It’s been exactly two years since ChatGPT 3.0 hit the streets and dramatically changed the AI conversation. One of the key beneficiaries has been Microsoft Copilot, which, in barely one year, has generated a remarkable $1 billion in revenues and created a vehicle for CIOs to claim early “AI victory” to their corporate leaders hungry to exploit the delights of this AI revolution. So, with Microsoft positioning Copilot as the new “UI for AI,” what do CIOs and their C-Suite counterparts need to do to achieve more value than a glossy AI veneer?

To answer this question, some of HFS’ tech research brain trust attended Microsoft’s Virtual Analyst Day to get an advance view of major announcements and its plans for the year ahead. The overarching theme was… Copilot; what Microsoft achieved in one year of Copilot and where it is going from here.

HFS’ lens for all of our tech research is ultimately what realistic value it offers for enterprise users, beyond all the glamorous AI rhetoric and marketing wizardry. In this vein, we were struck by just how little adoption there actually is and how the value and benefits are still squarely being focused on productivity versus personalization and insight. For example, a recent HFS study into AI adoption shows that only 8% of Global 2000 enterprises adopt GenAI on any scale. We felt like we were at a UiPath event circa 2018 given the number of enterprise leaders discussing use cases and strategies to encourage utilization and drive Copilot and agentic technology adoption at scale.

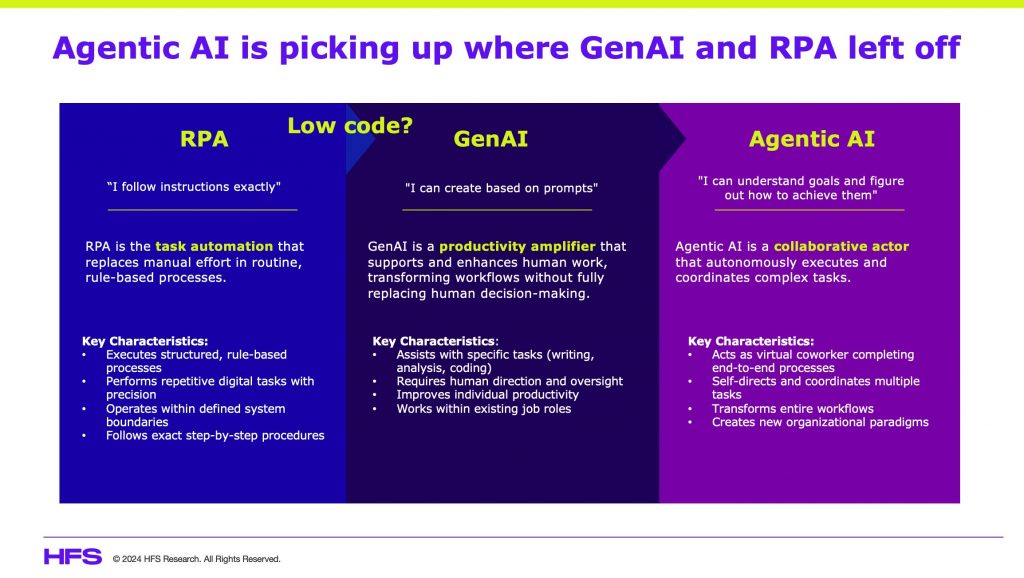

Why will Agentic be any different from RPA when it comes to delivering on the hype?

HFS’ big question is, “Why now?”—what’s really changed to allow GenAI and Agentic technologies to genuinely change how work gets done, how businesses can be more disruptive and competitive, and how the human experience in the workplace can be enriched?

