I received a very interesting synopsis from a senior executive at one of the major global IT-BPO providers on the subject of Poland as an offshore delivery location. From my own personal experience, Poland has proved to be a first-class location for high-quality, multi-lingual support, particularly for BPO functions such as finance and HR.  No wonder providers such as Accenture, ADP, Capgemini, Genpact, HCL, HP and IBM have all made significant investments there, in addition to many captive centers that have been established there in recent years.

No wonder providers such as Accenture, ADP, Capgemini, Genpact, HCL, HP and IBM have all made significant investments there, in addition to many captive centers that have been established there in recent years.

Siddhartha makes some excellent points, most notably that Poland is simply not an "alternative offshore location", as its value-proposition is not driven by scale and low-cost, but by highly-motivated and educated staff, and is a proven first-class hub for multi-lingual European language support. He also makes a bold assumption that Poland has the potential to be challenging the unique expertise of a country such as Israel, as Poland possesses far more potential that simply being a BPO / shared services location. In many instances, clients have not found significant cost savings using Polish delivery resources – they have used them because of the value and quality they bring to a global delivery model. Over to you Siddhartha:

“Move Over, India: The Shifting Geography of Offshore Outsourcing Creates New Challengers” stated an article published by the Wharton School, way back in 2005. Every now and then a prominent analyst, consulting or a research firms comes out with a report on alternatives to India as far as offshoring is concerned.  Today, Latin America and Eastern Europe are integral to the Global Delivery Models of most organizations – both for their in-house IT/Business Processes as well as outsourced IT/Business Processes. In this context, it is interesting to analyze the case of Poland which is the largest of the new European Union member states.

Today, Latin America and Eastern Europe are integral to the Global Delivery Models of most organizations – both for their in-house IT/Business Processes as well as outsourced IT/Business Processes. In this context, it is interesting to analyze the case of Poland which is the largest of the new European Union member states.

Poland is not a substitute to India for anyone seeking scale:The fastest ramp-up that a company has achieved in Poland is about 500-600 FTEs during a year – this equates the average weeklyramp-up of some of Indian companies in India (26,000 during the year) and half of peak-day hiring (TCS last year and Cognizant this year made about 1000 offers at Anna University in a day).

Hardly Attractive for Outsourcing from the US:6-7% appreciation of the INR (Indian Rupee) against the USD created a hue and cry in India with NASSCOM almost portraying it as a threat to the industry (INR has already depreciated to be back to cheaper than earlier levels). The Polish Zlotych had appreciated in excess of 30% against the USD in 18-months! Even though there has been USD appreciation over last few weeks, I am not sure of many business models which can take a hit of 25-30% and still remain viable.

More a BPO than a ITO Destination:Poland's is essentially a BPO/Shared Services industry with ITO being restricted to smaller scale Polish players (even with significant presence of IBM and Cap Gemini, their ITO work is not that significant, and focus is more on BPO – primarily Accounting Services). Even among BPO/Shared Service centers, captives form more than half the industry which is very distinct from the India story.

Skill Scarcity: If you sought help from any leading recruitment consultants for hiring people with 4-5 years experience even with common technology skills, they would suggest that it requires a ‘direct search’ as it is a "senior level" hiring placement. Initial offers from consultants mentioned rates of 20-25% of annual salary – you could almost hire a VP on those terms in India. I found this shocking but then it was easy to understand why. A software engineer, business analyst or a transition manager with 5 years experience is a European resource rather than Polish or a Romanian resource and hence cannot be source of any cost arbitrage.

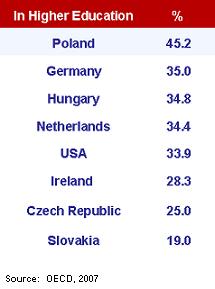

Poland makes up its lack of scale through superior quality: Poland has 45% of its population, in relevant age groups, in its universities; compared to only 10% in India. Moreover, until recently, it did not have graduates, but only post-graduates - hence the quality of human resource in BPO and shared service centers is far superior to most such centers in India and other European nations. Most BPOs hire post-graduates in Economics and Finance from top institutes for their operations – a luxury which may not be available in India other than to some high-end KPO operations (see this earlier discussion).

