HFS research has found that the average time for a bank to onboard a new commercial customer is 32 days. Not hours. DAYS. The rapid and often real-time digital interactions and journeys enjoyed in the retail banking domain have not permeated the commercial banking realm – despite the fact that commercial clients are typically banks’ highest-value clients.

As commercial banks strive to meet the broad B2B needs of small and medium enterprises, commercial clients, and corporates, they need to seriously up their digital game. This means something totally different and far more complex in the B2B arena. A sexy app does not win the day in commercial banking. Commercial banks must balance foundational modernization initiatives between practical platform solutions and custom builds—all in the name of enabling 360 visibility of working capital and real-time everything. Service provider partners have a critical role to play in enabling this future reality.

Who are the best service providers for commercial banks?

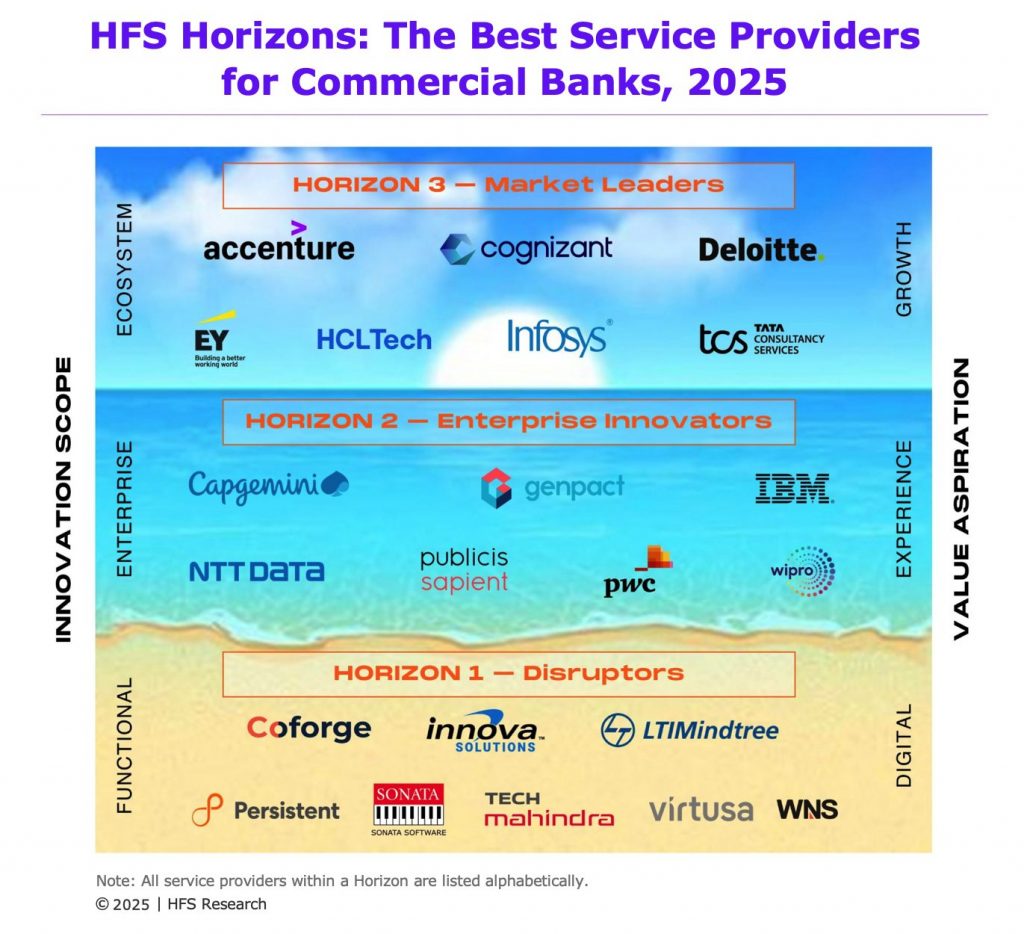

HFS conducted a deep-dive Horizons Study into the needs of commercial banks and the best IT and business process service providers to support them.: HFS Horizons: The Best Service Providers for Commercial Banks, 2025. This report evaluates the capabilities of 22 service providers across the HFS commercial banking value chain based on a range of dimensions to understand the why, what, how, and so what of their service offerings. It assesses how well service providers are helping their commercial banking clients worldwide embrace innovation and realize value across three distinct Horizons: Horizon 1, optimization through functional digital change; Horizon 2, experience through end-to-end enterprise transformation; and Horizon 3, growth through ecosystem transformation (Exhibit 1).

