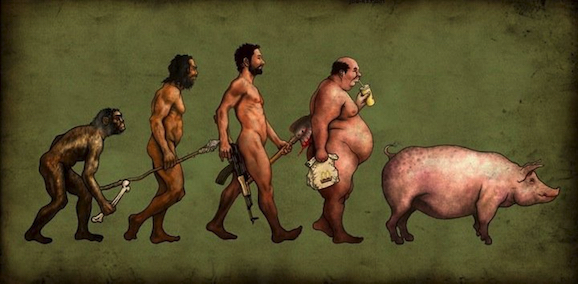

What are we becoming?

Each year, most of the service providers like to bring together their multifarious assortment of “influencers” to pitch their capabilities, reinforce their strategies and make sure their key executives have some sort of relationship with the key people in their space who talk to their clients.

Having been in and around the analyst and consultant community for the last 20 years, these gatherings were typically 90% attended by industry analysts, namely Gartner, Forrester, IDC et al and a few small boutiques, independents, bloggers etc who mattered to them. Then, about five years ago, most the service providers had the bright idea of tacking on a handful of sourcing advisors who could also benefit from the same experience of being influenced. All of a sudden, these events have become about 60% advisor, 40% analysts. I think only Accenture and IBM are the only service providers left which actually separate the analysts from the advisors these days.

As a recent example of this, I had the privilege of attending Capgemini’s influencer day in an arctic Chicago last week. And I was impressed at the line up of legends attending from the sourcing advisory world – characters like Peter Allen (Alvarez & Marsal), Harvey Gluckman (ISG), Kevin Parikh (Avasant), Chip Wagner (Alsbridge), Peter Bendor-Samuel (Everest), Tom Torlone (PwC) – all accompanied by teams from their advisory firms. I have to hand it to Capgemini’s advisor relations team – no-one has ever assembled a gaggle of advisors together in one place quite like they managed. I then popped into WNS’ influencer day in New York and a similar line up ensued there… with additional SWAT teams from KPMG and Deloitte adding to the festivities.

This change in dynamics is having the following impact on the way these service providers interact with their influencers:

Pros

Much better questioning from advisors. It’s almost a relief to hear sensible, real-world questions from advisors during these sessions. Long gone are those days when you’d get analysts piping in with their drawn-out abstract thought-patterns, which actually were never really supposed to be questions, more statements of how clever they were.

Advisors are much more social. Most the advisors like to network – even with their competitors. Always good to exchange views with (some) them over a glass of wine. Most analysts just disappear to their hotel rooms at 8.30pm, never to resurface.

Advisors have more energy and passion. Most of the advisors enjoy what they do – they are passionate about services and are hungry to learn more. Most of the analysts have been doing this for decades, are clearly jaded and exhausted by these dog n’ pony shows, and are just going through the motions these days.

Cons

Advisors have become quasi-competitive with most service providers. As the outsourcing service providers look to move further up the value-chain with their client engagements, they are essentially offering the same services as most the advisors. All I hear from the leading advisory firms, today, are how they are running consulting practises in digital transformation, robotic process automation, CFO services, GBS etc. These ambitious advisors want service providers who are only really focused on the efficiency-driven services further down the value stack, so they can profit from the consultative and governance-driven services they can layer on to their clients’ outsourcing engagements. However, the more complex clients’ needs are becoming, the blurrier the line is becoming between what service providers and advisors deliver.

Advisor “influence” is much harder to track. With analysts, the goal for service providers is simple: dazzle them and hope they will write about them to their readerships and social followings. Tracking their influence is easier when there is a tangible outcome, such as a piece of research or a blog post. Most advisors won’t write anything – even with a gun to their heads. The service providers simply hope the advisors are moving them up their evaluation curves and pushing more deals their way.

