Posted in : intelligent-automation

Passionate about #AI? Then look no further…

Tinker, experiment, explore, then disrupt: The Hyper-Connected Enterprise will be driven by Intelligent Automation.

As business operations have advanced through several inflections points over the last three decades, the core component at the heart of these changes has been the emergence of digital interactivity driving the hyper-connected global business – only made possible by intelligent automation.

Digital connectivity has transformed both front and back offices over the last three decades. The key now is to integrate and automate these activities to place the customer at the core of business operations

As you can see in our (below) “voyage to hyper-connected, interactive enterprise” we have leveraged digital connectivity to drive productivity and innovation across both the back and front offices of our organizations. Offshoring and outsourcing became a huge bi-product of digital connectivity to run business processes and apps remotely to save Western businesses huge costs through global labor and centralization of resources.

However, until recently, most of these activities have been restricted to improving efficiencies and reducing costs. At the front end of the business, the advent of ecommerce hit its stride in the late ’90s, where customers could communicate digitally with organizations to make purchases, make genuine inquiries and get connected with others with like-minded business interests. Where automation comes into play is being able to pull together these disparate front and back office activities into one single office (aka the HFS Digital OneOffice), where customer needs are placed front and center across all business processes, where staff performance can be measured on delivering customer driven outcomes, where the entire business operations are in-tune with their customer needs… and superior to those of their competitors to stay ahead of the game.

The urgency to be Hyper-Connected dictates why we have to drive Automation with real Intelligence

“Basic digital” capabilities (where most companies are today) make it possible for business operations to respond to their customers as those needs happen. Emerging capabilities in data analytics tools, machine learning and cognitive computing are making it possible to anticipate changing customer needs before they happen, where shifts in global supply chains, market and competitive dynamics, economic or political changes, compliance or regularity issues, all combine to change customer behavior.

The more intelligent your business operations, the more you can stay ahead of the game, but none of this is possible if your processes are not automated effectively to create this knowledge for your business operators:

Once the digital baseline is created, enterprises need to create more intelligent bots to perform more sophisticated tasks than repetitive data and process loops. This means having unattended and attended interactions with data sources both inside and outside of the enterprise.

From Experimenting to Disrupting: Cracking the Intelligent Automation code in Four Stages

The industry is struggling to solve challenges around the process, change, talent, training, infrastructure, security, and governance. There is deafening noise and hype around Intelligent Automation, but there are very few enterprises that have cracked the code of driving transformative impact by leveraging Intelligent Automation at an industrial scale. Why?

Our research and ongoing conversations over the last six years (remember our ‘Greetings from Robotistan’ in 2012?) in the automation space has allowed us to interact, help, and follow automation initiatives at several global 2000 enterprises. And we leveraged this extensive experience to develop HFS’ Intelligent Automation Maturity Model (see exhibit below). Our experience suggests that the organizational maturity and the resultant impact from intelligent automation typically follow four stages of evolution:

- The experimenter – trying out new ideas, methods, or activities. The intelligent automation journey often starts with some maverick individuals in some corner of the organization playing with different technologies. There is no real strategy at this stage, just passion. The objective is simply driven by automating a particular task that is innately boring or transactional but still time-consuming and inefficient. Different experimenters start at different places across the Trifecta. It is not necessary to start with basic automation and then advance to AI-based automation, but experimenter’s automation solutions are typically piecemeal.

- The tinkerer – trying to improve something in a casual or desultory way, often to no useful effect. The early successes from experimentation often result in the most frustrating stages of the intelligent automation maturity model. The tinkerers start to copy and paste what worked in experimentation for everything else. But if all you have is a hammer, everything looks like a nail. Failures are widespread at this stage, but tinkerers who don’t give up are the ones who eventually succeed to move to the next step. This is the stage where enterprises are trying to find some method to the madness but often with limited success. The tinkering stage is exemplified by rhetoric winning over reality!

- The explorer – charting out new territories. As reality dawns after extensive tinkering, enterprises start to realize the different pieces of the puzzle. They start investing in organizational management (often through COEs and a hub-spoke model), recognize that they need to invest in multiple technologies across the trifecta to solve problems and start tackling end-to-end processes versus individual tasks.

- The disruptor – radically changing the status quo. Intelligent Automation transcends from a program and becomes an enterprise-wide movement at this stage. Disruptors can bring to bear integrated solutions that combine the power of automation, analytics, and AI. Several automations at this stage are scaled up, and there is a high degree of confidence in scaling up others. It is only at this disruptor level when the promise of intelligent automation starts to become a reality.

The Bottom-Line: The more hyper-connected we get, the more this is about people, purpose, and planning – and less about whichever shiny new gadget is the flavor of the month

While the industry is busily adding fancy new words to their résumés and job titles, we have to remember that our technological journey is gradual. Change comes slowly and incrementally and you can’t just rip off the proverbial BandAid, hire a bunch of Millennials and Gen-Z kids… and it’s mission accomplished. As the Hyper-Connected journey illustrates, it took 30 years to get where we are today – and that’s because both front and back offices needed to go through major, secular changes to become efficient and digitized.

