At the end of the day, it’s not all about outsourcing and it’s not all about shared services; it’s about focusing on how to globalize processes, how to transform finance (and other) functions, and how to govern it all in a global business services context. There is no dominant model, it’s more about achieving the right balance across all delivery models to achieve the best business goals.

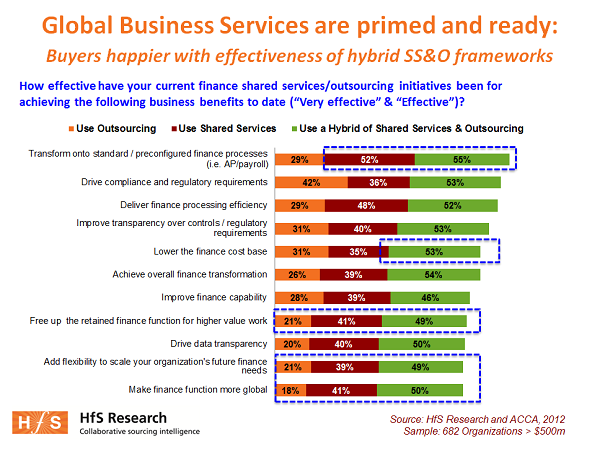

In conjunction with global accounting body ACCA, We spoke to 682 large organizations currently running finance in either an outsourced or shared service framework (or both) – and the results are emphatic: those organizations relying predominantly on outsourced delivery, or predominantly shared services, are viewing their finance delivery performance much more skeptically:

Why do these results signal the decline of the “predominantly outsourced” model?

1) Expectations are clearly higher with outsourcing… and they’re not being met. Only the ability to meet compliance and regulatory goals (42%) is brushing up notably well with the outsourced finance functions. Everything else is mediocre-to-average, in terms of meeting finance performance objectives. This is because many buyers’ outsourcing environments are relatively nascent, and their expectations were likely set to a high level when they embarked upon their engagements. In addition, most governance staff can clearly recall what it was like before outsourcing, and find their new environment a struggle to get things ticking over like they were in the old days. Buyers are clearly finding it hard to make productivity improvements to their finance processes when they outsource heavily, with the main reasons being the cost and complexity of dealing with providers’ change-order processes and also the fact they the operational people running the engagements on both the buyer and provider side are too junior to make decisions. Instead, they get absorbed into the table-stakes of meeting SLAs and running things on budget. Other reasons we will discuss further in our upcoming Sourcing Blueprint document. Our concern at HfS is that if buyers and providers allow these relationships to stagnate, we could get left facing a dangerous commodozitation of operational process outsourcing.

2) Shared Services delivery models aren’t faring much better. Those buyers sticking predominantly to a shared service model for finance are also suffering similarly mediocre performance levels to their outsourcing peers. Only their ability to standardize processes is really coming though as a major plus, with 52% experience really effective results to-date. Clearly, they find it easier to make tweaks to process flows and delivery quality issues. However, when you consider that most of these buyers have been doing shared services for an average time-span of 10-20 years, compared with 1-7 years for outsourcing, you have to conclude that a pure shared services model is not the best answer for those buyers seeking to continually improve their finance performance.

3) Hybrid shared services and outsourcing frameworks are reaping the best results. Those buyers operating hybrid SS&O frameworks are experiencing better finance performance in every single performance category. Clearly a strong, centralized retained organization that augments its shared services processes with outsourced options are enjoying the best of both worlds. Most notably, 54% of the hybrid buyers are finding genuine effectiveness with their ability to transform their finance functions, and similar proportions are encouraged by their ability to transform onto standard processes, meet compliance goals and even globalize their finance operations. Essentially, those buyers that are retaining more of their talent and working with their providers to help with achieving broader finance goals (at least initially), are developing their finance operating structure much more effectively. This indicates that buyers who leverage outsourcing to fulfill specific needs and blend it more effectively with their overall finance operations, are more comfortable with where they are going. At the end of the day, it’s not all about outsourcing and it’s not all about shared services; it’s about focusing on how to globalize processes, how to transform finance (and other) functions, and how to govern it all in a global business services context. There is no dominant model, it’s more about achieving the right balance across all delivery models to achieve the best goals.

The Bottom-line: Many buyers have little choice but to find GBS partners, or face a purgatory of inferior BPO and shared services

Buyers need staff who are ready to embrace these new global services environments. We’ve been hearing many buyers talk about populating their retained teams with staff who’ve only really ever worked in a globally sourced environment. And on the service provider side, buyers need delivery teams which can work with these retained teams to meet their business objectives, in addition to cranking out the administrative work. Should a provider fail to do much more than facilitate standard process delivery (yes, we all know they exist) the buyer needs to evaluate how to bring in external help to plug the gaps to globalize processes and work consultatively and strategically with the retained team.

