Just when you thought it may be safe to give up a couple of days of your life to get to know a service provider better, with, maybe, a 10% reduction in slide bombardment (if you’re lucky), one of the Indian majors has added a whole new dimension to the sales cheese game…

Fly in anyone with a pulse (literally) to receive the bombardment. Suddenly, they don’t really care who they’re talking to anymore… they just want butts on seats.

As an industry analyst, I need to devote a good amount of my time with service providers to learn more about their businesses and attempt to decipher what makes them different (if anything) from others. In addition, it’s important to meet their leaderships to challenge their business models and relay what their clients and prospects are saying about them. Most of the time, these discussions can be held privately in briefings, but once (or twice) a year, some of them beg me to attend an event of theirs so I can absorb multiplous hours of their posturing, pitching and pontification.

And sometimes these actually turn out to be educative experiences with two-way dialog and a chance to meet some new people. However, I tend to keep my expectations at the floor level, as many of these experiences frequently end in boredom and bemusement that they are pitching the same stuff that was in vogue a decade ago, and depression as all the kingsize rooms were divvied out to the Gartner analysts.

But now enter the new “whack-a-mole” marketing strategy. Fill the room with suits… and who gives a damn!

This week, my suspicions of this new strategy were initially raised, when I inadvertently showed up late at a lovely airport hotel, where I quickly registered and slipped quietly into the ballroom to join the proceedings. The room was wall-to-wall packed… there was nowhere to sit, so I sheepishly hid in the corner at the back of the room for a while, with the vein hope some nice helper would slip me a chair. It didn’t happen…

Then followed lunch, when again, there must have been 20% over-capacity with the butts:seats ratio. Anyway, once that fiasco was endured, we were all rapidly shepherded into our break-out sessions for more PowerPoint proliferation and it was business as usual, as the laptops all came out and the vast majority of the attendees absorbed themselves in whatever they do when their laptops are on, and the provider executives proceed to read off their endless decks.

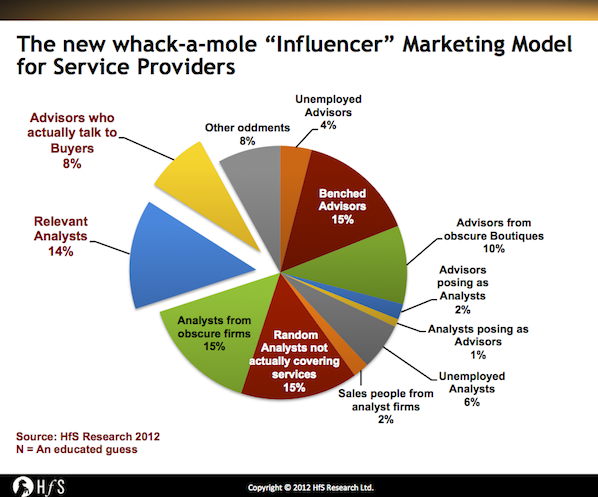

These days, we’re used to some providers mixing up their audience with analysts and a few reputable advisors, but this was a whole new experience. Here’s the breakdown of characters:

- Advisors who were actually unemployed;

- Even more advisors who were on the bench and openly complaining about the “lack of deals”;

- Advisors who worked for boutiques even I had never head of (and were probably unemployed);

- Any “analyst” based locally in Boston who was trying to figure out whether they had anything in common with the provider’s business (I even bumped into one who was covering renewable energy). Several were spotted slinking our of the exits after lunch;

- Analysts who were once gainfully unemployed and still attended any vendor event under the sun, still holding out hope that the good old days were soon returning and one of the big shops would miraculously rehire them;

- A handful of analysts and advisors whose coverage and client engagement was relevant to the provider in question.

And here is an educated guestimate break-down of these characters at the whack-a-mole show:

The Bottom-line: The butts-on-seats model may work with the outsourcing model, but not influencer marketing

The provider in question has a strong reputation for its aggressive pricing and determination to win new client logos. What baffles me is the ROI with its marketing focus. Why not pick out the 20-30 folks from the audience who actually care about services who talk to clients and stop wasting time with everyone on their spam list who has nothing better to do than show up at these things? We estimate that barely a fifth of this audience actually had some relevance to the provider’s business and future growth potential.

