Has anyone inspired the world more in the last half a century than Nelson Mandela? Peace be with you during this time old friend…

Posted in : HfSResearch.com Homepage

Has anyone inspired the world more in the last half a century than Nelson Mandela? Peace be with you during this time old friend…

Posted in : HfSResearch.com Homepage

The whole discussion surrounding Visa Reform, and how it could damage the outsourcing business, raised much bigger questions in my mind than clients simply having a few extra dollars-per-hour slapped onto an invoice. It has highlighted the failure of outsourcing to become truly global and deliver more for clients than offshore body-shopping services.

It’s the over-reliance on the offshore that is holding back the whole industry from moving beyond the back office and into the front office, where providers can truly help clients with solving business problems and driving new growth, as opposed to merely making processes more cost-efficient and cheaper to run. The more a provider can present itself as a local partner, a business companion, an extension of its clients’ enterprises, the more its clients will think about their provider as a business partner, as opposed to an “outsourced” service. Hence, if Visa Reform can be a catalyst for driving more local investment from Indian-centric providers, then it will eventually prove to be a blessing in disguise for an industry still struggling with its identity.

I am already seeing positive steps with most of the Indian-centric services firms developing onshore workforces, but we need to see it happen more publicly and more aggressively. I would advocate more acquisitions of onshore services firms from the Indian leaders to speed up the rate of progress… there are plenty of candidates out there. There also needs to be greater focus on developing management and marketing leadership outside of India. You just can’t keep putting the same lipstick on the same pig!

One example of an Indian-centric provider which is setting the standard for many others to follow is up-and-coming BPO provider EXL, which has not only invested heavily in local delivery resources, but has also put significant resources into developing its corporate, sales and marketing leadership in the United States. With revenues at the $500m level, EXL has greater capable US marketing presence than most Indian-centric services firms several times its size. It is also becoming much more effective – just check out its new website.

Substance over Puffery: Becky Dennis is Chief Marketing Officer for EXL

When EXL first started hawking its services about a decade ago in New York City, its first sales recruit told me he was paid $40/day to knock out 150 cold calls daily, with the marketing support being a single poster he could mail to interested prospects. The firm relied heavily on executive networking and pure word-of mouth to grow its business. About two years ago, the firm’s leadership clearly had an epiphany: it realized that most of its Indian-centric competitors were also pretty weak at marketing themselves and it could gain a significant jump in the market if it invested in some quality marketing resources.

Hiring Becky Dennis was one of the smartest steps the firm could have taken. Becky had earned her BPO marketing chops at ACS, during its golden years, and more recently WNS, before EXL’s leadership realized it was time to unleash her potential and give her the CMO reins in 2011. What I like about EXL’s leadership is they tend to be a pragmatic bunch, who can see beyond the spin and puffery when they do things – and Becky provides exactly that. She understands the business and is willing to get her hands dirty and execute. Where some people may talk a big game, Becky just figures out what’s realistic and achievable and gets on with making it happen. There is too much talk (80%) and not enough substance (20%) in this industry today, and Becky is one of the 20% who has her foot on the pedal.

Becky proudly contacted me last month too show-off her hard work overseeing the launch of the new EXL website. I have to admit it’s refreshing to visit a website that is more than a mere poster board of corporate info and corny, over-used and meaningless buzz words. It’s actually relevant for buyers, analysts, consultants etc who want to learn more about the firm and the business services industries within which EXL operates – it’s also easy to navigate to find what you want. So I asked Becky to show off her achievements and tell us a bit about what’s she’s been up to…

Phil Fersht, HfS Research: So Becky, tell me (in a nutshell) about EXL – what has evolved over the last 18 months? What’s different today?

Becky Dennis, EXL Service: Where to begin, Phil … The evolution started shy of two years ago when EXL, a business process solutions company, consciously decided to invest more in strategic marketing activities. Recruiting a highly seasoned marketing team was the first of many steps to help EXL build greater awareness in the marketplace. Our company has been a “best kept secret” for too long and we haven’t publicly articulated or celebrated all the ways we drive impact to our clients’ businesses.

So part of EXL’s marketing evolution is how we better articulate our value. We previously went to market in a way that was more internally focused on how we were organized. Today, we are more client-centric in our market approach. Too often, providers focus on the “me” rather than the “you.” If communications do not better inform our clients, they are not as valuable as they should be.

