Newsflash: just because buyers aren’t always in a rush to outsource, doesn’t always mean they are too “short-term focused” or simply “missing the big picture”.

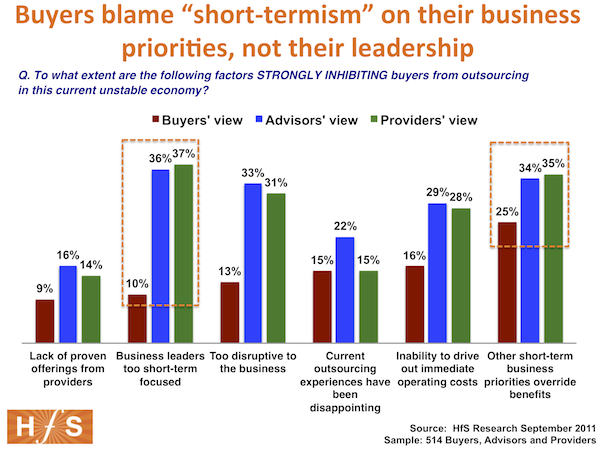

Our latest study shows that many buyer executives are, in actuality, in violent disagreement with many provider and sourcing advisor executives that their business leaders are too “short-term focused”:

When you talk to some (and the operative word being some) advisor and provider executives, they are convinced that every company needs to outsource as much of their operations as they can – and as quickly as they can – so long as they can make the numbers work. It’s this attitude that – in my view – has been holding the outsourcing industry back. Too many provider and advisor executives are overly myopic in their view that business leaders must be “short-term focused”, simply because they don’t pull the trigger on deals fast enough.

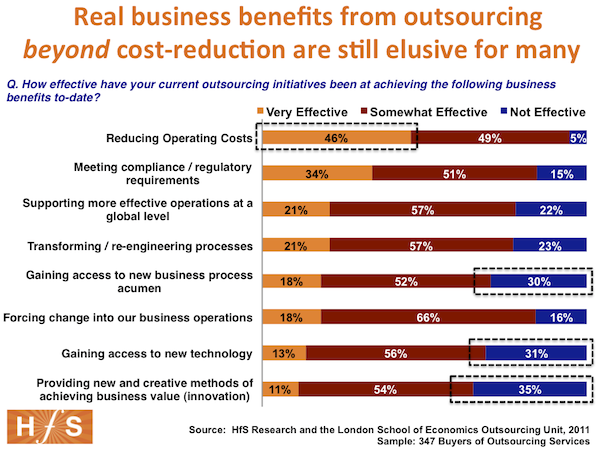

Yes – corporate politics is a critical component of any outsourcing deal, but today’s smart operations and IT leaders all know that the short-term benefits of outsourcing are – by and large – centered on achieving short-term cost-savings from the bottom-line. Our recent State of Outsourcing study reveals this dynamic in spades. Moreover, the data also blatantly demonstrates that buyers are yet to be wholly convinced of the long-term benefits of outsourcing beyond cost-reduction:

What’s more, many business function managers are under intense pressure these days to drive out more tangible cost wherever then can, so their resisting outsourcing (or taking time to do their due diligence) actually implies that many of them are justifiably avoiding rushing into a potentially hazardous irreversible scenario for their organization, if not executed correctly.

So if a business leader was genuinely short-term focused and had done their homework, they’d already know they could score some points with senior management and save mothership a few shekels by doing some outsourcing.

Additionally, only 13% of buyers are concerned about the disruption caused by outsourcing – much less than the third of providers and advisors who believe they are – which tells us the issues holding them back are more a lack of conviction about the benefits of outsourcing, than the sheer horror of the prospect that their help desk ticketing schedules and accounts receivable remittances are going to disappear down a sewer in Chennai and destroy their company.

The Bottom-line: Those providers and advisors which can demonstrate a genuine understanding of their clients’ business pressures, will win out

You do start to wonder whether many advisors and provider executives really have much understanding of their clients’ business pressures beyond cost-reduction – and our recent survey data, discussed above, supports this viewpoint.

When you look at the people some providers employ today, they are often young, hungry sales people who are only focused on “selling cost-reduction”. It’s all they really know and are not experienced enough (or confident enough) to develop and demonstrate a genuine understanding of their clients’ true business pressures. Seeing as many of them previously were trained to sell ERP licenses, or web-development projects, it’s little surprise that they bring this mentality to their clients and end up frustrated that they can’t close deals fast enough.

What’s more, this also makes you question the mentality of several advisor executives, who clearly are laser-focused on pressuring an outsourcing deal negotiation onto their clients, as opposed to investing time to get closer to their overall business dynamics and pressures.

