Celebrating Cognizant's latest acquisition

Trying to analyze why one Indian service provider had a better quarter vis-à-vis another is becoming pretty moot.

Yes, there are various nuances clearly helping or hindering some of the W-I-T-C-H firms with certain deals, such as TCS’ flexibility to win selective large complex deals, Cognizant’s savvy US leadership team, HCL’s price aggressiveness to pillage legacy EDS contracts, and the fact that Wipro and Infosys somehow “lost their mojoes” in the kerfuffle. However, the bottom-line is clear: The Indian services business is hurtling toward commodotization, and there needs to be a much more radical play from their ambitious leaders to alter the game.

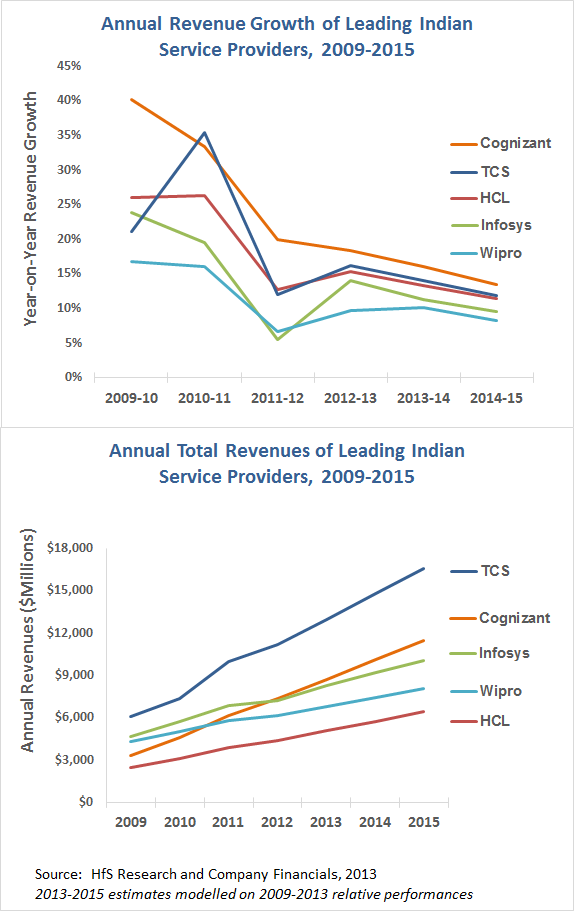

In order to highlight this dynamic, we took quarterly revenue and growth performances over the last 4 years and created a predictive revenue forecast for each of the W-I-T-C-H providers, based on the past four-year historical variances:

What this data tells us, is that the growth trajectory is now declining at such a clip that none of these providers may make the HfS IT Services Top Ten if they continue with their current growth strategies.

Why the WITCH providers can either fight for the old dollars, or revamp for the new

Essentially, what these five great firms have achieved is to create huge factories of (predominantly) young talent that can service operational technology and business process work that can be standardized, externalized and run from their Indian centers. The simple fact that their margins have remained largely unaffected, despite increasing price pressures, is two-fold:

- A weak Rupee which has kept the Indian firms hyper-competitive throughout the Recession years;

- Industry-leading innovations in training and developing hundreds of thousands of employees from the Indian colleges.

Only Accenture and IBM, and more recently Capgemini, have really been able to compete aggressively for the operational work, because they invested heavily in developing their own Indian (and other global) delivery centers in recent years in order to catch-up.

However, as this data plainly dictates, we’re now on a fast-track to lower growth that will likely be dipping below the 10% mark by the end of next year, for some of these firms. So… this leaves two stark choices for the WITCH firms:

1) Accept the industry is commodotizing and be prepared for slower growth and reducing margins. Hell, we’ll still be massively wealthy and our owners and long-term executives are so rich, who cares?