But the next phase is not a trade-secret – this “Future of Work” is merely a phased transformation of the present. Dumb robots evolving into intelligent assistants… ineffective supply chains plagued with manual breakpoints becoming fluid, autonomous and intelligent – with the ability to interact with other supply chains. Quantum computing and blockchain emerging to challenge the very logic of TCP/IP and computing architectures. But to get there, we need to be experimenting, tinkering, exploring and disrupting with the kit that available today to get our organizations in a place where all these far-flung innovations can have some real possibilities.

So let’s have less talk about the future of work and focus on the present… we know where we are and what we need to do. So let’s do it!

Posted in : OneOffice

The Cambridge University FORA Summit recap…

Posted in : Outsourcing Events, Robotic Process Automation

It’s time to give these poor Millennials a break

What is wrong with us old timers these days? We go to conferences where we make sure no one under age of 40 comes near the place, and we spend half our time bemoaning the lack of a “digital mindset” from our colleagues because we all have these world-class digital mindsets ourselves. And can someone please explain what the f*** a digital mindset actually is? And can someone explain why everyone blathers on about their company’s inability to change with the times, but never admit they don’t really want to change anything either…

But let’s be honest, we treat our beloved Millennials like some sort of obscure species whose members only communicate digitally with each other, like to wear these really big expensive headphones, drink far less than we did at their age, and no longer go to bad discos to find romance. Not to mention an unhealthy love of avocado toast that helps their quest for a purpose in life because of failed parenting strategies leaving them permanently depressed because of low self-esteem.

In addition, we’re now accusing them of lacking ambition and only caring about their next vacation. But how can we blame these poor folks from feeling like we stitched up the world before they came along… as most cannot come close to affording the cheapest shoebox in any half respectable neighborhood, the poor folks in the UK are going to get cut off from working in Europe soon, and the lost Millennial souls in the USA had to choose between two septuagenarians as their president, who hardly represent the emerging mindset of the digital youth (even though you do have to be impressed with the President’s twitter skills…).

So imagine the refreshing impact when HfS analyst Ollie O’Donoghue, a proud representative of the Millennial race when he’s not trying to annoy Amazon, piped up on LinkedIn with the following staunch defense of his species:

Click here to join Ollie’s LinkedIn discussion

The Bottom-Line: Love them or loathe them, Millennials are the Future

So to quote Ollie directly: “Entitlement goes both ways. It’s just previous generations got what they were entitled to. They worked hard, bought a house, paid a mortgage, got relative financial and social security. The reason so many Millennials are checking out of the economy is because they work hard and get, well, nothing. Home ownership is the stuff of legend, even job security is a thing from a bygone era – and something a lot of ‘future of work’ commentators are making worse.” So let’s use this opportunity to bring Millennials into our inane conversations about a future of work with less need for people, about our businesses being persistently disrupted by imaginary digital competitors, about blockchain’s emergence to destroy whatever we have left… because if we don’t, we’ll have a big hole left in our corporate legacies that we’ll struggle to fill, as all the talent will be checked out on the beach dreaming of their next avocado latte.

Posted in : HR Strategy

Clear communication to leadership has never been more critical in today’s business environment

Posted in : Uncategorized

Is Syntel worth $3.4bn? And does this bring Atos to the adult’s table?

Syntel brings to Atos a larger platform into the North American market, stronger IT automation capabilities to augment its data management and analytics heritage and, above all, access to quality long-term engagements. And not to mention a mighty Indian offshore IT depth that fills a lot of delivery holes for the firm. And don’t forget, this firm tends to know what it’s doing when it comes to acquisitions and making them work:

However, even with all this combined, $3.4bn seems like a hefty price to pay, albeit a price that will likely set both industry valuations, and other acquirable mid-tier service provider hearts’ racing. Not only that, competitors with banking pedigree, such as Capgemini, Cognizant, DXC and IBM will not welcome a stronger Atos being welcomed to the dance at a time when competition is already reaching a cut-throat breaking point.

We haven’t seen any meaty M&A in IT Services for over two years… So why now?

We’ve been predicting an increase in merger and acquisition activity across the business process and IT outsourcing space for some time, but these IT services monster marriages are like London buses – you wait ages for yours to arrive, and suddenly several appear right behind it.

To this end, the only real action of late has come in the call center realm with the feasting of Teleperformance on Intelenet and Concentrix on Convergys. Not since the dinosaur mating noises of HPE and CSC in 2016, or Capgemini’s nuptials with IGATE in 2015, have we had anything much to chew on in IT services bar lots of digital agencies being round up for slaughter.

Let’s be realistic, there really aren’t too many “heritage” mid-sized offshore-centric IT services providers left in existence which can get you an immediate seat at the adults’ services table, which explains Syntel’s fantastically lucrative exit, and the disappointment of several other suitors which had been eying picking the firm up on the cheap for several years. Moreover, providers like Atos are feeling the pressure like never before to force their way forward in terms of growth and breadth of offerings and believe the pressure point has been reached and it’s time to act.

