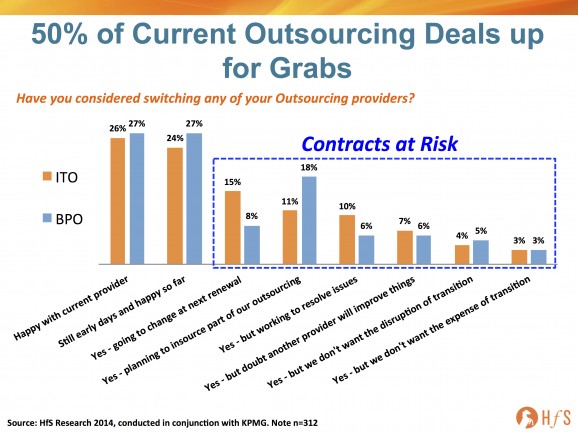

We’ve been calling it for seven years now, and finally the chickens are coming home to roost for the outsourcing business: clients are genuinely walking away from outsourcing relationships which provide mediocre value.

And, while some savvy providers are sensing the defections with a few notable re-bid wins of late, many still have their heads in the sand and hoping that once they win a new client, they’ll never leave them… oh how wrong they could be, as revealed by 312 enterprise buyers during our new State of Outsourcing study with KPMG:

So, why are so many outsourcing relationships hitting the skids?

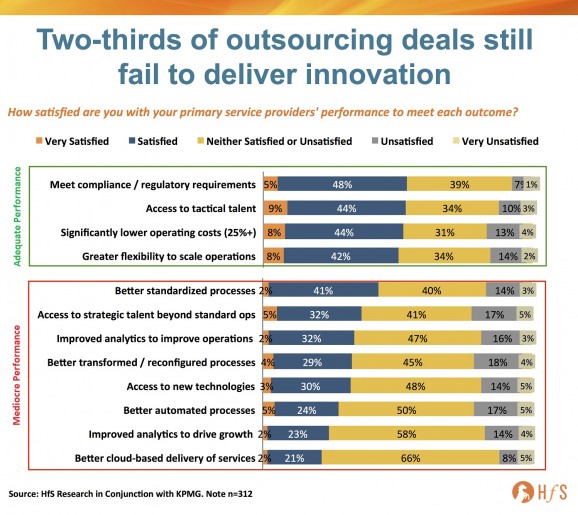

While we’re at pains to point out that relationships fail to deliver innovation where buyers lack the skills and capabilities, it’s also blindingly obvious that many providers are not coming to the table with the goods either:

As you can see, it’s the same old story – in fact, buyer satisfaction has actually got worse over the last three years (see our 2011 State of Outsourcing results). At least, back then, the large majority of enterprise clients enjoyed some degree of value from their relationship, while today, barely a third of buyers are seeing positive impact in terms of having improved strategic talent, better operational analytics support, better technologies, process transformation, automation… the list goes on.

The three main issues driving this churn problem – and how providers can address them more effectively

1) Buyers’ expectations – and impatience levels – have markedly increased. The world of business operations has evolved at an almost alarming clip over the last five years – it’s as if the recovery from the worst recession in living memory has driven an impatience from business leaders to advance their capabilities and cost efficiencies much faster than the snail’s pace of yesteryear, when ERP rollouts were calculated by the decade and outsourcing evaluations took three years just to get a meeting together. Suddenly, buyers want to talk about where they expect to be in a couple of years, they’re asking questions about robotic automation and developing meaningful analytics capabilities, they’re asking how their provider can help them improve the way they do things – not merely manage their legacy processes at cheaper rates.

How providers need to respond: Prepare more diligently to manage your clients over the longer-term. You know many are going to start asking for the “what’s next?” quicker than you expected, so be prepared with a plan to deliver it. Otherwise, they may no longer be your client when the re-bid process kicks in….

2) Most providers are still obsessing with the next deal, as opposed to cementing their existing relationships. The real “tangible” money on the table for providers today, is when they win a brand new deal that adds to their win-rate, their Wall Street scripts and feeds their PR machine. However, the cost of losing a client is far, far worse – the lost income, the ignominy, the negative perception from the industry. As more deals begin to churn, the focus will shift to protecting the base, and not just pursing the new.

