mmmm… some tasty ADM here, with a sprinkling of BPO

As if he didn’t have enough on his plate already following his rapid rise to HfS fame and glory, we sent Esteban Herrera to mingle with the elite of iGate and Patni to take a closer inspection of the first billion-dollar sourcing marriage of 2011…

At one point, there were over 200 investor-backed ITES providers in India. Today there is one less, as iGate has entered in an agreement acquire a majority stake in Patni. The world does not need 200 ITES outsourcing companies in India, so on that level this is a good thing.

In fact, as mergers go this is a fairly synergistic one: a high-growth, innovative company acquires a bigger but staid, stuck competitor. The vertical strengths of the two companies have little overlap, and the two companies together will sell a respectable billion dollars, giving them some clout in this hyper-fragmented market.

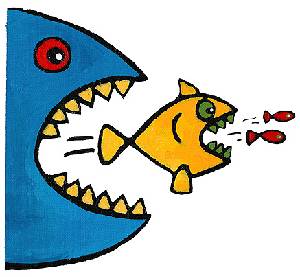

That said, a billion dollars ceased to be a big deal in this market about six or seven years ago, so like much of the other M&A activity we are seeing, this feels like too little too late. iGate has been making the right noises for some time, with outcomes-based pricing and combined BPO/ITO offerings, but one has to wonder why it hasn’t made even more of an impact—if those two characteristics alone are real, they should be eating the lunch of their larger competitors who don’t know how to spell risk and could not break down their organizational silos with a battering ram. But they aren’t. To be sure, adding Patni’s 16,000 or so employees will add scale, but everyone knows that’s not what makes a merger work.

A significant source of concern is the Achilles heel of all acquisitions—will the cultures fit? If you listened to the two company’s calls to brief analysts, it was hard to believe they had actually spoken to each other during the process. Then, this nugget from Patni: “Management, as you know, was not involved in the transaction.” Say what? It appears Patni’s owners and investors pulled the rug out from under their management team, and the mood was palpable even through the phone line. On paper and in principle, this acquisition makes a lot of sense, but execution is what separates the successes from the abysmal failures, and the Day 1 coordination does leave something to be desired. Printed materials and Patni suggest that it will be run as an independent P&L within iGate, but the message from the iGate folks was integration all the way. HfS Research is still wondering why the two companies even had separate calls.

In typical HfS Research style, let’s take a quick look at what this means to the various impacted constituencies:

Customers

iGate’s customers will generally benefit from a more disciplined delivery method espoused by Patni. Patni customers may well take advantage of iGate’s more innovative commercial models to transfer some risk and better align goals. This is all dependent, however, on the delivery teams from both sides being willing to work with each other, teaching, coaching, and knowing when to hold back. If you are a dissatisfied Patni customer (and we don’t know many), this is, of course, an opportunity to trigger your change of control clause.

Shareholders

Patni’s founders and General Atlantic had a decent day. $1.22 billion is not a huge multiple, but given that Patni had its “For Sale” sign out longer than a Nevada foreclosure, it was to be expected. iGate suddenly finds themselves in the world of leveraged buyouts—perhaps not where they intended to be. Debt changes a company’s behavior and iGate is going from having almost none to speak of, to carrying a large burden. There is nothing wrong with debt per se, but management of debt-ridden companies requires a different skillset than managing cash cows. Similarly, investing in leveraged companies requires a different stomach than investing in pristine balance sheets.

Employees

Patni employees can be heard breathing a huge sigh of relief—two plus years of uncertainty have ended. And except for those in the redundant functions (a decided minority) they appear to have pretty good job security post-transaction. iGate has cultivated a decent employer brand and will likely bring some energy and enthusiasm to the ranks of Patni, but it would be unreasonable not to expect turf wars and resentment, especially amongst long-term employees on either side who see themselves as “losing” in the transaction.

Overall, this is a synergistic, common-sense transaction and HfS hopes the combined entity will make a bigger dent in the marketplace, especially with innovative commercial models that better match risk and reward and simplify end-to-end services. At the same time, we doubt that this acquisition is sending shivers of fear into any of the larger competitors. We’ll be monitoring the situation and keeping our readers apprised.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services

[…] iGate swallows larger Patni—does it mat… […]

You are right. We are at the most bemused with this inevitable event and the way it was carried forth. Phaneesh has a bigger challenge in creating a single org model here especially since Patni was a bigger baby. But he’s wearing his heart on the sleeve now for his penultimate goal – to be big enough to challenge if not cause a shiver in the Big 4 especially post his past. Comes a moment when all you have left is sap for one good loving and courage for one good fight. Don’t waste the loving on a whore or the fight on a paper tiger. He seems to have heard me say this. Having said that, one must appreciate the move as there is no other way they could have managed to make it above the 1 billion mark. We’ll see the usual changes after an M&A but this is especially delicate more for Patni than iGate.

