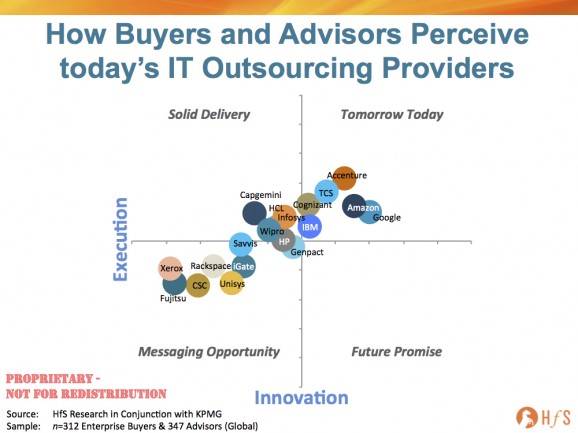

During the recent 2014 State of Outsourcing mega-study, conducted with the support of KPMG, we polled 312 enterprise outsourcing buyers and 347 outsourcing advisors on how they perceived each of the major 19 IT outsourcing services providers across our Execution and Innovation categories (click here for the full definitions). And the ultimate results might not be quite what you expect:

HfS’ Charles Sutherland, takes a deeper dive into these results, to understand better the reasons why these IT Outsourcers are being perceived this way:

With 50% of IT outsourcing deals at risk, how are IT Outsourcing providers being perceived?

The fact that Amazon and Google were the highest perceived ITO service providers on Innovation doesn’t come as a huge surprise, after all they are continually lauded for innovation in the press and don’t carry the breadth of “legacy” service offerings that the other ITO service providers do. However, they were also perceived as being at the top for Execution; in fact just 4 of the other 18 ITO service providers were perceived as well or better than they were for Execution capabilities.

What we also see, when we look at these results, is that the best Executors of IT Outsourcing services are generally also perceived as the most Innovative. It suggests to us that as 50% of enterprise IT Outsourcing buyers seek to churn their current IT service provider in the near future, many are also likely to seek out those positioned to the upper-right which can fulfill their higher-value needs, beyond the bread-and butter executional service delivery.

It also suggests that in the wake of greater market differentiation in IT services, both in capabilities and commercial performance, those providers lingering in the lower-left face some very significant commercial challenges over the next several years to remain competitively viable.

We broke the perception map out into 4 quadrants that have some common characteristics:

Messaging Opportunity. These are the ITO service providers which scored lower on the perception of execution and innovation relative to their peers. For these ITO service providers, the task ahead is to increase awareness of their capabilities and, in particular, to highlight investments in innovation for ITO service offerings and perhaps to break away from potential linkages in buyer minds to legacy ITO offerings, especially given the levels of potential market churn that the survey identified.

Solid Delivery. These ITO service providers were perceived as strong execution partners for buyers, but still being perceived as lower than the leaders on innovation, although they were seen as more innovative than the service providers in the first quadrant. This does not mean they are necessarily candidates for churn, although if their areas of execution become less significant going forward, that could spell future trouble.

Future Promise. Currently an empty quadrant, this area where perceptions of innovation out-strip those of execution, can be the resting space of up-and-coming ITO challengers, whether new or coming up from Messaging Opportunity, where they start rolling out leading edge services before they are necessarily fully time-tested.

Tomorrow Today. ITO service providers in this final quadrant are leading the way in terms of buyer perceptions, both on innovation and execution, relative to their peers. An interesting group of asset heavy (Amazon, IBM, Google) as well as asset lite (Accenture, Cognizant, TCS), they have as many or more differences between themselves in terms of offerings and market strategies, as they have anything in common, other than being the service providers best positioned today to take advantage of the high level of potential market churn.

The Bottom-line: The traditional IT outsourcing market as we know it is being disrupted, and the next year will likely flesh out the thrivers, the survivors and the also-rans

The intention from an enterprise to churn a current service provider, may be much less complex than actually completing the process of switching out to another provider, and we will be looking at the market dynamics over the next 12 months to see just how many significant contracts in ITO are moved. In particular, we will be observing closely how many hosting and IT management deals make their way over to the disruptive presence of Amazon and Google from incumbent service providers. In addition, how the ITO service providers at the lower left and upper right hand portions of our perception study fare, will provide a good input on the understanding as to how the ITO market is changing and what measures incumbent service providers need to be taking, not merely to survive, but also thrive in this fast-evolving marketplace.

HfS subscribers can click here to download the full POV “With 50% of IT outsourcing deals at risk, how are IT Outsourcing providers being perceived?”

Posted in : Cloud Computing, HfS Surveys: State of Outsourcing 2014, HfSResearch.com Homepage, IT Outsourcing / IT Services, Outsourcing Advisors, Sourcing Best Practises, sourcing-change

Nice. Surprised at Genpact’s ranking. Would’ve thought the GE and six sigma heritage would lead to a higher perception of delivery.

Charles – what challenges face clients looking to work directly with the Cloud firms like Amazon and Google? What are they missing from a traditional ITO provider?

Andrew Wilson