How providers need to respond: Start replacing the old-school sales guys with the fat expense accounts and standard issue BMWs or Jags (you know the type) with operationally-savvy account managers who understand how operations need to be run. While they may be less fun on the golf course, they’ll be much better-placed to develop your clients down the road.

3) Buyers still think that innovation should be free, despite the fact they bought labor arbitrage. If you didn’t pay for it, why should you get any? The perennial problem with outsourcing is the fact that low-cost still wins the day, with most sourcing advisors strong-arming providers to respond to RFPs in three weeks and allowing very little (if any) interaction time for providers to interact with their clients in advance to develop the right solution and get a stronger balance between delivery capability and desired outcomes. In most these cases, the buyer and provider teams brokering the deal hand them off to the operations teams on both sides to manage, with little room for investment on either side to do anything more than basic delivery with low-end resources.

How providers need to respond: Invest in more direct communications and sales cycles with clients, and be less reliant on the advisor channel for your future business. You need to develop relationships where you can spend more time with your clients to get this right, not second guess their needs and rely on some fudged math to get a deal done.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, HfS Surveys: State of Outsourcing 2014, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Outsourcing Advisors, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Sourcing Best Practises, Talent in Sourcing, the-industry-speaks

Stunning data, Phil. It seems to me that there are simply too many failing relationships with little plan on how to get them on track. What do you think is ultimately going to happen to most of them?

Andrew Wilson

@Andrew – I believe we’re going to see a (gradual) spate of re-bid situations escalate where a wave of disruptive providers (see Charles’ last post) come along with radically different pricing and delivery models in areas with a strong demand for standard processes delivered via a cloud model. We’re already seeing this in the HRO space with OneSource Virtual offering genuine HR cloud services, by offering Workday supported by HR BPO services that enable a genuine Workday environment – and transformation – for clients. We are starting to see this in the F&A space with some fledgling offers and partnerships, but we really need to see a game-changer like OneSource to take that space by storm. It has to happen… eventually!

We are also going to see a division from the legacy labor arbitrage-heavy providers with those which successfully combine labor arbitrage in a global operations model that provide value-added services in the areas of analytics, process transformation and strong automation capability. We have already seen several high profile defections in BPO where the clients simply ran out of patience with their provider struggling to deliver anything more than very rudimentary operational delivery. Providers with better (proven) talent and genuine solutions to improve processes and analytics areas are already winning out – and this will accelerate as contracts expire.

In ITO, the re-bid market has been hugely aggressive with the rise of the Indian majors radically undercutting legacy ITO deals in terms of price, however, it’s clear from this data that half the clients aren’t very happy with what they are getting and are looking to see what alternatives are on offer beyond the cheap low cost labor option. I really think many clients are already reaching rock bottom with their ITO labor arbitrage and have to look at automation-driven solutions for further IT efficiencies… that market is really starting to overheat…

PF

Phil,

Excellent piece – right on the money. This data signifies the changing of the guard in outsourcing – providers failing to step up their delivery value are going to have a very difficult time hanging onto their business in the next few years and will disappear into irrelevance very quickly. Is already happening.

Gaurav

Certainly agree with #2 for most providers

Even a great outsourcing contract can degenerate into a mediocre relationship if not appropriately governed. Clients need to invest suitably in their vendor management operations. Do not delegate the management of the hen house to the fox.

Phil, you confirmed with data the perception I had. Thanks!

Its all about continuous value creation, what pleases your customer today, is not going to please him or her tomorrow or day after. For outsourcing, IT or otherwise, the speed of change is much more than more traditional markets.

I liked your comments on the ‘type’ of sales guys the providers now need, quite true. In my organization I am facing the same situation day in and out. It helps that I come from the operational side of business and now handle sales, but I see the pure play sales people in my company struggle to handle prospective clients. Sometimes there is quite a gap between what the client expects and what he has signed up for, the blame often pin points to the lack of understanding of the client’s operational need and the solution there off.

This is therefore the dawn of the Farmers rather than the Hunters.

Best

Anirban

Spot on with our experience, Phil, and great comments on the provders’ suggested responses that reflect what I’d like to see as a buyer.