Exhibit 1: The HFS Horizons model helps commercial banks pick their service providers based on desired outcomes

We assessed these 22 service providers across their value propositions (the why), execution and innovation capabilities (the what), go-to-market strategy (the how), and market impact criteria (the so what). The seven (7) Horizon 3 market leaders are Accenture, Cognizant, Deloitte, EY, HCLTech, Infosys, and TCS in alphabetical order. These service providers have demonstrated their ability to support commercial banks across the journey—from functional digital transformation through enterprise-wide modernization to creating new value through ecosystems. Their shared characteristics include deep industry expertise across the commercial banking value chain, a full-service approach across consulting, IT, and operations, a strong focus on innovation internally and externally with partners, co-innovation with clients and partners, and proven impact and outcomes with commercial banking clients around the world. While these seven firms prevailed as Horizon 3 market leaders, we underscore the fact that there is value to be had at each horizon based on the needs and desired outcomes of commercial banking clients.

Key trends in commercial banking – change is hard and expensive

The enterprises and service providers interviewed for this study painted a clear picture of a market in need of modernization but mired in extenuating circumstances that impact budgets and solution extensibility. HFS notes three major trend themes:

- Macroeconomic mixed bag. Inflation and high interest rates have yielded good news/bad news scenarios in commercial banking. The good news has been that there was money to be made in the first rising interest rate economy in the past 15+ years. However, volumes were down as the cost of loans was high. Combine this with the steep competition for deposits, which forced commercial banks to offer attractive interest rates, thinning their net interest margins.

- CX in commercial banking is unique. Retail banking CX is flashy B2C. In commercial banking, it’s a B2B paradigm that requires 365x24x7 capital clarity. Commercial clients want simplified, connected access and straight-through transactions. Banks are meeting this need by balancing digitalization with personalized service—using digital tools to enhance in-person interactions, enable self-service, and deliver best-in-class onboarding among others. The 2025 wish list includes 360 liquidity across banks and real-time everything.

- Build AND buy to modernize. No commercial bank wants to build a custom or highly customized lending platform for treasury or trade finance among other functions. Witness the rise of COTS (commercial off-the-shelf) in commercial banking. However, for modernization needs—where there is no easy platform upgrade—commercial banks are building various digital, API-enabled solutions to extend the functionality of legacy systems that are not ready to be retired.

