The silicon valley giants are not satisfied with embedding themselves into your phones and laptops – now they are looking to connect up our cars, bank accounts, air conditioning systems, washing machines, even our hair dryers (OK, maybe not hairdryers just yet)… They want to manage data tied to your whole life, not just your computing activities. Live with it, it’s happening.

Suddenly, IT services are morphing into “Things services”. So we decided to get ahead of this and conduct exhaustive research into how the leading service providers are shaping up their capabilities and investing in this emerging space. HfS’ Charles Sutherland is a walking, talking, breathing example of the Internet of Things. He’s plugged in 24×7 into a global network of devices and companies operating said devices. Yep, he never stops, and his research into autonomics has naturally pulled him into this market.

Charles and his team have been conducting exhaustive research interviews over the past few months with many enterprises to learn more about their experiences with IoT, in addition to the performances of their service providers to provide the bread and butter service delivery and assess their innovative capabilities, vision and investments.

As a result, we are proud to unveil the industry’s first assessment of the IoT services market: HfS Blueprint Report: IoT Services 2015, which is available for our premium research subscribers on HfSResearch.com.

So Charles, why have we undertaken an HfS Blueprint on the IoT services market today?

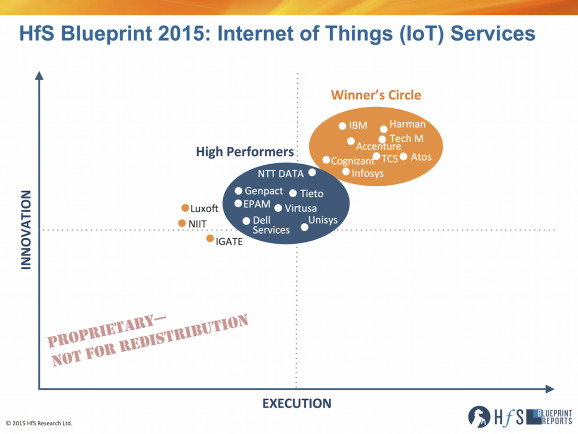

Because we wanted to sort through the daily avalanche of IoT related press releases, presentations and conferences to understand how 18 different service providers were really designing and delivering IoT services for enterprises clients. HfS is focused on the emergence of the As-a-Service Economy and the impact that digital services are having on IT and business processes and the IoT is part of how those are coming together for clients today. It is still very early in this market but we wanted to assess how service providers compared to each other as they build their execution and innovation capabilities to deliver IoT today.

How does HfS define the IoT Services market?

IoT Blueprint author Charles Sutherland is HfS Chief Research Officer (Click for bio)

We believe that there are 5 components to the IoT Services value chain today available from service providers. There is IoT Consulting, which includes planning, technology road mapping, governance strategies and custom app development. IoT Enablement that encompasses product engineering, sensor development, software engineering, embedded technologies and security services at the device layer. We also include IoT Connectivity which brings together network engineering, implementation and security. There is also IoT Integration for databases, SI, analytics implementation and application modernization. Finally, IoT Management services, which include device management, cloud hosting, network and data management. It is a complex value chain that typically requires the coordination of many partners to deliver a complete system, which is a theme we return to again and again in assessing the state of the market in this Blueprint.

What is the state of this IoT Services market?

Overall, HfS believes that the IoT Services market is still very much in its infancy. Despite the daily flow of press announcements and articles on IoT, it’s clear that overall proofs of concept (POCs) rather than large-scale system deployments are the most prevalent cases out in the market today. 2015 has seen a figurative explosion in PoCs for IoT and we expect this to begin to transition into a greater deployment of production systems in 2016 and beyond. That said, IoT will still take some time to achieve scale, because both enterprises and service providers are approaching IoT from many different angles and with a great degree of circumspection as to what the long-term goals are of these IoT initiatives. Will IoT enable greater operating efficiency in the business as it exists today or will it facilitate the creation of new markets and disruptive behavior, that is still very much an unanswerable question in the market as it exists today.

So which service providers are shaping the IoT services market?

Our HfS Blueprint methodology, which incorporates crowd-sourced evaluation metrics on criteria related to both Execution and Innovation together with client references, resulted in 8 service providers being captured in our Winner’s Circle. These were Harman (including the recent acquisition of Symphony Teleca), Tech Mahindra, Atos, TCS, IBM, Accenture, Cognizant and Infosys. Each service provider has addressed this market differently but many share some common leading characteristics as well. We cited Atos, Harman and Tech Mahindra for the capabilities of their proprietary delivery models for IoT. Accenture, Atos, TCS and Tech Mahindra were noted for focusing on as-a-service pricing models for many IoT engagements. Cognizant, Infosys and TCS also scored well for their willingness to co-invest with clients in projects to develop IoT related assets, which could be brought to other clients. While Harman, IBM and Tech Mahindra have been aggressive in acquiring the capabilities they need to lead this market through integrating specialist firms and capabilities at scale. Finally, Accenture and IBM showed well in developing a wide variety of industry models and related skills for IoT deployment in the G2000.

