We would like to thank personally all 1,335 of you who took the time to compete our State of Outsourcing 2011 study we’re conducting with the London School of Economics Outsourcing Unit. This is the largest ever study that’s looked at outsourcing, which included all industry stakeholders (buyers – both business ops and IT practitioners, service providers and advisors). A special shout also goes out to our partner, the Sourcing Interests Group, for inviting their members to participate, in addition to our 53,000 loyal readers.

We’ve been sifting through the findings these past few days, and let’s start here:

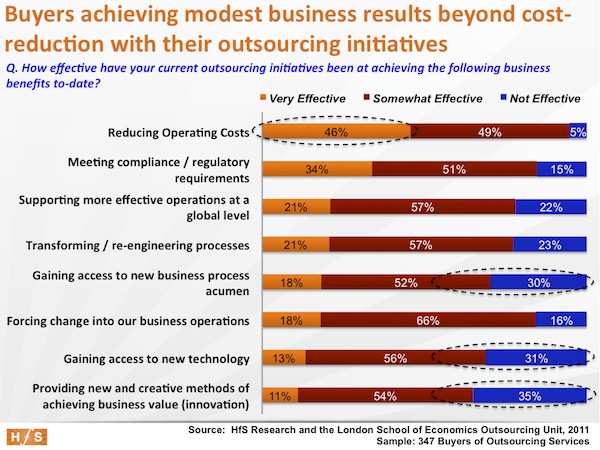

Engagements struggle to deliver business value beyond cost reduction

Whatever the motives buyers have when they outsource, the first critical metric they must reach is to save the money they were promised at the onset of the engagement. And we have spectacularly good news for the entire outsourcing industry – the cost savings targets are being met – and being met well, with over 95% of current buyers viewing the engagements as effective for reducing their operating costs. And half of them are really pleased with their cost-reduction progress, the other half seeing progress as “somewhat effective”. However, that’s pretty much where the good news tapers off, as the rest of the results are pretty modest…

After cost-reduction, how is outsourcing faring?

Business Process improvements. Barely one-in-five buyers feel they are experiencing significant improvements from accessing new expertise and transforming processes with their current outsourcing initiatives. Half of them do see some effectiveness gains, while more than a quarter are seeing no effectiveness gains at all with their business processes. Considering many of these processes were likely non-core/non-strategic to begin with, which is why they outsourced them in the first place, it’s unlikely buyers are clamoring for process improvement in the initial phases, instead waiting patiently for their providers to serve up experts, process maps and best practice examples to harmonize processes. As many buyers quickly discover, if process improvement is not in the contract, it will unlikely materialize without additional investment.

HfS believes those providers looking to develop real utility across their clients, proactively need to encourage them to adopt common best-practice process workflows. This means they need the availability of process consultants to drive the agenda with their clients. And these consultants should largely be based onshore (spending time onsite) to work with the retained team. This should be a major differentiator between providers – those that can quickly help clients to evaluate improvements, versus those who simply want to shift as much of the work offshore as quickly as possible and keep margins to a maximum.

Introducing new technology. This is an area where buyers should be experiencing far more effectiveness than they currently are, with 56% only seeing modest progress and 31% none whatsoever. Too many engagements are still largely centered on shifts in labor-based services, as opposed to any genuine technology transformation. It’s hard to gain improvements in processes beyond a certain point if they are not IT-enabled, and clearly most outsourcing clients still run the same processes off the same technology platforms that they were using pre-outsourcing. Like above, clients quickly discover if it’s not in the contract, they needed to budget for it – whether it’s the latest SAP upgrade, or implementation of a new expense management tool. If providers want to build true utility, they not only need their clients to have similar processes, but the more they can be enabled on the same technology, the more replicable and scalable their services will become. And if these technology platforms can be delivered in the Cloud (even for components of functions), the easier they are to provision for clients.