Now we are increasingly seen as a provider with a point of view. As a result, we are more often sought out as a speaker or expert through the media or different industry conferences. I attribute that to two things: 1) being more vocal about the thought leadership we have to offer; and 2), simply focusing on the channels that reach our clients through initiatives such as PR and targeted campaigns.

We’ve also changed our approach to the industry. While EXL has traditionally enjoyed deep relationships among the industry influencers, we lacked a formal approach as to how we conduct and strengthen these relationships. With a global program in place, we now have more meaningful opportunities to engage with influencers and their clients.

While we’ve bitten off quite a bit in the first 18 months, we’ve built tools such as campaign scorecards to ensure we are spending time on the right initiatives: ones that will drive impact for EXL and the clients we serve. Until we had a message that resonates with our clients, we put the development of content assets on the backburner. By building new assets that are high-impact, we are seeing a tremendous difference in the stats on our website. For example, last month we saw a 185% increase in web queries over this time last year because I believe visitors are finding the content to be more salient to their needs..

Phil: And the work you have done marketing and positioning the firm – what is driving this and what are the key messages you want clients and prospects to take away?

Becky: After 21 years in this industry, I’ve seen a lot of engagements, but I’m particularly impressed with some of the ways EXL helps clients … and in a tangible way. A few examples that continue to “wow” me are how EXL saved a client $1.5 BN in annual spend by identifying attrition root causes and developing a retention strategy. For another client, we increased their cash collection per hour by 66% by optimizing their collections process through the use of predictive dialers, better inventory management, and agent up-skilling. Many providers view their capabilities as silos. One of the ways EXL is able to achieve results like this is through integrating our people business of process management with technology and analyzing data and performance metrics. This makes a big difference to the buyer and generates far more value than just having a partner who reduces costs.

At the end of the day, I want clients to see EXL as a company that looks deeper to drive business impact through integrated solutions and industry knowledge. We solve a wide range of business challenges, including helping clients take products to market faster, building models to be compliant more quickly with new regulations, turning volumes of data into business opportunities or driving out costs while trying to grow.

Phil: You’ve clearly put a lot of work into the new website, what’s so special about it in your view? What do you want people to take away from their visits?

Becky: What I like the most about our new website is that it’s quite different from those of our direct competitors. We’re going to market through three strategies: 1), as an advocate for our clients; 2), as an expert who can help our clients with their evolving needs; and 3), as a challenger who look deeper to solve complex problems.

By moving away from the typical website that contains volumes of capabilities, we took a challenger stance to simplify and basically ask “what can we do for you?” Our site is based on adding more and more content that easily answers the strategic questions that clients are asking, rather than forcing them to navigate across a complex site that satisfies our own needs.

Phil: And, finally, is brand really that important in BPO services today? Surely it’s just a people business, right?

Becky: In my experience, as a company grows and matures, it undergoes a need to define and articulate its identity and promise to the market. I think the more diverse your client base and the wider the variety of services a company provides, it has a tendency to dilute the brand if the employee base is allowed to “spin” the company as they see fit individually. You tend not to have a true identity and fall victim to being a commodity.

A company like EXL—one that hires talent from our clients’ industries so we not only speak their lingo, but invest in building academies to ensure our employees truly understand their businesses, is not a commodity. It’s what the market is demanding as they face tougher competition as a result of economic turbulence. Now marks a time for EXL to enhance our image through a consistent means of identification that focuses more on the value we provide as a partner.

Sure, our clients cite attributes that are indicative of us being in a people business, such as the obvious passion for what we do to serve them, our knowledge of their industries, the seamless execution of our operations and a high level of senior engagement. But to advance to the next level of value, EXL is simplifying our means of going to market: a business process solutions company with advocates, experts and challengers who look deeper to provide business value.

Thanks for the opportunity to articulate this, Phil. You’re always looking at the provider community to challenge the status quo. That’s what EXL strives to do on behalf of our clients.

Phil: Well, it’s refreshing to see a firm like EXL starting to shake things up… and thanks for sharing your success with our readers.

Posted in : Business Process Outsourcing (BPO), CRM and Marketing, Finance and Accounting, Financial Services Sourcing Strategies, Healthcare and Outsourcing, Outsourcing Heros, Sourcing Best Practises, sourcing-change, Talent in Sourcing

Missed yesterday’s record-breaking webinar on the proposed Visa Reform? Or, were you one of the 870 registrants who enjoyed the discussion so much, that you’ve come back for more? Either way, we have what you’re looking for…

As promised, you’ll hear from both the offshore and an onshore perspectives, from a lawyer, a buyer, an onshore provider and offshore provider and a couple of analysts. We agree…it doesn’t get much better than that!

