During Part 1 of the largest-ever study that’s looked at outsourcing across both IT and business process, we revealed – beyond any doubt – that outsourcing is now a proven business model for reducing operating costs, with 95% of buyers reporting positive outcomes. Moreover, our study also reveals huge untapped potential for future outsourcing right across both IT and business functions, so surely this means the market is set to explode and we can wield new hockey-stick growth projections? Perhaps… but a few things need to happen first. Let’s investigate…

Strong outsourcing growth potential exists across both mature and virgin outsourcing areas

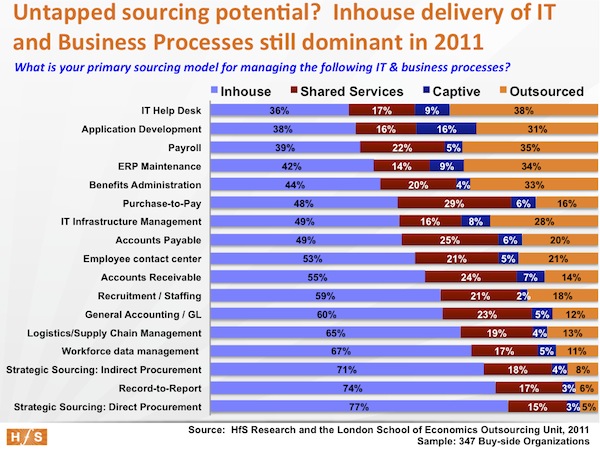

Established outsourcing areas have a lot of runway. As our data across global enterprises illustrates, as many as four-out-of- ten enterprises still primarily conduct mature outsourcing-friendly processes such as IT support, ERP maintenance and application development, payroll and benefits administration inhouse. In fact, with the exception of IT help desk, more enterprises still predominantly manage these processes inhouse than choose to outsource them. This seems unfathomable – right?

Maturing outsourcing processes are poised for heavy growth. For maturing outsourcing areas such as purchase-to-pay, accounts payable/receivable, general accounting etc., 50-60% of enterprises still adopt an inhouse sourcing model, roughly a quarter house them in shared services, while under a fifth have chosen the full outsourcing path. That’s a lot of administrative work still being run at unnecessarily high cost – right?

Emerging outsourcing functions are only just at the beginning of their growth curve. With emerging outsourcing areas, such as record-to-report, strategic sourcing and supply chain management, barely 10% of organizations have chosen to outsource, with the vast majority still clinging to inhouse delivery. OK – these are more complex processes, but not many enterprises are dipping their toe in the water – right?

So with these proven cost-savings on the table, why is outsourcing still in its infancy for so many business support functions?

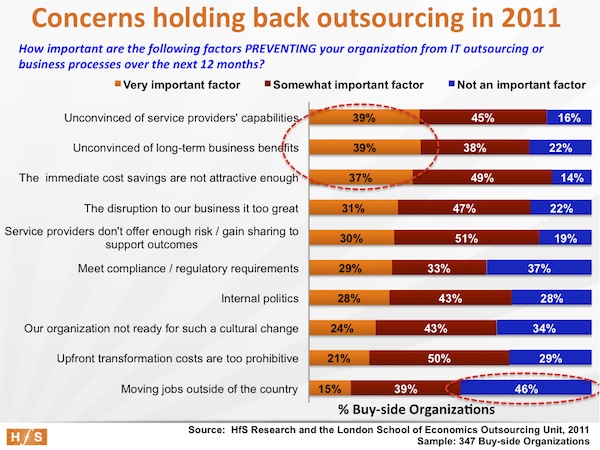

Buyers are distrusting of providers’ capabilities and haven’t been convinced of the proof-points

Clearly, many buyers have not been convinced by providers that they can deliver the goods:

Four out-of-ten cite they have yet to be given genuine proof-points that providers have the know-how to produce long-term business benefits for them. So why are they unconvinced?

The industry is polarized around cost. We believe a main reason for slower adoption of emerging outsourcing areas, lies with the fact that outsourcing has becoming polarized around cost as opposed to business value. Advisors and lawyers are too often brought in to develop watertight contracts and swathes of SLAs, which in turn diffuse much of the trust and relationship energy from the relationship before it’s even been signed. In far too many cases, it takes years to establish the level of trust that should have been established before the onset of the contract.

If you’re just inking a help desk deal and want your lowest price per help-ticket, that’s fine, but if you’re looking to globalize your procurement processes, or improve the quality and timeliness of your management reporting, you really need to see what’s under each provider’s kimono before you tie the knot with them.

Many providers lack proof-points and the ability to communicate effectively with buyers. Part of the reason for this, is that many areas of outsourcing are barely a decade old and there aren’t actually a lot of proof points available. Even so, some providers do a lousy job relating to buyers and providing a listening environment where they can have other clients share their experiences. Several providers still have archaic channels to market, whereby they simply fail to communicate with business function leaders who want to learn more about outsourcing and global business operations. Smart, creative relationship energy is required to influence the right business executvies and convince them of what can be achieved in a well-executed global sourcing environment.

