We made the conscious decision to invest in researching the healthcare and life sciences industries when we founded HfS, and one of those investments was to hire Barbra McGann to define the space, really sift through the core processes, issues and political dynamics to form a concise picture of who is genuinely innovating, who is effectively executing and aligning their capabilities to solving (and finding) problems for stressed healthcare clients.

To this end, we’re proud to release our third healthcare-related flagship industry analysis: HfS Blueprint Report: Healthcare Payer Operations 2015, authored by Barbra McGann.

The Blueprint goes in-depth as the market transitions to As-a-Service, with a focus on the consumer/member/patient, and more flexible solutions. Barbra looks at the increasing use and integration of automation, analytics, and other digital technologies into offerings; examines the changes in demand for talent; and investigates the increasing need for more collaborative and value-based engagements.

So, we thought, who better than Barbra to tell us about it?

Barbra, with all the market perspective published on healthcare today, what is unique about the HfS Healthcare Payer Operations Blueprint?

Phil, the only place that seems to be cutting back on reading material is the waiting room at the doctor’s office. (Am I the only one who misses Highlights?) Of course, that is just one change in the midst of many for waiting rooms, really, as technology and regulation are both expanding the opportunity for mobile health care. All that aside, healthcare organizations, service buyers and providers who are looking for a different perspective on trends and opportunities for increasing the value of sourcing in Health Care, here it is.

Many of the larger healthcare organizations have achieved the maximum potential benefits from legacy BPO by this point. In our recent “Ideals of the As-a-Service Economy” research, just about three out of four participants (72%) from this industry indicated that there was “no value left” in the current BPO sourcing model. At least one out of three are ready for more “intelligent engagement” managed by “brokers of capability.” Simply put, organizations increasingly realize the need to shake up their operations and engagements, and are looking for the people and the partners to help them put together a solution with the best capabilities to drive results.

What is increasing the value of sourcing in the healthcare industry?

The healthcare industry is being “shaken, not stirred,” by new ways and means of defining, delivering, and managing health and care. It is being impacted by regulation, consumerism, digital technologies, and maturing sourcing models. Healthcare is also an industry that is traditionally slow to embrace change. However, change is exactly what is needed in order to deliver on the “triple aim” of better health, better care, and lower administrative and medical costs.

Payers, providers and other healthcare organizations are all part of the same value chain in the effort to deliver on this triple aim of healthcare. The common factor is the focus on the consumer, who is also seen as a patient, a member, or a customer, depending on the lens. It’s time to line up the lenses.

There are many elements of the operations—processes and technology—that underlie healthcare that are common and repeatable. What we see is an increasing need to continue—and continue to improve—managing the processes for example, the steps for enrolling a new member or patient into a plan, ensuring they have the right coverage that is funded appropriately, enabling access to high quality care in the right place when needed, and processing referrals, claims and payments, etc. At the same time, health plans and healthcare providers also need to create better and higher quality experience in the healthcare system so that people will continue to subscribe and use their services and do it in a way that will keep them healthy or address their health and care issues expediently.

With years of BPO and ITO experience in healthcare, clinicians and other healthcare professionals on staff, best practices that many can tap into from other industries that have gone through similarly regulated and high profile change, and pilots and platforms with newer technologies, many service providers are in a position to partner in new and more collaborative ways. Newer entrants in the market will increasingly challenge the established players, driving new innovation, as well.

How did this shake out in the Healthcare Payer Operations grid?

In this report, we use the term “Healthcare Payer Operations” to refer to:

- A broader set of buyers: healthcare providers, pharmaceutical companies, and new risk-bearing organizations, such as Accountable Care Organizations (ACOs) and Provider-Sponsored Health Plans (PSHPs) among many that are using what was traditionally the back office of payers, e.g, claims, member management

- The increasing use of enabling technologies to deliver business process services, to “operate”

- New contracting and engagement models

- The scope of: claims management, member management, provider data management, and health and care management, along with analytics and enabling technology platforms

- Direction of business process outsourcing services and transition to As-a-Service.

