Barely more than a year since SAP made its bold move into the cloud with the very expensive acquisition of Successfactors, does the hotshot visionary and symbol of the attempted “new look SAP” leave the firm… Lars Dalgaard.

Lars Dalgaard… sporting a fine red tie to an SAP event

Anyone who has met Lars over the last decade has been drawn to his incredible passion and vision for the future of enterprise software with the shifting sands away from legacy on-premise software and expensive lock-in licenses.

Lars joining SAP was the acid test as to whether old-world ERP vendors could find a rapid path into the shiny new world of cloud and multitenant delivery models for enabling global business operations. He was a true visionary who had almost single-handedly taken on the legacy enterprise software firms, building up Successfactors from nothing to something, that would entice SAP to part with $3.4 billion to take it out.

The stark reality is there’s just so much vested in today’s legacy enterprise model

Lars leaving so quickly symbolizes SAP’s struggle, in my mind, to change its culture and approach to disruptive business models. The economics of the cloud cannot print anywhere near as much money for our German friends as the current legacy ecosystem of clunky enterprises, whose IT managers simply do not want to invite change or disruption. If your clients don’t want to change, why should you?

Net-net, SAP has created a nice cosy industry around itself that has created, literally, millions of careers. What are all these developers and project managers going to do if companies suddenly had single instances of SAP available in the cloud? What are many of the service providers going to do if they can’t earn tens of billions trying to stitch all this stuff together? And what would SAP do if it can’t command such incredible revenues from its consulting, services and multiple-license revenues?

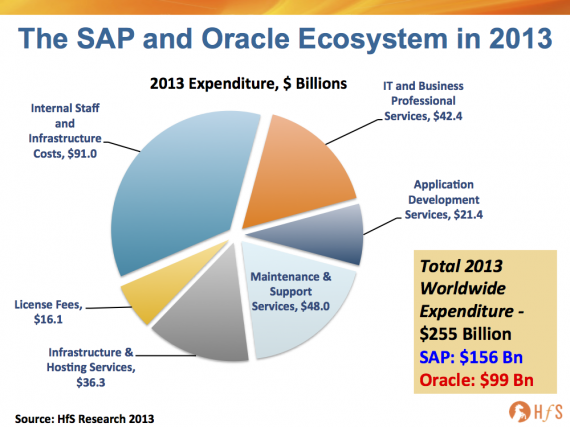

The startling truth is that there is a $255 billion industry (Source, HfS Research) that feeds off this ERP chaos and dysfunction centered around both SAP and Oracle, and and estimated $156 billion of this is purely the annual cost of keeping enterprises’ SAP worlds ticking over in 2013; the external services, the licenses, the hosting, the internal staff to maintain and develop the software etc.

Why do you think these little upstarts, such as Successfactors, Workday, Netsuite and SFDC command up to 40 times their annual sales income in valuation? Because they threaten the status quo of a much, much larger industry that is scared stiff of being blown out of the water by disruptive technology:

While the decrepit old enterprises stick to their legacy IT infrastructures, the evolving mid-market firms are breaking the mold

I recently spoke to a senior executive at a legacy software vendor stuck in multi-instance and fake-cloud land, who confided “we’re purely in the protection business now. All the new logos are going into Workday. Fortunately our existing clients still spend enough to keep us solvent.”

This pretty much confirmed my viewpoint that it’s the small to middle-market organizations (under $5bn in revenues) seeking technology and sourcing solutions that can drive nimbleness and cost-effectiveness, as they simply do not have the people and technology resources within their IT, finance, HR, marketing and supply chain operations to manage their evolving needs. Moreover, many of these organizations are moving from prehistoric infrastructures to cloud-based ones… bypassing much of the painful inch-by-inch transformation where so many of today’s high-end enterprises are stuck.