Most advisors with deep client engagements do not have time for service provider days. Having been on the advisor side myself, I can tell you that I never had the time to take entire days out to hobnob with service providers, unless I had a lucky week of break-time in between client engagements. Most of the advisors who do have the time for these service provider influencer days are clearly the executive-level leaders not so ensconced with the day-to-day execution of advisory services. Hence, the service providers are hoping this bedazzling of the advisor leaders is somehow translating its way to the advisor deal teams doing the site visits, service provider selection sessions etc.

The Bottom-line: The influencer model is clearly broken in the services industry – a new breed clearly needs to emerge that advises, analyzes AND influences

In short, the evolving confusion over advisor and analyst roles is a result of the lack of real influencers in the industry – experts who not only talk to buyers on a daily basis, but also share real insights and leverage data for them. In today’s world, advisors and analysts are very different animals – and the winners will ultimately be the ones which can fuse together the two worlds.

Posted in : Business Process Outsourcing (BPO), HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, Outsourcing Advisors, Social Networking, sourcing-change, Talent in Sourcing

Phil,

Excellent post – and right in line with what I am seeing. The industry is confused, in my view. Providers like dealing more with advisors as the premise is they’ll get them into their deals – it is more tactical and practical. Most analysts are losing relevance, but they still matter and providers need to make sure they cover them well. The bigger issue is the fact that some advisors are in direct competition these days with providers for consulting business – they bid against each other on a client RFP and then find themselves briefing with each other!

The influencer business is in a confused place.

Eric

@Eric – thanks for the kind words. It’s increasingly challenging and obscure for service providers to find precision channels to influence their market. In the old days it was easier – make sure you get mentioned favorably in analyst reports, have a separate strategy to influence the transaction advisors (TPI/EquaTerra) and that was enough. Service provider executives were much more engaged with the research and the analysts. Today, I have sat through these briefings and can tell you that barely none of these executives are reading research anymore – it’s all about deals and clients. Many of the analysts are facing an uphill battle in services to stay relevant – and remain in the conversation. On the flip side, I see many advisors I know rarely ever talk to buyers, so providers investing hours of their executive time trying to influence them, is a complete waste of time. Personally, I think we are approaching the age of the “hybrid” influencer who can pivot between buyer conversations, influencing the market through research and insights, and have excellent trusting relationships with the key service provider and technology executives who matter…

PF

Excellent blog, Phil! I would say that many advisors are like the new analysts. The conversations and the cooperation between advisors and service providers is often more engaging and more tied to actual deals and clients. However I agree with your conclusion that there needs to be more of a mix between the two,

Ramesh

Phil – very nicely written. My take is we’ve reached a point of co-opetition where service providers know they will need advisors for some deals, while on others they may be competing for the same business. So it’s quite simple for service providers – they just need to reach the entire advisor/analyst community with the same message.

Where this breaks down, in my view, is the different roles analysts and advisors play. Good analysts (should) provide more of a strategic conversation where the provider can ask for more advice, help, validation etc. With advisors, the service providers do not want to show any weaknesses or challenges as they need to be thinking about sales pursuits with them, not strategy etc. This is why some of the service providers still prefer to separate the analyst and advisor audience – it’s a different type of conversation for each of them.

I don’t see a perfect answer to this – end of the day, it’s up to each service provider how they want to address their influence channels, and having analysts and advisors together may be killing two bird with one stone for many,

Paul Smith

Great article Phil with some really insightful comments. That said there is a world of experience and an abundance of ideas outside the continental US. Love to hear your views on the RoW in this context.

Gerard

@Gerard – everyone’s an analyst these days 🙂 The broader discussion here is who is really “influencing” services buyers. My take is several of the legacy analysts (names not being mentioned here) have lost relevance and the foci is shifting more to relationships, and less about research (where the research is bland / not really being read by anyone). Most service provider executives today really do not care much for turgid report libraries and market sizing data. Advisors provide a good relationship channel for services firms, whether they are quasi-competitive or not, which is why they are not very much part of the influencer equation. And to answer your question about ROw, a similar trend is happening in UK and Australia… I expect continental Europe and other regions to follow this path.

