As the IT services industry braces for a slowdown in 2023 with large deals taking eons to get completed, Infosys adds some renewed hope to ambitious service providers that big, meaty deals can still get thrashed out, with a 1,400 employee $450 million outsourcing engagement with Danske Bank.

Danske Bank, a Danish multinational banking and financial services corporation founded in 1871, recently announced a new strategy to drive its cost-to-income ratio down to 45% from ~60% by 2026. A few weeks later, it announced the deal with Infosys for “digital and technology transformation,” including the sales of Danske IT, the Bangalore-based captive of Danske Bank that provides IT development and operations.

However, when you venture into regions like the Nordics, the whole premise of cost-to-value differs from deals in the US or UK, as it’s very expensive to displace people. So rather than basing the deal’s value on tangible cost takeout from onshore–offshore employee displacement, firms like Danske have to look to other metrics to justify the cost. Those metrics are tied firmly to the technology and talent (aka “digital”) capabilities Infosys can bring to the table to make Danske a more innovative, efficient, competitive—and ultimately profitable bank.

Danske Bank pivots with new “Forward ‘28” strategy and financial targets

Any enterprise that engages in a “big” outsourcing engagement, defined as $100 million+, does so for specific reasons. In other recent big banking, financial services, and insurance (BFSI) deals we’ve written about, such as Vanguard, State Farm, or Core Logic, the “why” is almost always a palpable need to modernize or risk irrelevancy—or at least minimize disintermediation. For Danske Bank, the “why” is less of a digital catch-up and more of a next-chapter strategy after settling its money laundering fraud debacle and implementing a massive overhaul of its risk and regulatory compliance protocols. 2023 is a new chapter, and Danske Bank is ready to move on with its new Forward ‘28 strategy and financial targets for 2026.

It has reaffirmed its focus as a Nordic bank with specific commercial, retail, and private banking propositions for Denmark, Norway, Sweden, and Finland. It has also unveiled revised financial targets, including a target 45% cost-to-income ratio and the resumption of dividend payments. The bank will execute its strategy by upping investments in digital platforms, advisory services, and sustainability from DKK 3 billion to DKK 4 billion (about $437 million to $584 million). This includes plans to further develop its customer-facing digital solutions and modernize its technology infrastructure to enable better customer experiences and drive operational efficiency. Infosys is a key piece of the execution strategy.

What is this “digital transformation” that improves cost-to-income ratios?

What does “digital transformation” actually mean to banks? There are thousands of answers, but one of the most succinct measures of digital impact is improved cost-to-income ratios.

This ratio simply shows cost as a percentage of income—literally, “How much does it cost to run the bank versus how much revenue is generated?” Digital transformation could impact both sides of this equation—driving new revenue and lower operating costs. The World Bank pegs the average cost-to-income ratio for all banks across 40 developed countries at about 60%. This stat has been remarkably consistent for about a decade.

In reality, there are three value levers to pull in a digital transformation engagement to create shareholder value, and Infosys will use them all:

1.) Better technology foundation. Modernizing core systems, automating broken processes, and moving activities into the cloud can significantly impact cost; less time is needed to oversee processes, legacy applications can be retired and consolidated, and leadership has better data upon which to base decisions. However, companies need to invest in consulting work and new technology to reap the longer-term rewards. Often a provider such as Infosys will apportion these costs over the duration of the contract so there is immediate “value” from the client end.

2.) Access to deep talent expertise at scale. When partnering with a firm like Infosys, by far, the largest lever to pull is the availability of tech and business support talent at much lower labor rates. However, the client would need to be able to offload onshore staff to offset with offshore, which can be problematic and costly, depending on the locations involved. For example, staff in the Nordics and Germany can only be removed at significant expense, but transitioning 1,400 India-based staff over to Infosys to manage and upskill should reap longer-term benefits for Danske.

Firstly, Infosys is vastly experienced at training staff on new technologies and domains, which should make the Danske dedicated “re-badged” staff more effective at their jobs. Secondly, Infosys will supplement Nordic talent with other staff worldwide to plug critical gaps in areas such as cybersecurity, cloud, and AI. Danske Bank emphasizes there are no planned redundancies as part of this deal.

3.) Ability to focus on the core. Danske can now pivot its whole approach to reinventing its banking operations to exploit the capabilities Infosys brings to the table; for example, the Infosys Topaz AI suite and the Infosys Cobalt cloud service set. Instead of being beset by old ways of doing things just to keep the IT wheels on and the regulators at bay, Danske can now focus heavily on achieving business outcomes through better technology deployment. This is where the “income” part of the equation is most impacted.