And a big thanks to Steve Semerdjian, Ed Caso, Stephanie Moore, Jeff Lande, Joe Hogan and Tim Norton for taking time to share their insights with everyone.

Click here for the replay and here for access to the slides.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Outsourcing Advisors

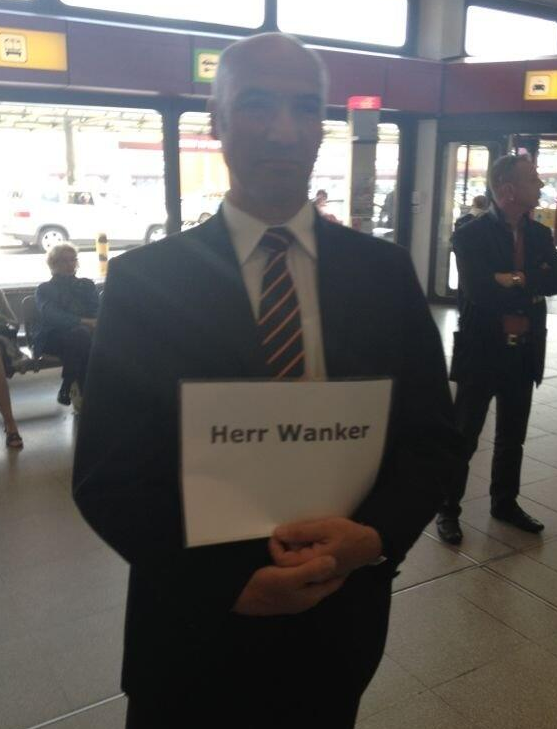

Posted in : Absolutely Meaningless Comedy, Sourcing Locations

New research from HfS clearly shows all is not as it seems in the global services landscape. HfS’ Jamie Snowdon investigates…

It would be easy to forgive anyone for assuming that the Indian services majors Wipro, Infosys, TCS, Cognizant and HCL (aka the “WITCH” providers) are dominating the global battle for services supremacy, given the hype that surrounds India’s dynamic IT outsourcing economy. However, In spite of their impressive growth over the past ten years, none of the WITCH providers have yet to make the HfS Top 10 of global IT services firms, despite dominating the application development and management business:

The first of the WITCH providers likely to break the Top 10 is TCS, provided it can maintain its current growth trajectory, break through its landmark $10bn revenue barrier, and there aren’t major acquisitions or merger amongst the Top 20 providers.

The IT services competitive landscape is still dominated by the traditional large global IT firms (HP, IBM, Accenture), the global enterprise software companies and local IT services firms with strong domestic/regional market positions (Fujitsu, NTT, Capgemini, CSC, CGI).

HfS Research’s new Global IT Services Market Size and Forecast 2013 provides an analysis of the recent financial performance of the leading IT Services companies and the key drivers and inhibitors that are driving growth in these markets, particularly how they are coping with the endlessly on-going economic crisis in Europe and the key technology and business dynamics driving growth in 2013 and beyond.

Ten ways the WITCH providers can break the IT Services Top Ten

1. Develop a greater client base outside of the US – particularly continental Europe where the benefits of offshore development are beginning to be recognized

2. Move up the value chain – too many of them are being “ring-fenced” into the IT back office and struggling to get a bigger chunk of the integration business

3. Expand into the upper-middle market ($1-$5bn revs), where the heritage western firms are much less dominant and demand is highest

4. Acquire more consultative capability to move clients into the cloud

5. Invest in word class BPO and business transformation capabilities to become genuine “technology enablers” and not solely IT body shops

6. Focus on verticals where they can really differentiate with institutional expertise and stop trying to be “all things to all people”

7. Become more global in nature, establishing more middle and upper management in locations outside of India

8. Diversify more aggressively IT infrastructure-based services and become less reliant on lower-level ADM work

9. Diversify beyond legacy ERP services into supporting SaaS enviroments such as Salesforce.com, Workday, Netsuite etc.

10. Acquire a “traditional” onshore IT services business that can add many of the areas mentioned in points 1-9

Posted in : Cloud Computing, Confusing Outsourcing Information, HfSResearch.com Homepage, IT Outsourcing / IT Services

Rather than panicking about the next quarterly earnings, Michael Dell is focusing on building something for the next couple of decades

I don’t want to shock everyone, but occasionally I do have positive things to say about some providers. And it’s nice to be pleasantly surprised by one which is clearly on the right path, because when Dell acquired Perot Systems in 2009, many of us were skeptical as to whether a product-centric firm, such as Dell, could make a genuine push into high-end services.

