If there’s one market people have been raving about for the past decade – and still are – but has never quite taken off as quickly as many have predicted, it’s the world of engineering services outsourcing.

This market is all about using third parties in the design, analysis, manufacture and augmentation of products. And in today’s world of global labor, the global marketplace, emerging technologies, smarter global sourcing models and the Internet of Things, the potential to embrace outsourcing expertise to bring products to market smarter, faster and cheaper has never been so exciting.

Engineering services has a huge market potential, but – somehow – engineering service providers have had limited success in transforming this potential into the actual outsourcing engagements. Now things are changing, and we believe that engineering services is evolving from a niche offering to the mainstream. So without further ado, let’s hear from HfS Research Director, Pareekh Jain, on the excellent research he’s completed that delved deep this this market:

Pareekh, how do you see this market evolving and what are the key drivers for engineering services?

Engineering services outsourcing, over the last decade, has evolved from simple drawing and drafting to complex end-to-end product design. Now an enterprise which wants to enter a new market segment can partner with some leading engineering service providers, that can not only deliver complete new product design but that can even collaborate with manufacturing partners for additional benefits. Some engineering service providers are also collaborating on high-end R&D projects with the world’s leading research institutions and filing patents both on behalf of their customers and the service provider.

We have observed six key demand-side drivers transforming the engineering services outsourcing market. First, product life cycles are getting shorter which means more product design work and faster time-to-market requirements for enterprises. Second, enterprises are looking to adjacent markets for growth but rather than do it all themselves they are partnering with engineering service providers. Third, enterprises are entering emerging markets and leveraging engineering service providers to do value engineering and to develop frugal versions of the enterprises’ products that can compete at the different price points in these markets. Fourth, the long tail of products created when technology companies merge (and they wish to maintain all existing revenue streams) is increasing the demand for the external help to manage the lifecycle management requirements of legacy or low growth products. Fifth, demand for smart products with the combination of software and hardware is driving enterprises to leverage engineering service providers which have developed expertise over the years across software, hardware and embedded solutions. Sixth, availability of composites and lightweight material is enabling enterprises to rethink the design of their products with the help of engineering service providers.

What was the scope of this Blueprint?

This Blueprint is focused on the product engineering segment of engineering services. The other two segments of engineering services i.e. software engineering and product lifecycle management (PLM) package implementation were excluded, and we will look to cover them in future Blueprints.

How did the Blueprint turn out?

Engineering services is a diverse market spanning across many different verticals and industries. While the value chain element of product development is common across this diversity the skills for designing a car are very different than the skills for designing medical equipment. We analyzed key engineering services outsourcing market dynamics and evaluated the capabilities of 14 service providers at the organizational level, the vertical level, and the service level. We evaluated both specialist service providers as well as broad-based service providers which also offer engineering services. All 14 service providers are leaders in at least one of the verticals.

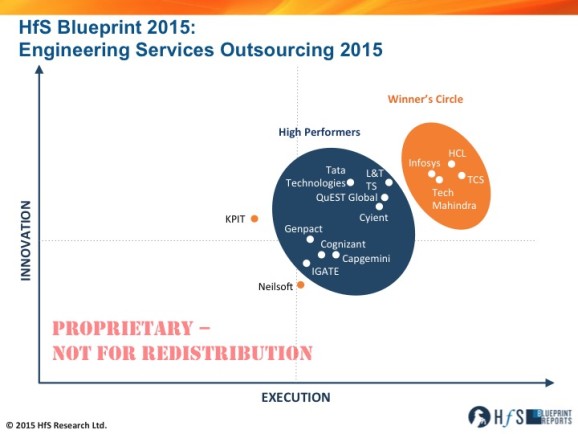

Our analysis shows four clusters. The first cluster includes leading broad-based IT service providers which also have scale in engineering services. The second cluster consists of leading specialist service providers with strong expertise in few verticals. The third cluster includes broad-based IT services firms that are relatively late entrants in engineering services and building their scale and capabilities. The final cluster consists of specialist firms which have strong expertise in one or two verticals.

There are four service providers in our Winner’s Circle – HCL, Infosys, TCS and Tech Mahindra that have four things in common: scale, scope, investment in future capabilities and strong customer references.

The eight High Performers in our study are Capgemini, Cognizant, Cyient, Genpact, IGATE, L&T Technology Services, QuEST Global, and Tata Technologies. They are on the right path and building their capabilities.

In this Blueprint, we also focused on benchmarking and operations improvement. This is first of its kind of engineering services study where we tried to collect important operating data from engineering service providers and arrived at the aggregate or the average engineering services industry metrics. This should help each engineering service provider and captive to benchmark their operations and identify their strengths as well as areas or levers of improvement.

So what are your key takeaways from this study and what should we be watching for in the next few years?

There are three key takeaways.

First, engineering services is a huge untapped market. Currently, it is dominated by captives but we believe that is rapidly changing as outsourcing to service providers becomes more significant.

Second, scale is becoming very important in this market as it enables service providers to make investments in labs, capability development, additional services and market access which are critical to developing this market further. Finally, the scope and complexity of work being outsourced is continuously expanding.

This year the revenues from engineering services for Indian services providers has grown faster than the IT services according to NASSCOM data, and it is fast becoming a growth driver for the global outsourcing market.

We will be watching three key trends in coming month and years.

First, we believe engineering service providers will witness high growth and eventually service provider outsourcing will overtake the captive outsourcing. Second, we will be watching for mergers and acquisitions among engineering service providers. Finally, we will keep track of how service providers augment their capabilities and service offerings. We believe IoT/M2M and engineering analytics will become mature service offerings in next few years.

HfS readers can click here to view highlights of all our 21 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report: Engineering Services Outsourcing 2015“

Posted in : Business Process Outsourcing (BPO), Design Thinking, HfS Blueprint Results, HfSResearch.com Homepage, kpo-analytics, Procurement and Supply Chain, Sourcing Locations

[…] Infosys, HCL, TCS, and Tech Mahindra make the first Engineering Services … This Blueprint is focused on the product engineering segment of engineering services. The other two segments of engineering services i.e. software engineering and product lifecycle management (PLM) package implementation were excluded, and we will … Read more on Horses for Sources […]