We’re going to release our 2011 Finance and Accounting Outsourcing (FAO) industry landscape next week, and one dynamic that has really stood-out over the last three years, is the different competitive strategies going on at the high-end of the market versus the smaller engagements.

Most striking, are the divergent strategies of the market leaders, Accenture and IBM. While Accenture has consolidated its commanding presence with the large-scale enterprise customers, IBM has determinedly gone after the mid-market.

You may recall we highlighted, back in January, that the average FAO engagement fell below $20m TCV for the first time last year, we also pointed out that those providers with scale and flexibility of delivery resources are those best-positioned to pick up the smaller engagements:

Scaling a global BPO business based on multiple small client engagements is wearing on resources – and profit margins, and the providers scrapping for their share of the smaller business, are faced with a simple choice: Either stick with it and view this as a 10-year journey, or if you simply don’t have the patience or appetite to put in the investment, then get out and refocus your services on other activities. For those who stay the course (and we expect most will), they need to keep putting in the grind to win small engagements, and attempt to scale their BPO delivery resources, while trying to turn some sort of profit.

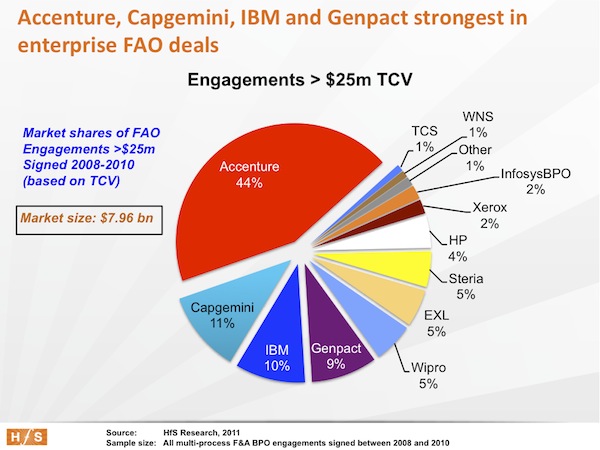

Our deeper-dive analysis shows that exactly this scenario is happening with several providers over the last three years. Let’s contrast both the enterprise-level market performances (engagements over $25m in TCV) and the mid-market (engagements below $25m TCV).

Accenture has developed a commanding position with enterprise engagements, while IBM has gained a lot of ground winning smaller-scale and mid-market clients. As these market share graphs illustrate, all the FAO engagements signed since the beginning of 2008 that have a Total Contract Value (TCV) of more than $25 million, dominate 80% of the total market, with a total expenditure of close to $8 billion. Accenture has been dominant in retaining and developing its client base of enterprise-level engagements, with Capgemini, IBM and Genpact providing the main competition with enterprise-level engagements.

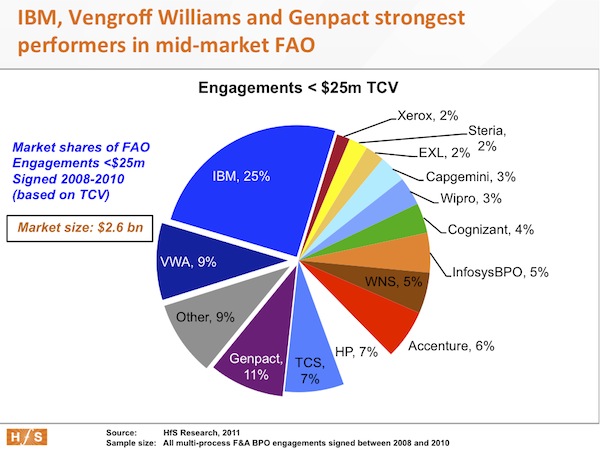

The FAO newcomers, over recent years, have struggled to win many (or, in some cases, any) enterprise-level deals, and have sought to grow their respective market footprints by taking on smaller-sized engagements – many of which fall into the sub-$5m TCV category. The following graphic illustrates the service provider shares of the smaller-scale FAO engagements signed since the beginning of 2008, where the one notable market-mover in the mid-market segment has been IBM, winning the lion’s share of business with a commanding 25% market share.

