The banking and financial services sector remains the largest market for IT and business process services and is generally regarded as one of the most aggressive in terms of emerging tech adoption. However, do not confuse the spend and the adoption with digital transformation. So much of what gets done in established banks and capital markets firms is all about care and feeding of some of the largest and most complex tech stacks and business processes in the world. As with the rest of the planet, the pandemic exposed the lack of digital transformation achieved by established financial services firms.

Many subsegments of the financial services sector were 100% certain they were digitally transformed pre-pandemic. It took a global crisis to lay bare the precise lack of connectivity between glossy front-end customer engagement interfaces and the myriad of aging back-office systems that actually run financial services firms. The post-pandemic imperative is rapid modernization across all BFS subsectors, with implicit cloudification and digital optimization to connect the front to back. This is only achievable with a collaborative ecosystem approach. This is where service provider partners came up big during the pandemic.

Our BFS practice lead, Elena Christopher, weighs in to share the results of our 2021 Banking and Financial Services research on the leading service providers specialized in supporting BFS customers.

Elena, what did you learn?

Well, aside from a searing validation of the myth of digital transformation in BFS markets, the pandemic served as the ultimate reality check of what happens when digital CX is not linked to the back office and employee and partner enablement. This pursuit of the OneOffice yielded three core study themes around context, collaboration, and creativity.

- Context. The pandemic ultimately helped BFS firms and their service partners prioritize their transformation needs with leading priorities centering around payments modernization, core banking transformation, and enhanced digital experiences for its customers. In all cases, the cloudification of legacy or migrating applications to platform solutions increasingly offered as managed services enabled the transformation. Digital enablers such as Triple-A Trifecta tech (automation, AI, and analytics) are increasingly embedded in engagements as native enablers rather than as engagements in their own right. This is transformation contextualized for BFS.

- Collaboration. You can’t achieve contextual transformation alone—at least not at pace or with guaranteed success. IT and business process service providers are critical partners to help BFS firms on their change journeys. Part of their value is their ability to help curate partnerships and form collaborative ecosystems of services expertise, technologies, hyperscale cloud capabilities, and industry expertise. It is this collaboration across partnerships and ecosystems that fosters exponential speed and value.

- Creativity. Driving differentiation as a provider of IT and business process services to the BFS sector is hard work. It’s a highly competitive, crowded market, often ruled by incumbents. Its strong sourcing culture is perhaps over-focused on the best deal rather than the best outcomes. Aside from table stakes investments in offerings, talent, and tech, providers are getting creative with commercial and engagement models such as modernized managed services offerings. They are also finding digital whitespace in neglected corners of the BFS market, such as wealth management, retirement, commercial banking, and capital market front-office capabilities.

Which service providers are really helping BFS enterprises make an impact?

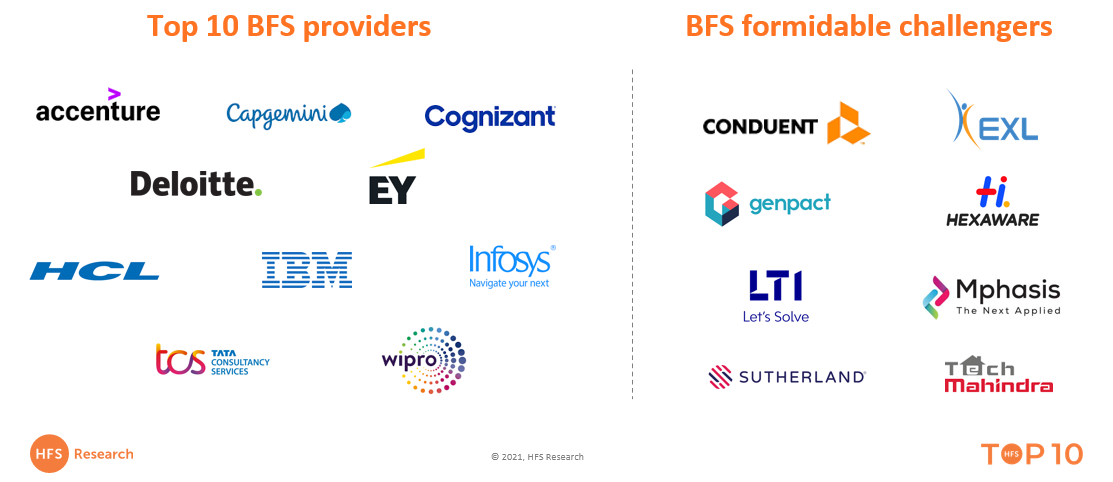

For the BFS study, we assessed 18 service providers who specialize in industry-specific services across banking and financial services value chain. We opted to break the results into two reports:

- The 2021 HFS Top 10: Banking and Financial Services—The Best of the Best Service Providers report examines the capabilities of the ten largest service providers to BFS clients. These providers have full value chain coverage across banking and capital markets, revenue of $1.5B+ and 20,000+ BFS-dedicated headcount. Enterprises assessing providers should think of this lot as your end-to-end transformation partners.

- The 2021 HFS Market Analysis: Banking and Financial Services Formidable Challengers report features eight IT and business process service providers offering differentiated approaches to meeting the industry-specific needs of banking and financial services clients. They may not be as large as the firms featured in the BFS Top 10, but they routinely punch above their weight delivering contextual transformation enabled by deep subdomain process expertise and enviable applied technology capabilities. Enterprises assessing providers should think of this group as specialists.

