I've been getting an increasing number of service providers talking up the growth of Legal Process Outsourcing (with the mind-blowing acronym "LPO"). Personally I'm a bigger fan of PPO (Political Process Outsourcing), but it seems like we could have some onshore/offshore complications with that one, so let's talk about LPO.

I've been getting an increasing number of service providers talking up the growth of Legal Process Outsourcing (with the mind-blowing acronym "LPO"). Personally I'm a bigger fan of PPO (Political Process Outsourcing), but it seems like we could have some onshore/offshore complications with that one, so let's talk about LPO.

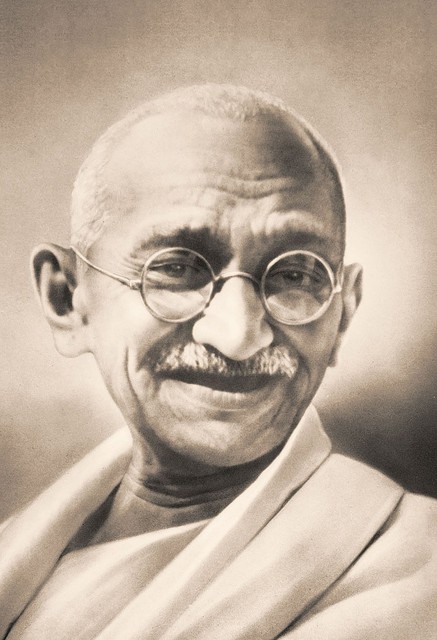

Having had a few discussions with clients and service providers in this space, it's clearly an area for major cost-efficiences for businesses. I've even had one service provider bragging he was making a killing doing liquidation administration offshore. Bottom-line, several of the fat law firms are already offshoring their own legal support work to low-cost locations, whilst still billing their clients top-whack rates, so smart corporate legal buyers are focusing on engaging with LPOs, as opposed to highly-expensive law firms, for a lot of legal work, while retaining expensive lawyers for critical activies that require deep experience. And did you know Mahatma Gandhi was a barrister? I'd use him anyday over Denny Craine 🙂

I've recently had the pleasure of interacting with the industry's one full-time LPO advisor (if there are others, here's your chance to make yourself known), so I asked him if he can educate us more regarding what LPO's all about. Step up Matt Sullivan who lived in Pune, India, for two years, where he managed the risk management & regulatory compliance practice for a global IT outsourcing company as part of a 20 year career in services and outsourcing. He now plies his trade at Red Bridge Strategy, where he's teamed up with some very smart and friendly consultants who focus on global sourcing issues. Over to you Matt:

Changes Ahead in Sourcing U.S. Legal Services in 2009

Businesses have traditionally relied on a combination of in-house legal departments and outside law firms for all of their legal work. During the past few years, maturing processes, technologies, and legal-services-delivery-perspectives have created an environment where corporations now have a spectrum of choices from which to source legal services.

General Counsels can globalize in-house legal departments by consolidating legal staffers in low-cost jurisdictions or outsource legal work to Legal Process Outsourcing firms (LPOs) at significantly lower costs than traditional U.S. law firms can offer.

The delivery of legal services from offshore locations, primarily India, has grown dramatically in the last few years, and will continue in 2009. While LPOs are compelling, they are not the only option. Whether delivered through globalized in-house functions (international, legal, shared services functions) or LPO firms, mature legal processes now make it possible to deliver high quality work from across the globe despite the unique legal challenges of privilege, supervision and conflicts. Some large law firms have created their own “captive” units to offer lower cost legal services to their clients.

Why Now?

The availability of global legal processes has arrived. During the past five years Business Process Outsourcing (BPO) vendors have provided human resources and accounting services, and as a result, shown that many types of professional services can be successfully outsourced. More recently, the recession in the U.S. has forced a more vigorous evaluation of legal costs than ever before, while, the volume of legal work, particularly e-discovery, has been soaring. The American Bar Association (ABA Formal Op. 08-451) and several regional bar authorities have implicitly authorized legal outsourcing. Finally, major BPO players such as Infosys and Wipro have entered the LPO market and the major independent LPOs (Pangea3, Mindcrest, Quislex, UnitedLex, and the Clutch Group) have announced significant growth plans for 2009. Given the clear economic drivers, the removal of previous barriers, and the stated intentions of many of the major service providers, globalization of legal services will certainly quicken in 2009.

Implications for Corporations

To take advantage of the relatively new legal services sourcing options, corporations must organize and optimize legal services like any other shared corporate services. For example, a corporation that operates in the U.S., the U.K. and India, may need attorneys in each of these jurisdictions, but may choose to concentrate the bulk of its legal team in India instead of London or New York; thereby taking advantage of resources that cost 50% to 80% less. Multinational corporations, such as Accenture, DuPont, GE and Oracle, have already taken advantage of their global presence to consolidate some of their common legal functions in lower cost jurisdictions like India.