We also identified a further cluster of 7 service providers as our HfS High Performers including: NTT DATA, Tieto, Genpact, EPAM, Virtusa, Unisys and Dell Services all of whom are making investments to grow their capabilities and become participants either directly or through partnerships across the entire IoT Services value chain.

What are the major trends we see which will impact these service providers over the next several years?

Well first of all the competition will continue to intensify. IoT is a magnet today for investor funding not just in Silicon Valley but globally and from this both many more potential partners and competitors will emerge to the service providers we see here today. That growing ecosystem will mean that definitions for the market will remain fuzzy for many as capabilities across design, mobility, cloud, analytics, supply chain and more get integrated into what are defined as IoT projects. This complexity also means that both service providers and enterprises need to deploy both Design Thinking and Systems Thinking when looking at IoT so that the projects solve real business needs and then account for all of the inter-relationships with broader processes and technologies both in the enterprise and outside. Improving partnering skills will also be a key trend for IoT service providers as so many different players are required to bring many IoT concepts to scale and traditional ways of working autonomously found in other IT fields will not work with IoT. Finally, creating data lakes and stitching together the myriad of APIs involved in IoT will be important for service providers as will enhancing analytical and process skills to account for these new capabilities.

So given all these developments in the IoT Services market, what recommendations do we have for enterprise buyers through 2015 and 2016?

HfS believes that enterprises that want to make the most out of investments in IoT going forward should:

• Select IoT initiatives with care. It can seem easy to roll out new sensors and devices but integrating the resulting data and changing business processes is often very complicated and expensive and not all PoCs will make economic and strategic sense to pursue.

• Demand service providers co-invest in innovation and are willing to be experimental in their solution designs.

• Keep the attention internally and with partners on security and risk management in IoT as PoC and evolving deployments may be creating new access points into the enterprise often with high sensitivity and a failure to manage this may cause unforeseen problems over time.

• Stay calm. Most of the IoT activity in the market including in competitors to the enterprise remains at the PoC level today. Yes, much of this may be disruptive over time but not everything that happens in this market will be successful and seeing a path through for the enterprise requires both investment and patience.

And what recommendations do we have for service providers through 2015 and 2016?

HfS believes that service providers that want to make the most out of investments in IoT going forward should:

• Build out Design Thinking and Systems Thinking skills to create new more business outcome based IoT projects and deployments.

• Learn to partner better both within the service providers, with enterprise clients and across the IoT ecosystem.

• Integrate internal silos so that IoT skills don’t become buried inside of practice areas that are isolated from broader developments in process, mobility, design, analytics, engineering and cloud capabilities in the service provider.

• Finally, recognize that not every IoT investment will meet its goals in these early days and not every client project or co-investment opportunity will create a repeatable asset for other clients. Right or wrong, the majority of the works in IoT for the next several years will in HfS’s opinion still bespoke solutions for individual enterprises rather new industry platforms for the service provider to exploit. Stay wise, stay calm and stay busy and the potential of IoT will be there.

Charles Sutherland can be tweeted at @cwsuther

HfS readers can click here to view highlights of all our 25 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report: IoT Services 2015

Posted in : Business Process Outsourcing (BPO), Digital Transformation, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, smac-and-big-data, The As-a-Service Economy, The Internet of Things

[…] HfS Research unveils the first industry assessment of service provider performance and potential with IoT […]

Surprised not to see Microsoft’s Azure IoT cloud offerings appearing anywhere on your chat

[…] Demand service providers co-invest in innovation and are willing to be experimental in their solution designs. • Keep the attention internally and with partners on security and risk management in IoT as PoC and evolving deployments may be creating new Harman, Tech Mahindra, IBM, Accenture and Atos leading the Internet of Things phenomenon […]

@ Steve

This Blueprint is focused on the service provider delivery capabilities for IoT requirements rather than the platform/tool suites for IoT which is where I would put the Azure IoT Suite as well as the Salesforce IoT Cloud amongst others. We do note where service providers are building their own platforms as well but its much more about how service providers use all the tools in the ecosystem to create the solutions that enterprises need today.

Charles

[…] Harman, Tech Mahindra, IBM, Accenture and Atos leading the Internet of Things phenomenon – Finally, IoT Management services, which include device management … These were Harman (including the recent acquisition of Symphony Teleca), Tech Mahindra, Atos, TCS, IBM, Accenture, Cognizant and Infosys. […]

[…] Horses for Sources, Harman, Tech Mahindra, IBM, Accenture and Atos leading the Internet of Things phenomenon, 3rd Oct, 2015, http://www.horsesforsources.com/hfs-iot-blueprint_100315 […]

[…] et l’évolutivité du système. Maîtrisant l’ensemble de la chaîne et leader de ce secteur (HfS Blueprint Report : IoT Services 2015), Atos vient d’être retenu par Bouygues Telecom comme partenaire de la sécurité d’Objenious, […]

[…] du système. Maîtrisant l’ensemble de la chaîne et leader de ce secteur (HfS Blueprint Report : IoT Services 2015), Atos vient d’être retenu par Bouygues Telecom comme partenaire de la […]