As we discussed during the previous five chapters of this encyclopedic journey to over-analyze our industry, customers are looking beyond the old simplicities of outsourcing to find new and creative ways to find new performance thresholds.

As we discussed during the previous five chapters of this encyclopedic journey to over-analyze our industry, customers are looking beyond the old simplicities of outsourcing to find new and creative ways to find new performance thresholds.

One of these areas is to exploit BPO opportunities within industry-specific domains, especially where there is opportunity to bundle both BPO and IT services together under a single vendor’s provision to generate more efficient business outcomes.

To cut to the chase, the industry-specific (vertical) process domains are where some of the newer vendor entrants are infiltrating, almost unnoticed, into the BPO industry. Most of the strong IT services vendors have been developing BPO niches in specific verticals where they have developed some strong process acumen and client credibility, and have the determination to invest in becoming best-in-class within that industry.

We’ve seen plenty of examples, for example, in both the financial services and life sciences industries, where some of the offshore IT services vendors have been seeking to expand their footprints, and layer-on BPO processes to their existing IT relationships. What’s more, some of the IT services shops have begun to realize that BPO is a great lead-in to help themselves to future IT work within clients.

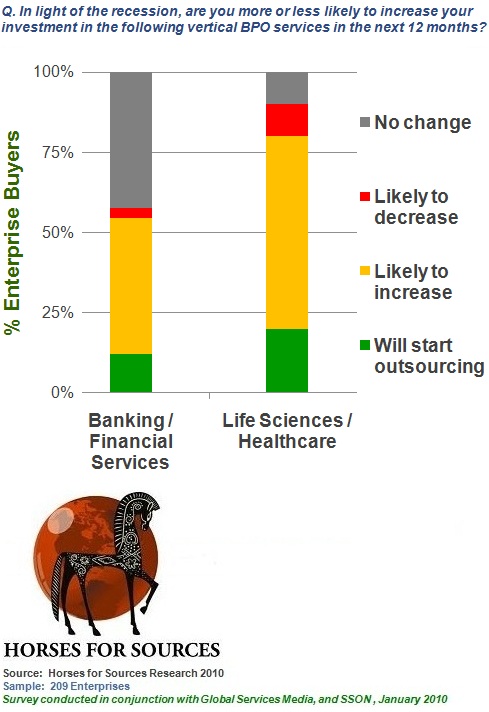

For example, if you’re already crunching data for clinical trials, why not also manage and develop the supporting applications and infrastructure? Bottom-line, customers see more opportunity within some domain-specific areas, and our recent “Seeking a New Normal in Outsourcing Delivery” survey points to a continued upswing in BPO demand within verticals:

Industries undergoing major fundamental change are moving aggressively into domain-specific BPO opportunities. One-in-ten financial services firms, and one-in-five from life sciences, are looking to move into some form of domain-specific BPO this year for the first time. These are typically areas where there is some immediate labor arbitrage opportunity, based on the availability of processing expertise offshore. For example, in financial services, we’re seeing a lot of trade settlement transactions and mortgage processing move into BPO scenarios, and in life sciences, many of the data storage and management processes that enable the drug-to-market cycle, are similarly evolving towards this delivery model.

Why these industries specifically? Simply put, the financial services sector has gone through such a fundamental change in its very infrastructure, that moving into a BPO environment is no longer the strange, abhorrent procedure and experience it once was. Similarly, in life sciences, the major drugs companies know their blockbuster drugs models aren’t going to last forever, and are facing toughcompetition from lower-cost generic manufacturers. Hence, they are similarly exploring new and radical means to improve productivity, source new revenue opportunities and drive-out cost.

The success of existing domain-specific BPO engagements is driving broader scope-increase. Over half of all the financial services and life sciences firms surveyed, are looking to expand existing BPO engagements this year, and very few are seeking to pull work back onshore. Firstly, it’s easier, and far cheaper, for operational executives to add scope within a BPO engagement, than hire new staff onshore, when they need more work done. Secondly, in many cases, these engagements started small, often with only a handful of staff provided by the vendor, so it’s only a natural extension of the engagement to add more staff and additional process scope as the BPO environment develops. However, this doesn’t necessarily entail massive increased spending overnight, but more a gradual incremental increase in engagement scope.