Poland makes up its lack of scale through superior quality: Poland has 45% of its population, in relevant age groups, in its universities; compared to only 10% in India. Moreover, until recently, it did not have graduates, but only post-graduates - hence the quality of human resource in BPO and shared service centers is far superior to most such centers in India and other European nations. Most BPOs hire post-graduates in Economics and Finance from top institutes for their operations – a luxury which may not be available in India other than to some high-end KPO operations (see this earlier discussion).

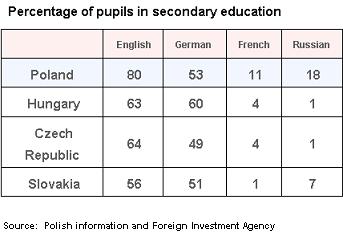

Ability to attract a truly global workforce: In our organization we not only have a multi-lingual workforce, but a multi-national one which includes Portuguese, Spanish, Russian, Italian, Brazilian, British, Polish and Indian nationals. This gives it an advantage which most Indian operations do not have. While most companies currently leverage this facet largely to source language skills, it has the potential to be extended to other areas in the future.

Poland has far greater potential than simply being a multi-lingual hub: I have talked to outsourcing heads of two leading financial institutions – one European and other American – who acknowledge that their Global Operating/Delivery Model is almost a euphemism for an India-strategy backed by couple of other locations for work that cannot be done out of Indiaeither due to EU or local regulatory restrictions or foreign language requirements.

The language skills advantage is significant but if that remains the key driver of outsourcing to Poland, then some really bright Masters in Economics would be in an accounting operation for a German client – not because she knows econometrics but because she knows German. In fact this ‘alternative offshore location’ positioning is unfair to a country like Poland which offers really unique benefits. With the strength of its education system and ability to attract global talent, Poland should challenge the niche positioning of a country like Israel in high-end technology or other niche skills rather than be a generic offshoring destination.

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Finance and Accounting, HR Outsourcing, IT Outsourcing / IT Services, kpo-analytics, Sourcing Best Practises, Sourcing Locations

Phil,

This is a great posting – thanks for sharing. I like the comparison with Israel, as Poland clearly has far greater potential than merely being an administrative BPO location.

Which provider does the author work for?

Sanjay Ramesh

Sanjay,

Let’s just say our mystery vendor operations executive pereferred to remain anomymous, but is in a great position to judge…

PF.

Some additional facts on Poland:

It has a Competitive cost base offers significant location benefits

According to the Ernst & Young report,

Poland achieved first place in Europe in terms of availability of industrial sites, cost of land and regulations.

In terms of flexibility of employment regulations Poland is placed second after UK and third in terms of corporate taxation.

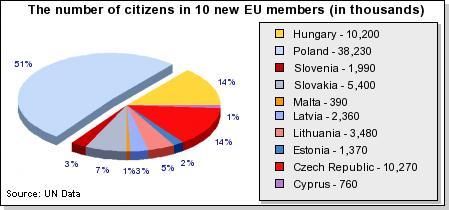

Bigger than all other 9 New EU members put together (2004 – excludes Romania and Bulgaria which joined EU in 2007).

Only country in Eastern Europe with expansion potential beyond a single city (Prague in Czech Republic; Budapest in Hungary etc.).

Over 90 billion euro available for development, infrastructure and human capital.

Poland benefits from the largest amount of EU funds of any beneficiary EU member state. Over 90 billion euro is available for development, infrastructure and human capital for 2007 -2013

Over 6 million attending higher educational institutions

About 211,000 students graduate in social sciences, business and law, 43,000 in engineering, 22,000 in science, mathematics and computing and 2,500 in language arts

Nationwide network of 427 centers of higher education

Currently poland hosts leading global companies in IT and BPO:

Accenture, IBM, Cap Gemini, ACS Captive Centers of UBS, State Street, Philip Morris, Shell, Lufthansa, HSBC.

