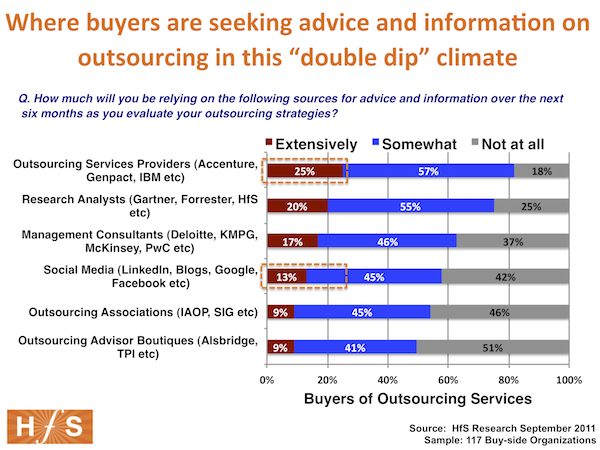

As we push our Outsourcing in a Double-Dip study, we couldn’t resist a quick sneak peak at the data at the half-way point, to get an early indication of how buyers are behaving in this market. And when we ask them where they’re foraging for help and information with outsourcing strategy-making in the coming months, the results are simple: they are turning to whatever sourcing are most easily-accessible and inexpensively-available to them:

Providers – once in a relationship provide a constant source of information. Buyers really start to leverage leverage their providers for help once they start working with them and their destinies become intertwined. Since most organizations today are already in outsourcing relationships, it is very easy for buyers to call up their provider contacts and ask for help and information, even though their experiences are usually limited to only those of their other clients. Moreover, our recent State of Outsourcing Survey revealed that 40% of buyers are yet to be convinced that their providers have the know-how to help produce long-term business benefits for them. In fact, an increasingly large number of providers are asking HfS to help their clients – they have the greatest urgency to educate and keep them informed with objective, credible data and advice.

Analysts – they make themselves accessible. Most large firms already have subscriptions in place to access reports and tee-up calls with analysts to bounce around ideas. Whether the advice is any good is another issue, but the fact that the leading firms make themselves accessible and (relatively) affordable keeps them top of mind when critical decisions need to me made. The downside is that it’s pretty tough to help clients with such complex and sensitive issues such as outsourcing over the one hour phone call, but smart outsourcing buyers know how to leverage these firms to get the datapoints they need.

Management Consultants – have upped their outsourcing game. Consultants have really made their presence felt, with several of them having developed comprehensive expertise to support their clients when the “O” questions start popping up. Smart clients can also squeeze a lot of info out of the without having to summon the MBA bus to their parking lot. Moreover, some of the leading consultants are much better equipped to run small-sized engagements these days, especially with experienced clients who don’t need to overhaul their entire operations strategy to understand which service provider can process their invoices best. Furthermore, buyers see the cost savings opportunities, but realize they need more than $20/hour Indian programmers and $15/hour Filipino call center agents (as we recently revealed here). They need re-engineering, better systems, etc, so many turn to the consultants for help, because their providers haven’t been able to deliver much more than the cost savings.

Social Media – becoming a significant channel for advice. The surprise package here, with close to 60% now leveraging the likes of LI groups (we have more than 14,000 in our group alone), blogs, Google Plus and other tools to get help. Essentially, there are a lot of knowledgeable sourcing folks getting connected these days, and they’re getting easier to seek out.

Associations – ongoing interaction proving valuable. Not to be undone, these entities provide some pretty decent networks to help well over 50% of buyers gain knowledge, and also access experts. For example, our network partner the Sourcing Interests Group hosts a regular stream of interactive webcasts and special interest group discussions to complement their events. They even make our research accessible to their members. Not bad huh?

Outsourcing Advisor Boutiques – great for deal negotiations, but less so for the other stuff. Many clients today are turning to these guys once they are ready to pull the trigger on a deal, but it seems they aren’t being as heavily utilized for general information and advice. Moreover, boutique advisors don’t produce a lot of data and insight that is easy to digest, or freely available. Much of it is written in industry-jargon and their online content often reads more like they are writing to each other than their actual clients. Don’t get me wrong, their content is often superb, but you sometimes need a PhD in the school of outsourcing hard knocks to understand it. The bottom-line is that many advisors simply don’t see the revenue incentive to give anything away for free, and employ too many hard-nosed deal guys that can negotiate an indemnification clause and chaperone site visits during a selection process, but simply don’t know how to evolve a sourcing strategy.

The Bottom-line

Buyers are savvying up on sourcing. There’s a lot of information and advice out there today and a whole array of individuals and firms are willing to provide it. The common theme is that if someone wants the price of a SOX expert in Slovakia, or certification as to whether they’d be nuts handing off their paper-clip purchasing to a Polish procurement provider, they want that knowledge right away. The secret sauce that once obscured outsourcing information has long evaporated, and the challenge now for buyers is to make sure they have consistent, ongoing access to people whom they trust to provide it, without it costing the earth.

Posted in : Business Process Outsourcing (BPO), hfs-2011-double-dip-recession-study, IT Outsourcing / IT Services, Outsourcing Advisors, Outsourcing Events, Social Networking, Sourcing Best Practises, the-industry-speaks

Social is increasingly powerful as buyers start to seek each other out to exchange views and experiences. Plus, it’s harder for consultants and suppliers to control the flow of information.

Interesting article,

Dieter Schwarz

Phil,

Really like the post and really agree with your perspective and conclusions. Buyer / advisor / seller rules of engagements are changing rapidly and permanently.

Mike Volpe, CMO for Hubspot put it this way,“Decisions are being made earlier in the process by people before they actually talk to a salesperson. If you are not getting found during this stage in search engines and social media, your company might as well not exist. Analysts no longer determine industry leaders. Search engines & social media are the ‘magic quadrant’ now.”

Matt

Isn’t it really a question of what you want and the level of experience that you are bringing into review? If this is your first entry you need authoritative information and even that needs to be substantiated (there is such a thing as commissioned studies). If you have moved deeper into direct evaluation you may find it useful to be assisted by a guide to reduce risk & distractions. Ultimately the buyer must make a decision and it must address the economics, delivery of business service, transitioning and engagement sustainment.