Salesforce dot com. Remember that upstart little CRM online platform that created affordable, intelligent customer management capabilities that defied the evil on-premise model?

Well, it’s now a multi-billion dollar service market that commands ERP-level rates, demands expertise that are in very scarce supply… and has driven a whole ecosystem of services upstarts and established providers all seeking to master the art of delivering salesforce-as-a-service. So without further ado, let’s hear from Blueprint report authors Khalda de Souza and Charles Sutherland on this escalating As-a-Service market:

Khalda.. why have we undertaken an HfS Blueprint on the Salesforce Services market at this juncture?

Well, we saw the Salesforce services market as being analogous to a “petri dish” where many of the innovations of the “As-a-Service Economy” are visible. As a result, we wanted to use our Blueprint methodology to assess how service providers were responding to all of these innovations up close and in a structured manner. Every enterprise and service provider is making the commitment to Write Off Legacy in some way by moving to Salesforce to begin with and with that they are looking for Plug and Play Digital Business Services that deliver Actionable & Predictive Data on their operations. Responding to these Ideals alone is leading service providers to innovate and invest in better execution of as-a-service capabilities yet these service providers are also experimenting wit how to bring Design Thinking into solution delivery, creating a regime of Collaborative Engagement and working together with clients to become Brokers of Capability. It’s a fascinating market today that is helping to shape the new way of delivering IT and business processes especially given the enthusiasm of all parties in this market that is on display not just at Dreamforce each year but in the way that all parties talk about what they are doing with Salesforce on an on-going basis. As a result, there was no way HfS wasn’t going to be covering this market with a Blueprint in 2015 and beyond.

How does HfS define the Salesforce Services market?

We believe that there are 5 components to the Salesforce Services Value Chain today as delivered by service providers to create value for enterprises: Plan, Implement, Manage, Operate and Optimize. Plan includes consulting services such as: Salesforce business case development, compliance, security and governance services, as well as CRM strategy and Salesforce specific process and design services. Implement covers all the services and skills required for effective deployment, including but not limited to: project management, testing, training and data migration services. Manage includes: all ongoing integration and support services. Operate includes: business processing outsourcing (BPO) services where they are delivered by the service provider around the enterprise’s Salesforce environment from sales and service to marketing and more. Finally, Optimize services are intended to improve the impact of Salesforce solutions and may include: the assessment of new Salesforce platforms, on-going CRM strategy alignment, best practice content curation.

So, which service providers seem to be thriving best in the “petri dish” of Salesforce Services today?