It is my personal belief that the likes of HP and CSC will be sweating from the oncoming threat from the Austin-based firm’s $8.5 billion services arm in the not-too-distant future, not to mention some of the flagging Indian firms struggling to rediscover their mojoes.

Why Dell is a dark-horse future services powerhouse

Strong leadership and deep resources. Michael Dell is a great guy, liked and respected by everyone who knows him and works for him. He is also a smart businessman and smart communicator and his no-bullshit style has permeated its way throughout the company. Moreover, he is very, very rich – with his Dell investment rumored to be only a third of his entire personal fortune.

Taking Dell private will shelter the firm from the intense public scrutiny being placed on services firms today, consumed with unrealistic margin pressures and gobbledygook strategies that mean little, but sound impressive. It is clear that Michael recognizes which elements of his business are nearing the sunset or maturity phase of their evolution, and where the future growth is coming from. He recognizes that the services industry is hitting crunch-time with too many competitors and too many copycat strategies. Being able to take a detour from the impending turbulence will enable the firm to weather the storm, make some strategic tuck-in acquisitions and re-emerge in the future onto public markets as a real Tier 1 force.

Talent in abundance. Michael has assembled an unbelievable array of talent through his acquisitions and direct hiring from competitors. In services, snagging Suresh Vaswani to lead Dell’s services shortly after he was displaced as Wipro’s CEO is proving a masterstroke. Suresh has built a very dynamic team, including Ashutosh Vaidya, Wipro’s former head of BPO, Tanvir Khan, who helped establish Minac’s US operations, and Sid Nair, one of Wipro’s US sharpshooters to drive the healthcare services offerings. In addition, what impressed me most was the talent in the middle-management layer, for example, former star Redmonk analyst, Michael Coté helping devise cloud strategy, and Cameron Jenkins, former COO of legacy modernization firm Clerity, helping drive Dell’s thriving application modernization business. While many of Dell’s competitors only push their thin veneer of senior leaders in front of the industry stakeholders to mask a mediocre middle-layer of sales people, Dell is proud of the people it has assembled throughout the organization.

Positive culture. Let’s make no bones about it, several of today’s services firms are suffering from low morale and executive burnout. Some have really lost their way and much of their top talent – and it’s sometimes hard to pinpoint people you still know in those firms. However which way we look at it, services is still a people-business, where passion and energy are still the core ingredients to inspire clients and drive new thinking and ideas. You don’t get that feeling from the Dell crew, even after several mojitoes… these folks are genuinely happy to be where they are.

Limited bullshit. When your leader is a straightforward guy who clearly articulates what he wants to achieve, the rest of the firm normally follows suit. This really is the case with Dell, where everyone talks a straight game regarding their strategy and game plan. The firm’s offerings are, quite simply, uncomplicated: IT products and services across all key areas, namely security, private cloud enablement, enterprise mobility, service management, application development and infrastructure management. I was particularly impressed with its cloud strategy, based on its own datacenter and hardware heritage, and also its modernization business, where it was addressing many of today’s businesses still plagued by legacy mainframe environments.

There is also a stealth BPO strategy where the firm is pushing into verticals where is has deep domain expertise (both onshore and offshore), such as healthcare, life insurance, transportation, retail and hospitality, as opposed to getting crushed in horizontal areas such as F&A and procurement, where it hasn’t established much presence. An estimated $350m a year of non-federal BPO business is enough to get Dell to the big boy’s table in its selected vertical areas, and open up the potential for acquiring additional BPO capability as it grows.

Very strong edge in the upper-middle market for IT services. There is a host of clients in the $1bn-$5bn range which are struggling to get the red-carpet treatment from the Tier 1 providers, still feasting off the fruits of the high-end enterprises. There is a great opportunity for Dell to exploit its massive installed base of hardware clients with no-nonsense IT services offerings from simple Windows migration projects through to complete apps and infrastructure modernization engagements. It also has a pretty decent brand to work from (with a concerted marketing push). It will need to contend with competitive friction from the reseller channel, but Dell knows it must develop its broad services business offerings if it wants to survive and prosper. In addition, many of these “upper middle market” clients are going to be the F500 of the future, and building a solid base of clients in this sector is laying the groundwork to attack more high-end business down the road.