I suspect there are several factors at play here, not all as strategic as we’d like:

(i) A lot of deals have been in play for many years now and buyers have woken up to the fact that what worked in 1998 might not be quite so relevant in 2014…

(ii) Provider complacency has been rife, particularly in the transactional space

(iii) The last 5 years or more of tough times has challenged all businesses to stop seeing outsourced deals (and a whole load of other areas, too) as sacred cows and senior execs have woken up to the fact that alternative models are out there

(iv) Everyone recognises how technology, cloud, automation, robotics have moved on dramatically and is therefore asking themselves “why don’t I have that?”

(v) Now that it’s happened more across the industry, the fear of the costs/disruption of switching has subsided: both buyers and providers themselves know that it can happen with much less pain

(vi) The space has therefore opened up for the “disruptive” providers to market themselves as viable options

I’m sure we could all go on, but it certainly adds up to a scary/exciting/challenging/ opportunistic time for both buyers and providers depending on your perspective and I think the new norm is for the standard 3/5/7 year deal to become exactly that in years to come and not to see the 10/15/20-year rollovers that many have gotten used to

Precision analysis as always, Phil. This data is very eye-opening on where outsourcing is struggling and why there needs to be a major sea change in how these solutions are delivered and paid for. It is clear that too many legacy practices are holding the industry back, but what can the catalysts be to change this?

Jim

Great piece Phil.

Your points on how providers need to respond are undeniable. What I struggle to see though is HOW these providers are going to get into a space where they can actually do it. It almost feels like we need a wholesale clear out of “no longer appropriate” outsourcing DNA.

Do you have any recent examples of providers who are adapting better to the higher value outsourcing space, and especially how they’ve been doing it?

Regards

Darma

Worth reading more than once!!!wow

Wow – I knew satisfaction was bad, but not this bad. Great data.

Perfect timing for publishing this Phil. Providers are getting too complacent. They are still expecting FTE pricing, 7-10 year multi-million dollar deals and yoy rate increases. They are failing to notice clients’ dissatisfaction with the status quo. I think if only 10% of the clients move their business from their existing service providers, they will hear the message loud & clear. Thoughts?

@Rajesh – the impact of unwanted client losses is huge for some providers (bear in mind some providers like to churn unprofitable clients). I think you’re right – 10% of clients walk, the game will change, but whether some providers know how to reinvest to up their game is very much in question… too many are micro-focused on making their contracts as profitable as possible by squeezing as much as they can out of millennials and cheap labor – that is their business model, that is their DNA. To find new value, they need to invest in skilled process experts, in robotic automation, in analytics tools and data scientists, in industry consultants who understand the institutions needs and requirements of their space.

PF

Phil —

So, why are renewal rates 90% and higher? This data suggests that incumbents should be losing more clients left and right, which they are not. (not yet anyways…)

I understand and trust your data on client unhappiness, but I also see and trust the data on renewal rates. Between the two is a gap big enough to drive a truck (or a team of horses!)

So what gives? A year from now, go back to the 156 unhappy buyers (50% of 312) and ask — Are you still with your same provider? Why are you choosing to settle for less than great?

@Mark – very good points – and renewal rates are certainly not as bad as 50%! As mentioned in the previous comment – even 10% client defections could be the start of a big shift in the industry. What is clear is dissatisfaction with the status quo of outsourcing is at an all time high and we’re not too far from a real shift in how these solutions are priced and delivered. As Rajesh points out – if you’re getting the same substandard service year in, year out, what’s stopping clients setting up their own captives and doing it themselves (and benefitting from losing the provider tax on wage rates)? As the same study points out (see earlier post), one in four enterprises are reinvesting aggressively in the shared services set-ups and outsourcing adoption is moderating… there’a a reason for this,

PF

Right on, Phil. Excellent analysis and summation, as always.

It still amazes me, after all these years, how many buyers still use traditional RFP-based procurement methods for outsourcing deals. And then they wonder why there are so many surprises, why providers start nickel-and-diming them, why change order management becomes the main topic for governance meeting, why service delivery team leads defect to other clients, why innovation funding doesn’t exist, etc. etc.

As you know, joint solution design is hardly a new concept, and yet I continue to find time and time again that buyers are keen to learn this “alternative approach” and supplier sales teams comment that it’s such a breath of fresh air; indications that it’s still the exception and not the norm in the industry.