The bottom-line

As Part 1 highlighted, buyers are only seeing modest business benefits in areas such as achieving new business process or technology delights. We believe this polarization around cost-reduction is manifesting a distrust among buyers to increase their outsourcing scope into new areas. It’s not about moving jobs out of the country – the core issues are about trust and demonstrating real business value and competency. Moreover, many organizations take a long time to accept such disruptive change as outsourcing – and they require a softer, more value-based and consultative approach to sourcing than simply hard metrics. Cost pressures have dictated much of the growth in outsourcing over the last decade, but it’s clear that many organizations want to see more before they will take the plunge. Remember, today’s corporate decision makers are unlikely to be schooled in the world of global sourcing – they usually come from finance, legal, sales or operations backgrounds. They want to see how outsourcing will really impact their business, and many of them are still yet to be convinced providers are going to deliver business value to which they can relate.

Stay tuned for the next installments in this series, where we will look at trends by industry, company size and by region, in addition to anticipated outsourcing adoption. And your comments and debate are always welcome!

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, IT Outsourcing / IT Services, Sourcing Best Practises, state-of-outsourcing-2011-study

[…] the original here: The undisputed facts about outsourcing, Part 2: Despite huge … Comments […]

Amazing data. Thanks a lot for sharing.

It would be interesting to see the attributed causes to the failed outsourcing attempts.

So instead of asking for “concerns” of why they won’t go for outsourcing, it would be interesting to know why clients would decide not to go for outsourcing anymore?

(asking clients instead of prospects)

Brilliant write up and fascinating data.

Clearly buyers are scared and worry about moving their processes over to third parties. I would 100% agree that providers need to do a better job of providing real proof-points to reassure clients of mitigating the risks and also creating value. Everyone knows they will save money (at least initially). The focus needs to move to risk-mitigation and value-creation through sourcing,

Andrew

HFS nails it again. First the hype, then the reality – you are such a valuable resource for the outsourcing business.

While the potential is there, you focus on some of the core issues holding back growth. I agree it’s a slow, challenging process for buyers, and providers/advisors need to go a lot further to take the discussions beyond simply cost-elimination. Part of the problem, as you mentioned, may lie in the contracting process at the onset of the deal, which doesn’t allow for relationship-building between providers and buyers, where many of these concerns can be addressed.

This may also explain why so many deals get bogged down and take years to some to fruition. Clearly something is wrong with the whole selection / negotiation process,

Graham Wright

Do you think it may simply be clients scared of “letting go” and having to trust the provider’s delivery staff not under their direct control?

Seems more of a change management challenge to me than a trust issue. It’s like a manager being secure enough to hire staff with more knowledge or expertise than he has and having to exercise relationship management skills to drive performance, as opposed to downward management expertise. Providers may need to communicate these control issues more directly at the C-level, as they may find themselves fighting a losing battle at the operational management level within clients.

Kieran Dempsey

@Kieran – people always doubt others can do something as well as they could, and this is especially the case when dealing with institutional, often unique business processes. I don’t think anyone’s to blame here – it’s simply a case of buyers learning that outsourcing is more about partnering than letting go. While giving up some operational control is clearly an issue for any company, they’re not giving up the ownership of their processes. Providers need to work harder to educate organizations on the principals of outsourcing – which means higher-level discussions with C-level executives and stronger proof points from mature outsourcing buyers,

PF

Very good article and data.

Could you further explain what do you mean in the chart about top activities outsourced by “Shared services” and “Captive”?

thanks

[…] Research Services « The undisputed facts about outsourcing, Part 2: Despite huge untapped potential, providers a… […]

@Tony: Captive = a non-outsourced delivery center in a nearshore/offshore location. Shared services = inhouse delivery center which runs broad business support operations in a centralized location (or small number of locations). A captive is typically an offshore center managed directly from the onsite/onshore team. Shared services are normally onshore / rural shore (sometimes nearshore). In most cases today, companies blend their captives into a broader global shared services delivery set-up. I doubt we’ll even be taling about “captives” in a few more months…

PF

[…] Fersht on June 9, 2011 If you participated in our State of Outsourcing 2011 survey (see here and here), you may have been anxiously monitoring your inbox for a notification that you’d won the iPad 2. […]

[…] existing service provider portfolios and further reduce their onshore staff numbers. As Part 2 illustrates, many firms still have plenty of IT support still inhouse or in shared services. We expect a […]

[…] Source: Horses for Sources […]

Great figures and data there, this would at-least help the Indian companies to over come the myth that the major reason for Onshore companies not to consider Outsourcing isn’t only the Job Cutting Dissatisfaction and keeping opportunities inside US, rather at most of the time it is that the India counterpart do not appeal to their Onshore client enough to convince them on how outsourcing can be benefited. Outsourcing is’nt only about sitting at an Offshore location and executing things with cheap labors, its rather joining hands and sharing the organizational responsibilities to ensure value addition along with cost savings, only then it makes sense and will increase the business.