The Bottom-line: Dell’s enterprise services journey is in the early stages, but it has a much brighter future than many of its counterparts

Dell has a lot of work to do, but Michael has spend the last three years putting together the framework and game plan to take the company forward. Being able to shield the firm from the Wall St. headwinds that are consuming the leading service providers, is a huge benefit for the firm seeking to take its time adapting to a rapidly changing environment and re-positioning itself in new growth areas where it needs to develop its brand and reputation. Rather than simply panicking about the next quarterly earnings, Dell can focus on building something for the next couple of decades. The firm does need to acquire additional scale and depth across most its service lines – and may need to sunset or divest of some of its own legacy businesses, which simply make less sense to own in today’s environment. However, for many of today’s ambitious services executives, this is one firm that has a great culture, strong leadership and a no-nonsense vision that is in tune with the realities of what is needed to survive. I hope to link back to this post in a couple of years with an “I told you so” smirk on my face 🙂

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Healthcare and Outsourcing, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, Outsourcing Heros, Talent in Sourcing

Barely more than a year since SAP made its bold move into the cloud with the very expensive acquisition of Successfactors, does the hotshot visionary and symbol of the attempted “new look SAP” leave the firm… Lars Dalgaard.

Lars Dalgaard… sporting a fine red tie to an SAP event

Anyone who has met Lars over the last decade has been drawn to his incredible passion and vision for the future of enterprise software with the shifting sands away from legacy on-premise software and expensive lock-in licenses.

Lars joining SAP was the acid test as to whether old-world ERP vendors could find a rapid path into the shiny new world of cloud and multitenant delivery models for enabling global business operations. He was a true visionary who had almost single-handedly taken on the legacy enterprise software firms, building up Successfactors from nothing to something, that would entice SAP to part with $3.4 billion to take it out.

The stark reality is there’s just so much vested in today’s legacy enterprise model

Lars leaving so quickly symbolizes SAP’s struggle, in my mind, to change its culture and approach to disruptive business models. The economics of the cloud cannot print anywhere near as much money for our German friends as the current legacy ecosystem of clunky enterprises, whose IT managers simply do not want to invite change or disruption. If your clients don’t want to change, why should you?

Net-net, SAP has created a nice cosy industry around itself that has created, literally, millions of careers. What are all these developers and project managers going to do if companies suddenly had single instances of SAP available in the cloud? What are many of the service providers going to do if they can’t earn tens of billions trying to stitch all this stuff together? And what would SAP do if it can’t command such incredible revenues from its consulting, services and multiple-license revenues?

The startling truth is that there is a $255 billion industry (Source, HfS Research) that feeds off this ERP chaos and dysfunction centered around both SAP and Oracle, and and estimated $156 billion of this is purely the annual cost of keeping enterprises’ SAP worlds ticking over in 2013; the external services, the licenses, the hosting, the internal staff to maintain and develop the software etc.

Why do you think these little upstarts, such as Successfactors, Workday, Netsuite and SFDC command up to 40 times their annual sales income in valuation? Because they threaten the status quo of a much, much larger industry that is scared stiff of being blown out of the water by disruptive technology:

While the decrepit old enterprises stick to their legacy IT infrastructures, the evolving mid-market firms are breaking the mold

I recently spoke to a senior executive at a legacy software vendor stuck in multi-instance and fake-cloud land, who confided “we’re purely in the protection business now. All the new logos are going into Workday. Fortunately our existing clients still spend enough to keep us solvent.”

This pretty much confirmed my viewpoint that it’s the small to middle-market organizations (under $5bn in revenues) seeking technology and sourcing solutions that can drive nimbleness and cost-effectiveness, as they simply do not have the people and technology resources within their IT, finance, HR, marketing and supply chain operations to manage their evolving needs. Moreover, many of these organizations are moving from prehistoric infrastructures to cloud-based ones… bypassing much of the painful inch-by-inch transformation where so many of today’s high-end enterprises are stuck.

As the existing high-end business opportunities slowly shrivel up, the new logo opportunities are springing up in the mid-tier, will the likes of SAP and Oracle be equipped to take them on, when compared with the evolving array of developing cloud solutions from the upstarts? Remember, many of these new mid-tier logos will make up a significant chunk of the F500 in the future… so clearly the failure to evolve to true cloud models is eventually going to come back and bite the incumbents. Surely they can’t keep spending billions and billions on new acquisitions to control them when they start to hurt their business?