If both parties don’t find ways to use these methods and set up truly mutually-beneficial delivery relationships instead of transactional contracts, the level of dissatisfaction and underperformance in the industry as a whole will continue to decline.

Great piece and core to what outsourcing providers must address. Everyone today must demonstrate how they continually add value to the business and that includes outsourcers.

@Jim – Yep! I recall we worked together on a deal in 2006 and it was the same discussion 🙂

[…] Horses for Sources Welcome to the era of churn, where 50% of outsourcing contracts are at risk Horses for Sources As you can see, it's the same old story – in fact, buyer satisfaction has actually got worse over the last three years (see our 2011… […]

Great read, thought provoking discussion, and amazing insights! Thanks, everyone.

An example that I feel would make sense in quoting here – A substantial percentage of voice services businesses that moved from India to the Philippines a few years ago, has gradually started to move back to India. One of the reasons is that the buyers have begin to identify areas within pure voice services or cost centers, that have the potential to be revenue generating centers or profit centers by adding the sales, up-selling element. This requires specific skills not restricted to a neutral accent and/or cultural affinity. Also, services bundled with technology, such as multi-channel offerings consisting of email, web-chat, social media, etc., could well mark the beginning of this phase with a paradigm shift in the way services were delivered. Adoption of newer technologies, cloud, automation, as rightly pointed out. Yes, it would be interesting to know how innovative solutions would be designed and implemented, and be a part of this (r)evolution!

[…] recent study from HfS Research shows that half the clients consider looking for another outsourcing provider or insource part of […]

There is no way to ensure vendor selection for outsourcing is always correct. So some churn is therefore natural. Greater transparency on the part of the client regarding outcomes expected and their own directions for future helps the vendor in providing better service. There should be an effort from both sides to assess in advance whether the vendor is in a position to meet these and what steps are being taken to overcome the gap. Continuous interaction and reviews will enable corrective action is taken from both sides and surprises at the end will come down.

Rajeev Lal

These are truly valuable insights.

No-one should be surprised as two characteristics are clear.

Firstly: Buyers are using RFPs to drive down costs with the result that many vendors are seeing single digit margins on core services. Consequently when buyers seek innovation they have not paid for, out come the change orders.

Secondly: I am seeing vendors buying headline revenue with no real control over risks and margin.

Both these characteristics are born from short-termism. Deals are being struck that later give both parties cause for regret.

Give a thought to consolidation of providers, an end to end view to outsourcing vs fragmented operations, move towards business outcome and domain expertise. But are buyers ready to take the pain of a shift. I believe contracts will get renewed with new terms and conditions but may not change providers. Let’s watch this.

These data is eye opener and publish on a right time. This is the time for reassess the things which might be the cause of these study.

I tell my team to spend a lot of their time trying to “imagine themselves in the shoes of the customer.” But, even with the best of intentions, we can still fall flat. What’s usually missing is a way to make it personal – to find a deep connection to our customers – revealing something of value about common beliefs that people can relate to and embrace.

In B2B, it’s sometimes tougher to find ways to make connections that are so passionate and personal, when the buyers of our technology and services aren’t necessarily the final consumers of the solution or the work experiences it supports. So, does it make sense to invest in ways to connect to the end users, the knowledge workers themselves?

The answer is – yes. In order to maintain outsourcing relationships, service providers need to focus on their customers’ wants and needs to deliver innovative solutions that really improve efficiencies and simplify how their work gets done. Without this focus, I believe that certain providers will continue to put outsourcing partnerships at risk.

Clients need to establish whether they should be outsourcing or offshoring in the first place and whether they have the temperament for the process.

Then,with expert help they need to negotiate better outsourcing contracts from inception and take into account the embedded value in outsourcing arrangements within the context of a trackable set of metrics and a legally binding formula for splitting this value with the outsourcing company.

Expert help should include a specialist outsourcing lawyer.

What typically happens is that clients rather like lovesick teenagers are rather too quick to “elope to Gretna Green ” and get “married” only to discover that things are not all they are cracked up to be.

Too often they are seduced by sales spiel,look only at the costs they choose to look at and lack the faintest idea about how to evaluate a proposition placed in front of them.

