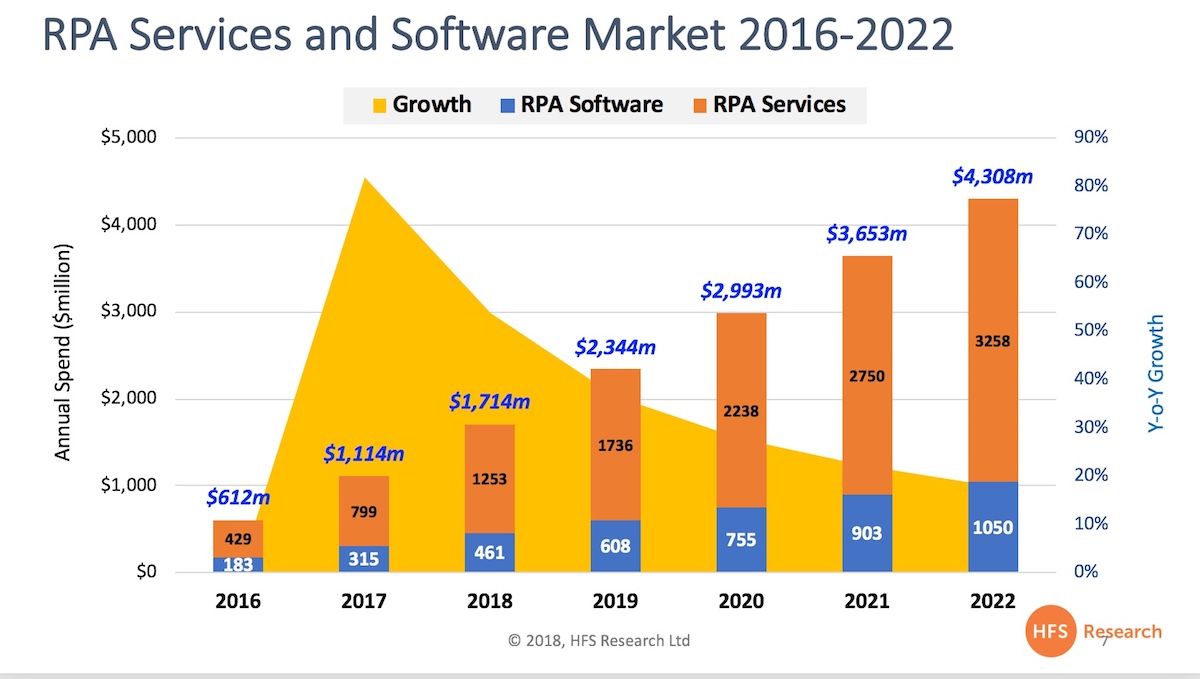

Well… it’s been quite a 2018 in the fantasy world of RPA (RPA plus RDA), where some of the fantasy dollars have magically become real, as the market hit $1.7bn – an increase of $250m from our forecast last year. So when the more conservative of forecasters (HFS) undershoots the market by 17%, you know RPA has been sneaking down the growth hormones of late.

So why is RPA growing above initial analyst estimates?

- RPA vendors, in particularly UiPath and Automation Anywhere (AA), have been able to recognize more revenues than expected. Bots licenses are being sold and deployed faster than we envisaged, due to effective training programs and aggressive support from third-party services firms;

- The slowdown in new business process outsourcing engagements is driving more focus from enterprises in discrete strategies to drive efficiencies and digitize processes (and encourage more bots plus humans engagements);

- The shift in the focus of RPA from job elimination to augmenting talent, digitizing processes and extending the life of legacy IT systems has increased the appetite of operations executives to fast-track RPA training programs and invest in broader intelligent automation strategies – even though most enterprises are still in the “tinkering phase”;

- The initial adoption of “attended RPA”, which makes up the majority of RPA and RDA engagements currently in play will eventually drive more “unattended RPA” where the increased value will be created and genuine alignment between RPA models proving to be a gateway to broader AI engagements;

- The ramp up from service providers and consultants to support enterprise adoption has continued unabated, especially with the flattening of outsourcing investments and the waning interest in Global Business Services models. This reliance on third parties has proven to be a key dynamic behind the growth in RPA as solution providers prefer to sell through the services channel for larger enterprise deals and accelerate client training and development. The strong focus from the likes of Accenture, Capgemini, Deloitte, EY and KPMG has given the RPA market immense credibility;

- Rapid funding of RPA vendors (in addition to rapid revenue growth) has encouraged these longer-term investments of many enterprises previously skeptical of investing in very small software boutiques. Largest examples have been AA and UiPath, attaining capital investment rounds as high as $250/$300m, but also some lesser-known niche RPA tools firms, such as Softomotive, which recently had a $25m investment round announced;

- Increased focus from major ERP / orchestration software vendors with Pega’s acquisition of Openspan and SAP’s first foray into RPA adding Contextor.