Providers need to start spending less on pointless marketing and investing more in hiring and training higher-caliber consultative client-side executives, who can develop much stronger affinities with their clients. Moreover, advisors which want to do more than number-crunch deals, need to hire a balanced team of business consultants, in addition to deal negotiation specialists.

All-in-all, if buyers only see outsourcing as a cost-reduction lever, they are going to place it in a pecking order of other cost-reduction measures… and it’s not always going to the most effective short-term measure in a tough economy. It’s the job of advisors and providers to educate and demonstrate to buyers the benefits beyond cost-reduction, as opposed to sitting back and complaining that most buyers are short-term focused and paranoid about disruption and change.

Let’s hope this data opens a few eyes before we end up in a depressing race to the bottom, where the lowest cost and very basic operational performance capability, is all that clients can expect from many of today’s providers.

Thanks to all of you for your contributions to this research – your views are articulating loudly and clearly what this industry needs to do raise its game,

PF.

Posted in : Business Process Outsourcing (BPO), hfs-2011-double-dip-recession-study, IT Outsourcing / IT Services, Outsourcing Advisors, Sourcing Best Practises, sourcing-change, the-industry-speaks

This is a brilliant piece of insight, Phil. It really does appear as if buyers now know the impact of outsourcing to their business, but are still unsure as to what it can deliver them beyond some initial cost savings. You can also understand the frustration and impatience of suppliers which want to do more with their clients – which explains their view that they think clients are short-sighted.

My theory here is that outsourcing is reaching an impasse – clients are saying “show me the innovation”, whereas suppliers want to persuade them to “try and we’ll show you”.

End of the day, suppliers are going to have to do a better job of proving their long-term value to their clients. Too many of them simply do not trust the capabilities of their suppliers to do anything more than wage arbitrage,

David Schultz

I think some providers are overly-focused on selling low-cost, and not enough outcome-based services. Cost-reduction is now standard with most outsourcing, so focus needs to be on business value and quality,

Dieter

Are these findings surprising, given that the outsourcing industry is generalist by nature, covering all business sectors, and therefore developing a mentality that business is business is business? Great comment that Outsourcing sellers are former ERP sellers! I always cringed when the ERP guys came in to tell my client that their business model, developed over one hundred years of successful business, needed to change to fit the ERP package model.

Innovation comes with knowledge and it takes time to understand truly how the manufacturing industry works, and then to see that telecommunications actually works quite differently, and so on. If David is correct, and our industry in about to come to an impasse, will we see business sector specific providers coming to the fore, or at the very least, winning the coveted integration vendor roles?

Jim

Hi Phil,

I hate to break it to you, but the problem here may be a bit more insidious than you are acknowledging.

A little “5 Whys” analysis here might be helpful. For those cringing, it won’t even take five questions to get to the root cause.

First why: Why are buyers so skeptical about providers’ ability to deliver benefits beyond short-term cost reduction through labor arbitrage? There can only be one answer…because they have not provided any. Don’t you think if there was an outsourcer that could put up charts about Handle Time reduction or Call Resolution or Compliance that were consistently improving and/or statistically different from their competition that 1) they would be touting it from Chennai to Cork and to Chattanooga and 2) have garnered a disproportionate share of the business (I am speaking about call center outsourcing primarily)?

Second why: Why is no one delivering significantly different performance on output measures? Here there can be two answers: 1) they don’t know how to get that improved performance, and 2) they know how but they don’t want to deliver better outputs for their clients.

Now before we can proceed, we need to ask ourselves, can a call center outsourcer reduce handle time, deliver perfect disclosure compliance, increase first call resolution, reduce the required training time to ramp up agents, and completely prevent credit card theft from their centers? Short answer: Yes. For a longer answer, you can read my comment to one of your previous articles. http://blogs.wsj.com/source/2011/09/22/logitech-faces-uphill-struggle/?mod=yahoo_hs

Third why: If it is possible to significantly improve outputs and deliver benefits beyond cost reduction, why aren’t outsourcers doing it? One possibility is that they want to but they have not done enough research to figure out how to do it. Shame on them. But is it possible that outsourcers know how to do it, but they don’t want to?

Fourth why: Why wouldn’t an outsourcer want to improve outputs for their clients? To get some insight here you just need to ask yourself what happens when outsourcers improve a client’s AHT and Call Resolution and reduce the training needed to ramp up? Well, less calls, less time on the phone, less time in training all mean less revenue for the outsourcer.

What? Outsourcers aren’t helping clients improve their metrics because they might lose short-term revenue? I am sure all outsourcers are not so short-sighted that they would deliberately not work to improve a client’s measures, but I can tell you in fact that many of them are this short-sighted.

I presented our technology to one outsourcer and these are the words that came out of a senior leader’s mouth: “Why would I want to improve our clients’ Handle Time since it will reduce our revenue?” They never called us back.