As the existing high-end business opportunities slowly shrivel up, the new logo opportunities are springing up in the mid-tier, will the likes of SAP and Oracle be equipped to take them on, when compared with the evolving array of developing cloud solutions from the upstarts? Remember, many of these new mid-tier logos will make up a significant chunk of the F500 in the future… so clearly the failure to evolve to true cloud models is eventually going to come back and bite the incumbents. Surely they can’t keep spending billions and billions on new acquisitions to control them when they start to hurt their business?

The Bottom-line: The evolution to the cloud for firms likes SAP is simply way, way to slow for a guy like Lars

SAP’s enterprise customers, and many of the services giants which feed off the beast, are still many, many years from being forced to evolve, but one thing is clear… eventually they will be forced to comply. The big question is whether it’s still another 5, 10 or 15 years away…

Simply put, SAP was never a place for the likes of Lars… and won’t be for many years to come. There is no burning platform for SAP to really jump into the cloud just yet, and guys like Lars do not work in the slow-change business. When that burning platform does come, it will need people to change the mindset a lot more aggressively than they are prepared to in today’s market. Maybe then, they’ll wish they had a Lars to call on.

Let’s just hope, for SAP’s sake, he doesn’t pop up at one of these other cloudy upstarts anytime soon…

Posted in : Business Process Outsourcing (BPO), Cloud Computing, IT Outsourcing / IT Services, Outsourcing Heros, Social Networking, sourcing-change

Phil,

Epic piece and lazer sharp. Am sure many people in the “SAP ecosystem” will start sweating reading this,

Jim McNamara

Don’t hold back, Phil!

Very well researched. I never realized just how big the SAP beast had become,

Gaurav

Very well thought out – and startlingly true. Inertia is the real business, not the cloud.

I think it is pure speculation that any of the ERP statistics led to Lars resignation. While there is no doubt on the costly clunky ERP and how the world works aorund that, I do not see a connection between that and Lars leaving. As you mentioned SAP made a costly acqusition and SAP is agressively competing and pushing for cloud HR solutions. As far as the story goes, they gave a free hand to Lars to develop and enhance SF and Employee central in particular to make it competetable wth workday…. so not sure where Lars felt suffocted…..

@Raj – fair comments. To be honest, I didn’t want to speculate on the exact reasons Lars left… I just wanted to make the point that culturally and politically this was never meant to be. I also reacting to comments from SAP staff very sad to see him go – he was a real inspiration to many. IMO the whole saga opens up a broader discussion… the pace of change, the inertia of big corporates and the lack of a burning “platform” that is driving business leaders to disrupt the current system.

PF

@Gaurav – it is very, very big… which makes you wonder how many years it will take for the current status quo to shift.

PF

@Jim – am sure they start sweating when Workday shows up for sales calls 🙂

[…] efforts. SAP is creating a single …At SAP, the Other Shoe DropsInformation Management (blog)$ 156 billion reasons why Lars and SAP were never meant to beHorses for SourcesTwin talents predict a clearer future for SAPThe […]

Excellent insight, focused many of the thoughts I had scattered in my head. 1- My clients show little or no desire or perceived need to move from the current platform to the cloud, this is in both the business and IT elements of the business. The few smaller, more core value focused clients have utilized cloud based tech wherever they can. They have little of no IT infrastructure either hardware, software, or human sand they are willing to accept that they are not so unique that they need custom processes translated into IT overhead. This is especially true for core non specialized back office processes. This faux uniqueness is still embraced by many larger organizations.

Always an admirer of the talents and perspectives of Phil and team, so why am I struggling somewhat with this piece.

Like many of you, I have a certain innate disdain for companies, industries, governments…that get too big and over time, lose sight of their true value, their original mission, and seek only to hold on to power, at any cost. So in this regard, I agree fully with the narrative.

That said, I am also a contrarian and skeptical of rebranded, ‘fake cloud’ concepts that ooze out of technologist, economist, and school kid’s mouths like so much pop candy, so often polluting our once interesting industry conversations and pursuits.