A drought in traditional client wins for some firms is literally pushing them to acquire as a way to drive market share. The IT services industry is no stranger to firms buying out rivals to gain short-term respite from the market in the face of poor market performance – buying time to regroup/transformation, an injection of new clients and scale.

Atos’ recent announcement of its intentions to acquire Syntel has already set tongues wagging in the industry, but before we get caught up in the inescapable hype, let’s dig into the facts!

At $3.4bn this could be the start of the M&A silly season where “Everyone’s up for Sale”

It’s hard not to get lost in the number of zeroes in this deal and, frankly, the price tag has left us all scratching our heads a little. At a recent press conference, an investment analyst asked whether Syntel was happy with the deal…why wouldn’t they be? And it’s this sort of seller’s market that’s getting a lot of the mid-tier firm’s excited about a potential takeover from a major firm in the space. “Everyone’s up for sale” proclaimed the CEO of the of the leading service providers recently in a private conversation.

With some of the world’s biggest IT services firms looking to shore up revenues, capabilities, and access to clients, a lot of firm’s are adjusting pricing expectations, setting the bar far higher than they would have a few years.

And the market is undeniably tough right now, and many firms are struggling to find their way. Recently, brighter horizons have been on the cards for some firms as the HFS Digital tipping point theory started to yield results, with enterprises investing in technology to drive their transformation ambitions. But the same theory argued that many firms would struggle to pivot their business models and offerings to meet the changing demands of the market. In this winner takes all market, it stands to reason that firms will shore up their capabilities through acquisition, at the same time that smaller firms that struggle to gain market traction become more attracted to the idea of a buyout.

Is chasing a “$250m a year synergy target” realistic, or just merger charm?

But, according to Atos, the hefty price tag is supported by some strong arithmetic. The firm stands to gain access to a lot in the deal, including strong long-term banking and financial services engagements and a decent launchpad into North America – a geography the firm has struggled to position itself in from its European stronghold – in spite of its 2014 acquisition from Xerox. But let’s start with what the firm has championed as the main selling point to investors, a $250m boost to annual revenues by 2021 from the synergy of the two firms.

On the face of it, this seems a challenging target to hit. Revenues in Europe have been hit just as hard as everywhere else in the IT Services space, more so in Atos’ strongest line – infrastructure and enterprise cloud. And Syntel’s revenue growth has disappointed financial analysts for years – even if its operating margin is aspirational to many. If the firm can export Syntel’s processes and embed them across Atos, it may stand to drive greater operating margins. Moreover, if it can leverage Atos’ Syntbots RPA technology in new and existing engagements, it could drive out some serious costs. But an increase of $250m a year is perhaps a little more ambitious than the numbers can accommodate. Even with Atos assuring investors that if its current bookings stay put, it should be more than capable of reaching its objectives.

The real motivation behind the price tag is likely to be tapping into Syntel’s existing client base and cross-selling between the two firms. In the current market, where new deals are few and far between, the adage of ‘if you can’t beat them, join them’ has never been truer. For the princely sum of a few billion dollars, Atos has gained access to some major financial institutions and enterprises that Syntel has managed to keep on its books for years (over 30 years in some cases). And many of these are big spenders, Syntel is always pleased to mentions that it has grown a handful of its clients to build out up to half of its overall revenues.

However, the challenge for Atos is to keep these clients happy. We’ve chewed over the pitfalls of some of the major M&A activities in recent research. And in many cases, these clients may be even tougher to please. Syntel’s ‘customer for life’ no questions asked approach has built a fervent loyalty among its client base – while its too early to say now, the sentiment from this client base may prove to be less than enamored with the recent announcement than either Syntel or Atos are willing to admit.

It is also worth pointing out that the oft-stated criticism of Syntel has been its overexposure to a small handful of large clients, should one get acquired or kick them out. However, with a massive new owner in Atos, surely there is now some air cover from this long-discussed risk.

A nice deal for Syntel’s shareholders, but what’s in it for the clients?

As usual, the bit that’s often missed from the narrative when a big deal like this rears its head is ‘what’s in it for clients of both firms?’ At an early stage like this, we can only be speculative, but there are a few things that enterprise clients of both firms should be cautious and excited about. First of all, for Atos clients, there is the opportunity to get your hands on some real RPA capabilities. Atos has struggled over the past few years to find its place in the market, but Syntel has positioned itself nicely with Syntbots – an intelligent automation platform that while lacking some of the bells and whistles of the others has proven itself time and time again to be a solid cost-reducer. Existing financial services clients can also look forward to more verticalized expertise, and a stronger proof-point around delivery as Syntel brings in its considerable experience to engagements. Finally, Atos’ multinational clients can consider leveraging some of Syntel’s North American and Indian delivery capabilities to expand engagements or move work closer to home or further offshore dependent on the circumstances.

