Global coverage for healthcare continues to shift away from commercial underwriting to governments as the quadruple aim of care (cost of care, experience of care, health outcome, and health equities) is challenged. This shift indicates a complex set of challenges and opportunities across the market, making a clarion call for a new generation of disruptors and innovators.

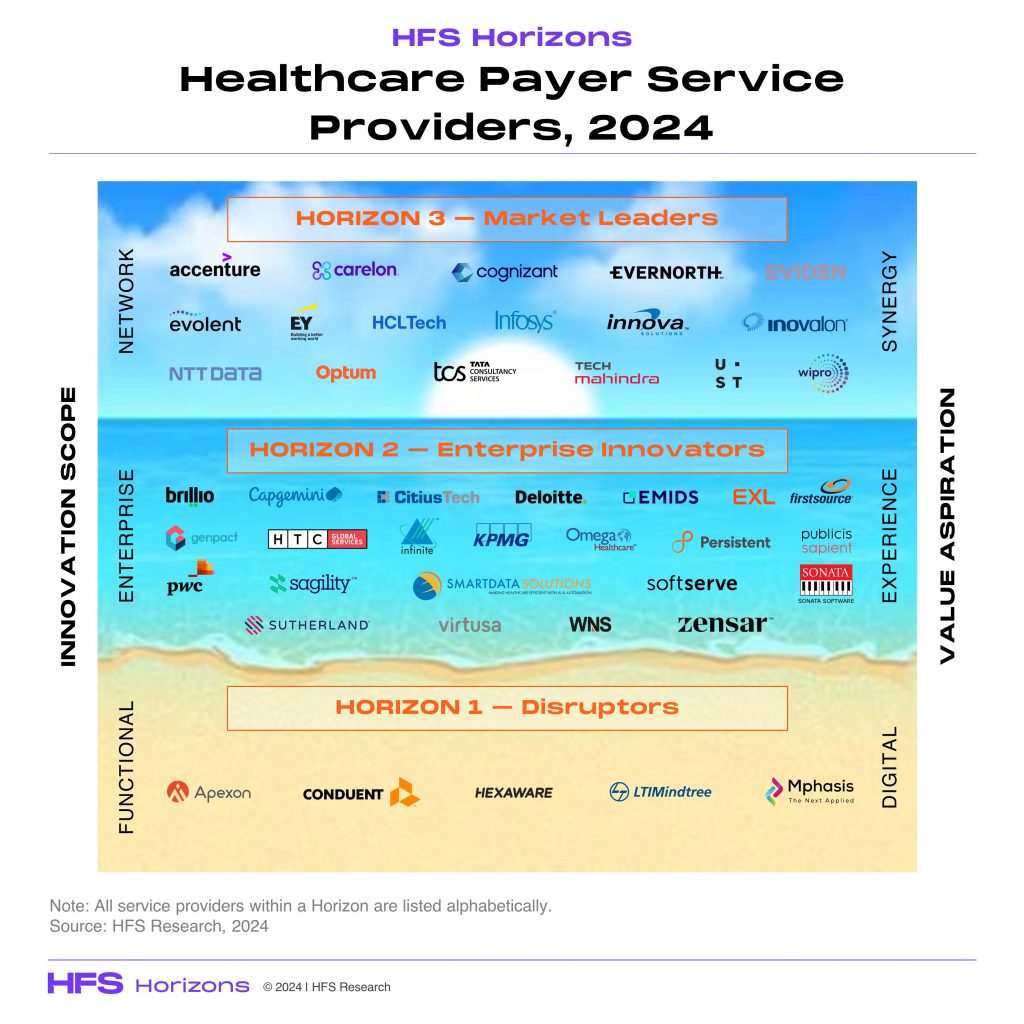

In the HFS Horizon: Healthcare payer service providers, 2024 study, we evaluated 45 service providers for their ability to address the cost of care (Horizon 1), experience of care (Horizon 2), and health outcomes (Horizon 3) for health consumers globally. We also began to explore service providers‘ efforts to address health equities. This study reflects inputs from more than 300 healthcare enterprises, over 80 enterprise references, and approximately 80 supplier partners.

45 service providers reflecting a variety of heritages attempt to address the quadruple aim of care

It’s a jungle out there, with new big game that’s been ignored in the past

The significant legacy commercial group insurance that contributed to high margins continues to decline. Medicaid lives are plateauing, Medicare reimbursements are declining, and ASO is under unprecedented pressure as employers seek other avenues for services. So, health plans have increased outsourcing and offshoring to overcome their financial challenges, driving service provider growth. Outsourced services include new (health equity) and traditional (customer service) services. Service providers are also exploring newer insurance markets in the Middle East and Latin America as they optimize their value proposition and diversify their revenue mix.

Costs and margins will headline the story more prominently than before

Large to mid-sized vertically integrated healthcare enterprises are reflecting 1-3% margins, while stand-alone health plans are showing closer to 1% margins, which is not sustainable or acceptable to their stakeholders. Despite the top-line growth reflected by service providers, they will see margin deterioration over the next three years regardless of claims that AI will aid in margin expansion. That tech–enabled growth movie has been played out in the past under banners such as automation and RPA.

Bigger ain’t better… a lesson that remains unlearnt

Top-line and bottom-line challenges have forced more than 50% of health plans to acquire non-similar businesses such as health systems, pharmacies, and health services. There have been signs of some successful financial integration, though not consistently, but certainly no evidence of success with operational integration. Most service providers can address both payer and provider needs independently but have yet to make the transition to integrated offerings to address vertical integration challenges, choosing instead to sell to legacy buyers. It certainly does not help that integrated healthcare enterprises continue to buy in silos, missing the benefits of integration.

Employers will drive the next apolitical healthcare transformation

Employers are underwriting the health of ~30% of all lives in the US, increasingly seeking new models and channels to address their employees’ shifting demographics and needs globally. Services providers remain on the sidelines of this market, unable to wrap their heads around this opportunity, assuming that servicing ASO is servicing self-insured employers. The fastest and largest segment of the market is getting the cold shoulder from most of the incumbent service providers, allowing a new generation of service providers to take pole positions.

Equity is not just nice to have… it’s an economic imperative

CMS added the Health Equity Index to Medicare Star ratings, which will be used in the 2027 rating calculations. So, the days of well-meaning health equity narratives must now translate into action on the ground. Consequently, service provider solutions for data aggregation and analytics to address equity are gaining some traction, but solutions to drive sustainable and stronger impact have not seen much daylight yet.

The Bottom Line: Although the buy–side market dynamics have shifted significantly, the sell-side remains biased toward the legacy.

Payers have morphed into service providers themselves and are stumbling about to craft a viable future path. So, service providers that have gained success by answering the mail and plainly addressing the needs of payers should rethink their success levers in the future. The game has changed, and so will the way it is going to be played.

HFS subscribers can download the report here.

Posted in : Healthcare, Healthcare and Outsourcing, HFS Horizons