Another outsourcer, forced by their client to use our technology, told their sales people to only pitch our technology to new clients (because it was different and sexy and might help close business), but not to existing clients because it would lead to less agents and less revenue.

The same analysis could be applied to the problem you raised of having the wrong sales people. You are 100% right about that, by the way. The outsourcers do have the wrong type of sales people and they do need to hire more sales people with a consultative approach.

But this is not a sales problem. Besides what good would it do for the head of sales to hire a bunch of consultative sales people only to have the service delivery end not be able to deliver the improved outputs that the consultative sales person identified as a clear client need?

No, Phil, I believe the problem we are facing is a management problem. Management does not see any benefit to competing with a consultative approach and through delivering better outputs than the other outsourcers. The attitude with many, not all, but many of them seems to be: Get some new clients. Hang onto them as long as you can. And when you lose them, and you eventually will, go get some more.

BPO management should have Led Zepplin’s Nobody’s Fault But Mine playing in constant rotation. Once they realize they are the ones who have to change…not their agents, not their sales people, and certainly not their clients, then the article about What Call Center Outsourcers can Learn from Toyota might provide a path out of the wilderness.

http://www.connectionsmagazine.com/articles/9/082.html

Dennis Adsit, Ph.D.

VP, Process Improvement Consulting

KomBea Corporation

@Dennis – good insight. However, before we go off on a complete tangent, let’s be realistic here – people outsource something because they probably weren’t doing that process all that well in the first place. If a company prides itself on great finance operations, and has its operating costs well under control, or has a highly competent ERP development team that isn’t overbloated and delivers real value to the business, there’s a much lower chance of these being outsourced. Hence, finding value beyond cost-reduction in the post-outsourcing environment is a huge challenge for both the buyer and provider to work on together. Smart management recognizes outsourcing as a lever to rip out some initial cost, and an opportunity to improve (or at least standardize) processes somewhere down the line.

The issue I am focusing on here is that buyers are much more knowledgeable about outsourcing today than 5 years’ ago, and the whole “cost reduction” angle should be a table-stake that is barely a consideration. The discussion needs to be around how those processes can be improved, how better technology can be provisioned and how a more flexible global operating model can be achieved as part of the initiative. Yes, I agree wholeheartedly it goes much deeper than a sales problem, but isn’t that where these conversations need to start? As the differentiation between provider continues to blur, surely the ability to be a consultative partner, and not just a low-cost body shop, is what’s going to separate them out? Or am I being overly naive and we really are on that depressing race-to-the-bottom?

PF

@Phil you are correct about buyers not being naive about the benefits and even some of the expectations that wish to realize. At the sametime they are often unprepared for the fallout created, internally/externally, from making the decision. The turbulence is heightened with the extent and speed of transitioning comes into play. Advisors have become their own worst enemy by being LAZY and applying cookie cutter (& Paid Friend Referrals) to buyers and now it’s coming back to roost. What you will be seeing over the next few years will be a major shakeup and those who don’t come clean (and do the right) will be out. Maybe this is why there is less talk among the big players on sourcing as of late and now have move on to the Cloud (still in a state of vapor).

Hi Phil,

Thanks for the reply. First, I apologize if you felt my comments were a “complete tangent.” Also, I want to make sure that you and your readers are clear that the BPOs I am referring to and most discouraged about is call center based BPOs…collections, tech support, customer service, etc.

OK, on to your points. Your first point is that companies are unlikely to outsource something if they are doing it well. I respectfully disagree. First, any company that wants to focus on its core competencies is unlikely to decide finance operations and ERP development (your examples) are core competencies, unless of course it is a service firm in those verticals. So even if a company is pretty good at something, it may still decide to outsource it. Additionally, companies might outsource part of what they are already doing well if they have highly seasonal demand. There is a lot of this in customer service…call volume predictably spikes seasonally and the company outsources to “shave its peaks” and avoid having to carry extra support staff to manage what amounts to only temporary volume.

But let’s assume you are partially correct and that companies tend to outsource what they are not doing that well. For example, a consumer technology company says something like, “we want to design products for consumers not be in the business of managing thousands of agents taking service calls. That is not what we are good at, so let’s find someone who makes their living doing that and outsource to them.”

So you go out to bid and you tell your prospective suppliers you have W million calls, with X Average Handle Time, and Y call resolution and Z Customer Satisfaction scores and it takes you 3 weeks to train new agents. And then you ask each sales team, “What are you going to do to make me better?” This is what you were saying in your original article and in your follow-up comment…it needs to be about improving processes, leveraging technology, and ultimately improving operational outputs.

It was in my previous post, but as a reminder, here is what they say, “We record calls, monitor agents, and coach.” Well, I did that at the time too. How is their approach to recording, monitoring, and coaching better than mine or better than their competition’s?

