Time running out for legacy Big 4?

Nothing has disrupted the cozy status quo of big enterprise technology transformations more than GenAI. It has been a true leveler across the industry where suddenly everyone is operating on a level playing field, trying to convince the world they have a better GenAI story than their competitors.

Up until November 30th, 2022, the Big 4 consultants dined on the ineptitude of large enterprises to move bad processes into the cloud, while the Indian heritage outsourcers fed on the tasty scraps of supplying armies of low-wage talent at scale to keep these hulking institutions somehow functioning.

The legacy software companies sold their licenses through these services firms to maintain the flow of insane amounts of money and maintain the veneer of competence as these clunking enterprises kept up with the latest versions of SAP, Oracle, Workday, and Salesforce, with smatterings of UiPath bots to knit together broken workflows and poorly integrated systems.

And to cap it off, the hyperscalers profited from everyone as they sought to force a cloud narrative for CIOs to desperately follow to sound credible. In short, everyone has been on the enterprise technology gravy train, and it’s taken a genuinely credible new technology that business leaders can understand to redirect the train.

As Henry Hill famously said in the classic movie Goodfellas: “We ran everything. We paid off cops. We paid off lawyers. We paid off judges. Everybody had their hands out. Everything was for the taking. And now it’s all over.”

Our industry has been equalized, and a new set of winners are going to emerge

A senior partner in a Big 4 consulting org literally declared to a major enterprise leader this past week: “GenAI is just another technology tool and nothing more”. Many of these (previously) highly respected and handsomely paid consultants have been caught flatfooted and are dismissing GenAI because they don’t understand it and can’t divert extra millions of dollars out of their clients’ budgets to “help” them. The harsh reality is smart clients can smell the bullshit and aren’t going to get burned like they have so many times in the past with consultants wielding shiny new tech. And you only need to look at the sheer scale of layoffs in these firms to comprehend that the gravy train is screeching to a halt.

Net-net enterprise perceptions are changing fast, and our latest pulse survey of 425 global 2000 enterprises shows the Big 4 did no better than other IT and business service providers when rated as strategic partners for emerging technology capabilities.

Why the legacy Big 4 approach and mentality will fail with GenAI

Services partners need to win their clients’ hearts before they can attack their wallets. No one budgeted for GenAI, and two-thirds of major enterprises are still recovering from overspending on bad cloud migrations. However, most ambitious C-Suite leaders are infatuated with the potential of GenAI to make their companies more competitive and improve their own capabilities to be smarter and slicker at their jobs. Partners who understand their clients’ institutional issues and are willing to invest time at no cost to figure out a GenAI roadmap will reap a lot of fruit next year.

Enterprises want to explore solutions that are fast and uncomplex. The big challenge with GenAI is to clean up enterprises’ messy data so they can benefit from the tools. Otherwise, GenAI becomes lipstick looking for a pig. Enterprise leaders want no-nonsense partners which can understand the business context behind their data needs, as opposed to teams of highly expensive technical and domain consultants who’ll charge $2 million just to show up and document the problems.

The winners will be the partners which can quickly understand what needs to be done to fix and scale the data without charging the earth, with the ability to work fast and smart. When you look at the deep institutional relationships the likes of Cognizant, HCL, Infosys, TCS et al. have with their clients, many of whom are into 4th or even 5th-generation contracts, surely these firms have a huge opportunity to convince enterprise leaders to take a risk with them to make the painful changes necessary to capitalize on GenAI tech?

Tech spend is rebounding in 2024, with AI as the main driver. The battle is on to partner with ambitious enterprises

As the HFS Pulse study showed this year, tech spending plummeted from 11% growth in 2022 to barely 2% in 2023. While a lot of the pullback has been a result of difficult economic conditions earlier this year, there has also been a backlash as our research has shown only 32% of enterprises consider they have achieved their strategic priorities with their Cloud investments. Net-net, enterprises are being careful shelling out more millions on new technologies after such heavy disappointment with Cloud.