2) Aggressively acquire the capabilities to find new sources of growth. Relying on the same tried and trusted formula of hiring kids, keeping prices low and selling ever-harder is clearly going to see us sink into the middle-of the-pack – we have to make radical changes if we are going to buck the trend.

The Bottom-line: It’s a clear decision for today’s leading Indians – prepare for commodotization, or invest for new growth

The WITCH providers will forever go down in the folklore of business globalization in the way they quietly infiltrated the major global financial institutions, moving from 10 to 50 to 250 to 1000+ FTEs in many of them, before their Western incumbent competitors realized they’d just had their lunch eaten (and for some it was too late to come back). Other major industries followed, from manufacturing to retail, life sciences to insurance, hi-tech to energy.

However which way you may want to criticize the low-cost model, they disrupted the industry and their competitors struggled to respond. But – like any market disruption – once it’s been disrupted a new landscape emerges and the next wave of winners will be those who continue to satisfy the customers’ needs profitably.

While wage arbitrage will continue to provide a lever for new investments, the next wave of customer demands is shifting into new areas where no clear leader has yet emerged. It’s no longer going to be all about ABAP programmers, help-desk jockeys and accounts payable clerks. The next round of winners will be those who can re-invent their clients’ business process to work around SaaS platforms such as Workday and NetSuite; who can recreate an organization’s entire approach to managing and analyzing its data; who can become genuine partners to both their clients’ front and back offices; who can consult, think, act and create for their clients. Tomorrow’s businesses want to get smaller, smarter and leaner, not fatter, more bloated and too sluggish to adjust to today’s global environment.

I do not believe today’s WITCH providers can get from today’s commodity needs to tomorrow’s emerging needs by making the occasional niche purchase to fill a few competency gaps – it’s just too slow and painful a process. The only genuine strategy is to go for the “big bang buy”, the game changer that will force the shift to Sourcing 2.0. We’ll take a look at some good potential candidates shortly… stay tuned.

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, Financial Services Sourcing Strategies, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, Sourcing Locations, sourcing-change, Talent in Sourcing

So true! I would suggest that the rest of the BPO leaders also heed this warning. Customers are expecting, and will soon be demanding, more use of SaaS to create innovation.

Hi Phil,

Well laid out analysis of the way things got here…eagerly await the scenarios and the potential candidates you paint next. This is the cycle of events that has been repeated many a times in many industries, the successful challengers become bogged down and struggle to change as the marketplace shifts.

In the context of de-commoditization and partnering customers in the ways that you describe it appears that a hybrid approach that is driven by envisioning the new spaces and supported by apt, niche acquisitions to help get there is the current thinking? It is not easy to identify the right big winners to align yet, so you could reason that all other large players have similar challenges so where are the right fit candidates…

Also I think it is significant that even in the natural evolution process, that should have led to the addition of deeper consulting capabilities and revenues thereof, these providers have not done a big bang acquisition of consulting firms (whilst progress has been slow, HCL and Infy may have acquired firms but these are not really big bets).

Could not have been better stated. So true ! As the CEOs of one of the WITCH providers recently said: “stick to your current model and very soon you’ll be conducting tours of your software development museums in India”.

[…] Countdown to commodization: Why the Indians need to get on the acquisition trail […]

Phil

A good analysis of the market o far. A Big Bang bang acquisition will be a big risk for most IT service providers as the cause of failed integration will probably resulting a massive failure of the bread and butter model as well. Moreover, it will be good to see which CEO has the courage to make this kind of choice.

Look forward to your next review

Suraj

@Suraj – it all depends which of the providers have the appetite to go for option (2), as opposed to “playing it safe”, and persisting with the same tried and trusted model. I would also like to know why making a major acquisition should become some a “disaster”? Don’t these guys have some experience, by now, managing complex integrations? Let me ask you one more question – isn’t is a bigger risk not to have the courage to buy big than stay with a stagnating model?