“Walking away” is fine and dandy but the costs that this involves including the potential for lost customers,reputational risk and escape of IP must be looked at much earlier.

John Gelmini

The only times when clients were on eye height was when an experienced and independent advisor was broking and strictly managing the deal. No hordes of sales people from various providers were allowed to approach the customer during RFP and downselection phase – acting against these rules excluded the provider from the process.

I am really surprised to see this “lovesick teenager behaviour” still happening here in UK. I perceive the UK (and US) Outsourcing market much more advanced in all terms, including mistakes already made, but few lessons learned?

Now the NOA has set up the next generation of education; they are offering Outsourcing education and professional certification already since 5 years, so why is all this still happening? Sales psychology? Blinded by numbers?

Carola Copland

“Lovesick teenager behavior” – I just love that. We should make that an outsourcing acronym like “Six Sigma” or “Black Belt.” Ummm . . . maybe not and not very politically correct. You have the “lovesick syndrome.” Buyers in my vertical, publishing, are often so naive, you just have to wonder what they are thinking. Buyers and teenagers is, unfortunately, what we often see far too often. Some buyers seem to be looking for the “knight in shining armor” to rescue them, like some fairly tale. I have seen very smart US publishers make the most catastrophic decisions about outsourcing with an offshore provider that I just can not begin to tell you about them. Impulsive, reactive, no strategy–the list just goes on. Honestly, my take is that providers should be much more realistic about what is and is not possible with off shoring work, and just speak straight without selling. This is often all about marketing. “We can do this, but we can not do that in the short a period of time.” Easier said than done, no doubt.

Jim

One of the areas we have deliberately built within Outsource Reality is our offshore team of Indian nationals. They have all run major business units for the likes of IBM and TCS and fully understand the differences in successfully running offshore contracts from some of the very average operations understanding local languages, cultures, management styles, attrition, etc.

We make them available to all out clients whether for one off supplier/contract selection, remedial operations or regular benchmarking and reviews.

Working with our onshore teams, we have the capability to support our clients throughout the offshore process to ensure successful results for all concerned.

David White

Reflecting on what has been posted in this blog, written in the industrial press and elsewhere one may safely conclude that – we have seen for some considerable time procurement activities outsourced and offshored typically in the name of cost reduction.

How well that has and is being done is clearly a moot point. As John Gelmini points out above businesses need to establish whether they should be outsourcing or off-shoring in the first place. Added to which they need to reflect on whether they have the ‘temperament’ for the process. Very good point John.

This is further muddied by the fact that many people still confuse outsourcing with off-shoring seeing the two processes as inseparable – despite the fact that much of the work that is outsourced never leaves its country of origin.

The fact that people use outsourcing and off-shoring interchangeably, becomes even more ridiculous when one sees the same confusion between in-sourcing and on-shoring. That said and given the degree to which outsourcing has been coupled with off-shoring this confusion is understandable.

However the business community will not see it that way. For example if a bank were to in-source its call centres from India back the home country, even here the lines are blurred despite the fact that this bank might be bringing the jobs back to the UK. Why, because they might well bring the work back and then hand the work to UK service providers. Ironically in the past many of the jobs outsourced to service providers have subsequently been off-shored by the outsourced service provider – that’s how they make their money.

So all-in-all people in business who wish to outsource need to have a very clear idea of what it is they are doing; they need to educate themselves about the PO market; and they need to find a good service provider with demonstrable credentials who will work with them to achieve a successful outcome.

Gerard Chick

[…] services that add real value to the front-office is the Holy Grail for many buyers. With half of today’s outsourcing contracts potentially up for grabs, those providers with genuine platform plays are in pole position to pick off legacy outsourcing […]

[…] can bemoan for days the struggles so many outsourcing clients are going through trying to achieve value beyond cost, however, the happy reality of today’s outsourcing business, is that most services buyers are […]

[…] seeing this happening in many situations, where too many service buyers are feeling burned and want a different type of relationship. […]

[…] fundamentals up front creates larger problems in the long run. Perhaps this is part of the reason so few BPO customers are happy with the services they are […]

[…] in that order). All of these trends sound valuable and value-adding. Why then, are so many BPO clients unhappy with this array of benefits they are supposedly […]