Cognizant’s bold $1.3B acquisition of Belcan isn’t just a headline grabber; it’s a game-changer in an IT services market that’s hitting a plateau:

- Growth Catalyst: Engineering services, where Belcan excels, is the rocket fuel Cognizant needs. While IT services see modest gains or losses between -5% and +5%, engineering services are soaring with growth rates over 10%.

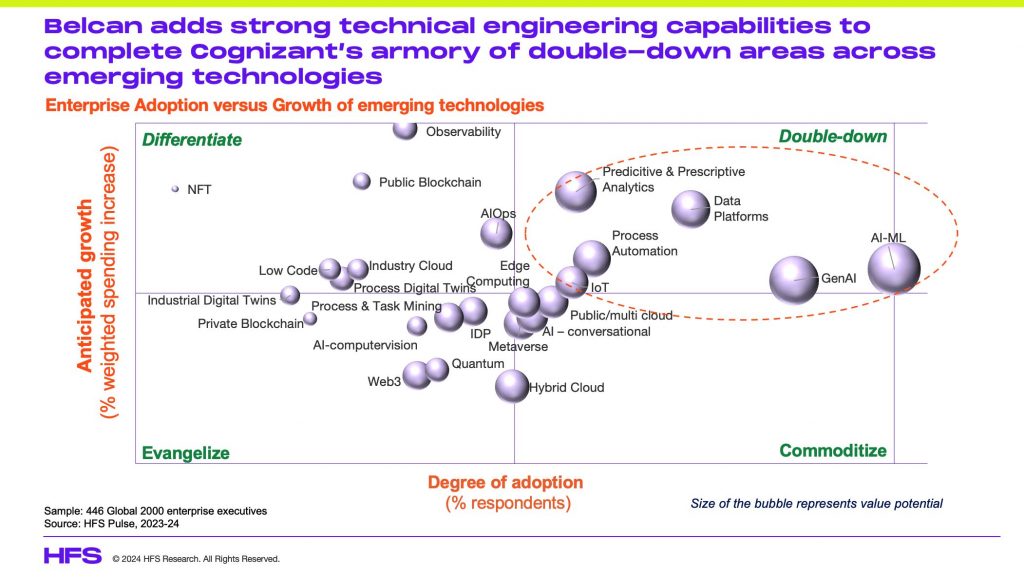

- Tech Arsenal Upgrade: Belcan’s technical engineering services prowess adds serious firepower to Cognizant’s already robust suite of emerging technologies and digital engineering capabilities. With formidable AI, automation, and analytics capabilities, Cognizant now stands tall across all high-growth, high-adoption technologies:

- Diverse offerings and domain expertise: Belcan brings expertise in both engineering and traditional IT development, testing, and integration capabilities across Aerospace and Defence, Automotive and Industrials. This strategic expansion and capability addition in global locations complements Cognizant’s existing technology expertise.

- Niche Industry skills: Belcan brings deep technical expertise in high-precision sectors of Aerospace and Defence, Automotive and Industrial – industries where subject matter expertise is crucial to delivering complex projects. These industries are investing in digital threads, MBSE, integration of operations and enterprise technologies, building sustainable solutions and supply chain resilience which is Belcan’s sweet spot.

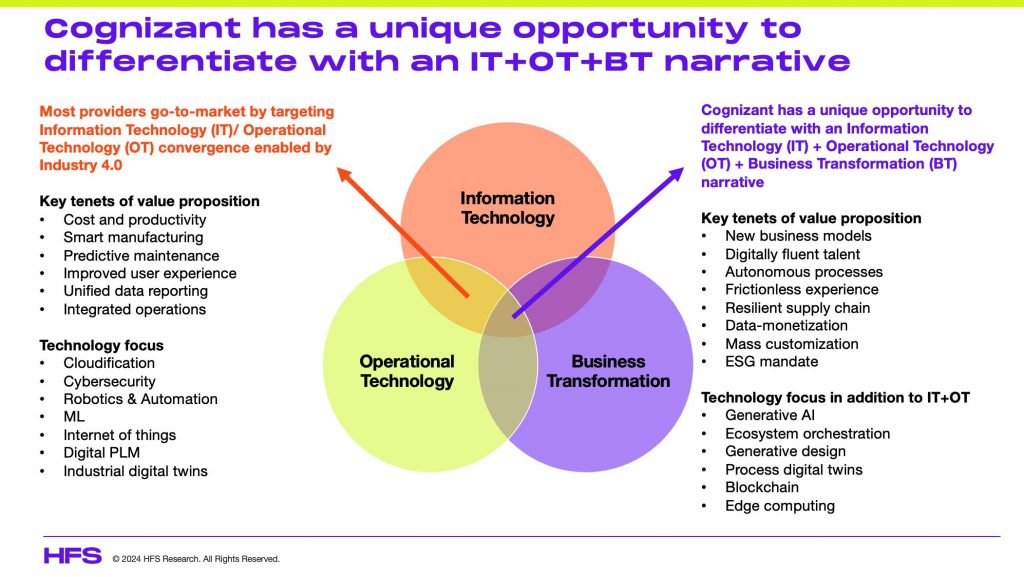

- Strategic Differentiation: In these asset-heavy industries, Belcan’s expertise gives Cognizant a unique edge in large-scale transformational deals. This expands Cognizant’s digital transformation capabilities into aerospace and defense industries that are currently in a growth trajectory and are undergoing technology disruptions, compelling them to think of new product development, efficiency in operations, and business model transformation. This acquisition positions Cognizant as one of the few major players capable of seamlessly integrating IT (Information Technology), OT (Operational Technology via Belcan), and BT (Business Transformation) (See below). Only a few service providers, like Accenture, HCLTech, Infosys and Capgemini, can boast a similar trifecta:

The challenges of this merger

Historically, Indian heritage service providers have struggled with large mergers. But if Cognizant can bridge these gaps, this acquisition could redefine the competitive landscape. However, all this hinges on seamless integration—no small feat given both firms are very different:

- Geographical Divide. Belcan’s workforce is predominantly North American, while Cognizant’s strength lies in its substantial Indian presence. Although the value proposition is different, this integration should be similar to Capgemini’s integration of iGate, where European consulting norms were merged with an Indian IT culture.

- Budgeting Clash. R&D budgets, Belcan’s domain, operate under different dynamics compared to IT budgets, which are Cognizant’s forte.

- Reduce dependency on financial services and healthcare. Cognizant has a high revenue dependency on the financial services and healthcare sector—almost 60% of its revenue comes from these two highly regulated sectors. This deal will help Cognizant diversify its revenue mix. Additionally, the aerospace and defense sector is riding tailwinds due to the demand for travel and geopolitical conflicts.

Major opportunities this acquisition creates for Cognizant

Makes Cognizant one of the largest players in the engineering services business. There have been many acquisitions in the engineering services space recently – HCLTech acquired ASAP, Infosys’ acquisition of ER&D services provider in-tech, Happiest Minds Technologies acquired PureSoftware Technologies. However, this is the largest engineering acquisition by an IT services major since Capgemini acquired Altran in 2019 for $3.9B. Cognizant’s engineering business post-merger will be in the region of $1.8B.

The investment price is reasonable and the investment is almost 100% additive in revenues. The $1.29B acquisition price is very competitive, adding an estimated $800m in incremental revenues to Cognizant, of which 40% is in product engineering and 35% in embedded software. This broadens Cognizant’s offerings far beyond its mainstays of healthcare, life sciences and financial services, which are struggling for future growth in traditional IT services markets.

The post-investment merger is set up to drive synergies and continuity. Cognizant will now boast a $1.8B global engineering services practice under the leadership of renowned Lance Kwasniewski, which includes the acquisition of embedded software firm Mobica early last year. In a similar vein to Jason Wojahn becoming leader of Cognizant’s ServiceNow practice with the Thirdera acquisition, HFS sees this as the smart strategy for Ravi Kumar to expand his team by retaining key leadership talent to continue driving the businesses they built. This helps blend the cultures, retain key talent and ensure continuity.

The aerospace and defence market opportunity is spectacular. The aerospace and defense market is booming in terms of commercial, private, and government spending, which HFS estimates at surpassing $800B this year and $1T in two years’ time. There is also a strong demand in MRO services in the industry and because of Belcan’s OEM experience with clients like Boeing, Airbus, and Lockheed Martin. Belcan is able to service this demand effectively. Being in a position to deliver AI, technology, embedded software, and technical engineering services is a real additive area for Cognizant to exploit in this high-growth sector full of both large enterprises and hundreds of mid-sized subcontractors.

Seizing opportunities in automotive, E&U and industrials sectors, which are going through technology shifts. These industries are investing in new product development and optimizing their manufacturing process and their supply chain, which need industry domain and technical expertise as it is complex high-precision engineering. For example, to seize product engineering opportunities a provider must have capabilities in aircraft design, avionics, propulsion systems and defence technologies in the A&D industry. Similarly, capabilities in vehicle design, powertrain development, and autonomous systems are needed to grab opportunities in the growing SDV and electric vehicles market. The acquisition builds an industry-focused differentiator and is an opportunity to build next-gen technology solutions for Cognizant.

The offshore opportunity is still fledgling and positions Cognizant very strongly. Boeing, Airbus, Collins Aerospace, Pratt and Whitney, Lockheed Martin, and Thales in the A&D sector, and similarly, ZF, Hella, BorgWarner, Volvo, Hyundai, Stellantis, and Ford in the automotive sector have set up GCCs in India. There is also a significant focus on the expansion of engineering-centric GCC centers in India right across manufacturing and other verticals. The market is ripe for expansion, with Cognizant in a very strong position to take on these services.

The opportunity to take engineering and embedded software capabilities into other industries is clear. Huge industries such as medical devices, household electronics, and automotive technologies are rife with demand for embedded software, product engineering, and supply chains. With Cognizant’s focus on bringing Engineering, OT, IT, and BT together, there is a clear roadmap for growth, provided the firm can bring together the differing skills, cultures, and client needs effectively as a holistic and integrated capability.

Bottomline: Cognizant now has a seat at the engineer’s top table, but now needs to ensure it stays there

The deal strengthens Cognizant’s already existing technical expertise and deepens client relationships, creating major new market opportunities. This also puts Cognizant on the industry map for large-scale transformations with strong emerging technologies capabilities, making the firm a formidable player in the engineering services industry with domain and technical expertise. All Cognizant now needs is to cross the integration milestone seamlessly to build on this considerable momentum.

Posted in : Business Process Outsourcing (BPO), engineering, IT Outsourcing / IT Services, Manufacturing, Supply Chain, Uncategorized