The insurance BPO market will hit $5 billion this year, growing at a 5% clip and has proven to be one of the select verticals truly embracing technology enabled BPO capability to support operations. The insurance market has become incredibly competitive in recent years, with the differentiation across insurers moving to customer service and brand perception, once price points are relatively similar across the reputable firms.

In short, these insurance firms need to invest every cent they can in their advertising intensity and customer facing capability to keep ahead in this market. And with advertising costs becoming so immense for the firms operating on wafer thin margins for many insurance products, they have no choice but to find cost efficiencies from elsewhere in the organization to pay for it all, if they are really going to save you 15% or more in a 15 minute phone call…

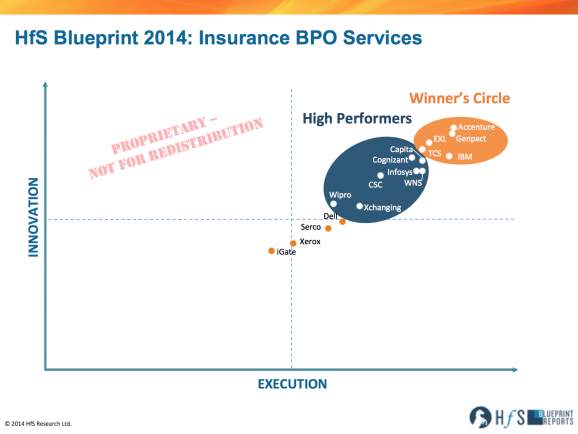

For the large insurers, many could go out of business if it wasn’t for the savings and efficiencies generated by maturing BPO delivery models. So let’s take a look at the industry’s first meaningful analysis of the innovation and execution capabilities of all the leading service providers:

HfS has evaluated the innovation and execution capabilities of service providers catering to life and annuities (L&A) and property and casualty (P&C) insurers, brokers, reinsurers and others (excluding healthcare). We asked Research Director leading the blueprint initiative, Reetika Joshi, to elaborate further on the results of the exhaustive study.

Reetika, what are the key challenges facing insurers today?

The key challenges global insurers in our study face are regulatory compliance, member retention, reducing total cost to service, integration efforts for aggressive acquisitions, multi-line agency management, profitable growth in new markets (esp. for L&A), pricing pressure (esp. for P&C) and most importantly, risk management. Our conversations with these insurers and their service providers, along with exhaustive secondary research reveal the changing mindset of buyers in this industry. Insurance clients’ outsourcing motivations are slowly starting to change, going from task outsourcing and optimization to impacting total cost to serve, cost of compliance, organization level efficiency and insight generation – in line with core organizational challenges.

How are service providers adding value beyond basic low cost staff augmentation?

Clients are increasingly looking to their service providers to help them with these business outcomes (part of what HfS calls “progressive outsourcing”) which goes beyond traditional, transactional “lights-on outsourcing”. Insurers are continuing to expand the scope of their processes with service providers to include more high-value, complex and core functions such as actuarial and underwriting support, agency network optimization and analytics across areas such as new product, risk and claims. However, service provider capabilities in these service areas are not consistent. Clients are more willing to entrust execution of complex processes to market leading service providers. Further, the delay in decision making around closed block administration outsourcing is starting to give way to a host of new contracts in the last two years. North American insurers are the source for the vast majority of these deals since 2011.

Our research sizes the global insurance BPO market at $4.72 billion in 2013, growing at a CAGR of 4.6% to reach $6.19 billion in 2018. For the scope of this study, we have excluded the traditional third party administrator (TPA)/loss adjustment segments as we believe the competitive dynamics of the outsourcing provider group is unique.

So how did they winners shake out?