For Syntel clients, it’s a different kettle of fish. Foremost on their mind must be the protection of the partnership culture they have become accustomed to. That’s not to say Atos is miles from the culture of Syntel, but long-term partnerships have been the building block of the mid-tier firm since its inception and may be a tough hurdle to overcome after the firm’s combine. But they can expect some of the benefits that the firm will bring, such as strong credentials in the enterprise cloud space, and the scalable heft that a larger provider can offer over mid-tier players.

Bottom Line: Market conditions and appetite for acquisition mean we’re sure to see more activity like this in the future

Ultimately, there’s a lot of areas where the two firms can create synergy, and cross-sell offerings into each others client bases. But there’s also a huge amount of risk that this engagement is akin to the appetite of the day, which is to stop trying to outbid rivals for engagements and simply buy up rivals. In some of these engagements, clients may come out on top, with access to more experienced and capable delivery partners – but equally, they could lose out on the cultural alignment, and agility that they looked for in a smaller partner.

However, Atos management has a historically strong track record for acquiring and integrating business in both the long and medium term. The firms have a long history of large acquisitions across borders and huge integration challenges, starting with Origin in 2000. Plus we see relatively successful integrations of Siemens Business Services back in 2010, Bull and Xerox IT Services in 2014. Indeed you can trace it’s acquiring prowess back to decent purchases of SchlumbergerSema in 2004 and UK and Dutch KPMG Consulting business in 2002.

The issue as ever for successful acquisition is making the most of synergy – so that the whole organization is greater than the sum of its parts. This is always a hard trick to bring off measured financially, by the value it can deliver clients and increasingly important, culturally. If the financial boost is only $250m on a $3.4B investment let’s hope gains in the last two are worth it.

What does this say about future mid-tier IT services acquisitions?

The fact remains that in spite of the turbulent market we’re now in, Syntel has attracted a big price tag. This can only mean many of the larger firms are on the acquisition trail. Which means this is unlikely to be the only major M&A activity we’ll be seeing in the coming months. Possible mid-tier targets we can expect to come under the spotlight of some of the big players (if they’re not already) include:

Hexaware – possible price tag $1.50 / $1.25bn: Hexaware is gaining ground quickly and building a narrative that seems to resonate well with clients – however the firm remains small enough for some of the bigger players to see it as a valuable route to inorganic growth. Has good hybrid BPO and IT capabilities, a strong specialization in HR Tech and promising potential in RPA services.

Mindtree – possible price tag $1.75 / $2.25bn: Mindtree has had a scratchy few quarters at the start of 2017, but since then have posted rapidly improving revenue growth – over 20% in Q2 2018. The firm’s strong digital offerings make the firm a good prospect for bigger firms looking to shore up capabilities as well as build out market share. Has managed to make a strong shift from BI and analytics to adding digital prowess and has a capable suite of offerings and loyal clients to boot.

Mphasis – possible price tag $2.25 / $2.75bn: Has made a strong market impact since freeing itself from a decade-long HP hell… plus CEO Nitin Rakesh is credited a lot for his fine work at Syntel, getting the place in better shape financially. Strong financial services presences could make this firm the next IGATE/Syntel-esque pick up.

Virtusa Corporation – possible price tag $2.00 / $2.50bn: Virtusa’s strong consulting background – gained from the acquisition of Polaris – puts this firm as a valid target for large providers looking to build up talent and onshore delivery capabilities in North America. Very strong offshore business built from the ground up by the irrepressible Kris Canakeratne, with deep presence in insurance IT.

Posted in : IT Outsourcing / IT Services

Who needs a digital strategy to reinvent themselves…

Posted in : Uncategorized

HfS slam dunks with Stevie!

We’ve run twenty leadership summits at HfS over the last few years and am sure most of you who’ve been to some of them love the candid conversation, the zero-selling ethos and absence of plastic booths and cardboard PowerPoint presentations. However, what most people haven’t realised is we’ve never dedicated staff to running these fulltime, and all we really had to do was invite our network, put together great people to speak and provoke some terrific debates.

However, we really want to start having a series of intimate regular roundtables across New York City and London, where we can drill into the hot topics du jour that we all love so much, such as Intelligent Automation, Blockchain, the Digital OneOffice etc. But to do that, there are precious few characters in the world who have the tenacity, network and charm to make these happen… and we managed to snag one of the very best, Steve Dunkerley (see bio), to run these for us.

I have known Steve for 15 years and have always enjoyed some of his terrific CXO roundtables, where he has this uncanny knack to bring some serious hitters together in one room. So when we had the opportunity to bring in the best guy in the biz to lead our summits and roundtables, we had to convince him join the HfS family and not rekindle his karate career…

Steve – it’s just terrific to be working with you at HfS after all these years! Can you share a little about your background and why you have chosen C-Level events, research and strategy as your career path?

Hi Phil, it is a pleasure to join the HfS family.

In terms of my background, my life really began in 1999. This was the year I met my wife to be, got married and started my B2B media career having earned a degree in communication studies a while before that.

From 1999 until the end of May this year, my employer was the company that is now known as Compelo. I was initially responsible for industry specific publications in the textile, water, food and MedTech sectors. Then in 2005 my attention turned to the office of the CFO with FDE (Finance Director Europe) and its sister title Future Banking.

