You only need to face the simple fact that 50% of corporate office space (in the US alone) is now left unused to understand that the connected worker is becoming less and less tethered to her/his desk – they are mobile. While Marissa Meyer is making valiant efforts to reverse this trend, the unfortunate news for her is that more and more workers want to be mobile, so if you want to the best talent, you’d better be able to cater for their mobile needs.

Quite simply, the speed by which Mobility is dominating our personal and business lives is staggering, and the capability of providers to mobilify their services to keep enterprises functioning is becoming increasingly significant by the day as a services differentiator. So let’s take a peek at the results of the first Blueprint Report into Enterprise Mobility Services, where HfS analyst Ned May scoured over 10,000 datapoints across 270 Enterprise Mobility services contracts:

Ned, firstly, can you talk about some of the business-specific uses of Enterprise Mobility that you’re seeing?

For some industries, Mobility is already table stakes, for example:

* Shipping: One of the earliest to adopt mobile solutions. Proprietary devices manage both the package status and the delivery fleet to provide real time information all the way back to the consumer.

* Market Research: In the field surveys now get entered immediately in a laptop – reducing costs and allowing for on the fly targeting of needed demographics.

For some it’s quickly getting there, for example:

* Healthcare Insurance: Membership apps for healthcare apps running on tablets allow sales reps to customize, quote, and close a new membership in the field and in a much more engaging way then possible via even a laptop.

* Travel: Flight attendants are being equipped with phablets tied into passenger data and entertainment systems that are also able to receive food and beverage requests all in an effort to better manage travelers and provide a personalized experience for everyone on the plane.

And some likely future uses:

* Car Insurance: Auto insurers will tailor car policies not based on actuarial tables and demographics but instead on real data gathered about each individuals driving habits gleaned from sensors in their smartphones.

* Retail: High-end retail shopping will become an augmented experience as laptops get handed out (or in store apps downloaded) that provides context around every item in the store, makes recommendations for complimentary purchases, directs buyers to the location of an item, allows for purchase of items sold out in one’s size, and even allows one to purchase items as they gather them rather than wait at the end to check out.

So what’s been driving the Enterprise Mobility market?

The rapid proliferation of smartphones is fueling a broad range of mobile activity across most enterprises today. Firstly, there a need for the first wave of customer-facing mobile initiatives to be better integrated with existing content and commerce platforms, and secondly, many businesses are pursuing more radical change by embracing Mobility internally across the enterprise. The Blackberry was a phenomenal communication tool, but its limited interface offered little opportunity for further integration with the business.

When CEOs began to demand enterprise level access for their iPads and iPhones, they unleashed a torrent of activity that very few IT departments had the wherewithal to stop. Today. that activity now has the potential to change fundamentally the way many of a businesses’ underlying processes are performed. In conducting this research, we found most enterprises fall within one of three stages of enterprise mobile adoption:

The first stage and the one where most companies reside today is characterized by the addition of a mobile interface to a discrete app. Typically, these interfaces are created within silos that enable some core function such as customer engagement or field support and they are often initiated outside of IT department in areas like marketing and sales.

The second stage of adoption we saw – and one getting a good amount of attention today – is those companies where the priority is to integrate many of their mobile initiatives that are underway. This stage occurs when an enterprise realizes the disparate activities will yield greater gains if they are rationalized within a cohesive approach. For example, by tying together a sales system with a customer care portal they can enable more seamless client lifecycle.

The third stage is what we label transformation and is characterized by those that are bringing about radical change to an underlying business process by leveraging new ways to harvest and interact with information via these devices. Few businesses are operating at this level today but those that are will mostly likely be tomorrow’s leaders.

Ned, what are the key challenges facing IT departments looking to Embrace Mobility today?

One of the biggest challenges most enterprise IT departments face today is how to rationalize all the disparate mobile activities currently underway across their enterprise. As functional departments outside of IT – areas like sales, marketing, and even HR – began to drive the selection and adoption of new enterprise applications they often layered in a mobile interface either at the outset or in a later refresh stage. This led to a hodgepodge of activity without a cohesive strategy. The end result is an enterprise riddled with multiple mobile entry points and interfaces that employees and customers alike are challenged to navigate. In short, the concept we know as the consumerization of the enterprise resulted in what could best be termed the Appification of the enterprise and today many companies are realizing that this model is not driving the hoped for efficiencies but rather it is at best driving confusion and at worst customer dissatisfaction.

So how should business executives approach an Enterprise Mobility initiative?

What I recommend for anyone tasked with driving a Mobility initiative in their organization, is to take a step back from whatever point solution they are looking to enable or refine, and to conduct a more thorough assessment of their organization’s overall Mobility readiness. Before another dollar is spent on development, a cohesive Mobility strategy is required – even if the short term recommendation from that strategy is to continue letting individual departments add the mobile interfaces they need. Nearly every service provider I spoke with for this report has this type of offering in place to conduct these assessments. Many, if not most, will even provide this for free, yet very few enterprises took advantage of this in 2014.

And how did the Winners shake out?

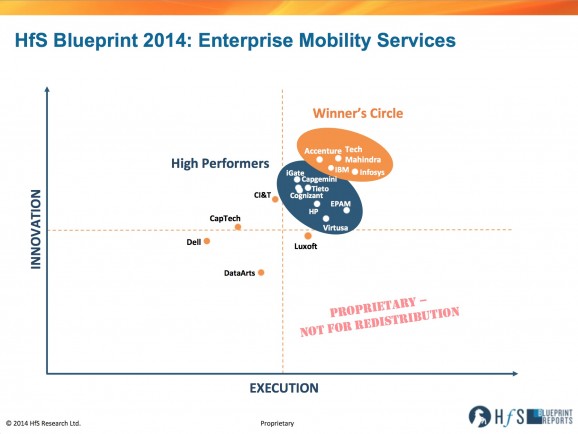

The Winner’s Circle Features a Mix of provider groups and strategies. The four leaders in our analysis represent a diverse mix of strengths and strategies:

- Accenture brings deep vertical industry expertise grounded in business needs and by combining this with a significant investments within user experience and UI design it has the ability to produce truly transformative mobile initiatives at global scale.