We are now seeing the rise of Global Business Services partners to work with buyers in “process integration” roles, where they can help their clients’ retained teams manage their whole business services mix across outsourced, shared services and inhouse models. This is not too dissimilar from the service integrator roles we have seen in the IT world, with some of the higher-value integrators stepping up to help their clients manage the whole morass of service delivery. However, unlike IT where it’s easier to disaggregate services and run multi-vendor environments, it’s a lot more challenging when you deal with business processes, hence we expect those buyers with provider partners which have invested in domain capabilities to have a major advantage over those providers which really can’t do much more than provide butts on seats.

We see a true divide developing between the providers only focused on standard delivery, and those which have high-caliber process experts on their bench. The problem is many buyers today do not discover how poor their provider is until after then signed the deal, and it’s not easy to put in requests for consultative help after they’ve outsourced. However, for many buyers, they don’t have a lot of choice but to start campaigning internally for funds to improve their current sourcing delivery frameworks because they are far too beholden to the capabilities of the provider they signed up with.

Essentially, if your provider is starting to sound and acts like a glorified staffing company, you might just want to open up conversations with GBS partners which can work with you to optimize what you have already invested in. However, we recommend you’re MUCH better off finding this out before you give them the kitchen sink…

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Cloud Computing, Finance and Accounting, Global Business Services, HR Strategy, Outsourcing Advisors, Procurement and Supply Chain, Security and Risk, Sourcing Best Practises, the-industry-speaks

Ah, the truth comes out. This is spot on, or at least real close. BPO should always be Business Process Optimization, never Business Process Outsourcing. Outsourcing because somebody has relegated systems, operations and processes to 2nd class citizens and therefore those banal tasks can be handled more cheaply elsewhere is a formula for self-destruction.

Process improvement must always be the primary goal, cost is a consideration but the business and financial impact is always wider than pure cost. A similar and accurate argument can be made against Big ERP – “Buy this giant suite because it will do everything ‘good enough’ for you.” Yech, same issue. Simple analysis: Honestly identify a business process at your company you are comfortable with letting degrade. Can’t think of one? Well then, never go down the cost-only path or ease-only path for outsourcing or ERP, respectively. And every one of your competitors who has falls for taking these superficially easy paths are wide open to attack by your superior processes.

Phil,

Wonderful analysis and a great headline 🙂

I couldn’t agree more with the issue of some providers simply not being equipped to help clients with anything more than very basic operational delivery. Now the onus moves to those providers with the consultants and whether they can put together their own “hybrid” offerings to help clients with both outsourcing and shared services. If it’s simply a case of clients merely being sold more “consulting” to optimize their outsourcing, it’s going to be a struggle. The winning providers will be those which can embed real domain talent into their delivery teams to help clients genuinely improve their business functions in those areas beyond operational delivery which you highlight here,

Daniel Bergman

Surely a seminal piece data here – these findings are very telling.

Can you elaborate more on the sample size / regions covered?

Many thanks

Paul

@Paul: The study was distributed to a global audience of 275,000 finance professionals, who are subscribers/members of both the HfS and ACCA organizations. We received 1912 respondents to the study (1509 total completes), with the following characteristics:

Even distribution cross North America, Europe and Asia/Pacific

All respondents are finance professionals only (others were screened out or deleted retrospectively)

45% have revenues over $500m/year (the sample used for this specific chart);

32% are finance VP-level or above

46% have had their SS/O in place for 5 years or more

In terms of their current sourcing frameworks:

29% No shared services or outsourcing

11% Use Outsourcing

(limited/no shared services)

38% Use Shared Services

(limited/no outsourcing)

21% Use a Hybrid of Shared Services and Outsourcing

Hope this helps – drop me a note if you want more clarification,

Phil

[…] link: The end of outsourcing as we know it… Part I Comments […]

A very interesting and timely piece; many thanks for the research. Increasingly I am witnessing the commoditisation of BPO. The seeds of this outcome are sown early in the life-cycle of an outsourcing endeavour. Procurement/sourcing/vendor management functions need to hold their business managers to task when these projects are in their embryonic stages, as service providers rapidly fall into providing a vanilla “by the numbers” solution during the tender process if they are presented only with such objectives.

The customer must also recognise their approach to partnership will provoke such behaviour. An organisation with a spoken or unspoken expectation of flawless pickup, without investment of effort on their behalf, can expect providers to look to deliver a polished ‘product’ rather than a partnership where honest debate may take place on improvement.

Phil ,

Very insightful article. In the long run it will be imperative for both the Companies outsourcing and the companies outsourced to start building capabilities on both sides of the fence . Failing which , there would a rapid commodization of operational process, with little visibility into the strategic vision the the organization .