What commercial banks want from service providers

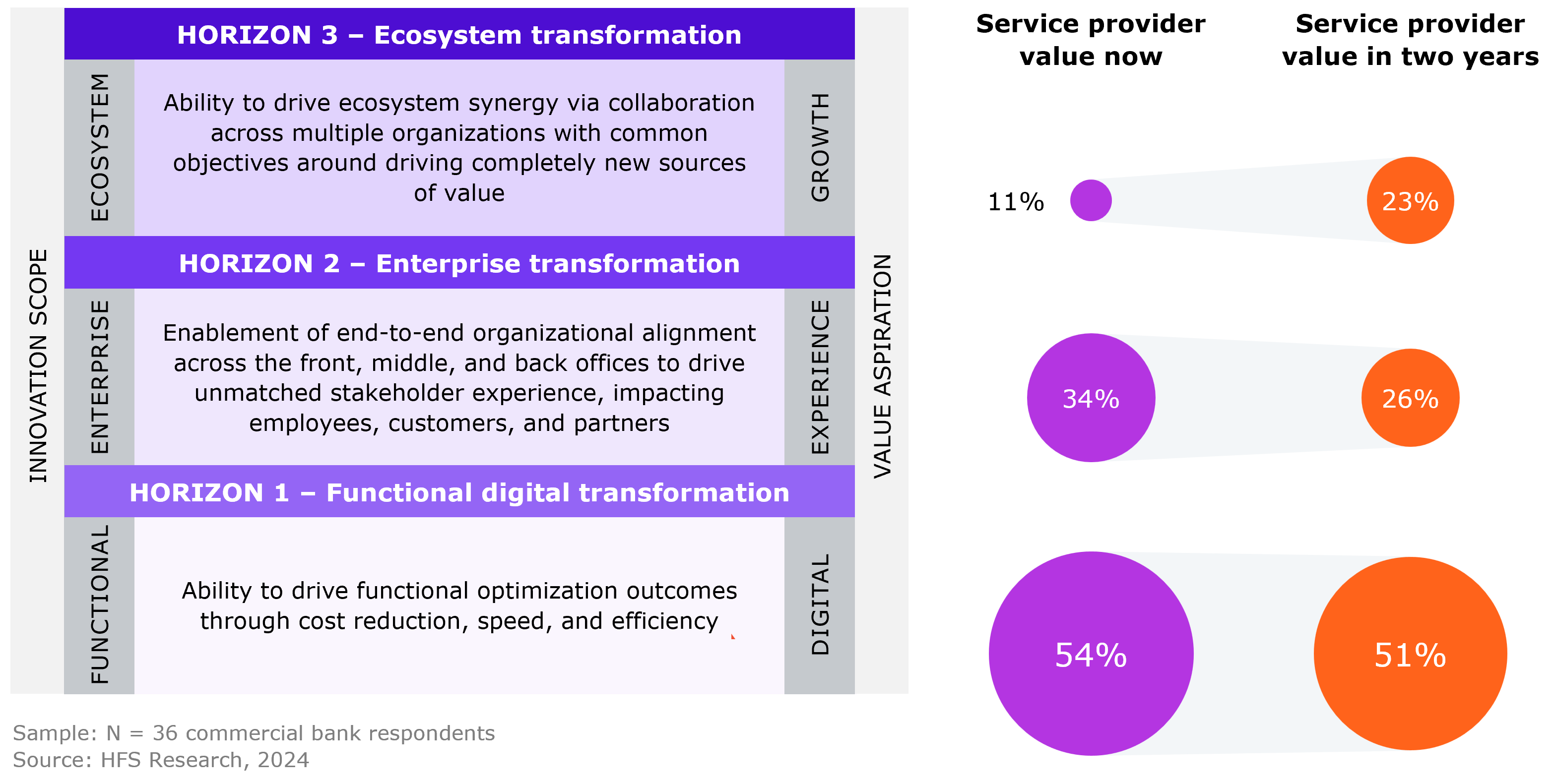

The HFS Horizons model aligns closely with enterprise maturity. We asked commercial banking leaders interviewed as references for this study to comment on the primary value their IT and business service provider partners deliver today and are expected to deliver in two years. Respondents indicated that the primary value realized today is largely Horizon 1—functional digital transformation focused on digital and optimization outcomes (54%). In two years, the focus will continue on digital and optimization outcomes (51%), as the industry strengthens its digital hygiene to better serve large customers while also expanding to effectively cater to small and medium enterprise (SME) clients (Exhibit 2).

About a third of commercial banks are currently tapping their service providers to support enterprise transformation (34%). While modernization needs abound, this focus will be downplayed in 2025. The biggest value shift in the next two years is to Horizon 3 initiatives. Commercial banks want to leverage their modernization initiatives to help them expand their footprint and increase their relevance to commercial customers with broader liquidity offerings, non-banking services, and other ecosystem plays. Commercial banks must choose their partners based on the value they seek; incumbents may be the convenient choice, but they must demonstrate updated and relevant value.