Some organizations may not have sufficient legal work or sufficiently predictable volumes of certain types of work to warrant global shared legal services. These organizations have traditionally retained outside law firms when they become parties to litigation or acquisitions. These situations, that create sudden, large volumes of documents to review, are exactly the circumstances for which LPO vendors are well suited. Many LPOs have the ability to quickly deploy large teams of young lawyers using the latest technologies to assess the responsiveness, privilege, confidentiality of litigation-related documents or to review the assignment and termination clauses of acquisition-related contracts. Indian LPOs can typically deliver these services for $20 to $50 per hour as compared to $60 to $100 or more for legal temps in the U.S. Low cost legal services sources are also emerging in such places as Israel, the Philippines, South Africa and Costa Rica.

For many corporate legal departments, the prospect implementing and managing a global legal operation can be a daunting. Combining the practice of corporate law with business process redesign and outsourced vendor management requires a new set of skills. Working across cultures and time zones with a business in India or other distant countries adds to the complexities. There will be both stories of success and tales of woe, but the advantages of moving to new legal sourcing models are compelling, and the trend towards both corporate global shared services models and legal process outsourcing will increase significantly in 2009.

Matthew Sullivan (pictured) is a founder and principal at Red Bridge Strategy, Inc., a management consulting firm that helps organizations design and implement global strategies to reduce costs and improve performance. Matt has more than 20 years of business consulting experience, and lived in Pune, India for two years. He is also a member of the Massachusetts Bar.

Matthew Sullivan (pictured) is a founder and principal at Red Bridge Strategy, Inc., a management consulting firm that helps organizations design and implement global strategies to reduce costs and improve performance. Matt has more than 20 years of business consulting experience, and lived in Pune, India for two years. He is also a member of the Massachusetts Bar.

Matt can be reached at [email protected]

Posted in : Business Process Outsourcing (BPO), kpo-analytics, Outsourcing Advisors, Outsourcing Heros, Sourcing Best Practises

Matt: great article – a excellent view of how this market is developing.

What elements of e-discovery are working offshore? Which technology tools are commonly being used by the LPOs to faciliate this? Appreciate your insights here,

Sri

Sri Gupta –

Many LPO vendors have embraced the Electronic Discovery Reference Model (“EDRM”; See http://www.edrm.net), and can provide assistance with many of its elements. However, the value of using vendors depends on the skills within the organization seeking assistance. Many large corporations now have electronic discovery specialists within their corporate legal departments. These individuals are often tasked with coordinating with corporate IT to facilitate information identification such that e-discovery is simplified when it becomes necessary. They are also typically involved with preserving, collecting, and processing (formatting and reducing the volume) data when appropriate. Organizations that do not have these skills in-house may choose to source them from some combination of LPOs, outside counsel, discovery tool vendors or independent consultants. The portions of e-discovery that really illustrate the value of LPO are review (evaluating electronically stored information for relevance & privilege) and analysis (evaluating electronically stored information for content & context, including key patterns, topics, people & discussion). These typically consume the majority of discovery costs because they are completed almost entirely by humans. LPO vendors will typically make their work product available in a form that can be easily produced to the opposition.

The vendors I have interacted all have relationships with multiple technology vendors. Client needs have required them to be technology agnostic and, as a result, they have used such products as Concordance, Ringtail, Stratify, and CaseLogistix. Because the offshore vendors are focused on the technologically simple aspects of review and analysis, they can generally adapt to a client’s preferred provider.

Matt

Where are you seeing the most interest: Corporate Legal Departments of Law Firms?

Bob

Hi Bob –

While there are certainly law firms taking advantage of the globalized legal market, corporate law departments are by far the bigger drivers. Law firms have seemingly conflicting incentives to maximize their profits and provide low cost services, but corporate law departments tend to be much more focused on their costs. Despite these generalities, some of the LPO vendors have shown that law firms can, in some situations, maintain their profits, if not their revenues, by offering offshore resources. Some firms are currently using this as a competitive advantage and I predict there will be many more within a few years.

Matthew Sullivan

Red Bridge Strategy, Inc.

Electronic discovery is one of the areas of scale for any legal service provider. A provider with the reach and partners can provide end-to-end solutions for e-discovery starting with collection of documents/materials from the on-site locations until final production. The key to this is by means of having strategic partners in the form of scanning vendors, top tier platform providers etc. Earlier, it was only the ‘review’ part of electronic discovery that could potentially be outsourced. This trend changed with the on-boarding of big players like Infosys into the legal services space … e-discovery is key focus area for the big players and its only them who can sustain this in area that promises to be the next best thing that happened in the outsourcing of legal services after contracts… On technology tools, key to winning such deals as I cited earlier are 1) tie-ups with top tier platform providers; 2) trained resources; 3) tie-ups with global scanning vendors; and 4) the ability to scale rapidly

The vendors I have interacted all have relationships with multiple technology vendors. Client needs have required them to be technology agnostic and, as a result, they have used such products as Concordance, Ringtail, Stratify, and CaseLogistix. Because the offshore vendors are focused on the technologically simple aspects of review and analysis, they can generally adapt to a client’s preferred provider.

http://legallaw.sosblog.com/admin.php?ctrl=posts&tab=posts&blog=1&post_id=35#form_comment