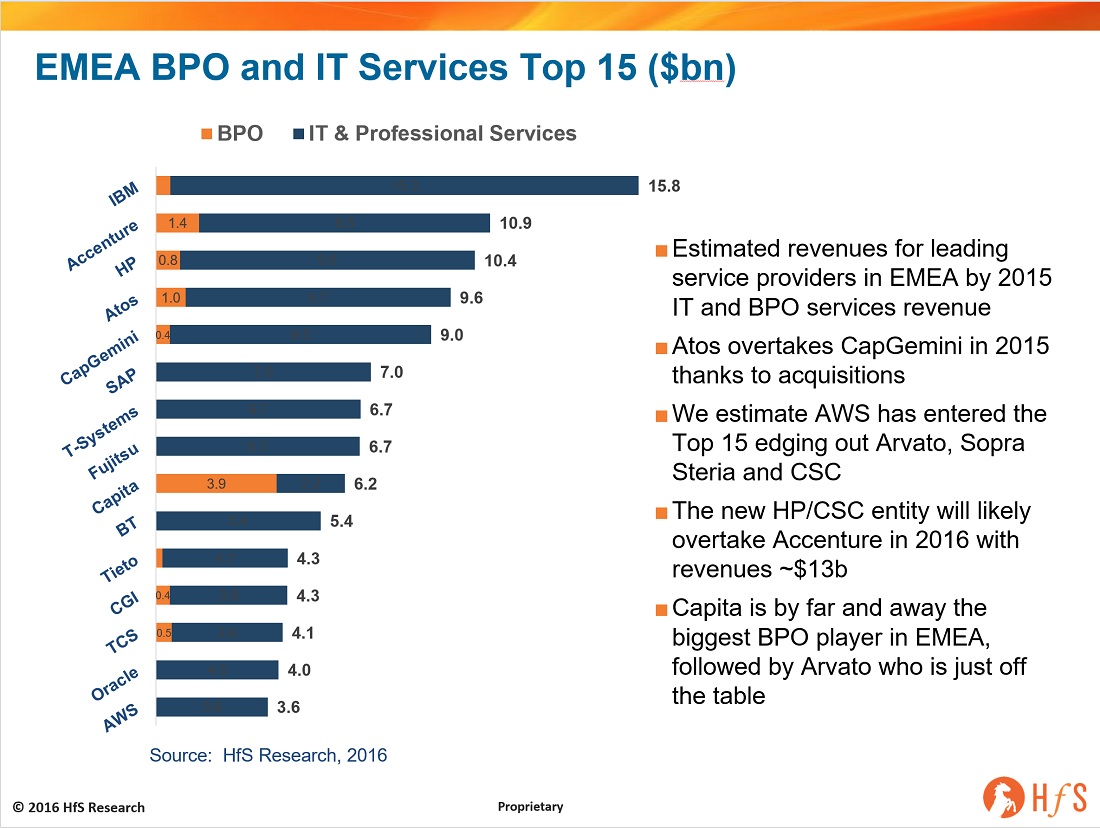

The Global majors: IBM, Accenture, and HP, still dominate the top of the list

These top 3 service providers are likely to remain in place in 2016, unless Atos and Capgemini can pull some more rabbits out of the hat, with additional acquisitions – this time focused on the EMEA market. This is not such a big leap of imagination, given the length of these firms’ recent acquisition trails. However, it is likely that HP (or whatever it becomes) will overtake Accenture when it adds in CSC’s and, let’s not forget, Xchanging’s revenues over the course of the next year. Although, given IBM and HP’s recent weak growth performance, we expect Accenture to be the fastest growing of the top 3 over the next year, particularly given its recent strong financial performance, most notably last quarter’s double-digit growth, and its broader set of digital capabilities, beyond bread-and butter IT apps and infrastructure.

Atos and Capgemini remain close in revenue terms in Europe, and both firms seem to share similar sets of challenges and goals, albeit from slightly different perspectives – both are focusing management effort on growth in the US. Atos is bearing down and trying to solidify its position in the infrastructure management space, with software defined datacentre led approach. Capgemini is building on its broad consulting skills by building out specific industry capabilities and leveraging its IGATE assets. Simply put,both are vying to be their customers’ guide to the digital promised land, but taking different routes to take them there. Both firms show strong growth in the first half of 2016 (Capgemini 15.6% and Atos at 17.9% constant currency) as they continue to integrate the finances of the recent acquisitions. Additionally, the providers grew organically, 1.9% for Atos and 3.3% for Capgemini.

Capita consistently remains the biggest BPO player in EMEA, although most of its revenues are from the UK and Ireland markets (we estimate >95% revenue). Recent half-year financials showed a 5% growth, over its 7% growth in 2015. Over the last couple of years, Capita has started to focus on expansion into Europe, with the acquisition of Avocis at the start of 2015 – its biggest commitment to this strategy so far. With the emergence of the competitive Genpact as a serious contender for European BPO deals, Capita is being forced to broaden beyond the English-speaking customer base to avoid losing further market share. Brexit has not dampened its enthusiasm for the expansion. Management comments regarding Brexit echoed those made by TCS and Infosys, some potential short-term uncertainty, but likely medium term gains and we all gain clarity of what’s in store.

There is a stark contrast between the EMEA provider list and the North American list (which we are publishing next week, so watch out for a blog). The EMEA list contains far fewer offshore-centric firms, which still depend on English-speaking centric services for the lion’s share of their business. Both Cognizant and TCS are top 5 players in the North American market, but in EMEA only TCS has managed to claim a Top 15 spot. The UK list would feature most of the big five players, as well as a strong showing from TechMahindra. Although there has been some emerging success outside of the UK for all of the other offshore firms, TCS has been the only one to gain genuine scale, thanks to its focus on localisation and more entrepreneurial approach to expansion. Although, all of the firms have had some success in the Nordics, most notably HCL with its huge Volvo and Nokia wins, but TCS has been the only offshore firm to generate significant traction in continental Europe.

Bottom Line: Europe is still a battleground for the Traditional Service Providers, but expect their Indian-centric counterparts to become more prominent as global markets consolidate

The EMEA market is still a hugely important market for all of the Global services firms, and there are plenty of opportunities given its non-homogeneous nature. The reality of the matter is simply that EMEA is not one market. Indeed, the European Union is not one market – look at the relative success of the offshore providers, outside of the UK and the Nordics. The differing national markets all have a distinct character and require different capabilities from their service provider organizations, such as local regulatory, compliance, data privacy, labour laws and accounting expertise. Many of the individual European countries have specific laws governing where data resides and whether processes can be executed outside of said country. This is especially evident when you look at smaller scale clients, which need specific attention the large providers simply cannot scale down to support profitably. So as experience in Europe increases we expect to see the other offshore providers, in addition to TCS, scale up across the continent, especially as the English-speaking markets becoming increasingly overheated for commodity IT and BPO services. For the top 15 list itself, we expect a few changes further down the list, including with the entrance of SopraSteria or Arvato in addition to the boost to HP from CSC and Xchanging.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services