John Vasili

A lot of the info here echoes the experience of one of my clients, which has been slowly building up a captive presence there. They are generally very satisfied with the quality they are getting, and hoping to move more work there, BUT (there’s always a but), their efforts have been stalled by the dollar’s free fall and the ability to recruit fast enough to move as much as possible over from other European sites.

Hello,

as a person living in PL for over 30 yrs and as a person professionally involved in IT services market research, i’m happy to read such a flattering text about poland. yet, i need to say that the reality happens to be less optimistic and some recent changes like increasing salary expectations and decreasing number of ppl willing to get employed in bpo centers in certain cities, which have been a popular destination for such centers (krakow, wroclaw being best examples) may make future investors more careful while choosing the best place to locate a bpo center.

rgds

I agree with Ewa and that is why it is essential that anyone looking at Poland for plain vanilla BPO or IT work should think twice – increasing salaries, higher attrition and currency volatility – all put together mean that you should look at Poland for specialised work

In selecting a BPO location inside the European Union and in India, its useful to first segregate the City-level metrics from the Country(EU)/State(India)-level metrics and then quantify relative-importance of each metric vis-a-vis others, specific to your unique need.

Country(EU)/State(India) Metrics – BPO/SSC Set-Up time; Visa/ Work Permit Requirements; Subsidies/Government Incentives; Labour Laws; Tax & Accounting Laws; Political stability

City Metrics – People (Labor Pool size / Education – Graduate skills/ Location attractiveness for Senior Foreign Hires/ Understanding of US & Western European cultures/Languages) ; Infrastructure (Real Estate, Telecom, Light/Heat/Water etc) ; BPO/SSC Competition; Travel links with key Client sites

You will note that there is little to choose (from a BPO perspective) through a country-level comparison between CEE countries. Poland, Czech Rep, Romania, Bulgaria etc. – all present EU stability, consistent ex-communist educational systems, progressive labor/tax/accounting norms more aligned to Brussels roadmaps than Old EU countries, Spirited govt. investment cells etc

Eventually, the one-on-one negotiated govt. subsidy/incentives (thru PaIiz in Poland, CzechInvest in czech rep, SARIO in Solvakia etc) for job creation, is the salient country-level metric for BPO new entrants.

Other-wise, its best to focus on City-Metrics to develop a meaningful point of view on a BPO location inside the EU. For eg., if you seek to set-up a 500 seats+ BPO venture in the location you select then, its best to validate break-even point for the handful of cities with 300K+ population.

In my experience within the EU (just as in India), its most useful to do location selection focused on city-metrics and a comparison between 3 Economic (Comparable cost-of-living) Groups of Cities. For eg –

a) Prague, Warsaw, Krakow, Budapest, Bucharest, Bratislava

b) Lodz, Wroclaw, Brno, Ostrava, Cluj etc

c) Various Sub-150,000 population towns

Poland & most other CEE present several interesting BPO locations even today. Just as in other industries, the BPO industry too will eventually progress towards a “stateless multinational mindset” ( Refer – http://www.economist.com/opinion/displaystory.cfm?story_id=12263150 ).

One should mostly trust the NUMBERS of one’s business model, in BPO location selection, within the EU. Inputs to the model are mostly at a city-level.

Comments on a Nation as a BPO location in Europe, still invite a lot of nationalistic demagoguery. As philosopher AC Grayling reminds us – ” Nationalism is an evil. It causes unncessary wars, its roots lie in xenophobia and racism, it is a recent phenomenon – an invention of the last few centuries. The word – “nation” – is meaningless: all nations are mongrel, a mixture of so many immigrations and mixings of people over time that the idea of ethinicity is largely comical. ”

Its fairly common these days to find nations present themselves aggressively (thru their investment cells like Paiiz, czechinvest, sario etc) at BPO conferences in the CEE region. A new & meaningless war of words has been underway for the past 5 years. We need to rise to a stateless multinational mindset.

[…] its global delivery acumen, by showcasing its expanding European delivery center in Krakow, Poland, to industry analysts and […]