PF

I can’t disagree with your points. There are two issues that create a bit of a ripple in all of this and that is the lack of Indian willingness to embrace outsiders into their management fold and customers are not willing (and have never been willing) to accept being a commodity unless the price is super cheap. Everyone say they are unique which sets the banner for specialization. With that said however is the fact that its really not as important on the how, although interesting and useful, its what’s the value that this environment sets. If these companies can’t demonstrate their abilities to run their own operations in a highly regarded way, why would any customer be even remotely interested in talking with them?

Phil

Like it or not, the WITCH company CEOs are staring at the truth right here. Has there been some realisation on what the future holds…maybe yes…the point is who first…let me wait and watch…let me look at the success rate and look at mistakes being made and learn from that. The attitude truly is that I will grow at the cost of other’s mistakes and I am sure this is definitely not the best recipe for success.

Having said that, the key point is the Indian giants have been extremely good in handling cost and labour arbitrage which is the key theme of the lift and shift form of outsourcing. How many of them have truly ventured out to start looking at transformation per se as the business model for the future? The only times when these companies have looked at transformation is to extend the contract beyond the original dates. And what has been the level of transformation..process improvements adding yet another few percent to the customer. Quantify the value add..the customer sees very little..for want of choice earlier the customers have stuck with them…but with globalisation really catching up and with the growth market spanning across Latin America and GCG the customers have more choice today.

Second – what the WITCH group probably have failed to keep pace with is the market dynamics which is moving from a supply side utility to a demand side utility to a Customer side utility today. The times when these dynamics have shifted went un noticed as they were relentlessly focussed on today’s revenues and not on tomorrow’s margins.

Lastly, as they gained in revenue and size, all five of them had surplus cash at their disposal to acquire (which they did in the same model), to improve R&D to move their delivery capabilities to the next level…but no one ventured out to truly invest in talent development to take these companies up the value chain.

How many of these five came forward to look outside themselves for new heads that could think out of the box. who could revolutionize the industry with models that was more commoditised. Maybe time for them to start this.

The term “service” will soon be obsolete and in will come the new theme “offerings”…and I for one will wait holding my breath to see who has the choices.

Ramesh

Phil,

Agree with all your points! Change is slow and speed of changing is going to differentiate the commoditized market in the next decade. Though WITCH companies sit on cash pile and can gobble up something BIG, the buys are supposed to be again in a specific area or a point solution rather than keeping a larger strategic picture in mind and acquiring targeted companies to connect the dots. This kind of long term vision and strategy will help them to fill the gaps in say an end to end business process / area and make them a commendable player and / or a leader in that specific business process / area and gain market share accordingly. WITCH players are conservative and do not put all their bet in a single bucket.

Decision making takes time as “CASH” had come with hard work after decades of mastering the outsourcing art. It is not like a western counterpart where in decision can be taken fast and if it goes wrong, either file for bankruptcy or go on sale to a competitor! Also MONEY is not available easily for any risky behaviour, in the part of the Geo where they operate and a small mistake can end up in closing the business and walking away. Also they do have social obligation to keep considerable people employed may be as the sheer population numbers demands that !!! Anyway talent remains in the sub continent and will see waves of movement of talent to those organizations who keep up pace with the ever changing environment.

Rgds,

Senthil.

A really solid point that has been true for several years. However, most of the Indian providers are obsessed with remaining “Indian”. When one decides to become a truly global firm it will be well positioned to dominate the industry.

[…] the entire post: http://www.horsesforsources.com/countdown-to-commodization_070613 This entry was posted in Uncategorized on July 11, 2013 by […]

What does the acronym WITCH stand for.

Wipro, Infosys, TCS, Cognizant, HCL

[…] Indian services business “is hurtling toward commodotization,” says HfS Research. It says the top five firms — Cognizant, TCS, HCL, Infosys and Wipro – […]

[…] the entire post: http://www.horsesforsources.com/countdown-to-commodization_070613 Share page:EmailPrintLinkedInTwitterFacebookGoogle […]