So why…am I still not convinced SAP/Oracle/ERP are on the wrong side of history? It may be Phil’s very point that there are too many full-spectrum economics, careers and legacies at stake, it may be increasingly valid security, proprietary IP concerns whether hackers, int/ext, gov (US/CH), competitors, it may be performance, it maybe a cynical view, possibly correct, that depreciation calculations v. lifespans of companies relative to frequency of ‘new’ tech waves…says, dig in, it may be many things.

So I ask myself…why must there be only one right way?

@Miles – you are SO right to struggle with this. SAP/Oracle and others are not consciously creating strategies to preserve crappy, dysfunctional, backward infrastructures. They truly want to be the cool kids and invest billions in cools companies to show they still are the game-changers and innovators (Taleo, Ariba, Successfactors etc).

In fact, this was probably the most depressing piece I have ever written and I didn’t feel a whole lotta pride in doing it. But it’s a stark description of the status quo so many of our enterprises are vehemently preserving… it’s the anti-innovation attitude of so many companies today which is holding us back.

Lars was a rare jewell who just said what he believed (and could sell his vision). Having him inside of the likes of SAP gave corporate revolutionists like me some hope… now who is left to guide the way? I need heroes!

PF

Phil,

Loved this blog – you encapsulated a whole industry in a very stylish way. You also said what had to be said – I agree it’s not pleasant, but nothing will change if we all keep sweeping this inertia and unwillingness to innovate under the carpet,

Eric

Great Article Phil,

I really liked how you summarized a key point that a lot of us in sales have been feeling deeply. No decision has been the winner of over 50% of deals lately and that the customers are the ones who are resisting the shift to cloud. I’m convinced the first leader of these F500 of today that starts to act boldly in their decision making will reap massive rewards against their peers and competitors alike. I think every business leader today needs to read the book Flip by Peter Shehan, who founded one of the world’s most successful consulting firms. He evangelizes the idea to act despite ambiguity and he proves out time and time again that doing so allows you to break away from the pack and define new and exciting market segments. Innovation only works when it’s a big shift coupled with easy to use, easy to adopt products.

Now, on the flip side, SAP is a giant company that is aggressively trying to change it’s corporate culture; but let’s not forget, they weren’t the same company they were 5 years ago let alone last year. They only have so many resources to change so much and I think they are doing a fantastic job addressing the mid-markets desire to have better and complete cloud solutions. Take a look at their cloud solutions recently announced at Sapphire – basically their entire foundation stack with HANA as the open platform for app development. http://www54.sap.com/pc/tech/cloud/software/overview/index.html

Another key thing to remember is Lars is still part of the Board of advisors to SAP and SAP has kept on Bob Calderoni (CEO of Ariba) which was a more valuable acquisition than SuccessFactors. From an innovation, Ariba takes cloud to the next level by leveraging social at it’s core to build out a commerce network. Bob has done a fantastic job not only ensure Ariba reaches impressive top-line growth figures but has managed to do what has been thought impossible for cloud companies and ensure strong bottom line growth as well.

Bob now heads up cloud solutions for SAP and with Lars helping them on the development front, their vision is set and they are moving faster than ever. Now all that is needed is for SAP to continue on it’s existing path and they should be fine as long as they adopt a culture internally of constant and rapid innovation.

@john – you are a credit to your employer 🙂

I would love to hear more about the future plans for SAP to attack the middle market with single-instance multitenant business applications in core ERP areas such as HR and finance.

The fact that this was announced on the Friday of Memorial Day Weekend in the US, traditionally referred to as “take out the trash day” in the media business – translation: Bury the headline, minimize it’s impact on a slow news cycle, to me, speaks volumes to the fact that everyone knew this was bad news. Curious timing indeed.

Pure and simple – Workday is changing the game for ERP providers.

If someone gave you hundreds of millions of dollars, maybe even billions, for your company, would you stick around and work for the conglomerate (beyond the contractual obligations of the purchase)? Don’t pre-suppose a cultural divide or a managerial dispute. Occam’s Razor suggests that he took his millions/billions and left to go enjoy life while he’s young enough to do so.