HfS believes providers need to aggressively introduce new platforms to their outsourcing clients, and drive the IT-enablement of their business processes. Those providers which can acquire or develop unique technology IP to support their outsourcing clients are at a clear advantage. If clients are using highly customized IT platforms, for example in the capital markets industry, providers need to have the consultative skills to IT-enable the outsourced business processes effectively.

Innovation. As we discussed last year (read post here), at least 50% of clients take innovation very seriously when they outsource. And where they may be struggling to achieve innovation with their outsourcing engagement today, they at least see the potential to achieve it in the future. Innovation is a progressive goal, once clients have got their processes operational and are in a position to explore new and creative ways to improve growth or productivity. Providers need to work with their clients to develop an innovation agenda as they operationalize their outsourcing model, and their clients need to be encouraged to plan and budget for an innovation strategy from the onset of their engagement. Turning around to the board after two/three years to request budget for “innovation” is going to be a lot harder than if it was embedded into the initial agreement with some contractual provisions to cater for future innovation needs. Once the ink on the outsourcing contract has started to dry, corporate leadership has likely already turned attention to other priorities.

HfS believes innovation needs to be addressed front-and-center – right from the onset of an outsourcing initiative, and not as an afterthought. It’s like changing the wheels of a care while your driving – the world isn’t going to stop suddenly to allow for an innovation plan to be developed. It needs to be in the works constantly as the engagement matures.

The bottom-line

HfS views this data as an important success factor for the outsourcing industry. The initial goal of outsourcing – to drive out cost – has succeeded, and succeeded with flying colors. However, the findings also point out that the sequential business needs that need to be addressed are falling short. Our concern at HfS is that costs are like hedgerows – once trimmed they always grow back. Providers cannot afford their clients to struggle. After their transition to a working operational outsourcing model, corporate leadership isn’t going to keep reminding their shareholders about “that stellar 30% we took off the bottom-line three years ago”. They are going to be looking for their next improvement metric. And the only way to achieve that, is to constantly look at harmonizing process and enabling it with better technology. Outsourcing should provide an opportunity for buyers to take advantage of the talent acumen and IP their provider can deliver. If buyers really do care about continuous improvement, then they will seek out a services partner which can prove, through multiple client experiences, that they have the discipline, culture and motivation to work with them over the long-haul.

Related Reading:

HfS BPO Innovation Study posts (June, 2010)

HfS 2010 “State of the Industry” posts (January, 2010)

Busting the innovation myth (March, 2010)

Why innovation in global business operations is critical for survival (March, 2010)

Where have all the consultants gone? (April, 2011)

Posted in : Business Process Outsourcing (BPO), Cloud Computing, IT Outsourcing / IT Services, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, state-of-outsourcing-2011-study

[…] about continuous improvement, then they will seek out a services partner which can prove, … read full news Published: Mon, 30 May 2011 04:54 Tags: but …, Part I: buyers are saving money, The […]

[…] The undisputed facts about outsourcing, Part I: buyers are saving money, but … – Horses … […]

[…] more: The undisputed facts about outsourcing, Part I: buyers are saving … Comments […]

Very interesting analysis. The good news is that outsourcing is working as a cost-reduction measure. The bad news is that clients and vendors need to work harder to achieve business benefits that will ensure longer-term success for both of them. Vendors with lousy clients will never make money and clients with lousy vendors will struggle to maintain lower cost.

Jim Doherty

Not surprising. You make a very good point about the fact that many of these processes were originally outsourced because they weren’t core in the first place, so why have high expectations of improving them in an outsourced model, when the buyer didn’t care too much about them pre-outsourcing?