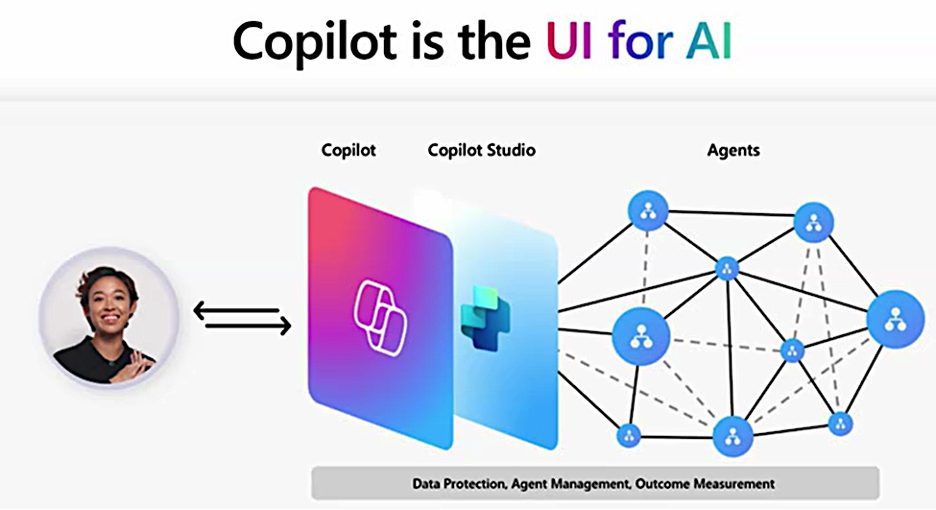

Microsoft’s answer is agents and the ability to use them safely, orchestrate them, and govern them. It wants Copilot to “be the UI for AI” – creating a “constellation of agents”. Maybe, just maybe….for Microsoft products. The big challenge now, similar to UiPath in the RPA days, isn’t so much selling licenses tied to a corporate dream, it’s getting leaders across the lines of business units to actually understand their real value and deploy them at any sort of meaningful scale.

Don’t confuse license sales with utilization

Microsoft Copilot hit general availability on November 1, 2023. It was a hell of an inaugural year with a massive proliferation of Copilot licenses as enterprises hoped to leverage “safe” AI in the secure cocoon of their Microsoft product ecosystems. We got Copilots for 365, GitHub, Power Platform, Dynamics, Windows, Stream, Azure, and more announced at Ignite this week. We also got Copilot Studio to help build custom AI agents. We’ve seen a number of out-of-the-box agents announced at Ignite this week as well. From all this, Microsoft generated an estimated $1 billion in Copilot revenue within eight months of its launch, used by 70% of Fortune 500 companies. The speed is notable. The utilization is not.

Copilot as the fast answer to the CEO question, “What’s our GenAI strategy?”

When ChatGPT3 was launched in November 2022, enterprises quickly stepped up to determine their path forward, commencing what HFS calls “death by 1000 pilots”. AI is not new, but determining how to best safely leverage, govern, and manage GenAI was a major challenge for all. And there were no planned budgets for GenAI in 2023, with most projects being funded through loose change from other present budgets.

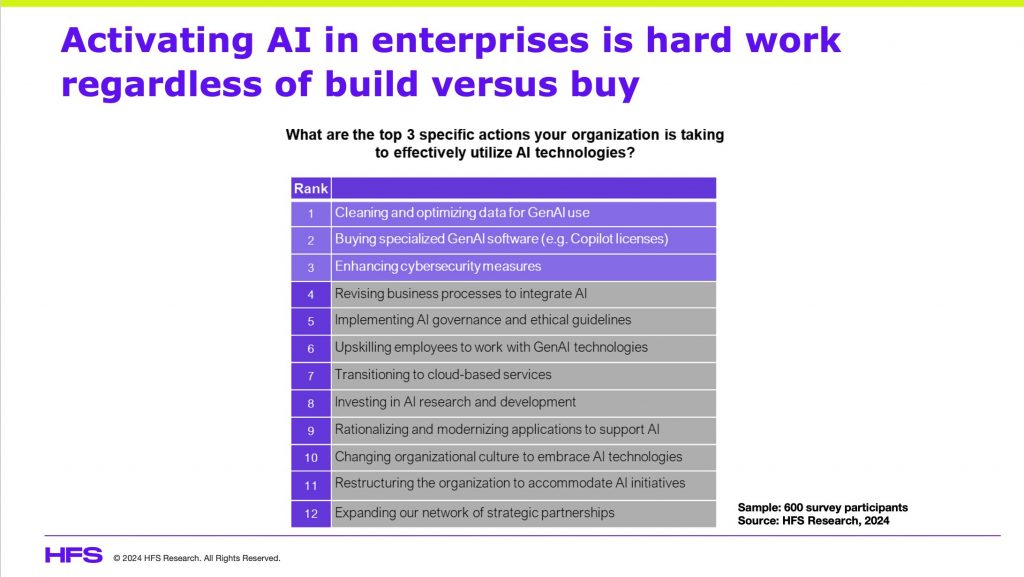

2024 brought planned budgets but also extenuating economic conditions that left discretionary IT spending very thin. Enter Copilot. As shown below, a recent HFS study of Global 2000 enterprises indicated that licensing GenAI software like Copilot rated as the number two option to drive AI use, behind data optimization and notably ahead of enhancing cybersecurity measures. But even if enterprises opted to buy versus build, all the hard work related to the other 11 options in the below chart are still required.