The onshore order-to-cash specialist, Vengroff Williams and Associates (VWA), also performs strongly in this segment, while there has been a relatively even-spread of business across all the major service providers, such as TCS, WNS, InfosysBPO and Cognizant, in addition to the FAO pure-plays, WNS and EXL. Genpact has proven the most consistent at developing a balanced portfolio of enterprise and mid-market clients over the last three years.

So what do these competitive dynamics mean for the future of the FAO industry?

Essentially, the FAO industry is readying itself for life beyond the simple “lift and shift” deal, where margins were made off labor-scale being shifted offshore. Labor-arbitrage doesn’t amount to nearly as much, when you’re dealing with, for example, a 30 employee transition. What’s more, most of these providers need to start scaling their resources across multiple clients, or face a depressing race to the bottom, where their only real differentiator is their ability to provide low-cost labor. Having scale and flex from ingesting several large-scale clients is extremely valuable for providers, but only if they can leverage those resources to new clients as they take them on, in order to optimize their margins on the new business and remain cost-competitive.

Our take is that providers need a good balance of both large and mid-scale engagements, whereby they can allocate delivery resources and process acumen across their customers in order to develop repeatable process flows with application wrappers to enable them. While small-scale engagements can struggle to be profitable, they do force the provider to develop a utility model that keeps then in the black. Clearly, we’re in a highly-competitive market situation, and this isn’t a market for the faint-hearted.

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, IT Outsourcing / IT Services

Interesting.

Higher the marketshare in F&A deals in >25 mm deals, lower the revenue growth, profit growth and stock price growth of companies. While TCS and Cognizant have seen the fastest growth across all three parameters while maintaining high levels of cutsomer satisfaction, Genpact, Wipro, Cap Gemini have all seen tepid growth. May be Accenture is an exception or is it a classification/nomenclature issue?

Suprisingly, companies that did not fare well in > 25 mm category have done well in <25 mm category, barring Genpact. May be that's the sweet spot that helps companies balance growth withour dilution in the fundementals.

A very astute analysis. Shows the market is quickly maturing when major providers, such as IBM, are going after mid-market clients. Also fascinating how many suppliers are competing in this space – surely it’s rip for consolidation?

Paul Ellis

I agree with Paul’s assessment: too many sellers and not enough dollars in this market for all of them. Something’s got to give.

Al Dayton

@Paul – agree we’re in a rat-race here. We’re moving to an inevitable scenario where we’ll see consolidation and some “exits” from this market (exits being where the provider caters for a small number of clients, but does’t invest in scaling their presence any further). We’ll discuss this more in our forthcoming report…. stay tuned! PF.

I have a question, when we say FAO players, what proportion of these are pure play operators as against the ones who get FAO as a part of their bundled offerings. What is the market outlook for pure play FAO vendors?

@Tushar – these are all the providers who deliver FAO whether it’s “pureplay FAO” or that FAO component of a bundled engagement. We extrapolate the FAO portion from a bundled deal where it occurs. We do have some detailed analysis of proportions of FAO deals bundled with IT in our new report. Shoot me an email on [email protected] and I’ll ping you a copy next week. PF

Phil – Great analysis. My experience on mid-market deals is that you need to closely engage the client on what they need and not scare them with the big picture of FAO transformation. Do you have the analysis of specifics around the value proposition beyond arbitrage and some CIP, which clients are looking for in the mid-market segment considering the challenges around investment from both sides. Whats working for the players who are a higher hit rate on mid-market deals.

Hi Phil,

I agree completely that consolidation by bigger players acquiring smaller players is on the cards and maybe the game-changer for this year..especially for providers like Steria, which supports limited no.of clients may get merged with some big fish..

[…] convinced? For just one proof point, look at HfS Research’s recently released finance and accounting sector analysis. It hasn’t escaped my notice that the majority of the top players come from a consulting […]

[…] (ACS) when it was merely a commercial spin-off of GE’s F&A captive, to become one of the “Big 4″ F&A BPO organizations today, with revenues now well past a billion dollars. You can read a dynamic three-part interview we ran […]