The Bottom-line: industry-specificity is clearly a major driver in outsourcing, but the financial pressures on vendors to maintain their profit margins may override its development. The capability to deliver genuine domain-specific process acumen to clients is quickly becoming a major differentiator in the market. However, investing in the talent to truly scale these capabilities is expensive, and the margins aren’t as appealing at those currently being displayed by several vendors delivering the easy, operational work. While some vendors are clearly content with a thin veneer of vertical capability, others are stealthily picking verticals where they feel they can gain an edge over the competition. But it’s a gradual development, and you have to wonder whether every vendor has the patience and attitude to invest in the depth of talent they need, when they’re more concerned with satisfying Wall Street’s short-term demands.

While financial services and life sciences are both becoming saturated, we’re already seeing many new BPO opportunities arise in industries also going through fundamental change, for example retail, manufacturing, healthcare and media. Moreover, the move to greater domain-specificity is intrinsically tied to the business utility model of the future, where we are starting to see signs of the convergence of SaaS, Cloud and BPO/ITO models within an engagement structure. The need for clients and vendors to define, develop and implement holistic end-to-end process solutions is slowly coming to the forefront… and industry-specific BPO is ultimately just one piece in a larger jigsaw.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Financial Services Sourcing Strategies, Healthcare and Outsourcing, hfs-industry-2010, IT Outsourcing / IT Services, kpo-analytics, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, the-industry-speaks

Phil,

This is a fine analysis of where the industry is heading from a vertical standpoint. I especially agree with the findings that it’s both financial services and life sciences that are more focused on specific outsourcing areas – they have invested so heavily in offshore captives over the years that evolving into fully-outsourced environments is a natural extension for them.

Am also seeing more interest from firms looking at supply chain functions, such as management of environmental compliance, distribution management, sourcing etc.

Mark

Phil,

I guess the way the market is heading towards is a clear split. There are vendors who are clearly trying to do everything for everyone, and are spread thin, however from doing low value – but high volume business they are able to manage the quarterly demands of the Street, but are unable to have the depth that most clients find desirable.

Other end of the spectrum is a Niche service provide, that understands client industry, needs, and specific requirements.

Simar

Phil,

Many of outsourcing engagements begin with IT outsourcing. The clients want to explore BPO offerings for their specific sector.

Having strong processes and clients in same domain helps win over these deals. One of the key challenges is also to demonstrate how “BPO+IT” is more than “BPO” deal alone, apart from financial benefits.

We have seen clients split their IT and BPO business between vendors where they found BPO depth of service lacking for their domain.

Also once they outsource BPO and are aware of how other clients are leveraging this they tend to consider options not previously marked for outsourcing. This is because some of the vendors have made significant progress and have built IP and strong delivery models around their BPO offerings

Phil

Indeed, providers who can bring in Industry domain expertise will emerge as significant players.

1. Industry specific services allow providers to reduce the customers Cost of Revenue (or COGS) rather than just impacting SG&A. Not only that but, a competent provider can help in new GTM strategies in existing markets and in Greenfield ventures. A great partner to have on all counts. This is an area where gain-share type of contracting is really relevant.

2. Providers who have delivered business consultancy services and/or developed products in these emerging domains or eminently more suited to meet the customer needs immediately. Further, having these diverse service offerings will allow these providers to paint a better career opportunity graph as they scale their potential employee base of bankers and doctors. Providers who have not offered these services, will not only be at disadvantage in terms of having a ready skill base but also will need to work on the career proposition for the talent they need.

3. Historically, Travel (airlines) is another sector where industry specific services such as Pricing/Fare filing or Yield Management or Load Management have seen demand though “revenue accounting” has got the most mind-share. From a future perspective, I believe apart from the verticals you have mentioned – Insurance is a sector which has been waiting for a good platform solution for a few years now. The historical players – especially in the UK market have not made most of the opportunity and this has seen the decline of one large player and acquisition of another.

4. Incidentally, Industry specific variations of Horizontals do continue to remain unaddressed though a few areas such as Revenue Accounting (Travel) or Revenue Assurance (Telecom) have been through the hype cycle.

Regards, Shyam