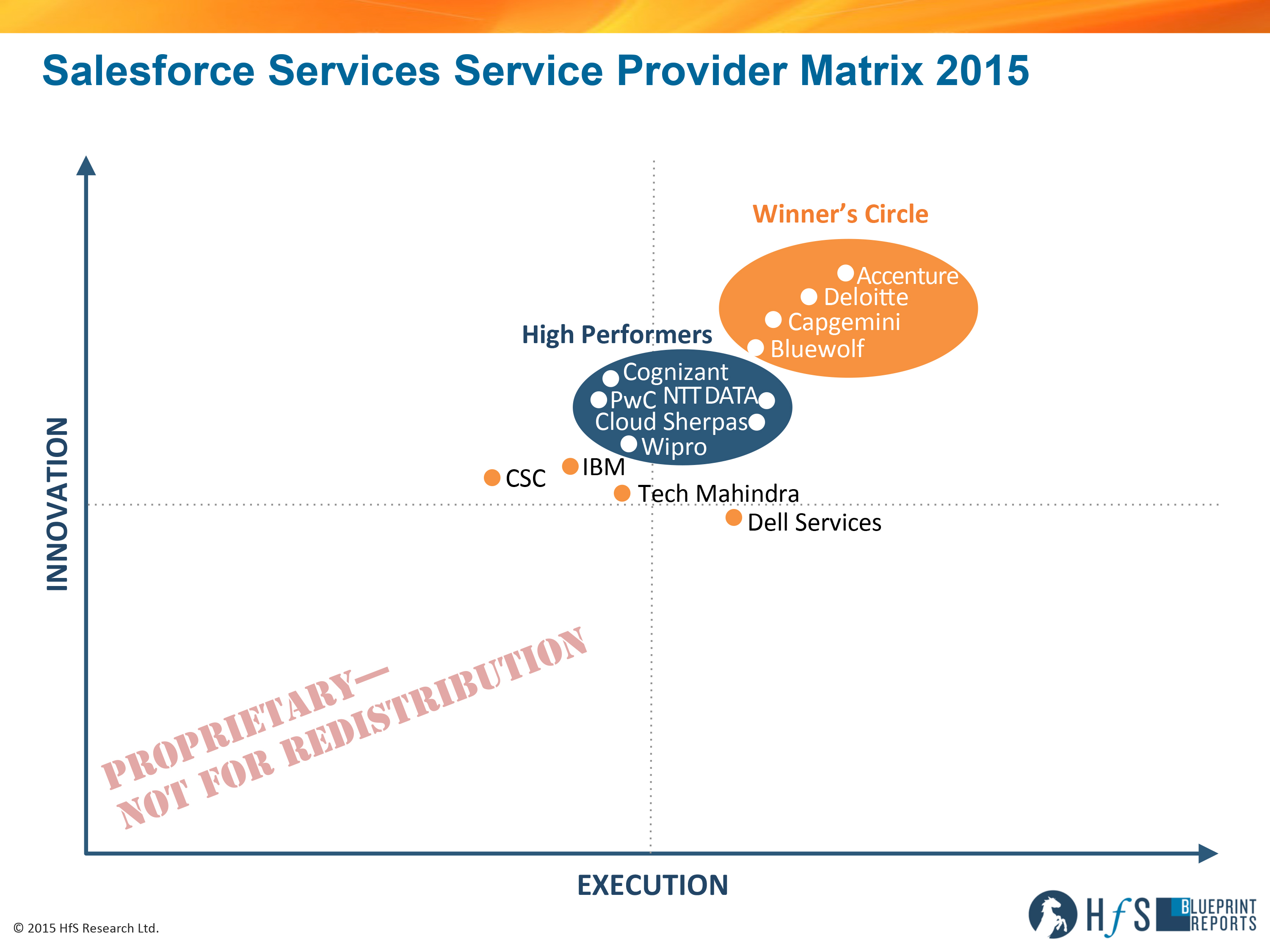

Using our HfS Blueprint methodology with its crowd-sourced metrics for Execution and Innovation assessment criteria we found 4 Service Providers who belong in our Winner’s Circle for Salesforce Services today. The Winner’s Circle providers were: Accenture, Bluewolf, Capgemini and Deloitte. Some of the reasons these service providers came out on top included the way that account management teams guided clients into the “As-a-Service” world, the breadth of reach in capabilities in Planning, Implementation, Management and Optimization, the vision each provided around maximizing Salesforce effectiveness, the management of solution partners and the investments in tools, accelerators and industry solutions.

We further identified 5 additional service provides that are HfS High Performers including: NTT DATA, Cloud Sherpas, PwC, Cognizant and Wipro.

What are the major trends we see which will impact these service providers over the next several years?

The biggest trend we see impacting service providers going forward is the ever-increasing reach across processes of the Salesforce offering. Enterprise clients are expecting service providers to be able to support across Sales, Service, Marketing, Analytics and now the world of IoT as well through Salesforce solutions. This means that service providers need to be investing in the recruiting (and retention) of Salesforce certified staff and then their on-going training across the offering set. The leading service providers will continue to invest in differentiating skills and solutions to meet the growing client demand for business focused Salesforce deployment and support services.

