In years gone by, TPI’s Index established itself as a bell-weather for all stakeholders in the outsourcing industry – most outsourcing deals were big, everyone knew what there were, and TPI advised on a good chunk of them. The Index was a reliable checkpoint to know what was going on. However, after their recent Q3 outlook, several industry colleagues expressed concern that TPI wasn’t reflecting market reality, with particular reference to their claim that the BPO industry had taken a 15% nose-dive (see slide 4 here) in 2010.

New HfS Research data that encompasses all current Finance & Accounting (F&A) BPO engagements, reveals two key factors that cause us to question the reliability of the latest TPI Index’s BPO outlook:

1) Advisor-led deals are diminishing

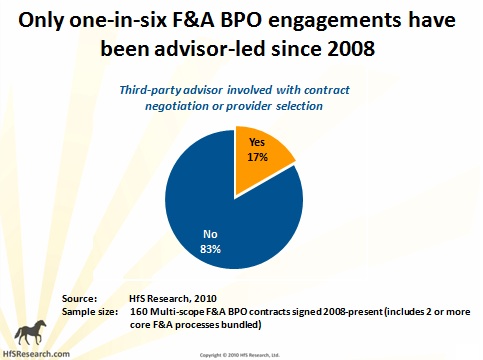

Our latest research of all current multi-process FAO engagements, for example, reveals that five of every six engagements signed since the beginning of 2008 have been orchestrated directly by the customer. Many of these were competitive bids, in addition to sole-sourced situations, but what’s clear is a third-party advisor was not involved in process:

2) The average deal size has fallen below TPI’s radar

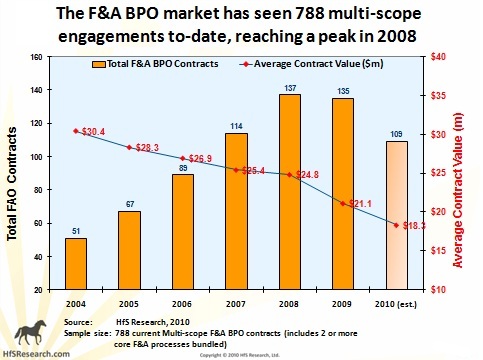

TPI only bases its Index on deals with total contract values greater that $25m. As our new research reveals, the average deal size for for multi-scope F&A BPO engagements in 2010 is $18m, and fell below the $25m level in 2007:

What’s clear is that 2010 wasn’t a banner year for BPO and growth was not spectacular, but the market certainly didn’t contract – there’s an additional $2bn of TCV to add to it, and at least another 100 new deals.

While we commend TPI for performing a valuable service for the industry over the years with its reporting on market trends, it concerns us that such negative reporting is sending mixed signals to the investment community, and other industry stakeholders, that the outsourcing industry is seriously faltering. While TPI’s own stock valuation maybe experiencing a miserable 2010, this shouldn’t reflect on the broader industry, which has managed to continue healthy growth, in spite of the lethargic post-recession economy.

Posted in : Business Process Outsourcing (BPO), Confusing Outsourcing Information, Finance and Accounting, IT Outsourcing / IT Services, Outsourcing Advisors

Good point. Additionally, as boutique firms and mid-market outsourcers mature (especially India-based), the TCV of deal sizes (on average) will continue to trender lower.

[…] This post was mentioned on Twitter by Phil Fersht, Phil Fersht, Phil Fersht, jonathanheng, Phil Fersht and others. Phil Fersht said: Is TPI’s Index reflecting the real BPO industry picture? #Outsourcing #HfS http://bit.ly/e1jQMv […]

Great article. I can add one more factor to this: TPI only base their data on publicly announced deals – many providers (including us) don’t tell them about all the deals we do.

Don’t Mistake Volume for Value in the BPO Market

By John Keppel, Partner & Managing Director, TPI Research

In this post, Phil raises questions about the validity of our TPI Index data in the Business Process Outsourcing (BPO) segment of the market. We at TPI are big HfS fans and enjoy and value Phil’s unique perspective on the industry, however, over our 22 years of leading the sourcing advisory marketplace, we also value the facts and just have to correct Phil on a couple of points about our beloved Index.

Let’s start with what Phil got right: The TPI Index established itself as the outsourcing industry’s bellwether long ago. For 32 consecutive quarters, it has given a snapshot of the sourcing industry for clients, service providers, analysts and the media. It is the authoritative source for marketplace intelligence, related to outsourcing transaction structures and terms, industry adoption, geographic prevalence and service provider metrics. We know Phil’s a fan and are always glad to see the Index’s position noted by leading analyst.

Phil is also correct that the outsourcing market is undergoing significant change, clients entering into transactions without an adviser, however, is nothing new and is certainly not unique to BPO, it is true in IT outsourcing (ITO) just as much as BPO.