If you focus on those relevant influencers who actually understand the industry and are involved with real buyer clients on a daily basis, then you’re going to have a more intimate and educative experience for all. However, if you lump those who matter in with those who really don’t (many of whom waste everyone’s time asking stupid questions), then you’re going to lose the real influencer’s attention and probably their attendance at future events.

It’s time for some of these providers to wake up and start engaging influencers properly – this type of approach has little ROI and the net result likely to be negative.

Posted in : Business Process Outsourcing (BPO), HfSResearch.com Homepage, IT Outsourcing / IT Services, Outsourcing Advisors, Outsourcing Events, Social Networking

Haha, Phil, you’re still going to these things trying to learn something about the service providers? Hopefully the food was good, and at least it was local.

Hey buddy! I have been trying to be more selective, but was “sold” very hard by this particular firm to invest my time there. Lesson learned 🙂

Thanks for an uplifting view on the new Indian provider marketing techniques – good observations.

We participate in a fair few conferences, acting as both Partner, Tech provider and … occasionally … advisor (Public Sector Clients) and the feeling that we get pushed to the back of the room when attending hosted conferences by the large number of “Interested” parties is sometimes a little disconcerting.

A recommendation to these provider groups could be to introduce the roped off VIP area … seems to work in Night Clubs – then everyone could participate at the appropriate level.

Hilarious.

Let me guess, HCL?

Excellent article. It never ceases to amaze me how some Indian firms are obsessed with advisors. Is it because they do not believe analysts will help them sell their services, or simply because they do not want to pay their firms the exorbitant sums of money to turn up at their conferences?

However we look at it, mixing advisors and analysts together is a tried and failed model and most providers have veered away from it today. Most outsourcing advisors have been in the industry for 20+ years and only focus on the way the industry once was. They are looking for deals/jobs, whereas analysts are looking for information and points of differentiation.

If this provider wants to be more effective, then avoid throwing everyone together in one single conference.

Very funny! I don’t think anyone’s shocked by this and most of us have endured similar experiences.

The way some of these suppliers market themselves mimics they way they sell: no subtlety or finesses. If they want to move up the value chain from what you call “butt on seats” then they need to refine the audience they are looking to influence.

Phil

A new model? This was the approach 10 years ago. The only difference today is the increase in unemployed advisors,

Mark

This particular firm has an obsession with the advisors and has invested heavily in those relationships…I am sure TPI and Alsbridge are happy because they then buy their research.

Off course they have to fill a ballroom, how else will the ego filled execs feel satisfied that marketing is doing a good job and driving billions of dollars of CV into the pipeline….

@analyst – are you saying this provider pays advisors money?

I agree with Analyst in that the larger boutiques are happy to attend since there is an implicit quid pro quo arrangement. Haven’t you ever wondered what Momentum from ISG is all about? It’s TPI coaching service providers. So much for “un-biased” advice.

Phil, this is just indicative of the Indian providers’ historic business model and delivery model: inputs are cheap, spread them around. The marginal cost of one more unit of output is low – whether it analyst bums on seats, or transactions, or lines of code- so managers are not used to being measured on their skill at making descretionary judgement, but on low cycle-time and high throughput.

@analyst2: this has been going on for years. In their defence, some of the Big 4 and McKinsey all make a fortune consulting for providers. In fact, there is one advisor who makes more money from providers than they do buyers. However, if a boutiques’ core business is administering RFPs and outsourcing transactions, as opposed to management consulting, then taking money from the same providers with whom they broker deals, is very “tenuous”. What bothers me more is the fact that many of the Indian providers rely hugely on the advisor community to get pulled into deals, as they do not want to invest in high-caliber consultants to develop high-level relationships – for example in the BPO space, here is the picture…

Momentum, who now owns Outsourcing Center….

and for the record not all Indian vendors do it….for this particular vendor “focus” is not what they are good at. The spray gun tactic is what they see as best internally and externally. I am sure the chiefs at the top of the organization measure success as how full the room is and how long the queue was for the cold hard chicken…

@mile – sigh. This industry needs to get off its ass and improve its value proposition, or we’re forever dealing with the lowest common denominator of services. I trust you read our BluePrint Document?

