Thanks to all of you who took the time to complete our recent poll of the financial crisis and its impact on the outsourcing strategies of financial institutions. Below is a snippet of the findings:

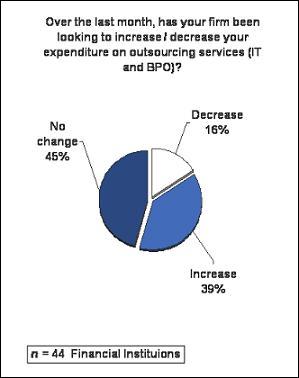

* Only 16% of financial institutions surveyed have actively sought to pull-back their outsourcing expenditure plans, while 39% are now looking to increase expenditure in light of recent events

* Only 16% of financial institutions surveyed have actively sought to pull-back their outsourcing expenditure plans, while 39% are now looking to increase expenditure in light of recent events

* 45% have not made any changes to their planned outsourcing expenditure on ITO and BPO services

When we delve deeper into the data, it's the major US banks which are clearly the most aggressive with ramping-up their plans to pursue outsourcing strategies. The main service-lines where they are focusing are banking-specific BPO services, application outsourcing, IT infrastructure outsourcing and Finance and accounting BPO. Insurance companies also stated a strong focus on adopting insurance-specific BPO services in a 6-12 month period.

Service lines not being so aggressively pursued are primarily HR outsourcing and IT staff augmentation projects. More thoughts to follow.

Many thanks to the folks at Global Services Media for their help in sending the survey to its readership.

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, HR Outsourcing, IT Outsourcing / IT Services

What will be interesting to see is how companies balance their desire for increased outsourcing activites with the short term need to reduce or control spending. Will companies cut back on using expert advisors (while at the same time they are laying off the very staff needed to run their internal initiatives)? Will there be increased pressure to reduce one time expenses such as transition costs? How will companies achieve this and how will outsourcing providers react?

Hi Morgan,

There will be pressure to avoid large transition costs moving into engagements. I predict we are going to see a number of smaller-sized engagements to begin with, in addition to a few new large global engagements where the winning providers streamline much of the initial costs over the duration of the deal.

This is providing a great opportunity for advisors – project costs of $1m-2m to manage outsourcing deals are not going to be a major issue when you consider the size of the tasks at hand. The larger project costs to help with M&A are going to be challenged, but when you consider the size of some of these M&A deals, the banks will have little choice but to spend the money – especially with the brokerage / bank mergers,

Phil