Click on each chart to enlarge

RPA Definition:

Example use-case: automating invoice processing across multiple business applications handling rule-based exceptions. RPA is different from traditional automation software as it is inherently capable of recognizing and adapting to deviations in data or exceptions when confronted by large volumes of data. In effect, it can be intelligently trained to analyze large amounts of data from software processes and translate them to triggers for new actions, responses, and communication with other systems. RPA describes a software development toolkit that allows non-engineers to quickly create software robots (known commonly as “bots”) to automate rules-driven business processes. At the core, an RPA system imitates human interventions that interact with internal IT systems. It is a non-invasive application that requires minimum integration with the existing IT setup; delivering productivity by replacing human effort to complete the task. Any company which has labor-intensive processes, where people are performing high-volume, highly transactional process functions, will boost their capabilities and save money and time with robotic process automation. Much for RPA is self-triggered (bots pass tasks to humans), but requires human intervention for judgment-intensive tasks and robust human governance and to make changes / improvements.

Similarly, RPA offers enough advantage to companies which operate with very few people or shortage of labor. Both situations offer a welcome opportunity to save on cost as well as streamline the resource allocation by deploying automation. The direct services market includes implementation and consulting services focused on building RPA capabilities within an organization. It does not include wider operational services like BPO, which may include RPA becoming increasingly embedded in its delivery.

RDA Definition:

In addition to RPA, the other software toolset which comprises the emergence of enterprise robotics software is termed RDA (Robotic Desktop Automation). Together with RPA, RDA will help drive the market for enterprise robotic software towards $2.3bn in software and services expenditure in 2019 (with close to three-quarters tied to the services element of strategy, design, transformation and implementation of enterprise robotics). HfS’ new estimates are for the total enterprise robotics software and services market to surpass $4.3 billion by 2022 as a compound growth rate of 40%.

Example use-case: automating transfer of data from one system to another. RDA is essentially surface automation, where desktop screens (whether desktop-based, web-based, cloud-based) are “scraped”, scripted and re-programmed to create the automation of data across systems. A well-designed RDA solution can automate workflows on several levels, specifically: application layer; storage layer; OS layer and network layer. Workflow automation on these layers requires equally specific technologies but provides advantages of efficiency, reliability, performance and responsiveness. Much of this automation needs to be attended by humans as the automation is triggered by humans(humans pass tasks to bots), as data inputs are not always predictable or uniform, but adaptation of smart Machine Learning techniques can reduce the amount of human attendance over time and improve the intelligence of these automated processes. Similarly to RPA, RDA requires human intervention for judgment-intensive tasks and robust human governance and to make changes / improvements.

The Bottom-Line: Automation and AI have a significant part to play in engineering a touchless and intelligent OneOffice

However which way we spin “digital”, the name of the game is about enterprises responding to customer needs as and when they occur, and these customers are increasingly wanting to interact with companies without physical interaction. Moreover, the onus is moving to the most successful digital enterprises being able to anticipate the needs of their customers even before they occur, by accessing data outside of the enterprise across the supply chain, or economic and market data that can help predict changes in the market, or emerging offering that customers will want to purchase.

This means manual interventions must be eliminated, data sets converged and process chains broadened and digitized to cater for the customer. Hence, entire supply chains need to be designed to meet these outcomes and engage with all the stakeholders to service customers seamlessly and effectively. There is no silver bullet to achieve this, but there is emerging technology available to design processes faster, cheaper and smarter with desired outcomes in mind. The concept was pretty much the same with business process reengineering two+ decades ago, but the difference today is we have emerging tech available to do the real data engineering that is necessary: However, if these firms rest on their laurels, this market dominance will be short lived. Once the digital baseline is created, enterprises need to create more intelligent bots to perform more sophisticated tasks than repetitive data and process loops. Basic digital is about responding to clients as those needs occur, while true OneOffice is where enterprises need to anticipate customer needs before they happen (see below). This means having unattended and attended interactions with data sources both inside and outside of the enterprise, such as macroeconomic data, compliance issues, competitive intel, geopolitcal issues, supply chain issues etc.

In short, every siloed dataset restricts the analytical insight that makes process owners strategic contributors to the business. You can’t create value – or transform a business operation – without converged, real-time data. Digitally-driven organizations must create a Digital Underbelly to support the front office by automating manual processes, digitizing manual documents to create converged datasets, and embracing the cloud in a way that enables genuine scalability and security for a digital organization. Organizations simply cannot be effective with a digital strategy without automating processes intelligently – forget all the hype around robotics and jobs going away, this is about making processes run digitally so smart organizations can grow their digital businesses and create new work and opportunities. This is where RPA and RDA adds most value today… however, as more processes become digitized, the more value we can glean from cognitive applications that feed off data patterns to help orchestrate more intelligent, broader process chains that link the front to the back office. In our view, as these solutions mature, we’ll see a real convergence of analytics, RPA and cognitive solutions as intelligent data orchestration becomes the true lifeblood – and currency – for organizations.

Do take some time to read the HfS Trifecta to understand the real enmeshing of automation, analytics and AI.

Posted in : intelligent-automation, OneOffice, Robotic Process Automation

Great overall update and insight. Thanks Phil ! ,Thanks Jamie . You saved me lot of hours of searching and reading. (…no way at all you guys will be somehow robotized in the near future)

Yes, RPA market is growing rapidly as everyone is looking for automation. There are 3-4 product companies Ruling Uipath , automation anywhere and blueprism and on Services and RPA consulting side ALTEN Calsoft labs and similar ones are helping customes to identify which are the right set of products for their oraganizations.

Though the data of $4.4 billion is massive. Huge amount of money can be made by RPA product and services ompanies.