While we’re all getting carried away with robots and sexy SaaS solutions replacing our rules-based transactional labor (and all the lovely buzzwords that come with it), something else is going on that is taking these dynamics in a different direction for thousands of Western enterprises’ operations: IT and business processes are increasing their extension offshore at a breathtaking pace.

While we’re all getting carried away with robots and sexy SaaS solutions replacing our rules-based transactional labor (and all the lovely buzzwords that come with it), something else is going on that is taking these dynamics in a different direction for thousands of Western enterprises’ operations: IT and business processes are increasing their extension offshore at a breathtaking pace.

Offshoring is an increasingly large component of business operations. Clearly, the offshore option offers immediate savings and firms are getting much more adept, confidant and experienced at managing their processes remotely – whether by an outsourcing provider or their own offshore shared service center. And – as we’ve lamented on this site since the days when ACS was a market leader and people still used Yahoo! – enterprises are just obsessed with driving out cost – and then figuring our things like “transformation of processes” at some future point in time.

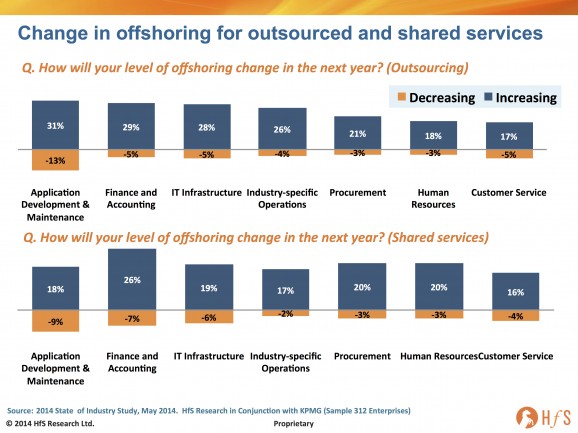

However, the difference today is that most of the perceived “risk” of moving offshore has gone and enterprises are simply doing it as part of their day to day operations. The evidence from 312 major enterprises in our brand new State of Outsourcing Study, conducted with KPMG, is startling:

The extension of process to offshore delivery is almost as prevalent in shared services as outsourcing. While a small number of firms are pulling their application development and maintenance back (one-in-ten), close to a third are increasing the offshore component with their service providers, and a fifth with their shared services – a similar trend to IT infrastructure. Moreover, where the new traction is clearly occurring is with business processes, which are clearly reaching a level of maturity with offshoring – almost three out of every ten enterprises are increasing their offshoring of finance processes with both their service providers and their own shared services operations. We also seeing similar dynamics with industry specific processes, procurement, HR and customer services.

The Bottom-line: The story today is about managing integrated services across global operations

1) The game has switched to integrated global operations management. It was barely 2-3 years’ ago (click to view some older survey data) that the trend was very much moving towards outsourcing, with offshoring as a key component, for many enterprises looking at more radical measures to drive out cost. What’s clearly transpiring is that many enterprises are clearly also investing in their own internal capabilities to run processes offshore (stay tuned for more hard evidence of this trend shortly). They can hire offshore staff at wages rates frequently far cheaper than their own providers charge (i.e. not paying their margins), which is nothing new, but clearly they are far more determined and confident to govern their own offshore internal resources themselves. What’s more, many organizations are clearly not very impressed with the quality of their providers’ resources (again, stay tuned for more hard evidence of this), and have made the decision to look at a more integrated services model to deliver their services to their organization. This is why we’re seeing a heavy push from several of the Big 4 consulting shops, such as Deloitte, KPMG and PwC, to push their own managed governance and Global Business Services options, while Accenture is marketing its own flavor of integrated services management called “Integrated Business Services”. We are even seeing providers with deep offshore specialization, such as Genpact, eager to push their service models and capabilities to clients, often as separate engagements from their existing bread-and-butter outsourcing relationships.