My role was initially commercial, whereby I positioned providers alongside appropriate commissioned content. Then I became more focused on editorial strategy across multiple media, whereby I sourced and interviewed CFOs on a particular topic and then brought them together in a briefing or roundtable setting. I have organised dozens of these types of events across Europe and have had the pleasure of introducing top CFO speakers such as Graeme Pitkethly (Unilever),Iain Mackay (HSBC), Laurence Debroux (Heineken), Natalie Knight (Arla Foods), Koos Timmermans (ING), Andy Halford (Standard Chartered), Brian Gilvary (BP), Imran Nawaz (Mondelez Europe and soon Tate & Lyle) and most recently Gilles Bogaert (Pernod Ricard).

Aside from the thrill of bringing leaders together for them to share their pain points and ideas, I also enjoy hearing about the personal and business victories that were a direct consequence of attending an event.

So why did you choose to join HfS… and why now?

Well Phil, aside from your mastery in persuasion, outsourcing, automation and digital have been a reoccurring theme at my events, so moving deeper into this space with a research firm like HfS was a logical choice for my career path.

What distinguishes HfS from the competition is its pioneering nature in addressing topics before anyone else, as well as its reputation in the market. For example, it seems that most of the press releases or magazine articles I read concerning IT or BPM services typically features HfS’ opinions before any other analyst. Also, on a number of occasions at my events, speakers have actually referenced HfS statistics in their presentations.

While I chose HfS, you of course chose me too. It’s always a two-way thing. I’d like to think that when you have spoken and moderated at my events, you have been hooked by the event experience – especially in terms of the seniority of the participants and the quality of the content.

So where is the industry right now, Steve? Do you see us in a transitional state, or is something else bubbling to wake us all up?

Looking at the service providers, it used to be all about who had the biggest headcount to serve clients from a labour arbitrage perspective. As headcounts haven’t really receded despite the potential job displacement associated with the RPA & AI movement, I definitely see the industry being in a transitional state. Enterprises seem to be still applying RPA in a tactical way for very specific tasks. That said, there is massive interest in these type of change agents judging from massive audiences you have been speaking to at the recent Automation Anywhere “Imagine” and Blue Prism World conferences

This, together with the what I have also been hearing from CFOs at my recent events and the compelling messaging from the vendors via HfS POVs, it’s only a matter of time before things take off. Many CFOs are very excited about the potential of blockchain to revolutionise operational finance, so I see this one bubbling away nicely and is one of the topics that personally interests me most at the moment.

So what can we expect to see from you at HfS… can you give us a little snippet of what you’re going to be working on as you develop our FORA Leadership Council, roundtables and summits?

One of the key objectives for me is to assemble a council that is made up of enterprise leaders that are in tune with the OneOffice framework as well as domain experts in areas such as blockchain that can move the conversation forward. For this I will work in collaboration with Karel Franchois, who is in charge of the FORA membership programme, which is an annual subscription service that has been designed to enable enterprise leaders to have access to the HfS blueprints and data as well as join the exclusive ‘invitation only’ events throughout the year for a nominal fee.

At the recent FORA Summit in Cambridge I was delighted to have invited leaders from two of the biggest companies in the area to be the keynote speakers. Tim Pullen, CFO, arm and Steve McCrystal, VP GBS at AstraZeneca both provided some great insight as to how their operations are evolving in a time of rapid growth and digitalisation. I also managed to interview them both before the event to and hear first-hand about the journey they have been on Click here to read my interview with Tim.

For the remainder of the year and in 2019 I look forward to working with you in order to help assemble another stellar line-up for the New York FORA Summit in December and the London Summit in March 2019. I am also pleased to confirm the leadership roundtables are starting to take shape with one scheduled for 17 October with you and Derk Erbé at the helm.

For those FORA members that can’t attend the events, I will interview as many of the speakers and participants as possible either before or after the event and share content that can keep FORA members abreast of what was discussed. I also want to involve HfS analysts in content creation, so one example of this is a video interview I am planning with Sandy Khanna, Managing Director, Group Business Services from BT in collaboration with Elena Christopher from HfS, who has just published an in-depth Telecom Blueprint. Sandy will be joining the roundtable on the 17th October, so I look forward to welcoming him and 14 others to this exclusive event as well as collaborating with the new HfS digital content lead, Hannah McBeth to drive useful output.

And finally, is the analyst industry as exciting as it was 10 years’ ago?

10 years ago, analysts were the gatekeepers of the most desirable enterprise information – they were the popstars of content. This is also true to some extent today, although the democratisation of information via public blogs, google and freemium access to HfS – for example – has levelled the playing field. That said, the digital paradigm is moving at a tremendous speed and is getting ever more complex, which means the analyst is always going to be in demand – breaking down the complexity and serving clients in a more sporadic ad-hoc basis. If anything, quality analysts who can simplify the big, complex and (sometimes) thorny issues are more valuable than ever – but they need to demonstrate real enterprise use cases and clearly define the market, not add to the confusion!