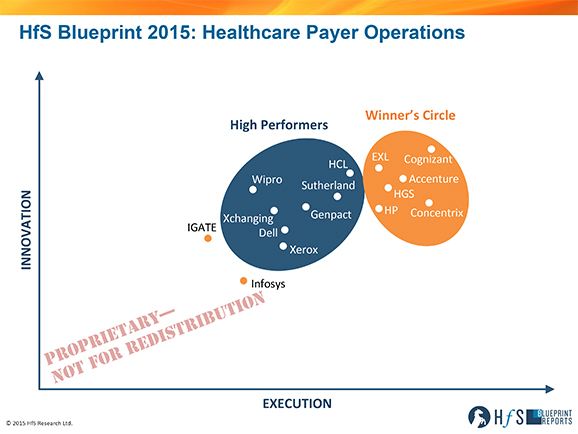

In this Blueprint, we take a look at how the chain of service buyers and service providers are stepping up to the ball to help drive change in the healthcare industry. There are a few service providers that are making bold moves to rethink how and when to partner and look beyond process to rethink targeted results and then put together solutions. Cognizant, Genpact, and HCL all come to mind. While the Cognizant / Health Net story is still unfolding, it is an example of a healthcare organization and a service provider making a collaborative leap to challenge the status quo for sourcing. Each link in the chain needs to get more efficient, deliberate, thoughtful and innovative in re-imagining and streamlining its services to the other connected links.

Some service providers are investing in acquisitions to refresh and build capability to fill gaps that are opening because of new industry regulations and the increasing imperative to engage and empower consumers to lead healthier lives—because impact in both the front and back office in the long run can reduce the expense of healthcare. HGS, Dell, and Xerox have been leading the way here. Interestingly, the latter two are the only ones that are also expanding their telehealth operations to broaden the reach of healthcare into retail.

How is technology starting to play out in what has been a very labor arbitrage driven industry?

Automation is par for the course, and the industry is at the beginning stages of experimenting with cognitive computing and artificial intelligence. There is a reduction in effort, an increase in accuracy and throughput recognized at every service provider with the use of automation. In commodity areas of sourcing – claims and provider data/network management in particular – automation is the innovation right now; it is helping to streamline and speed up processing. Increasingly, service providers are also introducing platform-based services that typically target a specific area like EXL in population health and care management, risk management analytics from Accenture, IGATE for managing lines of insurance, or customer service and engagement with Cognizant. Xchanging is operating on all cylinders with clients on SaaS, BPaaS, and Digital “wraparounds” for legacy systems.

The limitations are in how broadly a service provider decides to leverage automation (that might cannibalize revenues and change the roles of their people) and other technologies that require on-going investment and maintenance. What also matters is whether clients will allow automation and platform-based services to interface with their healthcare administrative system or replace their current the end to end process.

Service buyers told me more than once in interviews that it is often their own organizational limitations that get in the way of being more innovative. Approaches like Design Thinking which is increasingly ingrained in Sutherland Global Services’s approach to work, observing as well as listening and doing, can facilitate new ways to partner that take into consideration the relevance and environment for innovation. This requires buyers to let service providers further “inside” and more familiar and interactive with the business and even the consumers than many have in the past.

Where is the healthcare sourcing industry heading?

Talent + Technology = The Great Game Changer. Enabling technologies help drive change, but not without people who make it drive toward the business outcomes needed in the right context. BPO roles in defining, managing, and delivering services are changing, and there is an increasing demand in the market for people who are embracing and leading this change.

Healthcare organizations need to focus on connecting with consumers, and that means increasingly taking advantage of service provider capability for front and back office expertise and capability from both healthcare, and other industries. Healthcare organizations that partner with service providers that can leverage best practices from other industries, speed to market with talent + technology, and subject matter expertise, as well as brokers who can collaborate will stir up and settle the industry into a new operation.

Barbra McGann can be tweeted at @sheridanmcgann

HfS readers can click here to view highlights of all our 24 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report: Healthcare Payer Operations 2015

Posted in : Business Process Outsourcing (BPO), Healthcare and Outsourcing, HfS Blueprint Results, smac-and-big-data, sourcing-change, The As-a-Service Economy