PF

Phil’s spot on here. It’s become a relationship business. Providers like advisors who get them into deals and analysts who are smart and do good research. Then there are the analysts providers feel forced to have a relationship with creating the odd mix at some of these events.

@anon – good name! Yes, the “forced” analyst relationships seems to drag on =)

PF

you may have missed something fundamental, Phil. Practitioners are the new influencers, or the new “black” so to speak. If you believe, as i do, that the brains of the industry are for the most part the guys and gals making change in corporations, not those of us sitting on the sidelines, then the whole map changes. Some of them are pretty good analysts, because they assemble and then test the data. And the referencing tom-toms are even stronger than those of our friends in the advisory community. So what’s your take?

@Debs – I agree there are some superstars on the client side – and most smart providers wheel some of these folks out at their events (both Capgemini and WNS did a really nice job showcasing their clients, for example). And we both make huge efforts to get these conquistadors of change to come to our summits.

So I would applaud your comment here that providers should reel in more of the star client practitioners to these influencer sessions. Problem we have is these people are hard to entice out of their corporate battlegrounds and put pen to paper, voice to microphone. Most industry events only seem to attract junior folks, or ones looking for their next job. So while they SHOULD be influencing, they aren’t being leveraged effectively to do it…

And (as we both know only too well) these people are rare breeds… but they need more love, more enticement to get their views out to market. I will take on your challenge to reel more of these folks out soon,

PF

Phil,

i think you have really nailed it in terms of these sharp observations around how the Influencer community is evolving (may, mutating) along with the disruptive changes in the Sourcing market and types of deals. The neat categories have blurred into a shape-shifting sort of ecosystem where Thought Leadership/Original Research/PoVs, client access, transformational expertise, and social media impact, are more important labels than whether you are an Analyst, Advisor, or a Consultant. Your firm in itself is a live example of this.

Btw, good to see the positive feedback about the Capgemini event!

Phil,

Influence is a complex ecosystem & becoming more so, but I’m not sure there’s anything particularly new in your observations. As you observe, the trend to including advisors in analyst days started some years ago, and I’ve seen the same thing happening in my patch (APJ) over that time. I would agree with your supposition that traditional service providers such as Accenture & IBM have tended to separate themselves more from this process, but the barriers are breaking down.

From my observations in this part of the world – and I know you’ve recently spent time in India – the Indian service providers have largely driven this trend, at least in APJ. There could be a number of reasons for this – including economies of scale & the fact that they are really predisposed to networking – but I would argue that they are less interested in delineating the the differences in influence & market impact.

“Traditional” service providers have generally seen advisors as competitors, while the more recent entrants have tended to see them as an aid to market. Without being too simplistic, advisors generally want to tap into deal-flow, while analysts want to evaluate & assess the market on an ongoing basis. So the objectives & outcomes are different, even though both types of influencers can impact a purchasing decision in different ways. And what they want to know varies, depending on where they’re at in their individual continuums.

Individual vendors & service providers will continue to define their influence ecosystems in ways that you & I may not agree with – from an analyst and AR perspective. But we both have to work with that. One of the most concerning trends I have observed in recent years is analyst/advisor relations managers being KPI’d on deals influenced/won – this is obviously an unachievable metric because there are so many other variables involved.

When I read through your “Pros” & “Cons” I could both agree & disagree with you on pretty much every point, from the perspective of an individual analyst. Business models are important in the influence game, but they’re not the only thing, and that’s why it’s important we don’t pigeonhole influence types. As you know yourself, a brand without insight/knowledge really doesn’t have any influence. And individual subject matter experts can have a big impact, even if they don’t have a global brand attached.

Long answer to a complex issue.

But to sum it up – horses for courses!

cheers,

Dave

@Arun – love the fact you’re looking at the impact of the influencer, rather than the label of analyst/advisor etc. Really amazing job (with Lisa) lining up all those heavyweights in Chicago, mate!