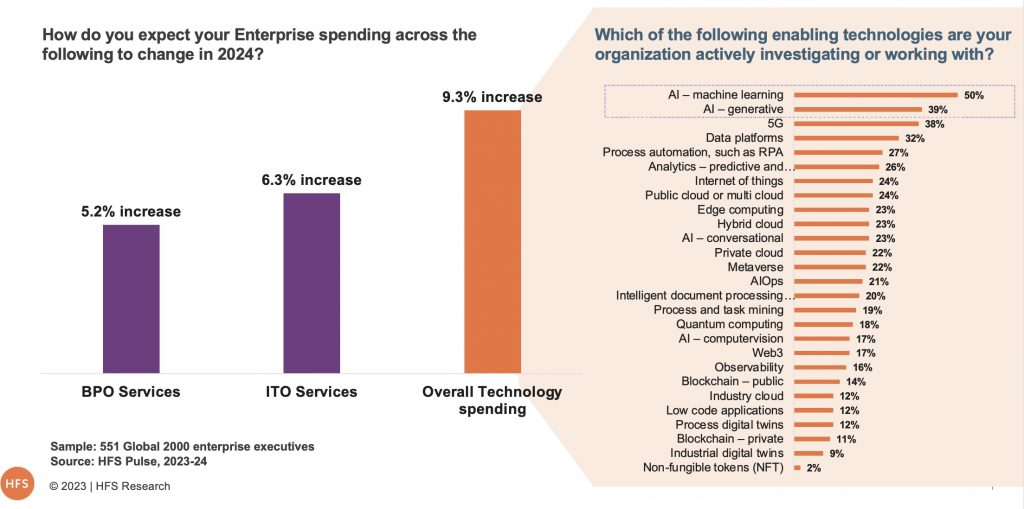

However, the good news is that our latest Pulse data of 600 Global 2000 enterprises reveals 2024 tech budgets are rebounding and the core driver is AI (both Machine Learning and GenAI). So the big question now is which services firms enterprises will choose to partner with to embed GenAI into their data and processes:

AI-driven technology spending is expected to increase by 10% in 2024

The Bottom-line: The old way Big 4 operated is over, and the smart ones are focused on re-winning their clients’ hearts

The Big 4 need to practice what they preach to get back their competitive edge. We have three recommendations for them:

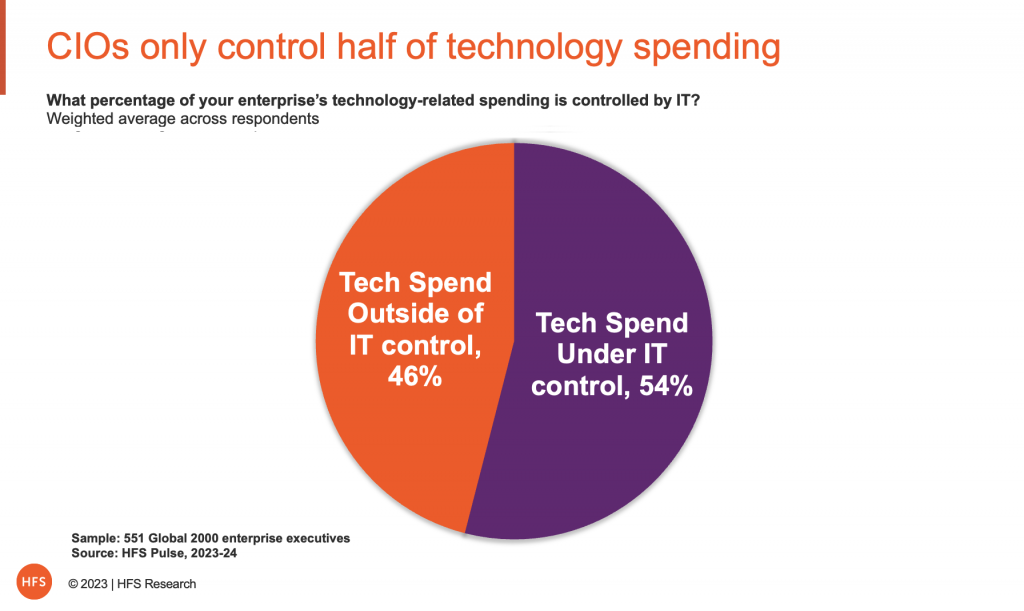

1. Double-down on the business narrative for technologies. The Big 4 have stronger relationships with the business compared to their IT services counterparts (with the exception of Accenture), who continue to struggle beyond the CIO / CTO. Our latest pulse survey indicates that IT controls just about half of the tech-related spending (see graphic below). The other half of the tech spending is with the business – that is where the Big 4 can win with their relationships if they can create a compelling business narrative for emerging technologies. They need to simplify technology, not complicate it. Make it solve business problems and make it easy to use and adopt!

2. Align advisory with managed services to create real value. The days of charging top dollar for slick PowerPoint decks are gone. The Big 4 need to get their hands dirty and be a part of the solution. In fact, managed services can protect the advisory business. Firms with operational relationships with clients can make the case for end-to-end services relationships. Managed services and ongoing operational relationships offer client stickiness and prevent client defections. The Big 4 should structure services around some elements of risk, trust, and compliance. This can also include LLM model evaluation and monitoring for Gen AI. Establish trust as a core value and marketing principle for managed services. This approach aligns with their branding and is presently not fully exploited by the competition.

3. Move beyond hourly consulting fees to performance and purpose-driven pricing. We don’t see clients paying $500-an-hour rate for advice at scale for long. The continued problem with consulting is the lack of skin in the game. But this is possibly the hardest challenge facing the Big 4 with a partner-led model where each partner thinks of their book of business, and while there is a lot of money for scoring the goal, there is no incentive for passing the ball. Managed services provide a foundation to shift away from a time-and-materials model, but this requires a fundamental transformation of the Big 4 operating model. EY tried to change things with Project Everest (splitting its audit and consulting business), but its legacy audit partners voted it down… too afraid to change their traditional model.

Posted in : Analytics and Big Data, Artificial Intelligence, Buyers' Sourcing Best Practices, Consulting, GenAI, Generative Enterprise, Global Business Services, IT Outsourcing / IT Services, Outsourcing Advisors, Sourcing Change Management