Welcome to the analyst community, Steve – am sure you’ll find HfS a fascinating laboratory for observing the next phase of this industry!

Posted in : OneOffice

Why AA’s investment windfall locks up the RPA market for the Big Three

We’ve now seen three pretty small software firms demonstrate 20x valuations… Blue Prism went public on the London Stock Excheng, UiPath received $150m in series B funding and Automation Anywhere has now announced $250 in series A funding. So it’s pretty clear there are three established leaders at the front of the RPA market and investors are convinced that RPA is the start of something much bigger for enterprises. Not only that, it’s becoming pretty clear that the barriers to entry are high, and we’re unlikely to see new players bulldoze their way into this space in the foreseeable future. So why is this?

RPA is kick-starting the true digital journey for many enterprises by helping create a digital process baseline

People love to espouse that RPA has quickly become commodotized and we’ll barely be talking about it in another year, when we all suddenly become experts so good at building algorithms, we can actually train systems to build their own algorithms on the fly. Suddenly, RPA will be some pervasive capability that is so devoid of value, it will disappear somewhere into insignificance. Utter garbage: anyone who’s got deep into RPA and tried to incorporate it into processes knows immediately that this type of thinking is naive, and likely coming from someone with no experience of the real world outside of their ivory tower. Firstly, RPA and RDA are not apps you sell to IT people to “rollout”, they are low-code solutions, designed for business operators to replicate, fix and digitize their manual processes, or scrape “static” data from screens to integrate into a dynamic workflows. And secondly, “low-code” does not mean “no code”. Talk to anyone with RPA battle-scars and they will tell you about the amount of code customization that was needed in certain areas.

Digital today is all about an enterprise being able to respond to the needs of its clients as an when those needs happen. Today’s RPA and RDA provides integral building blocks that digitizes processes to enable businesses to process the data they need to have business operations support customer needs in real-time. Sure, they may simply be performing dumb tasks, such as running process workflows in recording loops, or scraping data from screens into automated scripts.

The commodization of RPA breeds familiarity – and familiarity breeds innovation. The market is already established

Commoditization is good for bots, but remember that most enterprise folks have had to train to use the products and we already have very loyal followings for AA, Blue Prism and UiPath. The tech needs to be simple, low-code and easy to install, scalable and manageable. Noone wants highly customized solutions these days, so please do not confuse the devaluation of commoditization with the value of familiarization. You think Workday and Salesforce are not “commodity” apps? They are successful because they have crushed their markets through effective channel relationships, the creation of cult-like followings and years of building familiarity with their customers. I’ve even heard of HR people threatening to quit their jobs if their firms refused to invest in Workday – it’s an important part of their entire career path. You think you can’t find quality alternatives to Saleforce, such as ZoHo and Hubspot that are lower cost and even better in some areas, or likewise for Workday with SAP Successfactors and Ultimate? I predict we are already settling on AA, Blue Prism and UiPath as the RPA platforms of choice, as so many business users have already been through the pain barrier of training to understand the whole RPA paradigm. We’ll actually see more “micro-solution” firms, such as Thoughtonomy, which is building a service layer over Blue Prim and reselling that solution with positive results. Another example is Antworks, which is impressing a lot of people with its data ingestion capabilities and integration with automation needs.

AA, Blue Prism and UiPath already have 700-1000 customers each (depending on what you believe) and have energized many new careers for many people – it can take a couple of years for non-IT people to really learn these products (and many experiment with at least two of them). This market is only going to get stronger and more robust over the next three years – and beyond that, it’s really all science fiction as we observe the speed of development and macro changes to our business environments. Like with all other technology-driven markets where the key stakeholder is the business executive, once they are familiar with a platform, getting them to retrain on something else is a massive effort. Remember WorkFusion’s attempts to offer “free RPA”? People don’t want something just because it’s cheap – or even free, they want some skin in the game.

The Bottom-line: Today’s “Dumb RPA” provides a baseline for the development of intelligent bots in the future

You have to start somewhere, and for enterprises fixing their manual process messes, these three tools have provided the answer, with 70% of Global 2000 clients now expressing satisfaction, according to our new 2018 State of Operations study results. However, if these firms rest on their laurels, this market dominance will be short lived. Once the digital baseline is created, enterprises need to create more intelligent bots to perform more sophisticated tasks than repetitive data and process loops. Basic digital is about responding to clients as those needs occur, while true OneOffice is where enterprises need to anticipate customer needs before they happen (see below). This means having unattended and attended interactions with data sources both inside and outside of the enterprise, such as macroeconomic data, compliance issues, competitive intel, geopolitcal issues, supply chain issues etc.

So we have some clarity for now with three dominant solutions, and enterprises can invest more in learning these tools with more certainty and peace of mind. Some stability, after so much change in the world of business operations, is more than welcome. Now let’s hope these firms will wisely invest in taking their products into the world of intelligent bots, and not splurge all the newfound capital on yet more sales and marketing.