Phil, we all know the advisory biz is on the decline and hence their move into research and selling to vendors…what will the Indian vendors do when it hit homes that these guys are not pulling them into deals any more…this particular vendor for example hasn’t invested into the consulting model at all….everyone knows their one major acquisition in this space has been a failure…

@Analyst – some of the vendors will keep some of the (remaining) advisors on life support (and some are currently on it) as it’s cheap to throw them a couple hundred grand (that’s like the cost of one mid-level sales FTE). In reality, there are only two independent boutique advisors surviving with over $10m in revenues, so we may have already reached the end of this little game. What was witnessed this week was the remnants of this model. The presence of the Big 4 in sourcing should start upping the conversations and the value-model discussions next year,

PF

Phil,

Kudos for a brilliant – and very funny – post. Reading these comments it’s loud and clear that there are three things plaguing the outsourcing business:

1) Offshore vendors, their powerpoint, their aggressive selling and their unwillingness to listen,

2) Advisors who learned their trade in EDS in the 80s and 90s who only do one thing: broker cheap outsourcing contracts,

3) The failure of the entire outsourcing business (buyers, providers, advisors, analysts etc) to educate the business world that outsourcing can deliver more than merely low-value work and cost-reduction.

Until these three problems are solved, this business will feed at the bottom of the ocean,

Peter.

@peter – can’t argue with that. 2013 has to be the turning point…

Maybe as much as can be outsourced to India has been (and more, which is coming back as the miscommunication and lousy work expenses add up).

Maybe a business model that incorrectly conceives knowledge workers as interchangeable resources also incorrectly conceives customers/analysts/advisors as interchangeable resources. Hey, the useless middlemen all have to get their mordida on that continent, why would the US be any different?

Very funny, and very appropriate. This industry needs to shed the old guard mentality of big deals, maximum cost savings… and little else. The world has moved on and we need to move the conversation to value creation and growth that outsourcing can help support.

Providers, such as the one in question here, need to shift the conversation and avoid spraying the market with their message. More focus on value, less focus on transaction advisors is the first step. However, I suspect the provider in question thinks it did a great job and will repeat the same strategy year after year as long as it’s in business,

Steve Hedges

Phil – wow. Strong stuff wrapped up in good humor (do we expect anything else from you?).

Accenture, IBM and Capgemini must be loving the failure of their Indian competitors to close the gap when they see the same old behaviors continuing. If these Indian firms want to become real global players, they need to start behaving like mature global providers, investing in educating real business audiences that matter. Importantly, they need the voice of the business owner, not the same old aging advisory consultant, otherwise they’ll never move on from selling deals on price alone. The world is moving on – can they keep pace, or are they going to slip away with the slowing market?

Phil, I think you are being a bit tough. I was there also and agree the rooms seemed undersized. The round tables were not conducive for taking notes, tweeting etc for at least 5 out of 8 on each table and they probably could have handled 20 more seats in a more traditional row format, not to mention more writing table space.

I am always looking for innovation for my books and blogs, and as I blogged below, they came across as a traditional IT outsourcing firm – high labor, low automation. Having said that they are pretty clear they are relentlessly focused on the “rebid” market – contracts likely to churn they estimate at $ 190 billion in next 3 years. For that they do not need to show off high-falutin stuff to impress you and me. BTW – I was surprised how much they have diversified into Brazil, Poland etc, so they are much less Indian than they were a few years ago.

http://dealarchitect.typepad.com/deal_architect/2012/12/insight-hcl.html

Regarding who was invited – that’s always a mystery but let’s be modest. Both of us were invited, let’s not dictate who they should not have invited.

Finally many of the comments above are from “analysts”. Having been both an analyst and an adviser, there is a role for both, but analysts with their short burst phone calls and long reports just don’t customize their input enough for large, multi-month deal cycles.

My one concern with the advisers (and analysts) in the space is they are siloed. I just don;t see enough efficiencies demonstrated in adjacent markets like SaaS, cloud infrastructure being worked into IT outsourcing deals.