@Anonymous – I’d be amazed if Lars takes a back seat… not his DNA

The problem is not always “moving to cloud.” It’s the business application itself and how the company will use it, including the internal people, processes and “vision.” If it is a software application that replaces a current one, and makes things better, cheaper, faster, ect…then fine. Cloud is good. If it’s a system like Successfactors, where many companies are deficient in those processes that it manages (strategic HR), and dont know where to start, the Cloud/OnPremise is irrelevant. So your talking about two issues facing cutting edge cloud products…can the company handle it??? and if so…then cloud is a technical discussion, that most companies are willing to have.

Interesting article and speculation. However some points could use a little clarification. SAP had and was continuing to make a sizable investment in Cloud applications prior to the acquisition of SuccessFactors. In fact, the technology behind a number of cloud applications including Financials, Sales, Travel, etc. is the same and is a result of SAP internal development. Therfore I would say that it is not fair to say that SAP purchased SuccessFactors so that it could develop its business and that the departure of Lars will have a negative impact on that development.

It is fair to say that the Cloud business model was not running efficiently enough and that the acquisition of SuccessFactors has had a positive impact on the delivery of cloud apps.

SAP is a major enterprise run by some very intelligent people. I am quite sure that they are aware of the market trends (Cloud) and want to be in a place to take advantage of them.

Look forward to seeing SAP as a major player in cloud.

@john – I am not trying to say SAP is not investing enough “in the Cloud” – I have been inundated with mails explaining how much/where/why etc. The crux of this blog is to lament the pace of evolution among SAP’s ERP clients that command the lion’s share of the firm’s business – and why it’s moving at a glacial speed… Lars simply is not a glacial guy 🙂

If you were working the toll booth at the New Jersey turnpike, would you welcome EZ pass with open arms? Cloud, multi-tenancy and single instance are simply not everyone’s best friend when it threatens so much disruptive change for so many.

PF

Looking at this from the client inertia perspective helps to reveal the brilliance of the SuccessFactors aquisition. IT doesn’t buy SuccessFactors; HR does. And, HR is tired of legacy systems, the “backend” end-user experiences, and the glacial pace of change from their own IT organizations. HR realizes keeping records and paying people are table stakes. They’re seeing real business value from apps liked LinkedIn with consumer-friendly UIs (and in some cases free).

I had this exact discussion five years ago with an executive from one of the big two. He tried to tell my that my relationship with my IT department was my problem. I assured him emphtically that my relationship with my IT department was *his* problem. Our next performance management implementation was in the cloud.

Maybe the business case isn’t as strong in some other areas – perhaps SCM or areas that are well established and not in the throws of radical change. But, the war for talent is real, and HR is the new IT. Cloud enables HR.

Hi, this is a thought provoking article with many excellent comments already posted.

However, there is one dimension which perhaps should also be noted : the simple market reality of a transition from upfront revenue ( with expected qtr on qtr growth ) to a recurring revenue model and, the market sentiment and associated shareholder impact. Would the market tolerate a dip in revenues AND profitability on the basis of uber-conversion of on-premise revenue to cloud subscription? I don’t think the market would be that forgiving regardless of how it was spun… companies whose DNA is based on disruption to an existing mass-model ( think the Indian offshore companies in the last decade as an example ) enjoy a period of unprecedented growth and market valuation because of precisely that – they are challenging the status-quo, are the ‘fathers’ of a new disruptive value proposition and the market bets on them. ( which as an aside mind you, in that example – they were also extremely profitable which cant be said of a lot of cloud players today ). Look at the valuations of those companies now that ‘everyone is an offshore capable company’ in that space… much more traditional PE ratios abound.. will those 40x ratios still be commanded in 10yrs time by those enjoying them today in the cloud space? by en large, probably unlikely.

Also, companies don’t just invest in on-premise blindly or without requisite benefits. One can argue as to the investment comparison associated with each delivery model, but lets not limit the analysis simply to on-premise vs cloud. There are many, many other factors in the solution that impact the decision at the customer end. its nice to fantasize about nefarious motives a la ‘banking industry’ of the last 5 years but i dont think these vendors really have as much sway as that sentiment would might infer to some.