Posted in : intelligent-automation, Robotic Process Automation

Concentrix gets up close and personal with Teleperformance with its Convergys acquisition

One of the worst-kept secrets in the world of call centers finally went from gossip to reality as Synnex Corp added Convergys to its acquisition portfolio to roll under Concentrix. As we covered here in 2013, IBM spun out its call center business to the Concentrix brand and – almost five years on – will merge forces with Concentrix under the leadership of Chris Caldwell (recently interviewed here).

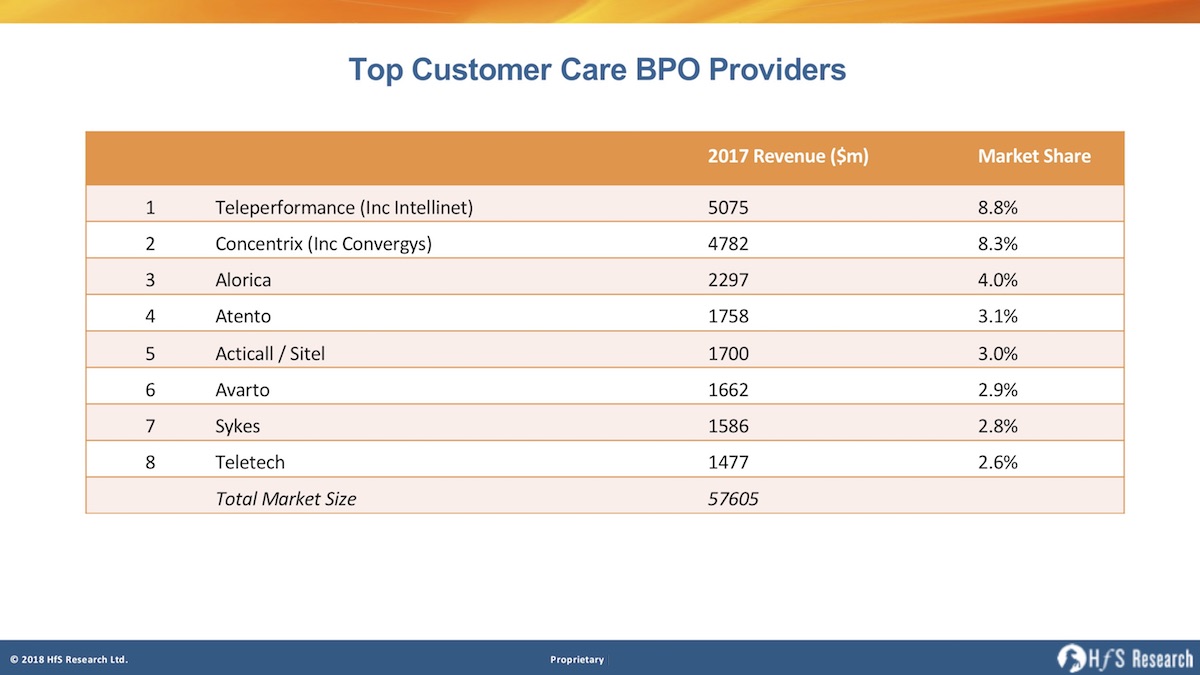

So, from 10,000 people (just 5 years ago) to being very close behind the market leader, let’s see how the call center market is shaking out right now:

Let’s just get right to the nub here… what’s good and not-so-good about this lovely marriage?

Pros

- The price tag is extremely attractive – especially when compared to $1 bn for Intelenet, which is a much less heritage firm in the market. At these investment levels, this appears like an amazing deal for Synnex, especially with its track record of making sound investments over the past couple of decades.

- We now have a very strong rival to Teleperformance at the top of the market. If Teleperformance had made this move, it may have been game over for a lot of these firms.

- Convergys was stuck and needed a new direction – and here is one with an exciting young firm. Convergys is a great, traditional contact ctr firm, very dedicated to its craft, but has been hurt by low-cost competition and struggled to maintain its edge in recent years.

- Scale can be priceless in a commodity market. When an industry is commodotizing like call center, it’s often better to operate at a larger scale, so you can ringfence your legacy business and invest in strategic clients who want to work with a co-investment mentality. Geographical expansion and diversification will help the merged entity drive greater cost synergies and variety for clients.

- Similar business ethos. As both core contact center service providers, both have a strong global operating model for consistency of services as well as a training and employee-focused culture. The challenge will be integrating the two together, but are generally aligned in terms of employee centricity and ops excellence.

- Convergys has a very loyal client base that identifies with the firm, its culture, understanding of call center agents, and its understanding of their needs.

- Microsoft partnership. Convergys has a very promising partnership with Microsoft and capabilities to harness Cortana and other apps. CNX will need to nurture this relationship.

- Good technology assets. Convergys brings a solid IVR business and some very popular agent portal platforms.

- Gives Concentrix strong market visibility and helps shed its “we used to be IBM” tag. For Concentrix, this could help them carve out the message of what they’re doing and want to be in the market. For Convergys, lends some sense of direction in the post Andrea Ayers era.