Andrew Wagoner

I think this is a major positive for outsourcing. It’s proven to be successful at driving down costs, while showing some progress in adding value in other areas to the business. A few years’ ago people argued that outsourcing didn’t always reduce cost – now that argument is moot. Companies will be more encouraged to move into outsourcing engagements now they know most other clients are achieving their cost reduction targets. Their key challenge, as you point out, is to work with the right provider to innovate and find new areas for improvement,

Ajay

@Andrew – the majority of buyers certainly do care about finding improvements and driving innovations (see our innovation study from last year. Whether you have outsourced or not (or do shared services), any CFO/controller worth his/her salt MUST have a continuous improvement program in place and should have an innovation goal in mind (or at least aspire to). Having a provider in the mix should add extra process knowledge and experience, in addition to better global effectiveness and availability of new technology. “Should” being the operative word here 😉

Interesting data. However, not the experiences we are seeing beyond savings. Adoption and long term sustainability is fully reliable on value beyond savings or the categories will only diminish returns rapidly. Buyers must ensure that outsourcers are not only focusing on transactional management. Long term meaningful results are directly tied to value and ease of use in the service. Improved visibility in consumption that lead to strategic adjustments will serve buyers well.

[…] Source: http://www.horsesforsources.com/the-undisputed-facts-part1_052911 […]

[…] Part 1 of the largest-ever study that’s looked at outsourcing across both IT and business process, we […]

Thank you for undertaking this study – provides confirmatory evidence to both clients and service providers that outsourcing is cost effective. The one issue that needs to be kept in mind is that outsourcing a business process doesnt mean that all responsibility and accountability has also been outsourced to the service provider. The client still has the retained organisation for the particular process and should drive and own the subsequent improvements. That this aspect needs to be built into the contracts is an absolute necessity.

[…] you participated in our State of Outsourcing 2011 survey (see here and here), you may have been anxiously monitoring your inbox for a notification that you’d […]

[…] Horses for Sources, in conjunction with the London School of Economics Outsourcing Unit, recently published the results of a study on the state of the outsourcing industry in 2011. The survey was one of the most robust we’ve seen on outsourcing – with over 1,300 respondents – and the results are interesting. The main conclusion of the study was that firms that outsource are consistently achieving cost savings, but not much else. You can find an article on the study results here. […]

Hi Phil,

This is good data to have, but I have to be candid: this is a bit like doing a big study to find out ice is cold, i.e., didn’t we know this?

In 2001, when I ran the call centers for a Fortune 500 company, we were outsourcing portions of our business. We did an RFP and got proposals from all the top-tier outsourcers and there was absolutely nothing that differentiated them. If you tore the cover off their presentations, you would not be able to tell them apart: they all had the latest technology stacks, they all had a large geographic footprint, and they all had the latest and greatest performance management systems (whatever that means.)

But ask them what they were going to do to help you improve your outputs and the top-tier outsourcers only had one answer and it was exactly the same answer from every one of them: “We record, monitor and coach our agents.” They had no answer to the follow-up question: “Are you telling me that you record, monitor and coach better than the guys that were just in here before you?”

Ten years later, nothing has changed. No outsourcer can tell you what they are going to do to make you better and back it up with some client data that shows Csat, FCR, AHT, Cross-Sell%, etc systematically improving beyond learning curve gains.

Despite decades of treading water, there is an answer for outsourcers who are dying to address the glaring shortfalls you identify around adding value, driving process improvement, and introducing innovation and new technology to their clients. The problem is that we are trying to make our centers better one-agent-at-a-time, an approach that has no positive ROI and, in fact, can’t work. The solution is to get clear on the correct process, leverage agent-assisted automation, and continuously improve that process so that every change you make instantly makes all 50 or 500 or 5000 agents better.