The next major trend we see is the increasing opportunities to offer value added services across the Salesforce service value chain, with the most obvious being in the Implement phase. Here service providers have opportunities to create differentiators by developing proprietary tools and technologies that facilitate faster and more effective implementations. Notably these would include automation technologies, and the leading offerings would have industry specific focus to deliver relevant business benefits to clients. The ultimate aim should be to achieve the coveted Salesforce Fullforce industry solution certification, a stamp that is clearly presented on the service provider’s profile on the Salesforce Appexchange web site for potential clients to see.

The third major trend of note is the continued push towards the realization of the 8 Ideals of the As-a-Service Economy in this Salesforce environment. In particular, HfS expects to see service providers invest in Design Thinking skills to maximize the benefits of new Salesforce environments and for investments by Salesforce themselves, third parties and the service providers in capabilities to drive through greater levels of Intelligent Automation in Salesforce solutions as well.

What recommendations do you have for enterprise buyers who want to get the best out of their Salesforce service providers today?

HfS believes that enterprises that want to make the most out of investments in Salesforce services going forward should:

- Use the Salesforce Success Community for information and to collaborate with experts.

- Use the Salesforce Appexchange web site to browse the latest solutions and consultant partners. There are top level profiles of the latter to facilitate provider selection short lists but beware that the statistics presented are not always up-to-date.

- Use the HfS Salesforce services value chain to identify which skills you have in-house and for which you require assistance from an external service provider.

- Push the service providers to go beyond the RFI and prove real differentiation, and demand access to other clients before selecting the service provider and during the engagement to compare best practice and experience.

And finally, what recommendations do we have for service providers through 2015 and 2016?

HfS believes that service providers that want to have the greatest impact on enterprise clients and lead the Salesforce services market should:

- Invest in functional understanding and adopt a holistic approach to CRM. Leading service providers position CRM and Salesforce in particular at the heart of clients’ digital transformation journeys, rather than view it as discrete, tactical technology implementation projects.

- Invest in industry sector solution development. Visionary service providers that continue to invest in industry specific solutions and strive for Fullforce industry certifications have opportunities to establish a leadership position in selected markets.

- Identify valuable partnerships. Leading service providers are able to identify valuable partnerships, including equity investments that will enhance and tailor Salesforce solutions.

- Be bold and stand out. Service providers should think out of the box, present innovative approaches and ideas to stand out from the crowded partner ecosystem.

- Tell the market what you’re doing! Too many of the service providers in this Blueprint are coy about their Salesforce services capabilities. This market is going to get more complex and demanding going forward especially as small service providers with unique skills will continue to be prime acquisition candidates for the major service providers. Therefore, Salesforce service providers need to market their strengths to Salesforce so that it can recommend the relevant providers to enterprises, as well as to potential clients themselves. Moreover service providers need to ensure that their profile on the Appexchange web site is up-to-date and reflects the latest statistics and capabilities.

Charles Sutherland can be tweeted at @cwsuther; Khalda de Souza at @Khalda_De_Souza

HfS readers can click here to view highlights of all our 27 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report: Salesforce Services 2015

Posted in : Business Process Outsourcing (BPO), Cloud Computing, CRM and Marketing, Digital Transformation, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, SaaS, PaaS, IaaS and BPaaS, Security and Risk, Social Networking, Sourcing Best Practises, The As-a-Service Economy

[…] Accenture, Deloitte, Capgemini and Bluewolf lead the industry’s first Salesforce Services Blueprin… – Salesforce dot com. Remember that upstart little CRM online platform that created affordable, intelligent customer management capabilities that defied the evil on-premise model? Well, it’s now a multi-billion dollar … […]

[…] Accenture, Deloitte, Capgemini and Bluewolf lead the industry’s first Salesforce Services Blueprin… – Salesforce dot com. Remember that upstart little CRM online platform that created affordable, intelligent customer management capabilities that defied the evil on-premise model? Well, it’s now a multi-billion dollar … […]