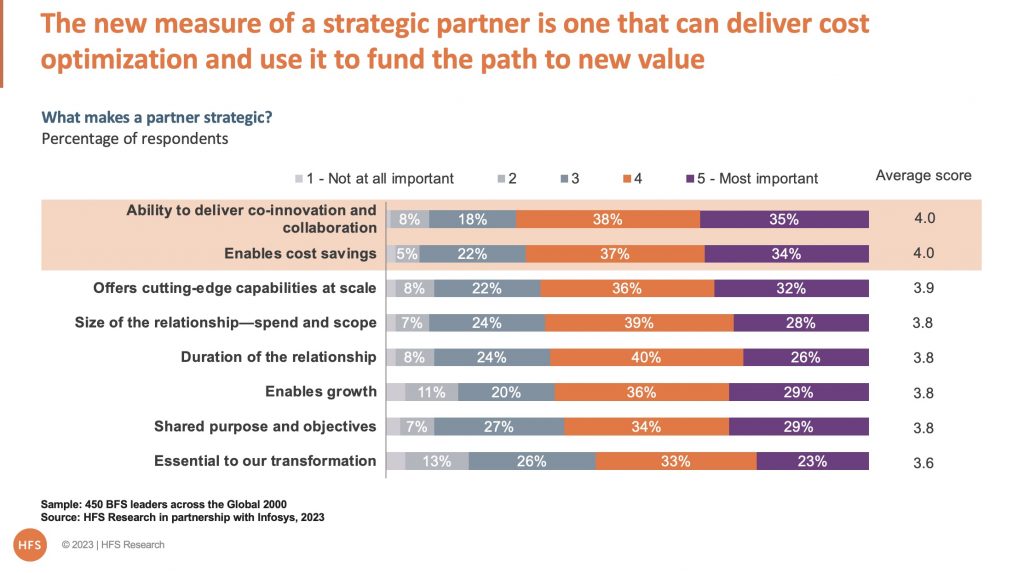

As illustrated below, the role of strategic IT and business process services firms continues to morph from cost takeout to an ambitious “and” proposition of cost and innovation to work to improve the cost-to-income ratios. It’s the combo pack that drives value.

The Bottom Line: Big transformation outsourcing deals could impact cost-to-income ratios by doing more than banging on the cost-take-out lever.

Congratulations to Danske Bank and Infosys on their new strategic partnership. Danske Bank has done a vital job defining its roadmap and key metrics for measuring its results. These same measures need to be considered in Infosys’ performance. While only the bank can control and drive cultural change, it must work closely with Infosys to drive cost efficiencies and applied innovation to impact cost-to-income ratios. This simple metric should have been dramatically reduced in all banks over the past decade, given the caliber and extent of digital investment. It has not, bearing out the fact that cost reduction alone is not enough.

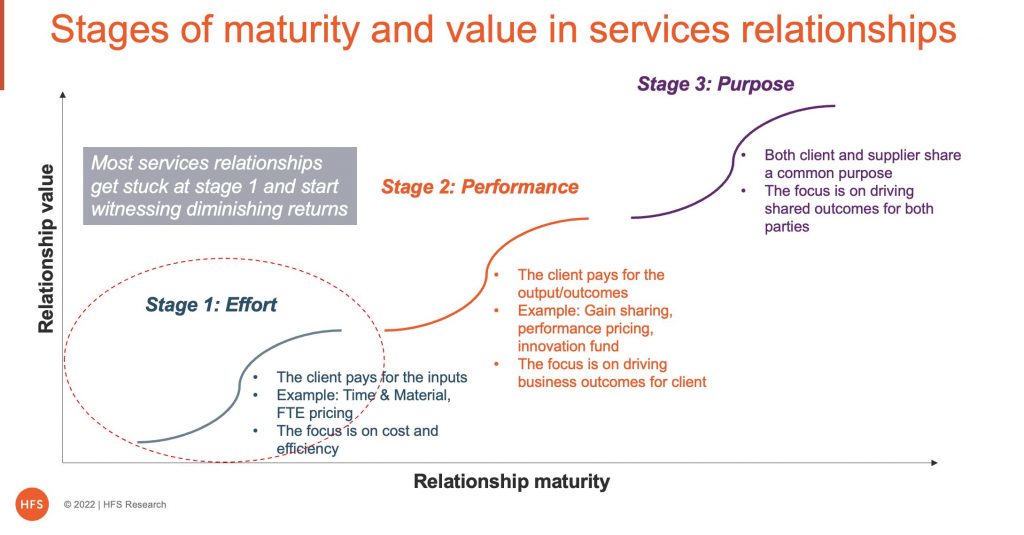

To conclude, clients and suppliers need to jump to a new S-curve of value creation where the client pays for the performance, not just the effort (See Exhibit below). Performance should be measured based on some attribute of business value, not just cost and efficiency, in this case a cost-to-income ratio.

Most services relationships get stuck at Stage 1 and start witnessing diminishing returns because you just cannot keep squeezing the lemon for more juice. In a performance-driven relationship, the supplier and client share the risk and reward while providing services at the lowest cost possible starts to become a given.

Time will tell whether Danske and Infosys can truly make the leap into a successful Stage 2 relationship, but we laud the way this engagement has come to fruition, with the necessary C-suite attention and focus from both sides.

Posted in : Artificial Intelligence, Banking, BFSI, IT Outsourcing / IT Services, Sourcing Best Practises