“Ten years ago, my CEO asked me to drive efficiencies through offshore outsourcing, now he’s asking me to make them through automation”, declared the CFO of a major corporation at the recent NASSCOM event in India.

“Ten years ago, my CEO asked me to drive efficiencies through offshore outsourcing, now he’s asking me to make them through automation”, declared the CFO of a major corporation at the recent NASSCOM event in India.

This pretty much sums up where we are as a global services industry. We’re embarking on the next phase of productivity, and that means we have to incorporate it into our contracts and prepare to invest in the future model, not merely perpetuate the old one.

Service Providers invested in the old FTE model and it worked, now they need to make new investments in As-a-Service delivery

It’s not completely dissimilar to the old “lift and shift” FTE-centric deals of 5+ years ago, where providers would invest in the short term costs of client transitions, and spread the investments out over a 5-7 year contract to make the deal offer immediate attractive cost-saving gains for clients. Yes, they were making their first steps to becoming insurance firms for their clients, which is even more the case today, where the risks are higher and the savings more challenging to generate. However, if today’s service providers fail to develop scalable As-a-Service delivery platforms they can replicate across clients for the future, they will likely get replaced by other service providers in the future, which have made the investments necessary to provide more automated delivery, better data – and consequently more intelligent operating talent.

OK – the legacy FTE deals were less risky, so long as you could deliver up the lower cost people and shift the work to them without any major blow-ups. The modern deals require providers to find additional margin by automating processes effectively, converting freed-up effort into lower operating costs and also redeploying available talent on higher value collaborative activities. In other words, the old model was all about hard savings from direct labor swapping, the As-a-Service model is about a combination of smarter labor provision and genuine process transformation through better technology (i.e. soft savings).

It’s higher risk to avoid making the necessary investments – extinction could beckon for many

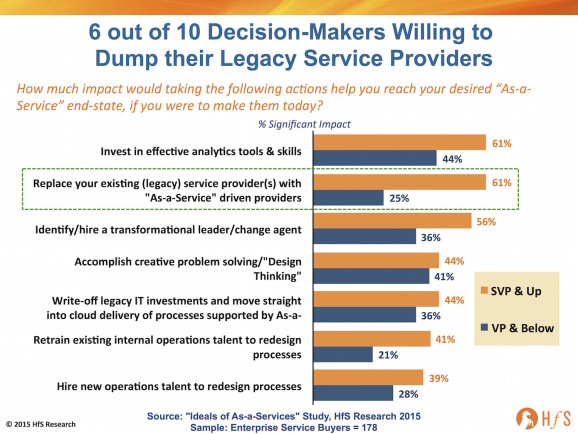

As the following graphic clearly illustrates, from our recent As-a-Service study covering 178 major buyers of services, if the major decision makers (SVPs and above) fail to see real As-a-Service progress made by their existing service providers, six-out-of-ten believe replacing their services providers would have a significant impact smoothing their progress towards their desired As-a-Service end-state.

While their more junior subordinates clearly do not view replacing their service providers as having such a drastic impact (25%), the frustration at the senior levels from providers’ failed promises and lack of progress to invest beyond the legacy model is abundantly clear:

This isn’t about like-for-like body-swapping, this is about removing menial transactional work and redeploying people resources into areas of higher value-add to clients. This is what real “transformation” (sorry, I said it) is about – spreading workloads across talent pools effectively, by leveraging smarter automation, SaaS-based process standards and training talent to work more collaboratively and intelligently.

The Bottom-line: Most service providers are not structured for success…. and the problem lies at the top

There are a lot of client RFIs on the market that are increasingly complex, but aren’t as attractive to providers as the juicy scale deals of the past, requiring a determined effort from the provider to cobble together the right resources and expertise to take them on effectively. Sadly, many of today’s service providers are simply not structured in the right way to take on more integrated / As-a-Service-type deals. At HfS, we are seeing some of the legacy service providers turn up their noses at these deals because they simply cannot break down the barriers internally to bid effectively for them. They are geared up for the dwindling legacy deals, not the new ones that are emerging from the next layer of buyers ready to move into outsourced As-a-Service business models.

In most cases, service providers are too vertically set up, for example, most still have an infrastructure service line, an application service line and a BPO service line – and most have product service lines too (not to mention some legacy vertical industry groups that do not even talk to each other). Each service line still tends to use its own unique contracting, pricing and risk tolerances. In short, client expectations are increasingly becoming much more mature around integrated services, taking the form of As-a-Service models, comprising elements of infrastructure, storage, comms, apps functionality and BPO, optimized around that integration as opposed to discrete components.

The legacy service providers (and those service providers who may not realize they are – actually – legacy) simply don’t know how to price, solution, assess the risk and pull it all together – they can’t, because they simply aren’t set up that way. These problems stem from the leaderships in these providers, where they simply have failed to structure their organizations in a way that can truly deliver As-a-Service. They are slaves to their little fiefdoms of siloed P&Ls, which have dictated strategy over the years.