- IBM made its mantra of MobilityFirst one of its four key corporate initiatives for 2014 and with its broad portfolio of proprietary platforms – many of which are some of the leading tools within Mobility – the company is in a great position to deliver on that promise.

- Infosys has a robust portfolio of proprietary IP and solutions that allows it to more quickly address many Enterprise Mobility needs at relatively low cost.

- Tech Mahindra’s roots lie in the telecom industry a space it continues to serve deeply today and in doing so it brings a deep understanding around the future evolution of devices and networks that helps it meets the future needs of an enterprise.

Close behind the ranking of these four providers were another seven that made it into our High Performers group. These seven were loosely clumped into two subgroups – one group excelling in execution and the other in innovation. The innovators were iGate, Tieto, Cognizant and Capgemini and those stronger in execution were HP, EPAM, and Virtusa though it should be noted that each brought strengths in the other areas as well.

Net-net, Ned, what are the key takeaways?

The Market Remains Immature: Though we identify five service providers in our Winner’s Circle and another six High Performers, there is considerable room for every service provider to move up and to the right. We expect the market to look very different in a year’s time.

Service Provider Capabilities Span Three Areas – Application Development, Integration, & Transformation: Enterprise buyers are advised to carefully assess their unique needs and make sure they engage with an appropriate service provider within one of these three. Boutique App developers will serve some buyer needs the best while leaving others without the solution they need. The same goes for a skilled integrator that might be lacking strength in up front UX / UI design.

The Market as a Whole Skews toward Innovation: On average, every service provider ranked higher on the scale of innovation then they did on execution highlighting the challenge of delivering excellence in a rapidly emerging market. This provides an opening for any service provider excelling in this regard.

Mobility Is Not Just a Device: Leading service providers are recognizing Mobility is about untethered data and not merely communicating to a screen on a phone. Offerings in telematics and efforts to make use of this data will be a big theme in 2014.

Mobility is Becoming Commoditized: Despite the relative immaturity of the market as a whole, parts of it are already rapidly becoming commoditized. e.g. Device Management an area that has seen a wave of roll up acquisition activity is now seeing SaaS like offerings that aim to simplify – even automate – the task.

Thanks, Ned, for an excellent synopsis of the new Blueprint

HfS subscribers can click here to download their copy of the 2014 Enterprise Mobility Services Blueprint Report

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Financial Services Sourcing Strategies, Global Business Services, Healthcare and Outsourcing, HfS Blueprint Results, HfSResearch.com Homepage, Mobility, Sourcing Best Practises, The Internet of Things

Ned, we appreciate the comprehensive study you have conducted and the findings you put together. Undoubtedly, this can be useful to CIOs looking for a partner to make mobility a scalable reality in enterprises. However, as the person who started the mobile capability at CI&T, I am surprised to see CI&T ranking just below your “winners circle” of highest performers.

CI&T was the absolute pioneer in bringing together UX and Development for mobile. (I encourage anyone to google my name and the term “lean UX” to find evidence of that.) Those cited as leaders in this report had to catch up years after CI&T was already impressing our clients at Johnson & Johnson and Coca-Cola. In fact, one of the companies identified as a leader here was part of the RFP process for one of our clients, and submitted a $1M proposal for a mobile salesforce automation application. Astonishingly, this estimate came without visiting the field. Taking a different tack, CI&T spent a day in the field with the sales reps to “walk in their shoes.” We came up with an innovative, time and cost saving mobile ordering solution that didn’t require “image recognition.” In fact, it ended up costing less than one quarter of our competitors’ proposal. Our name, CI&T, stands for Collaboration, Innovation and Transformation, and those are our driving principles. We partner with big companies to help them find innovative solutions to reinvent themselves. We love open source and open standards and we won’t be deploying proprietary tools to lock our clients in the present. We want them ready for the future.

In any case, it’s an honor to be considered and we are more than glad to compete with the companies ranked as leaders and high performers in your study. We are proud to be early innovators in the mobile space, and will continue to work to maintain that reputation with our clients. Thank you.

Cheers, Mars

Mars: Thanks for your comments and I don’t disagree with many of the points you make. That said, my individual analysis represents only a small fraction of the ultimate ranking as our Blueprint ratings are crowdsourced from buyer and market advisor input that measures performance across specific criteria along two axis: Execution (e.g. the strength of a provider’s proprietary delivery platforms and / or delivery partnerships) and Innovation (e.g. proprietary frameworks for analyzing business needs). Overall, I was impressed with the work your firm does as were others. In fact, you’ll see Ci&T ranks higher in terms of Innovation than several of those that made the High Performer list and as the report indicates the best provider match is very specific to an individual client’s need but again ultimately the final rank and placement is beyond my control. Thanks again for taking part and for continuing the dialogue.

Best regards,

Ned

[…] up to the chaos known as BYOD. As we pointed out in our Enterprise Mobility Services Blueprint (see link), the market is now reaching a stage of maturity where IT departments are being asked to […]

[…] up to the chaos known as BYOD. As we pointed out in our Enterprise Mobility Services Blueprint (see link), the market is now reaching a stage of maturity where IT departments are being asked to […]

[…] (Cross-posted @ Horses for Sources) […]