There has never been a time during the last three decades that the world has seemed less flat…

Thirty years of the Internet and the rapid development of ubiquitous data, coupled with the emergence of developing nations hungry to support bloated greedy corporations, had led us to a place where employment has seamlessly moved to low-cost locations to support these corporations at much lower cost and scale than employing people locally.

Until recently, these corporations primarily favored contracting with third-party outsourcers to deliver this lower-cost work, but we have seen a marked swing toward many of them opting to hire offshore people directly into their own labor forces as part of what they are marketing as “Global Capability Centers.”

However which way we look at this, the basic premise has been the same: moving work to low-cost locations that can rapidly scale up to deliver that work. Whether it is more beneficial to employ people directly in low-cost locations or contract to have them deliver work through third parties isn’t really that important. The big question now is whether these corporations are going to have tariffs imposed for exporting corporate operations outside of the country that could be managed at home.

Suddenly, we find ourselves in a world where moving work around the world carries a lot more risk… and cost

In the past, when economies got tight, and corporates panicked, there was always the constant of sending more IT and process work to India, more manufacturing to China, or more customer support to the Philippines to keep operating costs down and CFOs at bay. However, there is now increasing concern from industry leaders that all their exports of work outside the US will come under the spotlight as the tariff programs get rolled out. The impact would ultimately result in big hikes in costs, which could be as high as the 25% level, considering the current tariffs that are being set. Why stop at Mexico, Canada, China, and the EU?

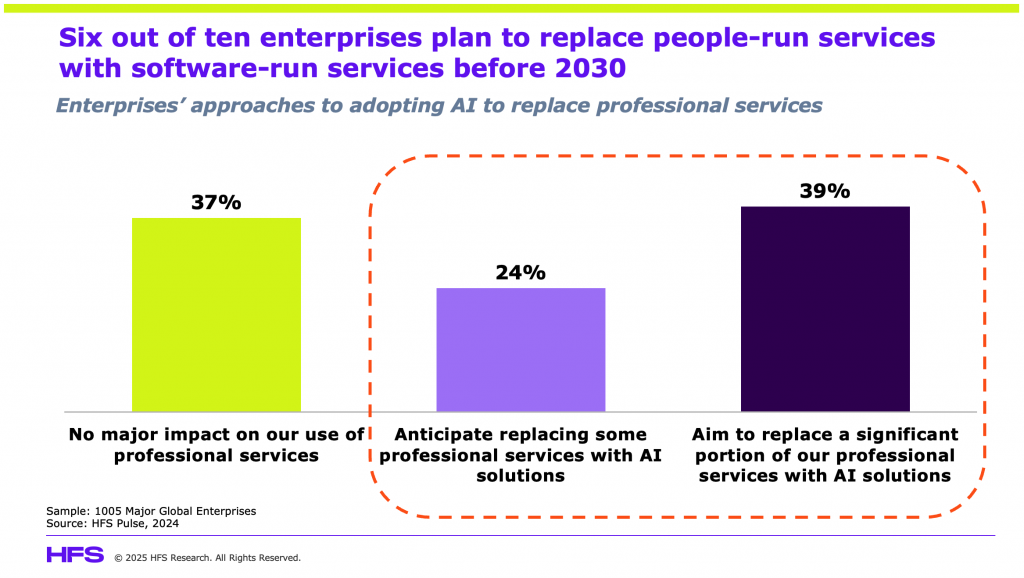

In our view at HFS, this will further drive the focus on AI-first services where increasing amounts of service provision are programmed into software platforms using agentic technology, generative AI, and other AI technologies. As we discussed recently, six out of ten enterprises are already serious about adopting an AI-first approach to professional services, so doesn’t this throw the whole location question out the window as the line between services and software increasingly blurs? If we are going to be buying supercharged agentic humans before long, so will the focus from people scale to outcomes:

We have already projected Services-as-Software presents a $1.5 trillion opportunity for both software and services firms, where enterprises stop buying static technology and people-intensive services and instead consume AI-powered, outcome-driven solutions that continuously evolve and adapt to changing business requirements. What we hadn’t projected were the locations that would benefit from this expenditure.

Why the US services option is becoming increasingly attractive

Already, Apple has announced $500 billion of investments in the US over the next four years as the firm seeks to get ahead of the political move away from globalization and the onset of these prohibitive tariffs. As we have seen with the succession of US-led enterprises renouncing their DEI strategies, surely we are poised for a wave of these corporations promising to move more of their jobs back to the US as they seek to curry favor with the Trump administration and also derisk their services supply chains exposed to global delivery strategies. Manufacturing, logistics, and retail sectors are already either slowing down hiring or shifting workforce priorities due to higher costs of imported goods. It is only a matter of time before other industries heavily reliant on global talent, such as financial services and hi-tech, seriously evaluate the penalties and risks of their globalized business operations.

Another factor to consider is the state of employment in the US, where a recent study from the Federal Reserve Bank of New York reported the widest unemployment gap between new graduates and experienced degree holders since the 1990s. In terms of MBA graduates, Harvard Business School has reported 23% of the 2024 MBA class remained jobless three months after graduation, a significant increase from 10% in 2022, while Wharton, Stanford, MIT, and Kellogg all report double-digit unemployment, well above previous years.

Bottom line: It’s time to brace ourselves as the future of global services may be about to go through some radical changes

Even if currently offshored services increase by ~20%, many will still be significantly cheaper than re-employing onshore as the wage costs are usually 30-70% higher. The short-term impact should be small, but we cannot ignore the longer-term effect, especially for areas requiring skilled workers that can be highly effective when boosted by AI tech. When services that may have required, for example, 100 people in India, can be run with 20 skilled workers onshore, there are both significant geo-political and straight-up business cases to consider. The changing nature of the US workforce supports the possibility of services coming to the US as anxious businesses look to get ahead of global risk and uncertainty. Only a fool would ignore the magnitude of what is happening in our geopolitical landscape.

Posted in : Agentic AI, Artificial Intelligence, Automation, Business Process Outsourcing (BPO), GCCs, GenAI, IT Outsourcing / IT Services, Politics, Sourcing Locations