The Bottom-line: The evolution to the cloud for firms likes SAP is simply way, way to slow for a guy like Lars

SAP’s enterprise customers, and many of the services giants which feed off the beast, are still many, many years from being forced to evolve, but one thing is clear… eventually they will be forced to comply. The big question is whether it’s still another 5, 10 or 15 years away…

Simply put, SAP was never a place for the likes of Lars… and won’t be for many years to come. There is no burning platform for SAP to really jump into the cloud just yet, and guys like Lars do not work in the slow-change business. When that burning platform does come, it will need people to change the mindset a lot more aggressively than they are prepared to in today’s market. Maybe then, they’ll wish they had a Lars to call on.

Let’s just hope, for SAP’s sake, he doesn’t pop up at one of these other cloudy upstarts anytime soon…

Posted in : Business Process Outsourcing (BPO), Cloud Computing, IT Outsourcing / IT Services, Outsourcing Heros, Social Networking, sourcing-change

I always like it when the nice guys get the top jobs. Too frequently providers put in a suit with good P&L skills, an upwardly mobile corporate persona, amazing PPT builds, is always “selling” and never letting any cracks appear in the glossy façade.

What’s wrong with a down-to-earth guy who’ll sit down and share a beer with you to give you the no-frills run down on his challenges and opportunities? What’s wrong with an executive who has shed blood dealing with a decade-plus of transitions and tackling real client pain-points? So I was pleasantly surprised when my good pal Gautam Thakkar got the nod to take on the reins at InfosysBPO last month.

Gautam has actually sat himself through one of our HfS sourcing executive council meetings to hear close-up how clients are dealing with the world post-transaction. What’s more, Gautam doesn’t live in a world of PowerPoint – he lives in the world of the tough realities of the business we are in – long decision cycles, complex change issues, challenging economics…

So we managed to “drag” Gautam away from the squash court and his collection of Malbecs (which is probably fairly pitiful at the rate he drinks it) to learn a bit more about how he intends to take on the next chapter of the InfosysBPO story…

Phil Fersht, CEO HfS: Good morning Gautam! Could you share some background on yourself, where you came from and how you got into what you’re doing today?

Gautam Thakkar, CEO InfosysBPO: Hi Phil… I’ve been working with Infosys for about 13 years. At that time the company was trying to grow an upsteam business – hiring consultants to work with clients and starting other transformation initiatives. I was in the middle of some projects and someone came up to me and asked, “Would you like to be a part of something Infosys is starting up, spend a couple of months framing a strategy for our BPO business?” I said sure, I’d do 2 months, but then 2 became 4 and 4 became 6 months. I went in kicking and screaming, saying this isn’t something I want to be doing for a lifetime! But as you now know, it’s become something I’ve done since 2001, before Infosys officially got into the business. I was one of the first employees at Infosys BPO and have been through almost 10 years of the company’s BPO journey, played different roles along the way and ended up in this position. I’ve lived and worked in the US, India and Europe. It’s been an interesting evolution to see a company that was conceptualized from the grassroots and growing to where we are today, at 25,000 people globally, 23 centres and more than 60 nationalities.

Phil: You’d been heading the F&A practice for a long time, and that’s now broadened into a CEO role. What will you be doing differently now?

Gautam: As I mentioned, since I was one of the early employees, we were pretty much doing everything in the beginning. Then I was responsible for the entire Europe business, which morphed into the F&A role. Subsequently to that, in the last 2 years I’ve been handling all horizontals outside of F&A as well. This is what we refer to as the entire enterprise business BPO, accounting for 65% of revenues today. So yes, F&A was the largest part of the business that I was looking at directly, but other businesses were also rolling into me. The transition has been smooth, as I was running 65-70% of the business already and was connected with most clients. The agenda that my predecessors saw for the company was growth, differentiation and people. This is the foundation on which we have grown the business and will continue in the future. From a client standpoint, we follow the 3 Rs – being Relevant to our clients & employees, Respected as and as the best place to work for employees and one of the most profitable businesses and having strong Reach with clients and drive sustainable businesses globally. I’m taking it upon myself to be connected to most CXOs, clients and otherwise. So directionally, the transition has been smooth because I was a part of leadership team earlier and will be taking forward these principles to engage with clients.

Phil: Looking back ten years ago to when you first formed InfosysBPO, what’s different today?