Companies such as SAP have been genuine disruptors when they invented their core technology and solutions. Lets not forget this company in particular had its genesis 40 years ago.. hardly a spring chicken in IT industry terms, so perhaps some credit that their customers still drink the cool-aid, and happily so judging from their results

The complexity around that business, model, ecosystem can not simply be turned in 12 months. The rate of investment and acquisitions SAP has made in the last 5 years would seem to indicate they know they have to acquire that DNA and like a bone-marrow transfer, go through not an insignificant time of assimilation where the body rejects just as much as it adopts whats new. I am sure that someone like Lars knew that just as he was taking his $3+Bn ‘thank you very much’ payday. The only thing one would find truly remarkable is he had stayed on for the long term inside the company… that’s a bit like the graduate marrying Mrs Jones and living happily ever after with 2.5 kids in toe…. 2 things are pretty much as certain as death and taxes in an acquisition: 1) the acquiring company culture always trumps the ‘acquired’s’ and 2) very seldom will you find Founders sticking around post earn-out fling…. it just simply goes against their nature, Mrs Jones…

A great sales executive told me that if I failed in my job it was his fault. He either hired the wrong person or failed to support me. (I worked very hard to keep HIM from failing).

SAP overpaid for SFSF by billions which still sits on the books as Goodwill. They justified the extra money by saying they were getting Lars Dalgaard’s “leadership”. If they can’t justify that number, they need to take a write down like HP did with Autonomy. All of these people who are now saying they are not surprised by his leaving were very quiet when Lars was supposed to be a Pitbull, or the Norse God Thor wielding his mighty hammer at SAP. Did they make a mistake getting Lars or supporting Lars? Either way, it is a failure.

Also, several articles list Dalgaard as the Filthy rich of 2011 at $1.9 Billion. Divide that by $40/share …did he own 47.5 million shares? Forbes does not have him on any list.

So it must be family issues. Stepping down to focus on family. Wait…no.

I agree with the main point of this article that there is a lot invested in on prem and protecting it’s big margins. SAP had to make a big splash with Cloud because of Workday and SFDC. They just over-hyped Lars Dalgaard. They tried to make him a Larry Ellison with Heart. They failed.

http://www.forbes.com/forbes/2012/0213/technology-lars-dalgaard-hr-software-sap-gets-pit-bull.html

http://www.eaconsult.com/2012/05/22/sap-energizes-its-cloud-strategy-%E2%80%93-the-lars-dalgaard-era-begins/

http://www.inc.com/ss/eric-markowitz/entrepreneurs-got-filthy-rich-2011#13

Very interesting, well written article.

I can’t speak to why Lars left SAP, but SAP is definitely not getting cozy and idly counting the billions from their ERP maintenance streams. Virtually all of SAP’s focus (marketing, acquisitions, etc.) is on Big Data, Mobility, and the Cloud. They see very clearly that the market is shifting away from big ERP. McDermott is always looking for double digit growth and he won’t get it from the traditional SAP bread and butter… The question I have, is SAP making the right moves now to set them up for continued growth over the next 10 years?

@Bern – of course all the marketing hype and new investments need to be about cloud-based product – what else is there to hype about and invest in? I am just looking at the reality of their business, which is thriving off of an age-old ecosystem that sees the cloud as a major threat to its cozy, inert world. What will get me excited is when SAP (and others) start bringing these legacy clients onto single instance, multitenant ERP product, such as HR/financials etc paid for by subscriptions, not 1-1 licences. PF

Phil, I think we are in violent agreement on much of what you say. However, I have found that that the ecosystem that supports the traditional, SAP on-premise solution is struggling this year. New, large ERP projects are on a sharp decline (I assume to your delight). If you are not doing HANA or Mobility, you’ve likely got resources on the bench. So, the market is shifting thanks to pioneers like Lars, and only the ecosystem partners that shift with it will thrive. SAP is attempting to shift with the market as well. But it will take time because (as you point out above @John), many of it’s core customers are moving at glacial speed.