Where Phil has started to get things wrong is in his detailed knowledge of how the Index works, and his assumption that the TPI Index looks only at the advised space. Contrary to Phil’s report, the Index measures both advised and unadvised deals, the index is and always has been a whole of market measure for the commercial sector. Our data covers the entire market, not just the transactions for which we are the client’s adviser and thus it is incorrect to say that the Index doesn’t provide this broader picture.

Phil also believes that because the average BPO transaction TCV has fallen below our $25 million threshold, we are understating the size of the BPO market’s growth. However, if he had listened to our Q2 conference call in July, he would know that we performed in depth analysis in the BPO market and we did this down to a deal threshold of $10m. We did this specifically to see what impact the high volume of smaller deals that we all know about might be having on the market. As those of you who attended July’s Index call will remember, what this analysis found was that these deals just don’t impact the growth of the market in any material way. That is, unless you measure growth simply by the number of contracts awarded and not how big they are.

Another informed but secretive blogger (Anon!) is sadly also misled by his assumption that TPI only works off publicly available information. In fact, TPI has an extensive and active engagement with the provider community to ensure that the impact of non announced deals is also included in the Index readout.

At a time of immense change in the outsourcing industry, the TPI Index continues to provide objective, fact-based insights into market performance, client behavior and emerging trends. We are always happy to discuss our research and insights and if we can provide you with more information, please do not hesitate to contact me.

John

Firstly: thanks for the quick response to this post – I appreciate it!

Secondly: your statment that deals down to the $10m threshold that “just don’t impact the growth of the market in any material way” is incorrect. If you look at all the sub-$25m F&A BPO deals, for example, that were signed since the beginning of 2008, that equates to a TCV of $2bn, while the deals over $25m signed in the same timeframe equate to $8bn. That’s 20% of the market -I do not think anyone here would say that that is insignificant. Moreover, when you look at other BPO markets, such as payroll, benefits, insurance, banking, call center etc, an even higher proportion of these markets is in the sub $25m deal category.

Thirdly, the anonymous provider who submitted the comment is one of the market-leaders and requested they remain anonymous, but their claim is that they do not reveal all their deals to TPI, and neither do many of their competitors. I personally do not have knowledge of this fact, but I do know the person who made the claim, and if his firm doesn’t reveal all its deal data to TPI, then you definitely have an accuracy problem!

And finally, I would dearly love to listen into a TPI quarterly call – if you could arrange for me to be registered for the next one, I would be delighted to put on my calendar.

More than happy to discuss these issues further offline, or to continue online if you are game – you can email me at [email protected]

Warm regards,

Phil.

Too bad that you have decided to take the discussion offline. For once, it would have been good to have an open session on disagreements for the numbers and forecasts. It’s an open secret that the forecast numbers given by various industry analysts, advisors etc have a huge variation between themselves. A few years back the provider industry would readily accept the number forecast but it has matured as well and now takes all these with a huge pinch of salt. Unless the advisory teams do not provide transparency in arriving at the numbers, this might go the hedge funds route 🙂

Sincerely,

Priya

@priya: any analyst who makes forecasts over 2 years’ out (or even 18 months) in today’s market is either clairvoyant or deluded. I am all about intelligent assumptions, based on demand trends, and accuracy, underpinned by real hard data (i.e. actual deal data). At HfS, we have gone to pains to collect every deal we can (both public and private) to get a tight picture of the market, but we’re also very open to having our assumptions challenged – that is what we are all about. We’ve also spoken to over 8000 enterprises this year regarding their plans, which – I hope – lends some credibility to our views.

I was delighted John Keppel chipped in and would love to have the debate online and public – so, if you’re reading, John, we are inviting you to have a live discussion with us on market trends and what we see happening in 2011 and beyond,

PF

Bit of a red herring this argument.

Not clear to me if anyone has gone to the trouble to define what the parameters of the market are.

Depending on your definition of BPO you are likely to arrive at vastly different numbers.

Maybe rather than arguing the toss over who is right and who is wrong the advisory community would be better off working together to arrive at a consistent and definitive view, as far as is practicable and possible given the cloak and dagger approach of the providers, who seem to think a lack of transparency is a good thing.

So this was the end? Or did you guys have a private chat? We would love to know the conclusion. Anyway, Happy New Year to you guys. Horses for sources has been refreshing in majority of the articles and staid in a couple – you know which 😉

@priya – am still awaiting John Keppel’s response to my invitation. I think our new F&A data kinda backs up my argument here?

http://www.horsesforsources.com/fao-shares_010511

Hopefully we will avoid boring you too much this year 🙂

PF

@Michael: HfS will attempt to standardize these definitions this year across industry horizontals and verticals. Your concerns are warranted

PF