Gautam: I think there are some things that are different, while others remain the same. Cost is a focus area and has stayed true as a favorable driver for clients to engage in BPO. When companies look to us, cost is still one of the drivers. However, what has changed dramatically is the way that we engage with clients. They are now looking at it from a revenue standpoint – how do we offer agility, flexibility and scale? So the conversation has moved from a cost focus to a growth focus in BPO. For example, we’ve moved with clients to different geographies. We recently opened a delivery center in Costa Rica where we are giving a client nearshore scale and flexibility. Last quarter we talked about creating 200 jobs in Atlanta. So ten years ago, the value proposition was largely cost. Now it has shifted to cost and growth as well – growth-led BPO. This is reflected in our revenues as well, where 40% of it comes from global centers outside of India. The headcount still remains largest in India, but we have 6,000-6,5000 employees working outside India in these global centers.

Phil: One of the things that impressed me about InfosysBPO is that you’ve gone after different markets, beyond F&A, from the outset (read our earlier discussion). For example, you’re the largest and most successful Indian provider in procurement BPO, and you’ve got tentacles in customer management and insurance as well. Can you talk a little bit about the broader portfolio and where you’re going to double-down in the next 3 years?

Gautam: Phil, the way we’re organized today, we’re centered around industry vertical solutions and the horizontals where we’ve made a lot of investments. There are certain areas where we’ll be spending a lot of our time and expanding on these investments. Sourcing and procurement is continuing to hold our attention because it is where we are having value based conversations with clients. We also acquired an insurance platforms specialist, Mccamish Systems in 2009 – insurance is another business we are spending a lot of time on, from a vertical solutions standpoint. Overall, sourcing and procurement, insurance and healthcare are the key areas we are being fairly aggressive on. F&A continues to be a staple, even though it is the most competitive service area. I believe its there for the taking, and is the easiest conversation to have with a client since the area is relatively mature.

Phil: Infosys has been frequently making acquisitions to grow the BPO business, more than most other BPO providers out there. What is the thinking around that? Can we expect more acquisitions in the near term?

Gautam: We have made acquisitions historically in BPO – the Philips center, McCamish, Portland and Marsh BPO. All these we acquired not for scale, but for a logical fit in our portfolio. We identify those areas (white spaces) which we believe will give us the capability and skillset to get a headstart or help fill the gaps from our overall capability set. However, each business has to stand on its own – we don’t want to go acquire just to get revenues. Businesses have to be profitable and have clear growth paths of their own. We also want to make sure we are able to go after them in a structured fashion. One aspect people tend to ignore is how the acquired firm integrates in the company and whether it’s a good fit overall. All our BPO acquisitions have been integrated extremely well, giving me great confidence to go ahead and look for similar assets in the market, as and when it happens. We’re always looking for the right assets which fulfill the criteria I outlined, and we’ll continue to do so.

Phil: So what are you going to do differently that’s going to make a huge impact to Infosys and the market?

Gautam: One of the aspects I’ve always been comfortable with at Infosys is client relationships. That’s my strength and I will ensure I engage with the right clients, whether existing or prospects we’re targeting. As I mentioned earlier, the bedrock of what we had evolved was growth, differentiation and people. If I extend that to the 3Rs, I am going to continuously focus on and hopefully take Infosys to the next level. The nature of the market is also changing, there are more integrated deals happening now. Fortunately when we talk to clients and customers, we are one business, whether its IT, infrastructure, systems integration, consulting or BPO. That gives me strength and comfort that we’ll be able to take this to market appropriately. I believe clients will start seeing that value proposition that I think will differentiate us from the rest.

Phil: There’s been a lot of talk, particularly from Infosys, about seeking “non-linear growth”…you’re saying 33% of revenues are going to be targeted at being non-linear in the mid-term. How realistic is that for BPO, is that achievable and are you already seeing signs of that evolving for the company?

Gautam: The BPO and technology businesses are very closely linked at the hip. The platform strategy that Infosys 3.0 talks about is very closely linked to BPO as well. For example, two of our platforms out there, TalentEdge and ProcureEdge allow us to go on the platform and manage the entire stack of applications, infrastructure and all the business processes. That completely ties in to what Infosys is trying to do from a non-linear perspective. The other thing to remember from a BPO standpoint is that we’re close to $600 million in revenues and 25,000 people. Three years down the line, if we want to double revenues, we can’t also double headcount. There has to be a break in linearity so that we can grow our business sensibly, along with technology interventions. Infosys 3.0 fits in with what we’re trying to do because for this industry or business, you don’t want to double both [revenues and headcount]. After a while, it becomes unmanageable. There are some core processes which will be intensive on resources, but I think technology will play a big role. This is why I mentioned the cost and growth focused BPO initiatives. The shift will increasingly happen, but it will be on the back of technology, not just on the back of headcount as you increase revenues.