2) Offshore delivery will impact the rollout of the disruptive technologies, such as robotic process automation and SaaS. While it’s not rocket science to see how impactful these disruptive technologies will likely be to labor-based services (read earlier post), the more that gets extended offshore, the more challenging it may become for enterprises to shift the model away from these linear labor-based services that are so dominant today. Quite simply, offshore outsourcers with predictable FTE-based annuity contracts are in no hurry to disrupt their own sources of recurring revenues, while enterprise operations leaders may not have genuine incentives from their leaderships to substitute their own offshore labor for technology driven alternatives.

Net-net, offshoring provides a very durable BandAid for many organizations, and we’re still yet to witness a slowdown in the amount of offshoring that is taking place – in fact, the data shows quite the opposite trend is happening. We actually predict it will be more those organizations which have yet to do a lot of offshoring, which will look to move straight to automation and SaaS models as the ROI to reduce high onshore costs, as opposed to much cheaper offshore costs, is going to be so much higher. Eventually, competitive pressures will force all (surviving) leading providers to shift a much larger proportion of their labor-driven models onto technology-based platforms (where IBM has already placed its bets), however, the attractiveness of the high cost-savings benefits that locations such as India and the Philippines can provide is still on an upward trajectory and likely to remains this way for several years to come, despite the hype that screams otherwise.

3) Offshore capability has often moved in tandem with the globalization of the revenue for an enterprise. Part of the offshoring movement over the last twenty+ years has been in support of the increasing globalization of enterprises in their pursuit of the next Dollar, Euro, Peso, Yen or Yuan. Shared services delivery capability has often been co-located with manufacturing, distribution or sales facilities whether in Latin America, Asia, Central Europe or Africa. As global revenues have risen and more complex operating models for tax management have emerged in the last several years, there is little incentive to pull back from offshored business process or IT delivery when the rest of the business is staying put.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Finance and Accounting, Global Business Services, HfS Surveys: State of Outsourcing 2014, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, IT Outsourcing / IT Services, Procurement and Supply Chain, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, Security and Risk, Sourcing Best Practises, Sourcing Locations, sourcing-change, Talent in Sourcing, the-industry-speaks

As the post says, “Offshore delivery will impact the rollout of the disruptive technologies, such as robotic process automation and SaaS”… At VO we are already seeing smart implementations leveraging the best of both these approaches – not just choosing EITHER ‘offshore’ OR robotic process automation.

Love this post, Phil. Very surprised how much offshoring is increasing – why do you think so many buyers are going back to their own captive strategies?

Joanne

@Matt – it’s not an “either, or” – you are correct. However, immature buyers in earlier stages of offshoring are less inclined to evaluate advanced methods to achieve new productivity, such as robotics, until their offshore processes are in a steady state and ready for some further improvement. For example, many insurance firms are very experienced at offshoring and are investigating the potential of robotics across their process chains,

PF

@Joanne – two main reasons:

1) It’s simply easier for ops leaders to invest in their own offshore shared services than pursue outsourced options;

2) Many buyers are using their shared services to add higher value processes, such as FP&A and compliance, which they do not feel comfortable outsourcing at present.

Also consider that 90% of the FORTUNE 1000 have shared services – 1 in 4 are investing significantly in them at present, which we will reveal shortly,

PF

Not sure if it merits a separate mention but there is a trend (apparently no longer small) in the Engineering, Research and Product (technology) development services in the visible growth of captive or shared or outsourced design and engineering centers in Industrial, aero and automotive sectors. Partly in context with the globalization of business point and also due to regulation, compliance and localization needs.

One great characteristic of a successful Shared Service Organisation is the growth in scope beyond the original business case – essentially expanding your share of work/wallet with your clients is a clear sign you are delivering value. In addition to the ‘push’ from the client, captive local and near-shore operations should be standardising activities to make them suitable to move to the lowest cost location/provider. While there are some companies pulling activities back on-shore, I believe this is just the pendulum swinging back from one extreme to the other in an attempt to correct a poor strategy/design. All large enterprises need to develop hybrid strategies – insource/outsource, near-shore, off-shore to get the right balance of service, efficiency and control.

