No industry has been, is currently – and will continue to be – so wholly and fundamentally disrupted by impact of Digital Technologies than retail. And how can retailers survive and prosper in this post-Amazonization world where good ol’ firms like Radioshack and Brookstone are on life-support? How can they constantly stay ahead in an environment where the channels to market are forever blurring, the places to market and advertise are increasingly complex to understand and target, and the supply chain strains to respond to increasingly unpredictable demand signals from ecommerce and social media, in addition to traditional retail channels. Staying ahead of the retail curve is harder than ever, but the rewards are also potentially much greater for those which uncover new market channels and make sense of the proliferation of available data. In order to extract some sense from this intricate market, HfS analyst Reetika Joshi set about developing a Blueprint analysis on the space…

Reetika, how did this market evolve and what is driving buyer interest in Retail Operations today?

The retail operations marketplace has evolved over the last decade in an opportunistic manner. Buyer demand has primarily addressed traditional IT services and horizontal BPO needs (including customer service, finance & accounting and human resources outsourcing). In the last five years, buyers and service providers have also started to venture into outsourcing retail-unique processes to a limited extent. These include service support for areas such as storefront operations, merchandizing and replenishment, ecommerce channel support (content, web development and customer service) and supply chain processes. Buyer interest in these core services support area is being driven by four key imperatives for global retailers today:

- Cost Reduction – Reducing cost and creating process standardization in a low margin business, especially for large retailers

- Surviving the ‘Amazonization’ of retail – Digital retail and developing a progressive digital roadmap (strategy and execution) that aligns ecommerce and brick and mortar operations. This includes not only the integration from an inventory management standpoint, but elements that affect customers that outsourcing can address, such as cross channel pricing and promotion and merchandizing opportunities.

- Creating a future-proof supply chain – Bringing visibility in supply chain operations, streamlining inefficiencies across geographies and units, improving forecasting and time to market. As supply chain management (SCM) becomes more complex, there is more of a need for proactive monitoring and reporting and dashboarding, customer impact visibility, cost, etc. This creates a demand related to SCM particularly in the analytics space.

- Elevating the consumer experience – Winning and retaining loyalty of fickle consumers, increasingly the ‘digital natives’ with their heightened expectations for same day deliveries, real time promotions and personalized in-store engagement. This is the most direct opportunity for service providers to pitch next-gen outsourcing services in omni-channel support, as retail has more consumer facing operations than back-office operations thus far.

To address this sea shift in retailers’ business models, service providers have had to go beyond services typically classifiable as ‘BPO’. We see buyer interest develop in areas that have more consultative and technological components along with service support. E.g. consulting/re-engineering services to help optimize supply chains, spend management or formulate digital roadmaps. To add to this mix, service providers have started to push technology-led solutions including point-solution toolkits, analytics products and platforms alongside services support.

And how did the Blueprint analysis turn out?

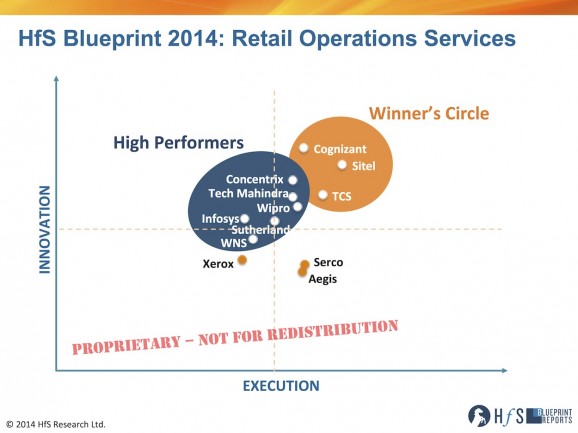

Overall, the clusters of companies in this Blueprint analysis are hedged somewhere in the middle of our map, reflecting the relative nascency of this market and its future potential. The Winner’s Circle service providers represent a diverse mix of origins, approaches and strategies for servicing the retail market. Cognizant, with a robust retail consulting and ecommerce practice, brings thought leadership, an array of retail-specific technology enablers and focus on digital support. Sitel has customer experience management expertise and a collaborative approach towards driving global best practices in retail customer engagement. TCS demonstrated technology expertise and along with its acquired captive retail assets, it brings ecommerce thought leadership to an expansive retail clientele.

