I want the best SaaS platform, some great BPO and a bunch of data scientists…

When it comes to outsourcing, dealing with the middle-market has been somewhat akin to dealing with the mother-in-law: can be awkward to deal with, very hard to please, and always has complex demands on your patience and resources. However hard you try, defining and delivering a solution that can deliver the outcomes you both want seems like the impossible nirvana.

However, as the wise ones among us have now discovered, winning over the mother-in-law goes a whole long way to achieving future happiness. What’s more, those of you who have avoided addressing the mother-in-law’s demands will soon regret it…

However which was you look at it, many of today’s middle-market firms are going to be the F1000 of the future. What’s more, most are seeking technology and sourcing solutions that can drive nimbleness and cost-effectiveness, as they simply do not have the prodigious people and technology resources within their IT, finance, HR, marketing and supply chain operations to manage their evolving needs. In fact, many of them can’t afford the top talent to run their operations, and those providers which can deliver it are already in high-demand.

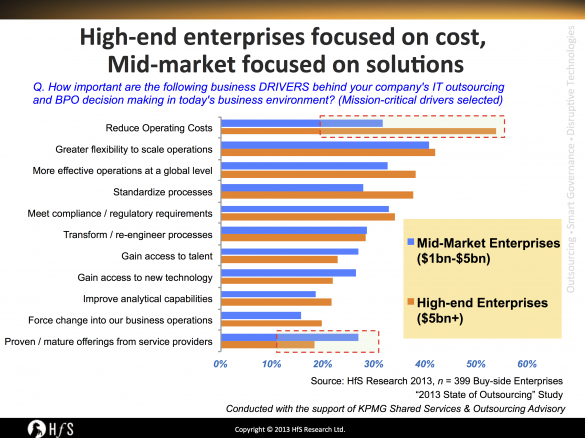

Let’s examine what 399 enterprises had to say about their mission-critical objectives driving both ITO/BPO decisions in today’s market. It’s already becoming abundantly clear that high-end businesses today, unlike their mid-market counterparts, are focused primarily on cost-reduction when outsourcing, as opposed to investing in new solutions and capabilities that providers could (and really should) bring to the table:

Why aren’t today’s providers winning over their mothers-in-law to grease the wheels for their future success?

So… if most the providers are promoting their wondrous capabilities in terms of talent, technology and analytical capability, why aren’t they targeting those clients who actually want those capabilities: the middle-market firms?

Providers are set up for high-end enterprise deals, not the mid-market. Sadly, most of today’s leading outsourcing providers are geared up for big, bloated enterprise deals, where the economics of labor arbitrage are simple, and selling cost-reduction is a much, much easier than selling business outcomes. What’s more, the providers themselves are not structured to sell aggressively to the mid-market – they tend to have limited sales talent and they want their A-team delivery teams concentrated on their A clients. When you talk to their sales heads, they’ll likely be able to tell you, pretty much, how the entire F1000 shapes up in their pipelines, but when it comes to the next few thousand firms, they’ll have little insight or visibility.

High-end buyers want to get smaller and drive out cost, not invest in new solutions. Moreover, the $10bn+ enterprises want to get rid of cost – they know they have hoards of talent, but their main motivation today is to get leaner and more flexible, to standardize processes and (if we are so bold to surmise) become smaller. Today’s enterprises want to grow their top lines, not their bottom-lines. This is why today’s outsourcing industry is so fixated on labor arbitrage, FTE-cost models and achieving basic operational success.

Middle-market solutions require business platforms, based on industrialized tech platforms and processes. We’ve talked about this for a few years now, but it’s taking an age to evolve. Where are the platform partnerships between the Netsuites, the Workdays, the SFDCs with the BPOs? Why haven’t we seen a “middle-market FAO solution” between a mid-market SaaS accounting provider and a leading F&A BPO provider? While there have been a few mutterings of hope, we are yet to see a single enterprise-scale SaaS/BPO platform engagement that we can write about.

The Bottom-line: The leading SaaS vendors don’t “get” BPO and the leading BPOs don’t want to invest in SaaS

Having spent the best part of my earlier career as an analyst studying apps and packaged software, before being subjected to the horrors of the BPO business, it’s as clear as daylight where enterprise solutions need to be focused – on the middle-market enterprises who want solutions that can be industrialized for the high-end enterprises of the future.

SaaS providers are blind to ADP’s success. However, one thing is very apparent – while SAP and Oracle quickly realized they needed to preserve their license revenue when clients signed BPO deals (both have practices dedicated purely to this cause), the likes of Workday, Salesforce.com and Microsoft Dynamics have shown little-to-no appetite to understand the opportunities a BPO channel can provide. Like, haven’t they noticed how ADP has become the world’s leading SaaS/BPO provider, with more then $10bn in annual income?

IT-BPO providers only looking to invest in niche tuck-in areas. Sadly, too many buyers are too focused on their quarterly balance sheets to focus really long-term on their operations; their operations heads are focused on preserving their empires with a few snips here and there to the operating budget. In addition, providers are also focused on their quarterly balance sheets and find it so much easier to pander to the needs of today’s F1000… not tomorrow’s. While we’ve seen a few niche acquisitions where providers are adding platform capability in process niches, such as Accenture/Octagon, Genpact/Jawood, Capgemini/VWA and Infosys/McCamish, we’re yet to see any of them really attack the mid-market with horizontal solutions that can infiltrate thousands of organizations, such as in Finance, HR and CRM.