Phil: Finally, if I wrote you a cheque for $2m today, what would be the first thing you would do?

Gautam: <laughs> What would be the first…? I think I would take my family on a long holiday. This is more for them than for me. They bear my travels and being away for long periods of time… I think they definitely deserve a break more than I do! I’ll take them to the most exotic place that they can think of and be at their beck and call to do whatever they want to and hopefully spend that money usefully.

Phil: Answered like a CEO should 🙂

Gautam: I’ll pass that on to my wife. I think she will be very impressed, I don’t know about the rest of ‘em!

Phil: Gautam – you’ve been a great sport! Am sure there will be many folks here wishing you all the best in the new role.

Gautam Thakkar (pictured above) is Chief Executive Officer and Managing Director, Infosys BPO (Click here to read his full bio)

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, Financial Services Sourcing Strategies, kpo-analytics, Legal Services Outsourcing, Outsourcing Heros, Procurement and Supply Chain, sourcing-change

Amigos – it gives me great pleasure to announce some imminent new analyst arrivals at HfS, in addition to announcing the promotion of a couple of guys who’ve been instrumental in the development of this business, which has literately sprung from nowhere in three years to the monstrosity it has become today…

Christa Degnan Manning joins HfS Research as Vice President to lead the firm’s Human Capital Management Strategies research practice addressing both technology and services dynamics. Christa joins from American Express where she was a leader with the firm’s managed business travel services. Prior to AMEX, she led the Human Capital Management Practice at AMR Research (Gartner), and the Procurement and Category Management Practice at Aberdeen Group. She was one of the few analysts at AMR who never took any crap from me… she is feisty, smart and fearless.

Ned May joins HfS Research as Senior Vice President to spearhead the firm’s research coverage of Technology Enabled Business Services, where he will research the impact of mobility, big data and cloud technologies on business and IT services. Ned previously led worldwide IT services research for analyst IDC and most recently worked in the new media industry covering the impact of new technologies on publishing and information. His official name is “Edward” and is known as the “Frat Boy” by his former UK IDC colleagues. He is also a great writer, thinker and all round guy.

Tom Ivory is promoted to Chief Operating Officer of HfS Research, where he will oversee the company’s commercial operations, events and marketing functions, in addition to contributing to the overall research strategy. Tom has overseen 300% growth in HfS revenue performance in his two-and-a-half year tenure. He previously worked in senior commercial roles at OpenText (Metastorm) software and the Corporate Executive Board. Tom has thrown himself hook, line and sinker into HfS and been a real part of our growth story. Just don’t be fooled by the angelic features…

Jamie Snowdon is promoted to Executive Vice President, Research Operations, where he will manage the core HfS research analyst team, oversee the HfS Blueprint supplier evaluation methodology, price benchmarking service, market sizing and forecasting, and research processes. Jamie has successfully overseen the firm’s establishment of its Market Index forecasting during his 18-month tenure, in addition to developing the firm’s PriceIndicator benchmarking service that focuses on IT services and BPO pricing. He previously worked in research leadership roles at NelsonHall, IDC and Input. Jamie is knows in business as the “Ginger Ninja”… the quiet research assassin who can produce research from practically anything. He has also promised he will finally get a mugshot done which involves a collar and tie… however I’ll believe it when I see it.

Being able to attract and develop this level of talent is critical to supporting our growth plans. The research industry has been both disrupted and transformed by the whirlwind availability of information and data in recent years, and maintaining a distinct voice above the noise has never been so critical. Research must be more about talent with a unique vision than dull reports and mass-produced trends, if the analyst industry is to thrive and prosper in today’s environment.

Finally, we wouldn’t be anywhere near close to where we are today without the support from YOU. So thanks 🙂

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Cloud Computing, Global Business Services, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, Talent in Sourcing

[embedplusvideo height=”390″ width=”640″ standard=”http://www.youtube.com/v/Vuz_RP32Cn0?fs=1″ vars=”ytid=Vuz_RP32Cn0&width=640&height=390&start=&stop=&rs=w&hd=0&autoplay=0&react=1&chapters=¬es=” id=”ep3911″ /]

Posted in : Absolutely Meaningless Comedy, sourcing-change