Thought provoking piece in the on going in house shared service v outsource debate. Sounds like opportunities for those consultancy firms with real depth of E2E process Knowledge. My take is that excludes many of the traditional outsourcing shops who simply providing a cost differentiated commodity service in many cases. But who are the new GBS consulting players?

Phil,

One of your bravest pieces yet, which I fear is very close to the truth. I agree with Deepak that both buyers and providers need to up their game, or this really will end up a low-end commodity based delivery business,

J Clemence

On the impact to the commodity/traditional outsourcing-shops: there is an opportunity but it will take some brave decisions for these organisations. They’ll need to admit they can’t be everything to everyone and still retain credibility as having in depth knowledge for the vertical/process of a particular customer. One can imagine outsourcing organisations openly recognising the split Phil points out and presenting two products to the market; one commodified and the other specialised.

Until that time there is a clear opportunity for specialist outsourcers attacking one vertical/segment. There is also an opportunity for boutique consultancies (declared interest: my role directing such a firm) to aid customers by adding a transformatory aspect to the deal. This by both establishing a partnership framework with the service provider, and by adding process-engineering/transformation expertise directly. To my mind the big name consultancies are lacking in-depth credibility in a similar manner to the big name outsourcers on this offering.

I remain to be convinced whether these statistics indicate “the end of outsourcing” or “the beginning of doing outsourcing properly”.

@Chris – these results signify the beginning of how companies need to approach outsourcing properly – both providers and buyers. Whether they WILL or not is still yet to be seen…

PF

@Matthew – you and I are in complete agreement regarding this spit between commodity outsourcing and specialized outsourcing. Providers (and most already are) need to manage their clients by recognizing which of their clients generally care about innovation / acquiring new capabilities and those who only really care about “keeping the lights on”. I have recently described these as the following:

“Augmentation of existing operations” (essentially labor arbitrage with a few tweaks)

When a provider is “augmenting” a process (or cluster of processes), they’re improving it, they’re removing some unnecessary sub-tasks, or even tweaking it to work with a new software application. Whatever they’re doing, they’re trying to make it function more effectively in an externalized environment that likely involves staff on both client and provider teams.

“Instituting new practices and capabilities” (essentially when clients adopt new process flows / technologies / ways of doing things)

The providers’ nirvana is to have their clients move onto “shared” solutions they bring to the table that have pre-configured quality process flows and technology underpinnings they can implement across multiple clients, resulting in more profitable engagements for them, increased price-competitiveness in the market and (hopefully) new capabilities and improvements to delight the end-customer to help them win more customers.

PF

Phil,

Am late to the conversation, but this I agree this is the boldest piece written in the industry yet – bravo to you!

I would second your analysis – and the comments of Matthew and Deepak that the onus lies firmly with BOTH clients and vendors to get this right – or forever languish in a commodity state. I hope we can all turn this page and start really hearing and seeing real examples of clients moving beyond mere cost-cutting and basic operations to start achieving real finance transformation with their global sourcing,

Amanda

@Peter Ward – and here lies the trillion-dollar question: Who are going to be the GBS partners of the present and the future? Some of the traditional consultants are making GBS noises, but most only really have expertise in shared services with a few token “outsourcing” consultants milling around. However, I do see a couple generally gearing up practices to implement GBS frameworks effectively. Regarding the boutique outsourcing advisors – unless they develop true shared services capabilities, they are going to get quickly sectioned into outsourcing-land where they only really facilitating transactions (which is what they are predominantly doing today in any case). In fact, some boutiques today have most of their staff sitting in India, so it’s hard to see how they can get focused on GBS when there core expertise is in outsourcing.

Then we get to the most interesting players, which are the traditional “western” outsourcing, such as Accenture, Capgemini, HP and IBM, and the Indian-centric globals, such as Cognizant, Genpact, Infosys, TCS and Wipro. For the Westerners they have to bridge the gap between their consultants and outsourcing division – a huge challenge in terms of fusing cultures, delivery mentality, client management, pricing, expertise and so forth. For the Indians, they have to acquire/hire domain experts who know more than how to project managing low-end outsoucing. They both camps have to figure out how to get their clients to pay higher prices to access high caliber resources (some will be willing to invest… many won’t).

It may be easier for some of the ambitious Indians as they can go quickly from “A to C” and incorporate more GBS components into their offerings. I would especially advocate these firms acquiring shared services / business transformation consultants.

As Chris mentioned – this just may be the beginning of outsourcing being done properly. Let’s hope so 😉

Definitely don’t agree with this viewpoint!.