Legacy baggage will ultimately sink many/most. Enterprise software follows legacy ITO.

SAP cloudifying its ERP is like Exxon or BP investing in electric cars.

As always excellent and provocative writing from HfS. You are my favorite newsletter!!

However, as the CEO of a Zalaris – a – SAP BPO provider in the HRO space (and SuccessFactors partner) I disagree with your view on the rate of change by SAP. Personally, I have never seen any company large or small that have so radically embraced the cloud business model and adapted to market trends as SAP has over the last five years. This is the Mammut dancing.

Phil – while the numbers you present speak for themselves, there is a personal factor – Lars is a father too – which IMO was the deciding factor.

@Hans-Petter – thanks for the kind words. It is certainly very encouraging to hear these experiences from SAP partners. The kernel of this piece is really to highlight that SAP’s customers and “ecosystem” are the real inert entities in this whole equation. I pose the question why would you expect SAP to move that fast when you look at the $156 bn environment it has indirectly and directly created over the last 20 years.

Personally, I see genuinely encouraging developments happening with the likes of HANA and how SAP has embraced the Successfactors business and kept its pricing competitive. As an enterprise business process analyst, my main focus is on the core ERP and how fast that is evolving. It’s taking a generation to move enterprise-level finance and HR to the cloud 🙂

I do believe if the likes of Workday and Netsuite can stay independent long enough, they will eventually drive away much of this inertia in the “upper middle” market, which will surely creep into the enterprise domain eventually. Just look at how ADP has infiltrated high-end enterprise accounts in barely the last six years. The same has to happen in other processes, beyond payroll, that are also screaming for standardization, such as general accounting, reporting etc.

PF

HfS team,

It’s these kind of insights and revalations that make you analyst of the year, Y-O-Y.

One of the very little e-mails from analysts that don’t swiftly end up gettng the ‘hit Delete’ treatment, the HfS one.

Best,

Rudi

Great article.

Just having returned from a Plex Systems ERP user conference, one can feel the excitement and commitment by customers of the path they have chosen in the multi-tenant cloud. The implementation time frames, reduced cost of operating the solution and speed of innovation challenges the notion that enterprise employees eschew change and don’t appreciate a new way. And Plex, as the pioneering player in the enterprise market has, through their Continuous Deployment model, a performance model that should be the envy on all those social and web kids!

Having talked to many customers of the NetSuite, Plex and other multi-tenant supply chain solutions, these folks have past experiences with long, expensive deployments and the ongoing challenges and disruptions big ERP upgrades. They are voting with their wallet–and we ain’t seen nothing yet. If we all agree that free cash flow/working capital/profit/margin is really important in this competitive world, the customers of multi-tenant cloud will win the cash and an innovation race over time compared to their on premise purchasing competitors.

Before you lock the door on the easy conclusion outlined above, please see the profile of Lars Dalgaard and the very significant personal challenges he’s faced over the past year in this week’s Fortune: http://money.cnn.com/2013/06/13/technology/lars-dalgaard-successfactors.pr.fortune/index.html?pw_log=in

There are a number of significant factors at play in this decision. Readers should beware of posts like this which use the event to draw conclusions that merely advance the writer’s personal interests.

@Jim – thanks for the link (for all you readers, Jim Deaver is a comms/PR rep for SAP).

There are no “personal interests” at stake here beyond creating a discussion around the SAP ecosystem and its inhabitants, based on some very solid data that I am sure is a genuine eye-opener for the tens-of-thousands of people who have read this post.

The departure of Lars merely poses more questions about the future direction of the firm when its best and brightest depart. I did not want to go into the personal issues facing Lars at all, but since you bring them up, it does make me wonder why he didn’t take a sabbatical, as opposed to leaving the firm.

One more point – Lars didn’t quit to take a year off with family – he took another job…

PF.