Exhibit 2: Commercial banks prioritize improving digital hygiene to reduce costs, improve operations, and elevate customer experience

How service providers are meeting the needs of commercial banks

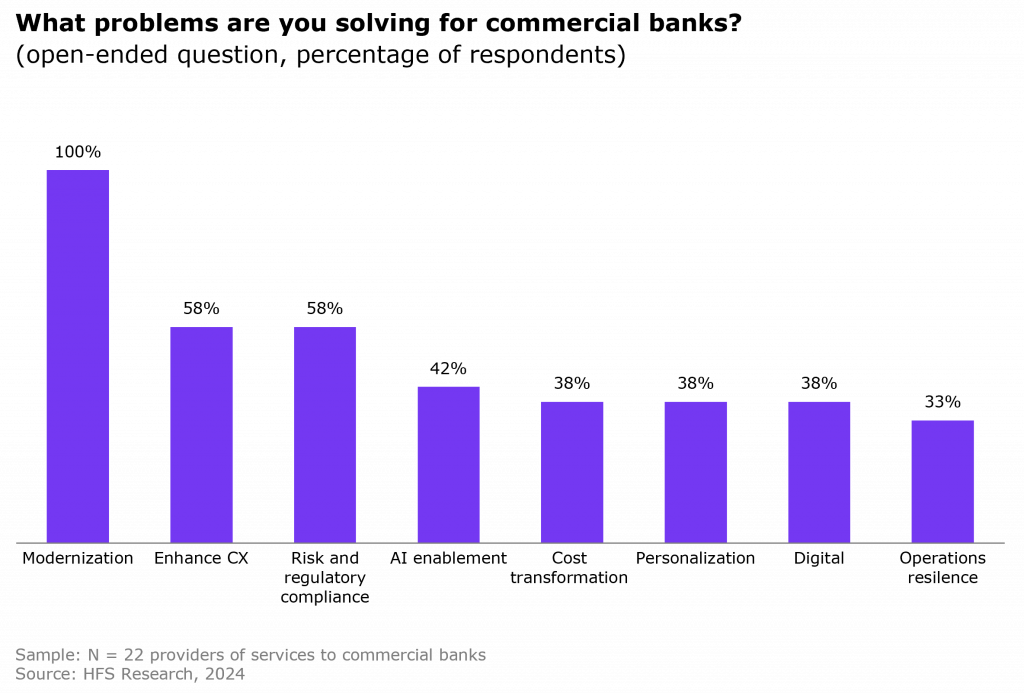

As commercial banks evolve and mature across the Horizons, service providers are on point to support these ever-changing needs. In our study, we found strong alignment between commercial banks’ digital and modernization initiatives (Horizons 1 and 2, respectively) and the fastest-growing service offerings from providers. Modernization, CX, and risk and regulatory compliance ranked as the top solutions meeting the needs of commercial banks (Exhibit 3). Modernization initiatives take many forms, but there is a strong focus on platform implementations for functions such as commercial lending and trade finance. CX in commercial banking is a B2B focus and requires more than great interactions—it includes elements such as faster customer onboarding, real-time payments, better cash management to enable real-time liquidity views, and faster credit decisions for lending. Enhanced customer onboarding was a top case study, as were nCino implementations for lending modernization. Risk and regulatory compliance is perpetual, and there’s still work to be done on optimizing these functions, particularly with AI. We’ll see what the incoming American federal government administration has in store for regulations in 2025.

Exhibit 3. Service providers’ top commercial banking offerings

The Bottom Line: Modernization is essential for commercial banking success in 2025

Commercial banking customers want digital experience: Commercial banks own the high-value relationships within their firms, but they must play catch-up with their retail banking siblings, shifting from manual processes and a people-led engagement running on legacy tech to seriously up their digital CX game. The competition is intense, with commercial clients diversifying their relationships across banking institutions and non-bank lenders and nimble fintechs gaining ground. Congruent priorities around customer experience, new business models, and enablement of better business transactions necessitate modernization to secure each bank’s future—goals that commercial banks can achieve with the help of their service provider partners.

HFS subscribers can download the report here

Posted in : Banking, Buyers' Sourcing Best Practices, Cloud, Commercial Banking, Customer Experience, customer-experience-management, Financial Services Sourcing Strategies, Fincrime, HFS Horizons