DXC Technology’s latest play is to bring Raul Fernandez off the bench as the new interim chief and move on from a difficult four years under Mike Salvino, who’s passing the torch. But when you look at the challenges facing this firm, you might just come to the conclusion that not even God can turn this one around.

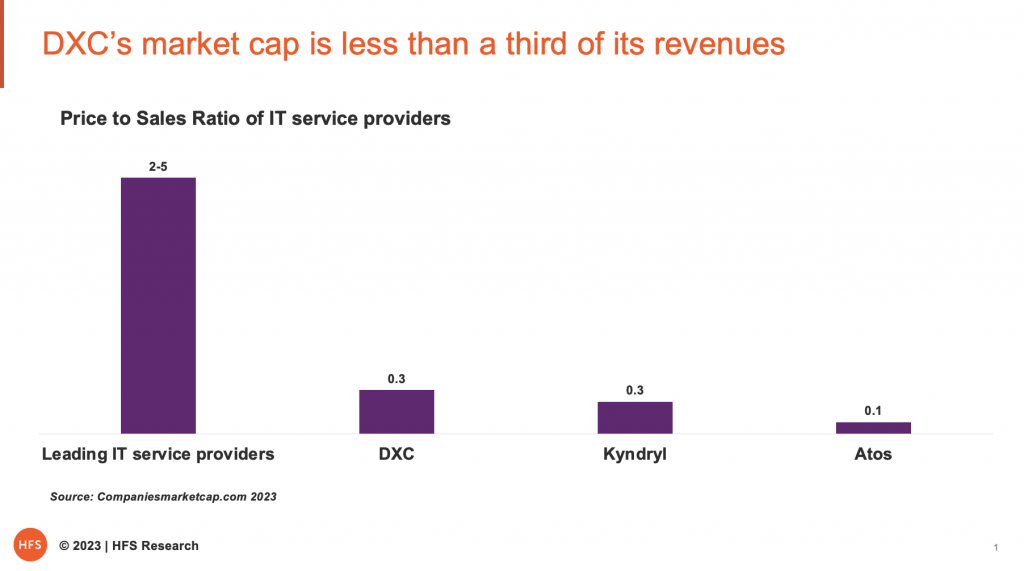

Let’s not kid ourselves; this isn’t your usual passing of the baton – it’s more like handing off a ticking time bomb. The company’s market value is literally running on fumes at barely a third of its revenue numbers. And that’s not just a hiccup – it’s a full-blown identity crisis:

Let’s not forget our trip down memory lane from four years back, where we laid out the gauntlet of challenges and opportunities for DXC (remember this blog?).

So, where did Mike Salvino go wrong?

DXC made zero acquisitions under Salvino and gave all their money back to stakeholders to prop up the share price. He could have made acquisitions to bolster strengths in growth areas such as cloud migration, AWS services, analytics, Azure, etc., or double down on industries where DXC could have real differentiation, such as insurance, private healthcare, energy, and manufacturing. The Luxoft analytics business had real potential, and little was done to build on the firm’s insurance software and IP.

Sold a lot of pieces but didn’t build new capability fast enough. For example, its US State and Local Health and Human Services Business (Medicaid) was sold to Veritas Capital for $5 Billion, but that money was never reinvested.

Stabilizing delivery on infrastructure doesn’t mean people will buy transformation. Just look at the similar price-to-sales ratio to Kyndryl, another firm struggling to sell transformational services tied to its commodity infrastructure business.

Very limited diversity on the leadership team. DXC’s leadership is almost all US men… diversity wins deals, and many enterprises want to work with firms with a strong gender and cultural mix.

Very limited stability on his leadership team. Salvino hired and fired at least 15 senior leaders and churned through 3 CFOs in 4 years, one of whom publicly sold off his stock.

What challenges face Raul Fernandez?

Fight back in a cut-throat market. We’re in an IT services market that is suffering from flat to negative growth, and even the most successful IT service providers are reporting low single-digit growth at best (Accenture reported barely 3% growth yesterday). What Hail Mary can Fernandez conjure up to convince enterprise leaders to take a bet on this train wreck of a company? When you have aggressive outsourcing juggernauts, such as Accenture and TCS, to contend with, where can you realistically play when you’re this far behind?

Find some way to survive the GenAI revolution. Then there’s GenAI, the Chicxulub meteor that will result in wiping out the dinosaurs in the IT services industry. Will DXC dodge this extinction-level event, or will they be left behind like the dinosaurs? With Fernandez at the helm, it’s do-or-die time, and we are watching closely to see if DXC can pull a phoenix and rise from the ashes.

Find a raison d’être for DXC to reinvent itself. DXC has not been able to create a true brand association and find its mission. Financial restructuring to bring it back to life is also going to be hard. It has not even been able to find a buyer for its BPO business that it has wanted to divest for several years now. Simply put, there is no strategy, and investors have little confidence left in the firm. Maybe Fernandez will find a transformation acquisition or two to redefine exactly what DXC is and create a path forward to long-term survival.

The Bottom-line: Raul may not be God, but he needs to find a saviour

Raul Fernandez is only interim chief, so his task is most likely to search drastically for a path to salvation for the firm and install a dynamic leader to take them there. This may be the toughest tech CEO turnaround task since Steve Jobs returned as interim Apple CEO in 1997, faced with the task of making Apple profitable again after losing over $1bn in 1996. How did he do it?

1) Rebuilding the core products and value,

2) Prioritizing the customer experience,

3) Collaborating with rivals, and

4) Reinventing the company culture.

Perhaps these four areas are the best guide to follow…

Posted in : Artificial Intelligence, BFSI, Business Process Outsourcing (BPO), Cloud Computing, Customer Experience, GenAI, Generative Enterprise