Apple’s pivot to shift its US iPhone manufacturing from China to India by 2026 isn’t just significant—it’s monumental, and it’s happening at warp speed for such a huge manufacturing shift.

This also signifies the deepening links between the US and India as these global trade wars gather pace. Apple is expected to create over 600,000 new jobs in India through its supplier ecosystem and also help fund its broader $500 billion investment plan in the U.S., strengthening its dual commitment to global resilience and domestic innovation.

The impact of geopolitics at the core of Apple’s move

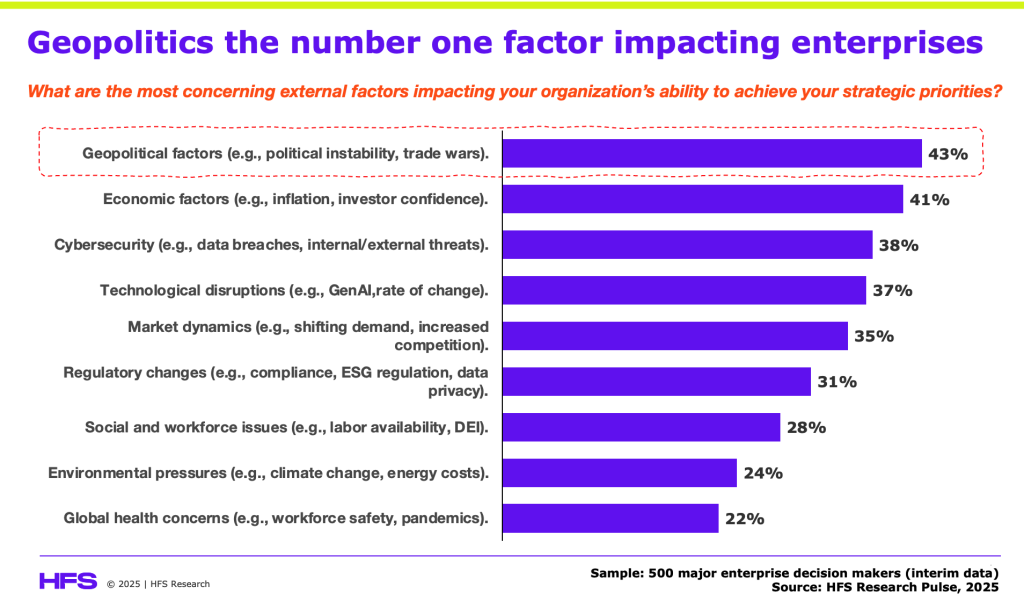

Think about it: we’re witnessing the strategic decoupling of one of the world’s largest tech titans from its longstanding reliance on China, driven by geopolitical tensions, tariffs, and a desire to insulate against future disruptions. This isn’t just supply chain optimization; this is Apple’s full-throated acknowledgment that geopolitical risk is now the primary disruptor of global tech, as revealed in our current HFS Pulse research covering the dynamics of Global 2000 enterprises:

Let’s not underestimate the size of this operation. One million workers in China are involved in the manufacturing of iPhones through Apple’s suppliers, notably Foxconn and Pegatron. Specifically, Foxconn’s Zhengzhou Technology Park, often referred to as “iPhone City,” employs around 350,000 workers dedicated to iPhone production. Additionally, Foxconn’s Longhua Science and Technology Park in Shenzhen employs between 230,000 and 450,000 workers, many of whom are engaged in assembling Apple products, including iPhones. These figures underscore the extensive labor force required to meet global iPhone demand and highlight the significant role China has played in Apple’s manufacturing operations.

India becoming the “New China”?

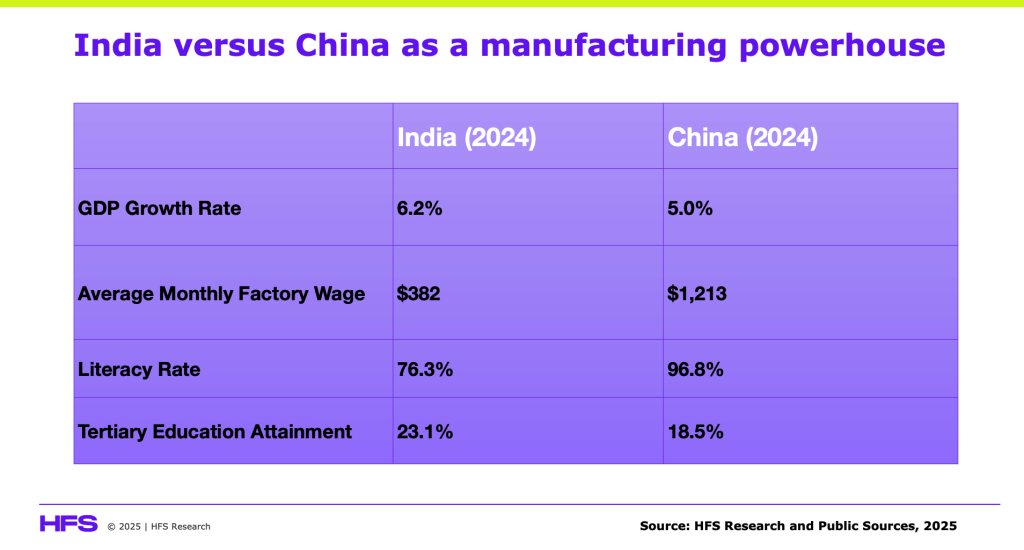

This strategic realignment underscores a broader trend: India emerging as a viable, large-scale manufacturing alternative to China. But let’s be clear—this isn’t simply about swapping flags on factories. India’s ambitions to become a global tech manufacturing hub are clear, yet the journey won’t be without friction. Production costs remain higher, infrastructure still poses major challenges, and the complexity of achieving quality and scale comparable to China is significant.

India is increasingly being dubbed the “New China” for several compelling reasons. Firstly, its demographic advantage—characterized by a young, skilled, and abundant workforce—provides a sustainable competitive edge. Secondly, the Indian government has rolled out aggressive policy measures, including tax incentives, streamlined regulations, substantial infrastructure investments to attract all the global tech companies, and a huge expansion of the Global 2000 into Indian cities, with 1.6 million Indians being employed in global capability centers. HFS estimates over 2.7 million people will occupy India’s GCCs by the end of 2026, which could top 4 million staff by 2029

With approximately 248 million students enrolled in over 1.47 million schools, India offers a massive future labor pool. Moreover, India’s commitment to digital transformation and innovation, supported by a vibrant tech ecosystem, positions it as an attractive destination for high-value manufacturing:

Bottom line: We’re arrived at a defining moment in India’s future as the world’s emerging manufacturing/tech powerhouse

Apple’s decision sends a resounding signal. It validates India’s potential and puts a bright spotlight on the Indian government’s proactive stance on incentivizing tech investment. This move could catalyze an industry-wide rethink about supply chain resilience, shifting the narrative from cost-driven globalization to geopolitically-driven diversification.

Challenges will be inevitable, but Apple’s bold move to India is undeniably a bellwether. Other tech hardware giants watching from the sidelines will inevitably reconsider their strategies. Apple’s India pivot isn’t just strategic—it’s transformative, reshaping the tech supply chain landscape profoundly and permanently.

This also raises the debate over $500 billion Apple has declared to be invested in advanced manufacturing in the US over the next four years to support Apple Intelligence with domestic workforce expansion, education initiatives, and datacenter expansion. If effective, we will end up with a cohesive US/Indo global operation that powers 1.4 billion iPhone users.

Posted in : Artificial Intelligence, GCCs, Politics