Here is the problem, Phil: Call center BPOs have no game they can bet on. They have no sustainable competitive advantage which enables them to take over a piece of business and completely outgun what the client was doing (even if they were not doing it very well), nor outgun the competition. So, in my viewpoint, your statement, “Smart management recognizes outsourcing as a lever to rip out some initial cost, and an opportunity to improve (or at least standardize) processes somewhere down the line,” is not correct.

In your second paragraph, you agree that the problem is beyond sales but ask whether sales isn’t where these conversations need to start. My answer is no. I told the prospective vendors’ sales people what I had in terms of output performance and I asked what they could do help me improve. They were consultative enough. The problem was their operations leaders had no answer that held any water.

Finally, I hate to be the bearer of bad news, but, in my opinion, you are being overly naïve because from where I sit, as things stand today, it is currently a race-to-the-bottom.

?

I refuse to end on such a sour note, however, because there is enough bad news out there and because there are a lot of reasons for hope.

Other industries are not as me-too as the BPO industry. For example, there are many companies that make cars, but, current problems notwithstanding, for the last two decades, no one has made cars with as much efficiency and quality as Toyota. As good as Toyota is, they don’t make cars by themselves. They rely heavily on outsourcers who have achieved their own stunning levels of quality and productivity.

You probably know this, but to create a backdrop, as recently as thirty or so years ago, manufacturing in the United States had a brass-knuckles approach to negotiating with suppliers. They would give pieces of the business to multiple vendors and pit them against each other to get the lowest possible price. They had contracts that spelled out every detail of the relationship. When their outsourcers were punch-drunk, they sent procurement in to squeeze out the last drops of margin. Quality and other performance variables often suffered. (Sotto voce: does this sound familiar?)

Then Toyota changed the game. They didn’t spread their business out; they concentrated it at one or two suppliers. This was a huge windfall of revenue for these suppliers to spread their fixed cost over and to invest against. Moreover, Toyota didn’t squeeze the last drops of profitability out of the vendors. They asked their suppliers to open their books because they wanted to ensure that they were allowing their vendors to make a fair profit. In some cases, they paid them more than they had in the past.

But in exchange for this windfall of revenue and profitability, the bar went up dramatically on expected performance. Smaller, more frequent deliveries, billing changes, higher quality standards, and drastically improved cycle times were now required.

Not only did the bar go up on current period performance, but the expectation was set that quality and productivity would continuously improve: the vendors were expected to experiment and deliver Year-over-Year (YOY) improvements. The gains that the suppliers were required to achieve were shared: Toyota got lower costs; the supplier got higher margins.

Making engine parts is a lot more complicated than answering calls. If the suppliers to car manufacturers continuously improved their quality and productivity, then BPO outsourcers can too. I indicated how they could do this in the link in my last post.

What would be the implications if a BPO outsourcer could produce continuously improving client outputs? This would enable them to outperform the other outsourcers the client is using and capture more of that client’s business. It would also enable them to increase their margins because they would have a consultative, skin-in-the-game selling approach that would structure the contract so that any gains the outsourcer achieved would be shared between the client and the outsourcer. Finally, with their sales decks stuffed with continuously improving charts, they would close a lot of new business as well. Hmmm…more share of wallet, higher margins and a rapidly growing client list…as hockey season opens across North America, that sounds like a shareholder hat trick to me.

As opposed to the depressing race to the bottom we have now this is a world within reach. An outsourcer just has to be able to credibly and continuously answer the question, “What are you going to do to make me better?”

This is a very good piece! Our European ITO research 2010-2011 shows that the prevailing majority of Western and Northern European companies adopt outsourcing to reduce OPEX/lower down IT budgets and accelerate time-to-market. Though we don’t measure (yet) the overall business benefits that EU buyers gain from ITO, we do measure satisfaction rates with current ITO partners, quality of services and engagement models used. Our research demonstrates that outsourcers who engage with their partners via project-based or dedicated development center models are less satisfied than those who utilize vendor’s resources as their own ones (as extension of own in-house IT/SD teams) with vendors being “higher-caliber consultative” service providers rather than mere project executors. And again, buyers that use outsourcing for knowledge/expertise accumulation/sharing between cross-border teams are more satisfied in terms of “grasp” of innovation and meeting mid- to long-term business objectives than those that are focused on short-term cost reduction. So, Phil, your study generally proves traditional outsourcing (when companies just transfer part of/entire development or IT to the 3d party to save OPEX) to be slowly dying out and next-generation outsourcing (let’s call it smartsourcing or whatever) to be catching on.

[…] we recently discussed, business leaders are beset by multiple business pressures in today’s climate, and […]

Nowadays companies are just focusing more on sales rather than business value and quality. This in the long run affects their business adversely, so prime focus must be on quality because only superior quality can build up your reputation and provide you long term business profits.