Similarly, the High Performers in this study also represent a mix of multi-dimensional strengths. Infosys, Wipro and Tech Mahindra are continuing to expand their range of work with retail clients beyond IT services and are making the most investments in retail analytics and select core process support such as storefront operations and supply chain management. Concentrix, Sutherland and WNS are looking to leverage their analytics capabilities and customer experience management presence in retail to add new logos and update solution sets through new technology enablers (automation, social tools, etc.)

So what are your key takeaways from this study and what should we be watching for in next few years in retail operations?

We believe the retail operations market is set for rapid growth in the next 3 years. This will be largely driven by the impact of digital requirements for retailers which will lead them to look for more and more external support. On the service provider side, this is an interesting space to watch because as a relatively new market, these companies can really build differentiated services portfolios by strategically alinging to what we call ‘progressive operations’. As discussed above, buyer needs goes beyond traditional ‘BPO’ delivery, and as service providers carve out their solutions in this space, they have the opportunity to invest in comprehensive analytics led service delivery, process transformation (especially for supply chain and ecommerce engagements), collaborative partnerships and investments with retail clients that bring together modern technology components to impact business outcomes. Some other observations we made around this market are outlined below:

- The ‘vertical’ retail story has a long way to go. Over the years, service providers have developed significant relationships with global retailers through IT services or horizontal BPO services. While they may have verticalized their businesses to align with client industries, we do not see the same level of maturity in well-thought out retail value chain services support as with other verticals such as banking and insurance. Industry alignment will help service providers bring domain experience to effect core industry outcomes across IT services, business processes and consulting for retailers, but only in the medium-long term.

- Digital proliferation is placing new demands on managing the customer experience. Retailers are looking to service providers most notably to help them address changing customer channel preferences, ecommerce and brick and mortar integration and the nuances of digital marketing. With this study, we saw the most demonstrated capabilities of innovation from these three areas. Service providers are aggressively trying to differentiate their CEM offerings by weaving in technologies that address digital (e.g. gaining a single view of customers, social media monitoring and promotions). Some service providers are starting to productize their offerings such as omni-channel customer analytics recommendations engines, monitoring tools, etc. Success here will hinge on the ability of a service provider to integrate insights back into campaign strategies, provide consultative marketing support, and ultimately transform traditional CEM processes to align with its retail clients’ digital roadmaps.

- Multiple delivery models developing to cater to the seasonal variability of retail demand. Retailers have the highest demand variability among industries for customer engagement management (CEM) services,creating staffing, retention and quality issues over the years. We are seeing certain service providers try and address this with alternate delivery models that have been appreciated by clients in our study. Examples include relying on a much higher percentage of work-from-home agents that are retained long term, and leveraging part time university talent pools in nearshore destinations. The challenge of seasonality is not going to go away and cracking the code on it has the potential to impact revenues at peak times – making retailers particularly amenable to working with innovative service providers in this area.

- Consolidating technology investments across the retail value chain. During our analysis, we observed multiple examples of service providers opportunistically funding/co-investing/piloting technology investments with retail clients. Some of these have resulted in productized offerings in the last couple of years, such as cloud based trade promotions management applications, analytics platforms for ecommerce revenue optimization and supply chain visibility. This approach can be helpful for establishing the business case for certain emerging technologies (e.g. in-store iBeacon mobile technology applicability). However, service providers must craft and more importantly, communicate a well thought out strategy for impacting the retail value chain through technology beyond these siloed projects. What this market doesn’t need is a wide variety of client specific solutions that lack ongoing investment and roadmaps, instead we need to move to more consistent business platforms that span across clients. This will call for service providers to actively enable their non-competitive retail clients to collaborate and contribute towards new solution development and a wider understanding of existing core service capabilities, where applicable.

Reetika, thanks for taking the time to share you new research and insight into the retails operations services market… we look forward to more of your coverage on this space in the coming months.

HfS subscribers click here to access the new report, ’HfS Blueprint Report: Retail Operations’

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Digital Transformation, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Mobility, smac-and-big-data, Social Networking

[…] rarely use this space to toot our own horn, but yesterday Horses for Sources revealed its HfS Blueprint 2014: Retail Operation Services, and Sutherland earned a position in the High Performers circle, and was called out for our […]