See my post on that below

http://dealarchitect.typepad.com/deal_architect/2012/12/whither-outsourcing-advisory-services.html

@vinnie – yes, this blog was harsh, but I believe honest. If we’re not harsh on these guys, they’ll never listen and keep repeating the same mistakes over and over. Firstly, I am admirer of said vendor in question (OK, it’s HCL everybody, so no more paranoid text messages while I am on holiday, please). Read my earlier blog on them:

Today, the firm is growing largely due to the sheer number of unconventional deals it is contracting, in addition to its aggressive pricing which is becoming a popular topic of discussion between sourcing heads. Plus, the firm has a very aggressive sales engine. It kinda reminds me somewhat of Cognizant five years’ ago in terms if its size, thin management layer, and incredibly personal approach to client service – from the CEO and his immediate team.

HCL is another example of an Indian-HQed firm that will pick up on the poor quality provided by Western Tier 1s. However, the firm does need focus, polish and business development leadership to get to the table. Its operations and infrastructure team resonates well with clients, but tends to get way too far in the weeds during initial sales pitches. It needs to avoid trying to solve all the client’s problems within the first 30 seconds of meeting them.

Having attended recent events with Indian-centric competitors Wipro, Infosys and Genpact (where I did not have the pleasure of bumping into you), the notable difference was the refinement of the audiences invited. Wipro and Genpact chose to mix the analysts and consultants together, but were clearly more selective and knowledgeable of the influencer community by with bringing in a smaller number of influencers who had clout and were largely working with their clients – and relevant to the subject matter. Infosys breaks out its BPO group conference (which is one of the best mixtures of buyers/influencers of any of the events) from its corporate (analysts only and clients). Cognizant’s own event, Community, as you know, is one of the best in the business and EXL recently did an impressive job bringing its clients together in New York.

All-in-all, I believe these events are critical representations of the providers’ ecosystem: its clients, its influencer, its caché in the market. For many, it’s the only real touch-point they get with the provider. While I admire HCL’s aggressive place in the market, it’s marketing prowess is way behind that of its competitors. Why they won’t hire a high-caliber CMO and invest in a team to grow its influence and message it beyond me… just compare its progress to the job Malcolm has done at Cognizant,

PF

In my new avatar as buyer of services from providers like the one you are referring to, I see this so often. I often tell them to close the ppts and have conversation with us and ask us questions and answer ours. Just by having a new CMO may not help, having a listening culture , breaking down the internal silos (geography,line of practice, horizontal and vertical) could be a good start.

Phil- I’ve always loved your harsh but honest feedback and truly believe this is the ONLY way to get your message across when there are so many advisors and analyst covering the market. I do belong to the same “Indian Provider” community and echo your comments. However, am trying in my limited capacity to change the way WNS goes to market to solve one problem at a time more by listening then speaking. Maybe banning use of Power Points by providers will compel them to start interacting instead of being under pressure to finish 60 page deck in 30 minutes…Yogi

@yogi – good to hear from you, old chap. The offshore-centric industry grew up selling low-cost solutions, and it was easy to force that message down company’s throats, after a few years or proving the ROI. As long as clients were assured they could mitigate the risks appropriately and the cost savings were worth it, decisions were made. “Low-cost” is now a commodity table-stake and the real solution sale is in the “what else can you do for me”. However, I do think most providers get that now. The bigger issue is with the legacy advisor community, which still makes 90% of its money around the transaction, and not the governance or business transformation. That is the factor blocking progress in this business. It never ceases to amaze me how little many advisors know about provider capability, beyond their pricing structures and negotiating tactics. However, as long as providers continue to pander to some of these advisors, throw them money for “services” and lavish boondoggles, this industry will continue to be stuck in Outsourcing 1.0. My advice to providers is to focus its relationships on those advisors who really understand the needs of the clients, and go beyond mere deal jockeying… they are the ones who will understand your value and actually “listen” to clients’ needs and help cobble together solutions for them. The provider/legacy advisor vicious cycle needs to be fixed for the industry to move on.

PF

As always your article was candid. Some lessons to be noted and implemented. I plan to read your newsletter more regularly in future. Will you be at NILF 2013 in Mumbai in February?