The Winner’s Circle Features a Mix of Provider Groups and Strategies. The leaders in our analysis represent a diverse mix of strategies and strengths:

The leaders in our analysis represent a diverse mix of strategies and strengths:

- Accenture with dominance in Europe and strengths in catering to both P&C and L&A segments

- IBM which exclusively plays in the North American and Asian L&A market

- EXL and Genpact which have a mix of P&C and L&A coverage, tending towards North American clients

- TCS which has a stronghold in the UK L&A market through its subsidiary Diligenta

These service providers have robust global delivery capabilities, demonstrated expertise across the core insurance BPO services value chain, have exceptional account management and client engagement efforts. Accenture, EXL, Genpact, IBM and TCS have all made significant investments in insurance technology to offer integrated technology and business process solutions to clients. Further, they are committed to future investments in the insurance vertical and delivering value beyond cost by consistently engaging with their customers on vertical-specific innovations. Their forward-thinking vision for the future scope of insurance BPO has helped clients realize benefits from the use of emerging technologies, continuous improvements efforts and regulatory compliance vigilance. We recognize Accenture, Genpact and IBM for leading overall Execution, while Accenture, EXL and Genpact lead Innovation in global insurance BPO.

High Performers Represent Strong Competition. High Performing service providers including Capita, Cognizant, CSC, Infosys, Wipro, WNS and Xchanging have strong execution skills and existing market share. Our study suggests that of this group, Capita, Cognizant, Infosys and WNS will prove to be strong competitors to the Winner’s Circle in the medium term. This is due to their significant commitments to the insurance vertical and investments in innovation capabilities that require time to mature.

And finally, Reetika, what are the key takeaways?

» Most buyers are unimpressed with technology enablers in use today – time to invest in real “value add”. Our primary research with a diverse group of insurers across geographies reveals that most buyers are ambivalent about the performance of technology enablers embedded in their BPO operations today (including reporting dashboards and other tool kits). Bar a couple outperformers, service providers need to address client expectations and improve the standard technology enablers provided to their insurance BPO clients.

» Buyers most swayed by talent management – at the operations level as well as account management. Insurers are highly vocal about how critical the talent brought in by service providers is to client satisfaction. Account managers are one such layer where buyers appreciate prior insurance industry experience apart from account management skills. Further, the industry knowledge and local domain expertise of BPO teams is highly valued by clients, and cited as one of the most important reasons for client satisfaction.

» Service providers of all categories have upped their game on industry knowledge – differentiation will now come from niches. We found numerous examples of efforts by service providers to impact outcomes through industry-specific solutions. Clients have consistently attested to their service providers’ level of knowledge on domain-specific processes including complex service areas, regulatory compliance and reporting knowledge and nuances of different market segments and niches. What this implies is that insurance industry knowledge is now becoming the norm, and will no longer be a source of differentiation in and of itself. Service providers will need to dig deeper into their niches within different market segments and geographic markets to push the envelope on further differentiation.

» Platform play is emerging as one of the strongest engagement models and differentiating strategy. Service providers have seen the most prominent uptake in business platform adoption from the insurance industry. 54% of the deals analyzed for this study featured modern business platforms proprietary to providers. Insurers are accessing new sources of cost reduction, process consolidation and standardization and technology modernization through platform based BPO engagements. Service providers are in turn owning larger parts of clients’ processes, and creating larger and longer lasting relationships (e.g. while average contract length is 7 years, platform based BPO engagements average at 8.2 years)

» Buyers are yet to see a proactive and consistent approach to innovation from their service providers. Our research finds that buyers and service providers have not yet tapped collaboration opportunities for disruptive innovation. Most innovation effected so far has had incremental operational and financial benefits for insurers.

» Regulatory support and compliance is top of mind for both buyers and service providers. Both clients and service providers are very aware of the possibilities of working together to improve regulatory compliance and support. Even if it doesn’t translate into actual business right now for all insurers, this is definitely an area where we see an increased scope for work in the near future.

Thanks, Reetika, for an excellent synopsis of the new blueprint.

HfS subscribers can click here to download their copy of the 2014 Insurance BPO Blueprint Report

Posted in : Business Process Outsourcing (BPO), Financial Services Sourcing Strategies, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Sourcing Best Practises

Definitely, to keep ahead in insurance market, Insurance firms need to invest every cent in advertising cost as its becoming immense margins for insurance firms.For impacting cost level efficiency the above mentioned website can also be beneficial.

Very informative content !

Going to read more of your articles