- An injection of fresh thinking and new ideas. Chris Caldwell has a terrific opportunity to take his ideas to a very significant level if he can get this right, especially with acquisitions such as Tigerspike in the digital design space, and Minacs in marketing analytics and support. Chris has a bold view of where the industry needs to go – this should be a terrific challenge for him and his team.

- M&A can buy time to take control in a commodity marketplace. Large mergers like this create the perfect distraction to make some discreet investments, keeps the shareholders at bay for a few quarters and can (potentially) help them focus on retooling the offerings and sharpening the whole approach. However, this depends entirely on decisive leadership and swift, focused transition and very strong communication to investors and shareholders.

Cons

- Is bigger really better? This acquisition seems to be more about bolstering scale and size, with Convergys having little to show in terms of proprietary IP or differentiated offerings (Contrary to Concentrix’s investments in Tigerspike and Minacs). However, in a market that has been largely stagnant for years, any movement like this can help shake things up.

- Convergys lacks a diversification in clientele with AT&T/Comcast being an enormous piece of CVG’s business. Telcos are typically the epitome of butts on seats deals—why choose a company that’s practically half telcos? Maybe this explains why the price was so attractive.

- Client overlaps in large accounts will impact some revenues, i.e. Cisco.

- The potential for culture clash. Concentrix comes out of IBM business and Convergys is essentially a traditional telco out of Cincinatti Bell … one has a background of tech and innovation and the other a very conservative and risk-averse culture.

- Convergys’ revenues have been decreasing the last couple of years. Call volume fluctuations and trying to compete with cost-focused customers and several butts-in-seats service providers in low-cost geos, has made it very challenging to focus on value-based deals.

- Appetite for automation in Convergys core industry puts ever more pressures on sustain margins and growth. For example, Convergys’ strongest vertical, telcos, are increasing their self-service interactions and automation, and have the strongest appetite in the industry for increasing Robotic Process Automation investments, in addition to their outsourcing focus.

- Desperate mid-tier providers. Many of the midtiers service providers may make the whole situation worse, by forcing price points even lower out of sheer desperation. Let’s be honest, we’re in a rat-race and the game is all about who can survive the next 18-24 months to emerge ontop.

- Low-cost IT/BPO offshore providers making subtle moves into the contact center space as digital customer needs accelerate. We’re already seeing many of the Indian heritage firms chasing after call center deals they would not have looked at a couple of years ago. They can be especially effective with “chat-only” engagements and with clients wanting to buy into a strong cognitive / automation story. Large IT-centric outsourcers, such as Techmahindra, HCL and Cognizant have been seen picking off some impressive wins with clients, especially where there are very strong IT elements. BPOs such as EXL and WNS have been much more active in the customer service segment, and EXL is making an impressive repositioning of itself as a digital intelligence provider, with some impressive depth in insurance, utilities and healthcare sectors.

The Bottom-line: As long as this “traditional consolidation” is short-term, this could pave the way for a OneOffice future for the winning contact center providers

Let’s cut to the chase here – Convergys is a great call center provider, but lacked the leadership and investment to break into the digital era effectively. This merger may just provide that opportunity for a very talented employee base with a terrific customer culture. For Concentrix, they needed one big play to get up-close-and-personal with Teleperformance, and this is the move. Plus, the price was really damn good, and we’re surprised why others with huge financial backing didn’t make the move, such as Sitel or Arvato.

On the negative side, these contact center heavyweights appear to be doubling-down on size and scale, rather than pursuing a true OneOffice vision for digital customer engagement. We are more excited about some of the smaller acquisitions happening in the space, such as Webhelp’s recent Sellbytell acquisition from Omnicomm and SYKES’ pursuing digital marketing with Clearlink – connecting the pieces in the front office as marketing, service and sales continue to overlap and converge, and using the vast amounts of customer data they process to better engage with customers.

The large contact centers can’t seem to get out of their own way—they talk about providing digital, analytics and CX consulting focused services, but the reality is that the bulk of their business is still traditional contact center. Despite some real capabilities, salespeople aren’t incentivized to sell a different way, and customers aren’t ponying up to partner and buy a different way. Continuing in this paradigm is a short-sighted view… look at what is happening with eroding revenues from the telco sector now, the most mature of the contact centers will eventually happen in other sectors, such as retail and banking. In addition, the wave of “chat only” deals are increasing and threatening the life out of the traditional voice business. Providers like Teleperformance and Concentrix don’t have to disown their core business – there’s always going to be a huge market for traditional interaction management, however, adding some truly differentiated digital offerings would be a much smarter long-term strategy.

Net-net, this is a massive coup for Synnex and the Concentrix management teams – and Convergys has found a good home to focus on the future with confidence. However, we would like to see some significant investments in intelligent automation and digital technologies to drag contact center BPO into the OneOffice era. Let’s hope these guys can work it out, as there is a real war on between the legacy cost-obsessed approach and the OneOffice approach…

Posted in : Contact Center and Omni-Channel, OneOffice