Kirk Wilkenson

@manish – indeed – we are covering this space in depth and have a Blueprint report out soon. very excited for the development of globalized engineering services in particular. Strong captive focus from several firms…

PF

Interesting validation of the increasing trend in offshoring across business and IT functions.

A side comment : negative trend could mean a decline from the previous year due to service quality/market trends/business climate or could also be that with a surge in the previous year/s possibly there is not much left to further increase the pace to offshore. Aside of this, in case of IT services (Application Maintenance, IT Infrastructure etc.) clearly CFOs are calling the shots to push more to gain cost efficiencies from offshore and letting their CIO colleagues figure out best ways to ensure quality of service to business is not impacted. While offshoring can bring (and does bring for many) improved process maturity, innovation etc., the first driver is cost efficiency in almost all cases.

An interesting trend that is peeping ahead is that automation/robotics are seeping into enterprise IT not through investment directly from businesses but from offshore service providers. As the offshore fields continue to be engulfed in dust with the competitive forces kicking in amongst service providers, many are now looking at bringing in automation as a differentiator and also to reduce their cost of operations. In fixed price deals which are increasing (against T&M contracts) these providers are more competitive and are able to insulate themselves from vagaries of increasing labor costs, staff turnover, currency fluctuation etc which otherwise contribute to unhappy clients or fewer clients. The thrust is more from larger players because:

a. they can afford investment in automation technologies directly or through partnerships

b. these are dearer to them for survival than smaller players who can still push their lower cost of operations due to lower overheads

c. they understand that these are long term investments in competing globally in future and have a more robust roadmap

Notwithstanding all this, enterprises stand a better chance to gain, leverage and ride on these trends and engage better with their service providers in a win-win partnership with a better understanding of the dynamics at offshore based service providers and their cultural context. Much like surfing : know the waves and surf-on, else you will keep wondering how to be on top and have your head not just above water but above your shoulders.

[…] more about platforms with distinctive, value-add services, most of today’s buyers are still focused on global scale with their global sourcing strategies and that is where the bulk of the money is – and will […]

Phil – I think its important to note here what we are seeing in the Talent Acquisition Services Blueprint report research underway: some global companies are starting to support the business in decision-making around how work gets done and are not talking in terms of on-shore, off-shore, or outsourcing any more.

I spoke with a global manufacturing firm HR leader today that told me when a hiring manager comes to his group with an approved business need for a headcount, he says “OK for that budget you can have a 1 full time hire in the US or 2 full time workers in our center in Mexico, you choose.” He noted the latter is a popular option but it’s also changing how the firm supports managers and the global extended workforce in terms of benefits, training, travel, etc.

Of note, this company was an early “offshorer” and had not so good HRO transitions but now has this workforce strategy and planning capability because of these early experiences. In speaking with other buyers of Talent Acquisition Services, this is the direction they all want to be going in and are looking to third-party specialists to partner with on the journey.

[…] from their internal business units into an integrated centralized services delivery model. As our previous post from the 2014 study emphasized, close to 3-out-of-10 enterprises are increasing the offshore […]

[…] from their internal business units into an integrated centralized services delivery model. As our previous post from the 2014 study emphasized, close to 3-out-of-10 enterprises are increasing the offshore […]

[…] from their internal business units into an integrated centralized services delivery model. As our previous post from the 2014 study emphasized, close to 3-out-of-10 enterprises are increasing the offshore […]

[…] organization form any decision-making authority. With the concerted move to increase investments in offshoring, shared services and outsourcing, not having an empowered senior corporate officer responsible for […]

[…] organization form any decision-making authority. With the concerted move to increase investments in offshoring, shared services and outsourcing, not having an empowered senior corporate officer responsible for […]

[…] (Cross-posted @ Horses for Sources) […]