch.com Homepage, kpo-analytics, Legal Services Outsourcing, SaaS, PaaS, IaaS and BPaaS, Security and Risk, smac-and-big-data, Sourcing Best Practises, Talent in Sourcing

[…] Accenture, Wipro, TCS and ISGN make the Winner’s Circle for Mortgage Services BPO – … and execution capabilities of the leading service mortgage services BPO providers: HfS has evaluated the innovation and execution capabilities of service providers catering to the origination, servicing and default/foreclosure management processes of … […]

[…] Accenture, Wipro, TCS and ISGN make the Winner’s Circle for Mortgage Services BPO – The residential mortgage services market is one of the most established and competitive segments of the global BPO industry. Most of the major … And how are service providers adding value to lenders after the global real estate meltdown of 2008-09? […]