Drop by Boston soon,

PF

@Dave – thanks for your thoughtful comments. Arun Kumar (one of the most active advisor relations professionals in the market) sums it up pretty well when he says “Thought Leadership/Original Research/PoVs, client access, transformational expertise, and social media impact, are more important labels than whether you are an Analyst, Advisor, or a Consultant”.

I would have to disagree that this is “nothing new”, it’s a real sea-change in how service providers are viewing their influencer relationships. I know from first hand conversations that several are finally questioning the impact of several legacy analyst firms, whose only audience is the sell-side, whose analysts are years out of touch with reality – and display no passion or excitement for the future of the industry. They want impact ‘analysts’, people who put out research that is relevant, easy to access, reaches the buyers… and changes the conversation. Analysts aren’t dying, it’s merely the old guard which refuses to change the model, which is driving the service providers to invest more time in other sources of influence, such as advisors and the emerging breed of “2.0” analysts.

What’s happened is that the fading analysts are no longer influencing clients – and the providers know it. Advisors are helping to fill that void, as they at least bring a conversation to the table and actually talk to buyers. And while there is some quasi-competition going on, the smart providers know they are better off having that relationship and working with these advisors. There’s no “secret sauce” here – it really is all about relationships.

The Indian-heritage SPs have done an incredible job exploiting the advisor channel, especially as their offerings have traditionally so complimentary to a consultative advisor, however, they are now entering into a competitive dynamic as they start to push more aggressively with more consultative offerings in areas like digital transformation, robotic automation and CFO services. With the likes of IBM and Capgemini now investing in more aggressive advisor relationship strategies, this tide of influence is definitely turning…

PF

Phil;

There’s a new entrant in this world of influencer. To be fair, this source has always been in play, but not as influential as today.

Restructuring consultants are capturing the C-suite and Board attention around change agenda for their Clients … painting pictures of new business models with dramatic adjustment to the cost footprint of today. When asked “How?” these new business models will be achieved, those management consulting firms commonly refer to the ITO/BPO industry as a source of ready transformational help.

This contrasts materially with the past when the Supply Chain folks would turn, out of necessity, to a sourcing advisor for help in understanding the market and contracting terms for the black art of outsourcing. Supply Chain recognized the need for specialist insight and commonly called for help.

Today, the strategies that require sourcing considerations are being drive top-down more often than ever before. Management Consultants are in the room, and rarely do they ask for help.

That said, it’s rare to see the core Management Consulting firms (you know their names) make the investment to truly understand the industry and how it works. It’s all rather convenient to say that substantial change to a business model will come through a contracting action with an ITO/BPO provider.

Peter

Phil,

As always an intriguing read !!!

A lot has been spoken about ‘relationship’ in the posts so has it narrowed down only to the relationships which the advisor and service provider share and everything else has taken a back seat particularly with reference to one of your replies which states “foci is shifting more to relationships, and less about research”.

If that is the case, wouldn’t the credibility of the influencers be at stake for the buy side ?

@Arush – I would argue it’s more about buyer-engagement that purely relationships. Research is important if the end-customer is reading it / influenced by it. However, the research needs to be combined with real buy-side client engagement – simply churning out libraries of content is not having nearly as much impact as a few years’ ago. A research firm needs to be driving its research to the buyer through community (social / events etc), through analyst engagement (strategy sessions/ inquiry etc), through blogs/ social media. Problem today is most the research firms produce content libraries that are not reaching the buyer at all – they are pandering to the vendor communities, and most analysts do not talk to buyers (unless forced). Most advisors are much more engaged with the buyers. It’s as simple as that…

PF

@Peter – agree – if there are specialists out there who can convince buyers to “saw off” their legacy to take advantage of new generation service models, then they need to be top of the influencer list!

PF

@ Phil, thanks for the reply.

Completely agree when you say that most of the research firms are just ‘pandering’ to the vendor community and I am sure, if not today definitely tomorrow they will lose the influencing power they wield and their ability to drive deals at buy side.

[…] Are sourcing advisors really the new analysts? […]