We have been writing about the problem and the solution for years. For all the reasons you cite, it is an idea whose time has come. I invite you and your readers to learn more about the sea change that is coming:

Is It Time for Mass Customization of Call Centers? (Part I): http://callcenterinfo.tmcnet.com/analysis/articles/57874-it-time-mass-customization-call-centers.htm

Is It Time for Mass Customization of Call Centers? (Part II): http://callcenterinfo.tmcnet.com/analysis/articles/58106-it-time-mass-customization-call-centers-part-ii.htm

What Call Center Outsourcers Can Learn from Toyota: http://www.connectionsmagazine.com/articles/9/082.html

The Biggest Joke in Call Centers: http://www.contactcenterworld.com/view/contact-center-article/the-biggest-joke-in-call-centers.aspx

Call Center “Hidden Factories”: http://www.nationalcallcenters.org/pubs/In_Queue/vol3no7.html#Call_Center_Hidden_Factories

Do Outsourcers Need to Carry Malpractice Insurance? http://www.nationalcallcenters.org/pubs/In_Queue/vol2no24.html

What the Call Center Industry Can Learn from Manufacturing: Part I: http://www.nationalcallcenters.org/pubs/In_Queue/vol2no21.html#Rushed%20Routine%20and%20Robotic

What the Call Center Industry Can Learn from Manufacturing: Part II: http://www.nationalcallcenters.org/pubs/In_Queue/vol2no22.html#What%20Manu%20can%20learn%20II

What the Call Center Industry Can Learn from Manufacturing: Part III: http://www.nationalcallcenters.org/pubs/In_Queue/vol2no23.html#What%20Manu%20can%20learn%20III

Sincerely,

Dennis Adsit

[…] Part 1 of the largest-ever study that’s looked at outsourcing across both IT and business process, we […]

[…] endeavors for both providers and buyers. But while the large buyers like saving the money (see Part 1), it’s actually mid-market sector ($1bn-$3bn revenues) which is getting a lot more out of the […]

@Dennis – that’s why we dubbed this series, the “Undisputed Facts”. Thanks for your excellent contributions here,

PF

[…] wary of outsourcing during recessions. While today it delivers cost-reduction to clients in spades (proven emphatically during our recent state-of-outsourcing study), many organizations have proven, in the past, to push […]

[…] are not only basing their planning on their proven, ongoing cost-reduction outcomes (see Part I), but also because the fundamentals of their industries have dramatically shifted in the recent […]

[…] are not only basing their planning on their proven, ongoing cost-reduction outcomes (see Part I), but also because the fundamentals of their industries have dramatically shifted in the recent […]

[…] many cases, most companies have already enjoyed a fair amount of cost-reduction in recent years with various outsourcing initiatives, so they already expect the financials to work […]

[…] institutional knowledge of their clients’ IT processes to support the business, which has proven cost-effective for the vast majority of leading global enterprises. Our recent state of outsourcing survey found […]

[…] “money slide” of 2011, where 347 buyers revealed they were happy with their outsourcing cost-savings, but the other business benefits were proving elusive. A defining chart for the outsourcing industry. Our concern at HfS is that costs are like hedgerows […]

[…] with outsourcing, are not only basing their planning on achieving ongoing cost-reduction outcomes (read here for more on this topic), but also because the fundamentals of their industries have dramatically […]

[…] Outsourcing has an image problem, not a delivery problem. The intent of the blog was to deplore the shoddy image of outsourcing in today’s economy and the discuss the lousy job the industry – as a whole – has done in defining itself. It wasn’t to slam the premise behind outsourcing, or the performance of engagements: the “industry” produces wads of cash and healthy margins while saving buyers lots and lots of money (our own research emphatically supports this fact). […]

[…] The undisputed facts about outsourcing, Part 1: Buyers are saving money, but aren’t seeing a whole…) Share this:FacebookTwitterGoogleLinkedInEmailPrintGoogle+ Ashley […]

[…] story – in fact, buyer satisfaction has actually got worse over the last three years (see our 2011 State of Outsourcing results). At least, back then, the large majority of enterprise clients enjoyed some degree of value from […]

[…] (Source: The undisputed facts about outsourcing, Part 1: Buyers are saving money, but aren’t seeing a whole…) […]

[…] old story – in fact, buyer satisfaction has actually got worse over the last three years (see our 2011 State of Outsourcing results). At least, back then, the large majority of enterprise clients enjoyed some degree of value from […]