This train is leaving the station soon… but who is going to jump on? As the existing high-end business opportunities slowly shrivel up, the new logos are springing up in the mid-tier. The winners of today will only be the winners of tomorrow of they can truly invest and build the solutions today’s mothers-in-law are craving. Those who have ignored the mothers-in-law are already in trouble… Hope springs eternal 🙂

Posted in : Business Process Outsourcing (BPO), Cloud Computing, CRM and Marketing, Finance and Accounting, HfS Surveys: State of the Outsourcing 2013, HfSResearch.com Homepage, HR Outsourcing, IT Outsourcing / IT Services, kpo-analytics, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, Talent in Sourcing, the-industry-speaks

Phil Fersht at his brilliant best!

You’ve nailed this completely and utterly. No-one invests in the mid-market companies of the future, it’s all about grabbing the remnants of the bloated legacy enterprise business.

Well done,

Andrew

Timely article. The opportunity to play with big guys is encouraging the smaller vendors to pursue the midmarket opportunity.

Thanks for the info.

Ramu Ramalingam

I work with Mid-Market companies at ADP and have a Mother-in-Law too so I totally related to this article. Mid-Market companies are after proven, trusted patners and peace of mind to adapt to change, retain and attract talent and to grow and be competitive, Mother-in-laws are also after the peace of mind of a trusted son-in-law.

Thanks 🙂

Nathan Gazzard

The observations are accurate. To peel the onion a layer further, it’s perhaps a good question to ask – well, why don’t BPOs want to invest? Almost all have the cash to do it. The pursuit cost of winning an F1000 client is close to that of winning a mid market client and the per client value will be lower. Second, the shared services resources + technology standardization needed implies a lower ROI till scale is achieved with multiple clients – for multiple clients loop back to reason 1.

One can argue that large deals are reducing so this is about looking forward to the next source of revenue. To end on a lighter mother in law note – and this is perhaps for those who haven’t quite figured their MILs out – what’s the definition of a dilemma? It’s watching your mother in law going over a cliff in your brand new car.

I completely agree…. mid market companies would sooner move to platfom bpo while its going to be difficult for elephants to manage their mainframe systems. Big elephants will have to learn from the mid market players and sooner or later follow the simple and agile practices implemented by mid market players

Great insight. Mid Market clients have similar business challenges as larger organization – view of global workforce, managing the total compensation spend, aligning & prioritizing initiatives, talent, and reward… Yet they do not have the capital to maintain legacy systems.

As to your inquiry about where are the “partnerships” between Workday to support mid-market clients seeking modern technology, Onesource Virtual (OSV) is that. OSV is a distributor of Workday to mid market clients. In addition to distribution of Workday to mid-market clients (less than 1k employees), OSV provides “cloud-sourcing” which is performing traditional service bureau administrative services and support to clients in a SAAS based model. Larger clients using Workday can also subscribe to these services as well.

@Bob – thanks for contributing, and I am aware of your Workday partnership and would like to learn more (I actually sent a note to Kevin Hautzinger for a briefing, if you can give him a nudge). I see a whole cottage industry growing up, based on companies like yours’ and Appirio’s, who are willing to take on mid-market clients. However, 150 clients in the mid-market is only a drop in the ocean…

One question I do have is around how WDAY prices for the mid-market – do you feel they have as much focus to build their presence in this space as they do the high-end?

PF

Sir,

Your choice of mataphor of a mother-in-law’ in your article is rather unfortunate. Maybe you have assumed that your target audience is all male perhaps? It may indeed become so.

Shabira Jaffer

Bob makes some excellent points!

Though servicing the mid-market may seem like an “impossible nirvana,” check out our blog on how OneSource Virtual focuses specifically on the mid-market for the deployment and delivery of HCM solutions.

http://www.onesourcevirtual.com/blog/january-2013/are-you-a-bargain-shopper

Also, follow us on Twitter (@OneSourceV) as we frequently post information about our benefits to the mid-market.

@shabira: I am taking the assumption that married women have mothers-in-law too 🙂

Touche!

As long as I see the male version of this metaphor used in the near future, and that is not a father-in-law! You’ll have to pick one as prevalent as the mother-in-law metaphor and I will concede. Looking forward to your choice.

@shabira: Fathers-in-law are for companies where the provider will never be good enough…

Hi Phil,

I have for long been a strong proponent of a platform based solution offering but even then, when I review the graph that you have shared can not come to a conclusion that this is something that Mid Market corporations are moving towards.

My understanding from the graph is that except for focus of large enterprises to lower cost; in nearly every other area the expectation is not too different from service providers between large and mid cap corporations.

In fact if we look at some of the acquisitions that you have highlighted it would be interesting to delve deeper into the reason of these acquisitions. If we look at the strategy adopted by Igate which largely targets Fortune 500 clients it has for long focused on outcome based pricing.

Mrinal Singh

Web Presence

http://about.me/mrinal.singh

Fantastic! Phil is spot on…yet again

[…] Full Article […]