Harish

Hi Phil…Seems more things change the more they remain the same. Before the Indians came into the picture, the Americans were guilty of the same problem. At EDS 18 years ago when I ran their A/C Relations program the approach was essentially the same…round up the analysts for a 1-2 day dog and pony show. Token appearances by reluctant executives who viewed the entire exercise as a necessary evil. I ended the practice and reversed the process…I took our executives to meet the analysts and advisors at their locations. In reality, it was less expensve and more effective. In 2 years we had transformed the market’s image of the company and forged relationships in the process. Many of the executives also found something interesting, if they actually spent the time, and listened more than they talked, they found the meetings to be more beneficial. Following that model, I did the same as the CMO for ACS with the same results. However, having run Sales & Marketing for 2 Indian firms, there is not just the cultural challenge of adopting such a model, there is the logistical challenge as many of the Indian executives spend insufficient time in the US to do it correctly, and console themselves by delegating the responsibility to an underling…then criticize the process without acknowledging the failed execution. However, the analysts and advisors want to engage with someone who can speak FOR the company, not just from prepared remarks ABOUT the company. Your comments also ring consistent with Deborah’s comments about Indian hiring practices…wanting to hire people who can “walk me into a deal”. Yeah, right…like that is going to happen. And, as if attending an annual analyst day will cause a key market influencer to have an epiphany about the vendor and fill their pipeline in the coming months as a result. NOT. That a pipe dream…not how one builds a pipeline. To the Indian company that can learn to do Sales and Marketing correctly, they stand to reap the rewards by taking market share from their Indian counterparts. But as long as they maintain their volume approach to everything, including Sales & Marketing, they will continue to lose market share to other parts of the world. They too have not learned the curse of pursuing too many deals and diluting the sales effort. As one Indian CEO shouted, “If I hear of another RFP on the street and we are not invited to bid, I will fire anyone associated with it!”

Phil

Very brutal, but extremely honest observation. I suppose its fair to say that everyone trying to talk about everything, and “pounding ” customers with powerpoint has become a norm, and not nessecarily the best one, across the industry today. Across any interactions, the general level of engagement has now reduced and people generally want a deck to get started.

I’ve run media, investor, and analyst relations at various points and while there are occasions when you meet need to communicate to the pack (mostly to avoid selective disclosure), the norm is to meet influencers one-on-one. There really is no excuse for the sort of party you describe — any marketer could have predicted the negative vibes it would generate. So this fiasco probably says more about the boss than the marketing guy.

@Thom – agree with and share your approach. The Analyst/Advisor day is created with the service provider’s need for economy of effort in mind. Neither the needs of the audience, nor the quality of interaction are given the priority they deserve. In my mind, Advisor Relations is a sales job, not a marketing job. Pick your targets carefully so that you can afford to invest effort in the interaction, go and see them at their convenience and spend quality time with them 1:1 talking about things that drive opportunity for BOTH parties. That drives sustainable relationships, not “Broadcast PPT”. But it takes thought, preparation and just a little bit of effort.

Not harsh at all. I liked Yogi’s comments about learning to listen. Having been with a prominent Indian firm I could see the difficulty of embracing a different way of engaging the market that differs from their historical “success model”. Labor cost savings for transactional work is in fact table stakes. The provider market has seen separation in terms of market share and momentum in specific service domains like F&A for example where the leaders seem to be creating separation and forcing others to reposition, focus on domain specific niches or just sale prices. The advisor and analyst community knows why the leaders are creating separation. It’s not labor arbitrage. It’s domain specific expertise, industry specific, track record, financial depth, quality of people, advice and engagement and perhaps most importantly, comfort that there is a cultural and values fit.

The insistence of some firms to deluge analysts, advisors and clients with an avalanche of capabilities pitches reflects the challenge and discomfort many firms face in transitioning from a transactional view and operating model of the business to a strategic one. It’s hard for firms that have not been able to make the leap to make choices, speak in strategic terms of end state possibilities, response to challenge and opportunity as their key differentiators. The ” if it moves, pursue it” mentality exists and some firms and many executives in the provider firms are ok with it because that’s how they feel they succeeded in the first place. It’s a tactical capabilities response to a strategic challenge. There is a reticence to cede control, embrace a different way, share real leadership outside the ” founders” team in many of the provider firms and that is seen in their org charts, client facing and marketing and sales hiring, willingness to invest in relationship and brand equity development and their resulting business and marketing practices.

I do believe the firms are better served focusing on a more thoughtful segmentation and messaging approach that will better serve their sales and communications needs as well as the needs of the audience. How often has anyone gone to these sessions and heard something unique, compelling or truly thought provoking?