What is being demanded is being sold by IT service providers!. While this article paints the ideal situation for outsourcing, its not realistic. In a pragmatic scenario, the IT functions themselves are isolated from processes. They work on projects that are time and again identified by business. They don’t own the process. If business stakeholders are giving the requirements to IT function (in terms of projects), they also dont manage the process in a holistic / systematic manner.

So, where is the question of end of outsourcing and rise of global business processes partners?

@Bala: You are confusing ITO and BPO. As you quite rightly point out, most of ITO deals today are disaggregated from the business processes (which is not ideal, in our opinion). The data here is specifically focused on business processes, where the focus has been similar to the IT mentality you mentioned, where too many deals are focused purely on basic operational delivery and price, and not on outcomes / business transformation. In your world of “100% operational IT outsourcing” with zero synergy with the business, I would already declare that as completely commodotized rate-card hell where buyers are just after the cheapest work that can get. It’s hardly even outsourcing, it’s more “low-cost staffing project services”.

And to your final point, we’re at a crucial juncture right now where we need to start seeing the rise and development of GBS partners. So far, the jury’s out, so let’s not proclaim the new beginning until we start to see real evidence of workable GBS relationships.

PF

Since the comments got on the BPO bandwagon — what do you think will happen if we take the same understanding and techniques that have led to the advent of cloud and applied it to the business space (in particular BPO opportunities). Back in the last decade we saw a great deal of activity related to workflow automation for business… and that seems to have died off to a degree (although not in the cloud space).

It seems to me that some of those “big data” insights should be automated and applied and that could be a differentiator in the BPO space. I agree though that it will be a different kind of outsourcing and one that may be based on industry expertise and unique skills rather than just cost cutting and labor arbitrage.

@charlie – essentially software people want to automate as much as they can, while services folk want to minimize expensive labor and automate where they can. If you want to get really cynical, software apps people really want to eliminate human interaction as much as possible by delivering SaaS-based process flows int he Cloud, whereas BPO folks are all about doing the same for less expense, and adding additional quality where they can. As we look to the next generation of outsourcing, BPO connoisseurs now want to bring in even more automation (i.e. Business Platforms) and seek to eliminate manual process altogether, wherever possible – i.e. once you’ve lumped everything offshore, the next natural efficiency, when you’ve run out of onshore bodies to offshore, is to eliminate the need for humans altogether.

Let’s keep this simple – the other day I made an electronic payment to one of our suppliers. Once the payment was completed, I had generously opted to pay the $25 transaction fee at my end for sending an “international payment” (even though it was all made in US dollars). Still wallowing in the pleasant thoughts about what a nice generous person I was, the next day I received a phone call from said supplier complaining that he had been subjected to a $35 fee from his bank for receiving the payment. ”Dude, we’re in the wrong business”, was the conversation that ensued.

Essentially, retail banks are making obscene sums of money from business process transactions that actually entail virtually no human interaction. In this example, both our banks had developed sophisticated Cloud-based transaction systems, and the only human labor costs they were incurring (associated with electronic payments) involved offshore support services to take the odd tech support call, if we couldn’t figure out how to use their online service.

It’s the same with insurance, where the vast majority of processes are standard, high in frequency, completely administrative and commidotizable. Applying for a policy can also be completely automated, based on the applicant’s details (i.e. age, location, previous claims history, desired coverage etc), and so can the claims process, where only occasional human intervention may be required – i.e. making a complex adjudication, occasional routine audits, taking a customer support call etc.

The kernel of this issue is that once the BPO provider has developed a Business Platform that removes much of manual process requirements and can be Cloud-based (i.e. no on-premise software or hardware), their insurance clients can focus their competitive differentiation investments on more subtle nuances – and in many cases it’s purely down to who can deliver their services at the lowest cost, with the most attractive service benefits and the smartest advertising strategy. Essentially, the more automated the process can become, with the least amount of associated labor and IT infrastructure costs, the more competitive the BPO provider can be with its pricing, and the more competitive the insurance client can become, having more resources to focus on better marketing and service differentiation.

So to answer you question… the next wave of outsourcing is very much going to involve much more automation of process and the blending together of Cloud and BPO expertise.

PF

[…] we have painfully laid out here time and time again… it’s not all about outsourcing! var fbShare = {url: 'http://www.horsesforsources.com/isg-gartner_05111',size: 'large',}0 Bookmark […]

[…] As we have painfully laid out here time and time again… it’s not all about outsourcing! […]

More automation would be possible if:

a) Core IT systems were simpler

b) Client IT departments were more incentivised to help suppliers solve automation problems

c) Processes were optimised for automation. Grouping work where expert judgment, or live customer interaction really adds value to the organisation is a good start.

Meantime, and whilst we wait for AI to get really clever, there are lot’s of rules based automation opportunities for front and back office using, for example, automated voice solutions (front office) and robotic automation techniques (back office).