Despite all the hype, the value and outcomes of Copilot squarely point to productivity

At the event, Microsoft featured various enterprise leaders discussing their use and achievements with Copilot. What they all had in common was that they were, by and large, tech leaders. They were all rightfully proud of the exciting use cases they have developed, and they all, sort of regretfully, indicated that the primary benefit realized thus far is productivity. Examples include:

- Blackrock has embedded Copilot into its Aladdin risk platform but indicated its “primary benefit today is productivity, but we are looking farther”

- Textron showcased its Textron Aviation Mechanic Intelligence (TAMI), which is designed to help combat knowledge loss due to retiring mechanics and amp learnings with new mechanics. It is now in pilot mode with 1500 mechanics and yields about 93% accuracy.

- Dow is working across “offense and defense” approaches trying to drive topline and bottom-line impact. Its latest and most exciting is tied to the payment revenue process tied to freight optimization, and it will save millions in its first year.

- Bank of Queensland is using Copilot to drive productivity in software development and customer service. It is piloting in other areas like HR and commercial lending.

RPA failed because it was focused entirely on productivity. CoPilot must avoid this blackhole if it’s going to succeed

In all cases, these firms and many other examples shared anecdotally by Microsoft leadership point to exciting use cases, with some in production and all currently focused on productivity benefits. The challenge with productivity is that when it is expressed in saved hours, enterprises run the real risk of not reclaiming that time. It’s incredibly hard to systematically guide human workers about what and how they should leverage extra time. We all state it should be used “for more strategic pursuits,” but unless it’s defined and prescribed, it’s potluck. This was the issue with RPA where its value was tied to dollars gained through productivity savings, and if customers couldn’t demonstrate real headcount reductions or actual monetary benefits from time “reinvestments”, all CFOs got to see were the millions spent on licenses and little else of value to them.

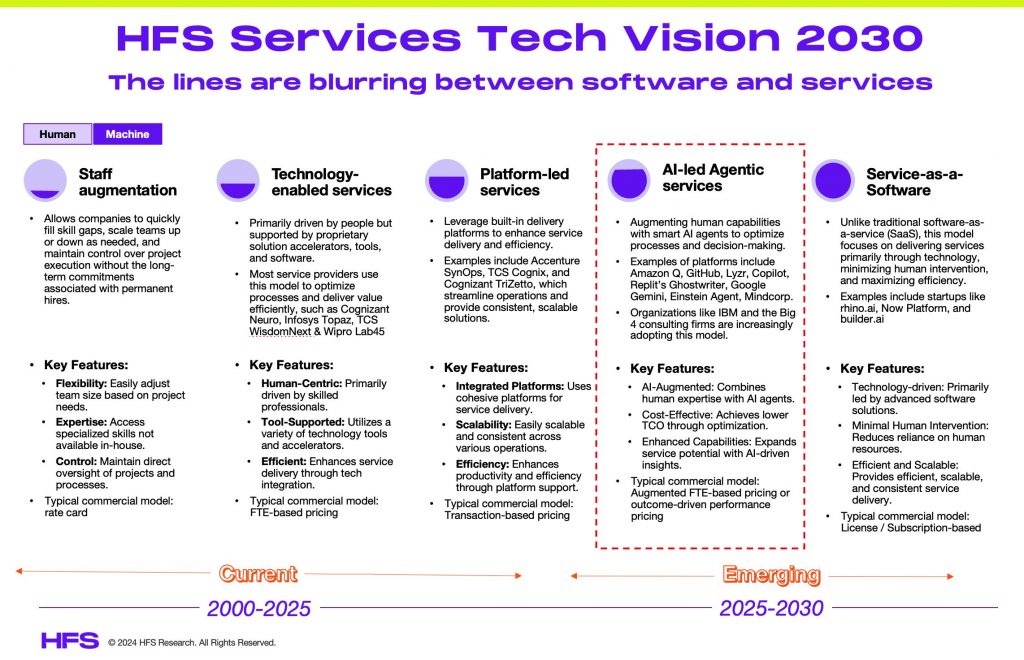

The progress so far is fast and exciting, but it’s low-hanging fruit. The real promise of GenAI and agentic technologies is the potential to change how we do work, not just reduce manual toil. In HFS’ vision of the next few years of technology innovation, we see a distinct blurring of lines between software and services. As we rapidly embrace agentic technologies, with rote manual processes getting automated, businesses will increasingly consume services as software. Copilots, other GenAI tooling, and assorted autonomous agents will combine to help enterprises work smarter. Read here for more on HFS” “Services as Software vision”.

