Buying Team becomes "Proxima", ICG Commerce,"Procurian"

Did anyone see this day coming? Yes indeedy, the day procurement gets a makeover has finally arrived, with brand-spanking new liveries and catchy brand names for both the Buying Team and ICG Commerce who’ve renamed themselves Proxima and Procurian respectively.

No – they aren’t venturing into wonder drugs or high-end restaurant chains – they are simply sexing-up their procurement with more P’s and less Zzzzz’s… so why now, and – in fact – why at all? Let’s leave it up to a man who once counted paper clip purchasing by the million-load, HfS research’s Tony Filippone himself. Over to you, Tony…

Pure-play procurement outsourcing heats up, triggering two name changes among procurement-focused service providers

You’d think that down-to-earth procurement guys (and gals) would avoid the expense of renaming a firm, but within the span of less than five days two procurement outsourcing service providers did exactly that. Yet, the rationales behind their name changes are quite different.

Proxima (formerly Buying Team) based its new name on the need for procurement to leave behind its cost savings heritage that has always marginalized its value in the eyes of its internal customers. In the place of cost savings, Proxima wants to focus on developing procurement’s “proximity” and “intimacy” with the broader objectives of its business unit. Proxima hopes to position itself as a company that will elevate the position of procurement within an organization through “management control and visibility of costs.” In effect, Proxima team is leaving behind the heritage of “buying”, which connotes boring “P2P” in the eyes of procurement executives, to become closely aligned sourcing organization. “During the last two years we have repositioned our business as an end-to-end procurement services business, with a clear vision and a strategy to achieve our ambitious goals,” explained Guy Strafford, Proxima’s Chief Client Officer. “Having done this, the next logical step was to refresh our brand, which included challenging the appropriateness of the buyingTeam name.” Frankly, based on their capabilities and services provided to their clients, which is heavily focused on strategic sourcing, this name change makes tremendous sense.

Procurian (formerly ICG Commerce) based its new name on the need for procurement to exert sourcing and category management excellence. Based on our research in the procurement space, category management is a differentiator, but clearly its old name didn’t describe the business Procurian is in. As, Shannon Parish, Procurian’s Marketing Leader, explained, “We realized that we needed our name to bring additional meaning to who we are and what we do. By combining ‘Procur’ with the suffix ‘-ian’, that denotes a specialist or doer, we are able to better project our specialized focus and long-standing commitment to procurement.”

Snazzy new names really reflect the changing focus the procurement outsourcing market

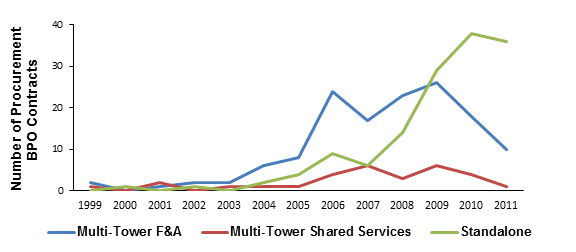

The Latinate marketing explanations for renaming these two firms belie what is really triggering two procurement organizations to rebrand. The real driver is that these two niche firms are challenging the two stalwarts of the procurement outsourcing industry, IBM and Accenture, because the nature of the procurement outsourcing market has rapidly changed. As shown in exhibit 1, procurement outsourcing used to be driven by multi-tower shared services and finance and accounting outsourcing initiatives. In the last three year, the procurement outsourcing market has become a market where buyers strongly prefer standalone procurement outsourcing contacts. Of the $2.5B procurement outsourcing market, standalone outsourcing contracts represent 56 percent of the entire market – and this number is clearly growing.

Standalone Procurement Outsourcing Captures the Attention of Procurement Executives

Source: HfS Research, 2012; n = 430 procurement outsourcing contracts

For example, while all of Proxima and Procurian’s contracts are 100% focused on procurement and 80-90 percent of Accenture’s procurement outsourcing services (fueled by its Ariba Services acquisition) are standand alone, only 30-40 percent of IBM’s procurement outsourcing client base contracts for standalone procurement outsourcing services. Proxima and Procurian have positioned themselves squarely in the headlights of chief procurement officers looking for procurement expertise. And, if they are going to challenge the category titans, they need to ramp-up their marketing exposure with procurement executives.

In fact, at the 2012 ProcureCon Indirect East event held last week (which had a solid showing with over 30 CPOs and well over 200 procurement experts, excluding service provider marketing and sales teams), only one procurement outsourcing service provider was actively marketing. We expect that to change dramatically in the coming year, as event attendance at both ProcureCon and SIG events has been on the rise.

But what makes marketing most important is the message. While the rest of the outsourcing industry deals with FTE-based lift and shift, procurement executives are really interested in gaining expertise. That’s the message these firms need to impart to their audience. Nearly 75 percent of the discussions at ProcureCon’s novel all-day “practitioner-only” day (no sales people allowed – the procurement executives were thrilled!) focused on talent management: the difficulty of finding category experts and procurement leadership. As we explain in more detail in our RapidInsight, “Broadening the CPO Mandate Through Procurement BPO” (download it here), procurement outsourcing has to be positioned as initiative geared towards improving spend management by leveraging service providers’ deep, experienced benches.

And that is exactly what both Proxima and Procurian are doing.

The Bottom Line: Differentiated, specialty services matter to CPOs

At ProcureCon, one CPO for a major manufacturing company took the main stage and said, “We want to keep it internal.” This speaks to the uphill battle that procurement outsourcing faces. CPOs simply don’t know that procurement outsourcing is different than other forms of outsourcing. They are used to the labor arbitrage comparison, and simply are unfamiliar with the ability to leverage outside expertise apart from expensive strategic sourcing consultants (see our report discussing the models here: “The CPO in 2011: The Toughest Job in the Global 1000”). Service providers have to educate CPOs on why procurement outsourcing is different to open a procurement executive’s mind.

Moreover, the CPO may be the one executive who is immune from service provider marketing rubbish. While relationships may (force) open a door, CPOs are most likely to turn any friendly discussion into a competitive bid exercise. If a service provider is going to win mindshare in a procurement executive’s objective RFP process, it will be on the basis of “why can you save me more than your competitors” and “how can you help me execute better”. Cool logos and fancy names aren’t going to convince prudent buyers of capability and CPOs know how to sniff out P2P players that are masquerading as strategic sourcing experts. Highly specialized procurement services catered to the CPO is what the market demands, especially those that can help the CPO rapidly mature his or her delivery. Proxima and Procurian have the mettle and are sharpening their message.

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, Procurement and Supply Chain

[…] with Xerox phasing out ACS, in addition to procurement outsourcers Buying Team and ICG Commerce re-branding themselves Proxima and Procurien respectively. Brian Robinson is Research Director, HfS Research (click for […]

[…] sex-up the name and relaunch his firm as ‘Proxima‘ (you can read more here about the relaunch) as they settled into their new Chicago […]