For the Top 10, we assessed 10 service providers across execution, innovation, OneOffice alignment, and voice of the customer criteria. The top five leaders are 1. Infosys, 2. TCS, 3. Accenture, 4. Wipro, and 5. HCL. These leaders’ shared characteristics include deep industry expertise across BFS subsegments combined with strong consulting, design, and IT and business process expertise, continued identifiable investments and growth in their BFS businesses, strong cultures of innovation, deep and ever-evolving third-party partnerships, internal OneOffice alignment enabling a comprehensive external approach with clients, the ability to deliver business outcomes, and exceptional customer experience.

Some specific call-outs on the BFS Top 10 leaderboard:

- Infosys secured the #1 position overall, successfully defending its title from 2019. What helped Infosys prevail across our four evaluation pillars was essentially continued investment and refinement of its capabilities leading to notable new client wins, deal expansion, and ultimately customers reaping the benefits of business outcomes. We specifically took note of its growth throughout the pandemic, ongoing investment in onshore and nearshore regional operations, big deal wins – most notable of which is Vanguard retirement, but complemented by wins with regional and mid-tier banks like Indiana-based Old National.

- TCS grabbed the #2 spot overall, driven by a commanding performance in Execution and OneOffice alignment. We took note of its sustained growth during the pandemic, regional investment like its roll-out of Pace Port innovation centers, and its continued focus on selling beyond the CIOs’ office.

- Accenture nabbed the #3 spot overall led by its top innovation performance and top three performance in Execution and OneOffice. What stood out for us was its strong investment in IP, notably its myIndustry offerings for BFS, clear connective tissue between its big investments in cloud and how that helps BFS clients, and one of the best partner ecosystems.

- Wipro’s continued investment in its BFS capabilities, including its recent mega-acquisition of Capco, helped it secure the #1 position in growth, #2 spot in strategy and vision, and the #2 spot in depth and breadth of capabilities.

- Cognizant secured the #5 position in strategy and vision, buoyed by strong investments in leadership and enhanced capabilities. Its customers also came through, recognizing its progress moving from IT provider to strategic partner, scoring it the #4 slot.

- IBM scored the #2 spot for scale, driven by its global footprint and capabilities. Its ongoing investments in innovation helped it score well across the board, ranking it no lower than #4 in any innovation categories and #3 overall. It Banking and Financial Markets group formalized an array of powerful services capabilities around core banking, payments, digital banking transformation, capital markets, intelligent security, risk, and compliance. Oh yeah and cloud.

- HCL secured the #2 position in co-innovation and collaboration, driven by its continued commitment to partnership beyond the contract. The firm also landed the #3 spot in growth.

- EY, a new addition to this year’s study, fared well across the board, securing a top-five position in execution and leading VOC.

For the Formidable Challengers report, we assessed eight service providers across execution, innovation, OneOffice alignment, and voice of the customer criteria. The top three leaders are:

Details on notable performances from our BFS Formidable Challengers include:

- Genpact was our #1 Formidable Challenger for BFS services. The firm shored up its BFS leadership in its consumer banking segment with strong hires from within the industry. This is driving renewed focus and growth, including geographic expansion with some recent UK and Europe wins under its belt. The acquisition of Rightpoint and consolidation of design and experience assets under the Rightpoint brand are driving effective tip of the spear transformation engagements. HFS notes the continued investment in new and improved CORA for banking assets and its cloud transformation capabilities that contemplate process reinvention. It also has notable strength in financial crimes compliance.

- Mphasis earned the #2 spot for Formidable Challengers driven by its unbroken growth streak despite the pandemic, putting up 13% growth year over year. About 80% of new deals are sourced proactively, and its average big deal size has more than doubled. Its new pandemic-driven offering is NextOps, a framework for reimagining digital operations. Mphasis recently opened a nearshore center in the UK to expand its footprint in the local region for its BFS business.

- Tech Mahindra secured the #3 slot for Formidable Challengers. While TechM is a $5B company, its BFS business is smaller than its TWITCH competitors’, allowing it to retain a certain nimbleness. Strategic M&A has been a strong growth lever for TechM, with several design-focused acquisitions boosting digital CX and design capabilities and a payments business to bolster its platform capabilities. It launched new offerings spurred by the pandemic, such as video-KYC and mobile customer on-boarding. TechM’s BFS growth is largely through expansion within existing accounts, often supported by co-innovation initiatives and funds.

- EXL and Sutherland secured the #1 and #2 spots in Voice of the Customer, underscoring the close ties these BPO-led firms have cultivated with their clients.

- LTI made it into the top three for Execution led by its supercharged growth and strong depth and breadth of capabilities across the BFS value chain.

We always go deep on Voice of the Customer to round out our research. Any notable take-aways here, Elena?

In a nutshell, BFS firms pick their service partners based on execution criteria, not innovation potential. This needs to change.

We did deep-dive interviews with over 50 BFS firms as part of our VOC research for this study. We observed that BFS firms select their providers based on execution-oriented criteria such as delivery quality, array of services, and industry and domain expertise rather than leading with innovation criteria such as advisory, digital expertise, automation, or partnership ecosystem. Downstream in the relationship, when assessing satisfaction, BFS firms have the highest levels of satisfaction with execution, while innovation capabilities leave something to be desired. If BFS firms want to get real about transformation and results, they need to prioritize innovation as part of the perfect partner capabilities mix.

Click here to access the full reports folks:

- The 2021 HFS Top 10: Banking and Financial Services—The Best of the Best Service Providers

- The 2021 HFS Market Analysis: Banking and Financial Services Formidable Challengers

Posted in : Banking, BFSI, Digital Transformation, OneOffice