Industry consolidation is inevitable and desirable for reasons of efficiency and economies of scale now that the market has reached a level of moderate maturity – I believe the next decade of growth will be far greater than the last.

My view is that there is a lot more to come before customer choice starts to be impacted. In fact my experience with customers is that they would welcome a greater gene-pool of majors who could bid / deliver larger programmes and relationships.

The big challenge for iGate is, in my view, not that tired record of making an acquisition work through combining cultures – that should be business as usual and they should deliver integration within 100 days – instead the challenge will be re-inventing the combined firm, and others that will be added, into the ‘next generation’. The post acquisition integration give iGate an unparalleled opportunity to move forward to next practice not just best practice. Innovations such as cloud computing will revolutionise the marketplace’s operating models.

iGate should use the opportunity they have ahead to (i) really listen when they visit customers and explain the new firm – that listening will spawn real opportunities for new propositions and sales (ii) leverage the very best of Patni (whose employees may be feeling a bit raw right now but who should take it as a compliment that they have been bought because of their strengths, and (iii) not stop bringing in new blood and new ideas to the firm (often I see firms who have atrophied because they put on hiring freezes for a couple of years during a merger or acquisition which leaves them way behind for several years in terms of top / fresh talent).

Finally iGate need to get a strong message out into the market about what’s new and exciting for clients from the deal to their US, EU and Global clients.

David von Ackerman – Copernicus Global Consulting LLP

Interesting take, especially the bit about company cultures. I think that in the long run, iGate and Patni will both benefit from this move. But there are definitely many hurdles along the way, before the promised happy ending for the ‘common-sense transaction’! Most importantly, battling attrition (post the friction that you mention), retaining clients (significant risk exposure there, in revenue concentration), managing stability and growth (given comparative industry growth figures).

But that’s not to say that there are no benefits! Once the dust settles, a strong new billion dollar IT player will emerge, with a more convincing value prop than the two companies in isolation. iGate-Patni will also be able to target iGate bid parter Apax Partners’ portfolio companies for new business.

I’ve elaborated on my blog, in case you’d like to read further: http://www.sourcingnotes.com/blog/patni-igate-i-do-now-what

Tier two outsourcing service providers, and this entity will remain a tier two firm, will continue to get squeezed by larger multinational, India-based, even some larger regional providers and going forward more often SaaS providers on the BPO side, when competing in G2000 accounts, especially if they lack any sort of material industry specialization. Cultural challenges are important and a given in the marriage on any services firms, but the debt could be more problematic given it is a relative rarity among major service providers. PE firms are very supportive when things go well but get cold feet quickly.

Comments not yet on the table: firstly, we’ve seen this picture before. Remember Carreker and Keane? Would be helpful to recall that outcome in the context of this acquisition. Second, trading out General Atlantic for Apax: does this auger a season of swaps between PE firms? And does it make sense?

[…] This post was mentioned on Twitter by bfgcorporation1, Bertromavich Reibold. Bertromavich Reibold said: iGate swallows larger Patni—does it matter?: iGate has been making the right noises for some time, with outcomes… http://bit.ly/eSb5w4 […]

Loved your take on this. Didn’t realize Esteban had joined HfS? Congratulations buddy.

[…] (Cross-posted @ Horses for Sources) […]

Will it also effect new joinings previously recruited by patni….

Lepeak (I assume Stan)-

I agree: the possibility of the debt proving to be problematic but saying that it will remain a tier two firm almost sounds prophetic. Like in any marriage especially where high stakes are involved, the firms will be working round the clock to ground internal differences and improve external perception. Also Deborah, this might not be as worrisome as other similar mergers since both have Indian management and are largely offshore based entities. More than the culture, there are bound to be ego clashes which will obviously result in fresh blood transfusion. Inevitable but necessary as there can only be growth after the war is over. Also General Atlantic is actually busy with planning its exit from the other huge Indian BPO provider, right? 😉

[…] no doubts – this merger is all about synergies, just as we said about the Patni –iGate merger. These are two remarkably similar organizations operating remarkably similar businesses, but with […]

[…] offering much more than bums-on-seats IT scale. Patni may have been interesting, but iGate won that battle, even though a Genpact-Patni merger would have been a stronger proposition. History is history, […]

[…] sexier, it’s curious why iGate would drop the famous Patni brand barely a year after its merger. You would have thought the lesser-known iGate leadership would prefer to maintain the legendary […]