Jim Dever, why didn’t Lars work for the SAP VC group in Silicon Valley as Bloomberg questioned. How do you explain to your shareholders? Sorry about the $2 Billion but his kid got sick? Why did he run to another firm?

Here is the Bloomberg link.

http://www.bloomberg.com/video/andreessen-horowitz-said-to-hire-lars-dalgaard-S~vEjRMgTtmuuPBjlaNTUw.html

“SAP has a venture arm in Silicon Valley that they have been investing in very heavily. You would have thought that if Lars was particularly committed to the future of SAP , that would have been an interesting place for him to go. Instead, he’s gone to the hottest name on SandHill rd. “

As an update. Eric Markowitz of INC did remove the reference of Lars being a $1.9 Billionaire. Forbes had no record of him as a billionaire either. He is rich, but Forbes guessed under $15O million. Several other websites have done the same. Not sure why people refer to him as a billionaire. It seems a lot of things about Lars are wrong. The sale price of SFSF. $3,4 vs $3.6 vs $3.8? Is he the founder or did David Strohm of Graylock capital, a VC company, recruit him as CEO of their new venture?

The odd thing is: $150 million is a fortune, but it is no where near a billion, or the $1.9 billion that reporters said other reporters said he was worth.

Why do people care so much about Lars’ net worth? Like, seriously – who cares. What’s more interesting is his legacy and everything he did for SAP cloud before leaving. Thanks to his leadership and all the good people hired to do the job (and do it well), the company is running like a well oiled machine.

Note on 2nd to last sentence: “Maybe then, they’ll wish they had a Lars to call on.”

They do have Lars to call on. He’s an advisor. 🙂

Sophia, the real question is “Does Lars get the numbers wrong?” Specifically, does he inflate numbers to make them seem better? His twitter profile still says he sold SFSF for $3.6 billion. That is a $200 million dollar mistake. With the SEC investigating cloud companies, this is going to be very relevant.

Is Lars believable? After he sold the company to SAP, an analyst asked him about plans for integration. He said, “It’s already integrated, we have lots of companies using both solutions”. It is a moronic thing to say given the complexities around merging two technologies.

His greatest achievement is selling the company. He made his “believers” very rich.

This is his legacy. He was a frontman for rich VC investors. He was not even the founder.

He says “SemperFi” but he is not a Marine. Do you have any idea how sacred the Marines hold their motto?

So I ask you, what exactly did Lars do? He was recruited by David Strohm at Greylock to re-launch failed start-up companies. Then he raised $500 million dollars in investor capital. Did that money go to help clients? No, a big chunk of it went to buy out early investors.

Give me an example of something Lars did to make SAP better? Or an example of how he helped a client?

[…] Read the HFS article, “156 billion reasons why Lars and SAP were never meant to be“. […]

[…] Read the HFS article, “156 billion reasons why Lars and SAP were never meant to be“. […]

[…] their products so their clients can start to do away with some of those unnecessary jobs on-premise software provides. And what about that evil Workday, which only provides cloud-based software and enables its […]

[…] their products so their clients can start to do away with some of those unnecessary jobs on-premise software provides. And what about that evil Workday, which only provides cloud-based software and enables its […]

[…] But all of a sudden, noone really seems to care about protecting jobs anymore – if people are just performing “transactional” tasks, for chrissakes automate them quickly, or buy a SaaS platform to get rid of the unnecessary waste. Where are the demonstrators outside of SAP headquarters in Waldorf, or Oracle HQ in Redwood Shores as these firms desperately try to convince the world they are cloudifying their products so their clients can start to do away with some of those unnecessary jobs on-premise software provides. […]

Finally someone smart in response. Lars – I knew him – was a snake oil guy of the finest Stamford pedigree. BrillIant,simply brilliant to convince SAP to buy his crap. Anyone here ever tried to use SuccessFactors? Good luck other than one spot to cross i’s and dots t’s of HR admin BS. As a way to drive human performance…..don’t make me laugh. And now Concur for billions….the Empire will never let go. No innovation, just buy and hope for the best. Sad sad sad – RIP Cloud.