Without a game-plan to take on integrated deals at lower margins to grow the future platform, many service providers can kiss goodbye to growth. The only route is to invest in smaller deals to build a service delivery platform for future client utility – today’s providers need to develop a 2-3 year plan where they will take on strategic deals at low margin/cost in order to build out the As-a-Service model of the future. Those ignoring this strategy better have a few billion in the bank to make acquisitions down the road, as that will be their only route out of this legacy black-hole into which they currently find themselves sinking.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Sourcing Best Practises, sourcing-change, Talent in Sourcing, The As-a-Service Economy

Completely agree. As-a-service is the economy that is beckoning us. I don’t say it’s the future because it is already here in our regular walks of life as a consumer – be it streaming music, or on demand cabs. And I do see a lot of interest in clients looking at as-a-service for outsourcing. And I see those who can successfully aggregate services will be the winners. The building blocks will be owned by deep specialists who will provide the components (whether cloud based infrastructure, applications or automation tools etc), but the real value will come from aggregators who can seamlessly blend it all together for clients and drive business results. This will thus also require new complex contracting structures for service providers with the component specialists. And clearly new delivery models as well.

We are privileged to be a part of the new emerging world of outsourcing.

Also facing extinction is the VP and below group that is not aligned to senior management and not paying attention to the pace of external change and competition. Risk-averse is the new risk. Those in Do Not Disturb mode will find themselves with unexpected Wake-Up Calls. There is a short supply of talent that can execute in this new level of ambiguity and complexity. Great opportunities for those who can, diminishing returns for those who can’t or won’t.

@Allison: you nailed it: “Risk Averse is the New Risk”. I have been quite alarmed with the number of mid-level managers on the client side, especially in GBS re-orgs, suddenly finding themselves on the job market. This is not a time to be mid-career looking for a job because you were unable to shift gears in your firm. Many people are coming in for a rude awakening – many people in leadership are hearing and seeing what other firms are doing and are under increasing pressure to deliver. The teams under them have to step it up, or face extinction. We’ll look back on this era as the great fleshing out of “transactional” and “value-add” talent…

PF

“The only route is to invest in smaller deals to build a service delivery platform for future client utility – today’s providers need to develop a 2-3 year plan where they will take on strategic deals at low margin/cost in order to build out the As-a-Service model of the future” – This is practically the most valuable and in-your-face blog from HfS. Kudos for the same. Yes, we all need to understand that this disruption is going to see an accelerated rate of change with IoT and AI. System Integrators have 2-3 years to reinvent or perish. Lastly, legal models within monoliths wrt risk is an area I would like to point out. Most SIs have dealt with pure services in the past. A new economy with “As-a-service” requires manufacturing of “Things” as well, as part of service. That’s another wake-up call. Thanks for the same.

Nailed it Phil, again, service providers have to organise to win in this new world.

One point I see on the client-side is the dissonance between SVP+ and VP- willingness to change providers. I see many clients start renewal process with open intentions of switching, only for incumbent service providers to play on the switch risk and give substantial discounts: more “faster, cheaper” but not necessarily “better” – and often lacking tech innovation. The VP- team, procurement-led, find there feet getting colder as the process progresses and take the easy path… Our experience has seen c.10 per cent switching. As a service provider these are tough odds to back when 5/6 businesses are competing for a low win rate. Any thoughts here, Phil?

Somewhere in a galaxy far far away.

Obi-Wan (Sr VP- Jedi shared services) : Master, the trade federation is creating a droid army to continue its focus on battle automation. Some planets are saying that there is no need for Jedi knights and their colourful powerpoint lightsabers.

Master Yoda (CEO) : hmmm.. strong is force I feel with droids. Time to leave powerpoint lighsabers it is. And join the dark side….

Phil, great article. I’ve seen this happening in numerous MSP’s as they are stuck in the siloes that you had mentioned. One area of pain that I see is finding the people that truly understand the XaaS model and how to price, measure outcomes and deliver the expected results to their clients,

Chas

Phil, me old droog, is that picture taken not from “A Clockwork Orange”?

Definitely the lambs, Douglas

Right on point.

In my experience, the premier service providers acknowledge the shift and know that there’s no time to waste in embracing it. For years, they have been struggling with the disconnect between how much it costs to deliver services and what clients are willing to pay – even with offshoring, even with shared services, even with some automation…

There is no small amount of organizational pain to be experienced in going from legacy models to “as-a-service”, to remove the silos and shift the very foundations upon which these businesses have been built. As it impacts every aspect of operations, especially with regards to talent, we’ll see that some areas will be quicker to adapt than others — but the change is happening now.