What Microsoft learned in year one of Copilot

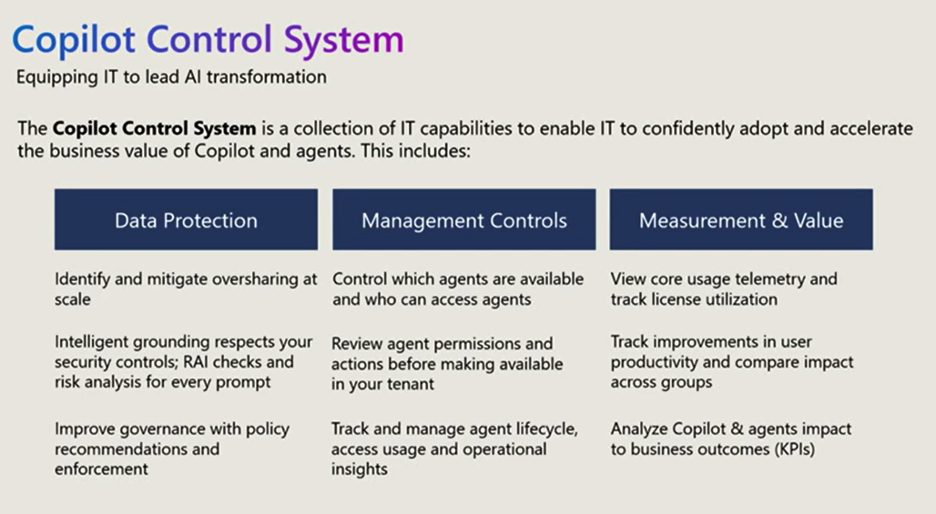

Copilot had a brilliant inaugural year, but let’s also consider the reality that this also represents the proliferation of an unknown quantity of AI agents into major enterprises doing bespoke work at the individual user level without appropriate governance, alignment with enterprise-wide AI strategies, orchestration, training, or adoption plans. What could possibly go wrong? This is Microsoft’s big learning of 2024 – it can’t really tell enterprises what to do with Copilot, but it (and its partners) can help them build and use a ton of agents safely, with solid governance and orchestration. This is critical to Microsoft’s Copilot growth strategy as well as to answering HFS’ aforementioned question ”why now”.

As shown below, Microsoft has just announced its Copilot Control System, which is designed to help enterprise IT scale armies of Copilots and agents. It is designed to complement the existing Copilot dashboard. As Copilots and custom and out-of-the-box agents grow in numbers, enterprises need a sane way to manage this new workforce while protecting themselves and downstream customers and partners. HFS views its launch as a positive but necessary step forward. Microsoft envisions a network of autonomous agents that can execute complex workflows independently while being orchestrated through the Copilot Control System. This is critical to extending Copilot’s role from a personal productivity widget to an enterprise-wide process transformation beast.

Microsoft announces Copilot Control System, a critical missing element in achieving GenAI scale

Source: Microsoft, 2024

The Bottom Line: Year two of Microsoft Copilot must amp data protection, agentic orchestration, and value beyond productivity

Bravo Microsoft. A year of Copilot has yielded license sales and some productivity gain. Year two must tackle safe, agentic expansion, adoption and education, value beyond productivity, and effective governance and orchestration. Its vision of serving as the “UI for AI” is quite plausible, but only in the context of the greater Microsoft ecosystem (see below).

Source: Microsoft, 2024

SAP, Salesforce, ServiceNow, Oracle, and other critical enterprise applications have their own plans for agentic domination. However, given Microsoft’s global footprint, its orchestration potential is meaningful.

Enterprise users of Copilot must demand more training, further investment in domain and industry-specific use cases and solutions, and simplified integrated pricing. Above all, enterprises need to think more broadly about their enterprise-wide AI strategies and how Copilot and other GenAI and agentic technologies fit into them. Don’t make GenAI and Copilot more hammers looking for nails. Think boldly about changing how work is done and the actual value of humans as we progress toward the age of Services-as-Software.

Posted in : Agentic AI, Artificial Intelligence, Automation, ChatGPT, Digital OneOffice, Employee Experience, GenAI, Generative Enterprise, OneEcosystem, OneOffice, Robotic Process Automation