Some technologies struggle to fulfill their potential and need to be laid to rest. However, there are technologies that simply came into the world before their time because if they are truly capable of delivering real business value, they will eventually find their time and place in the enterprise spotlight.

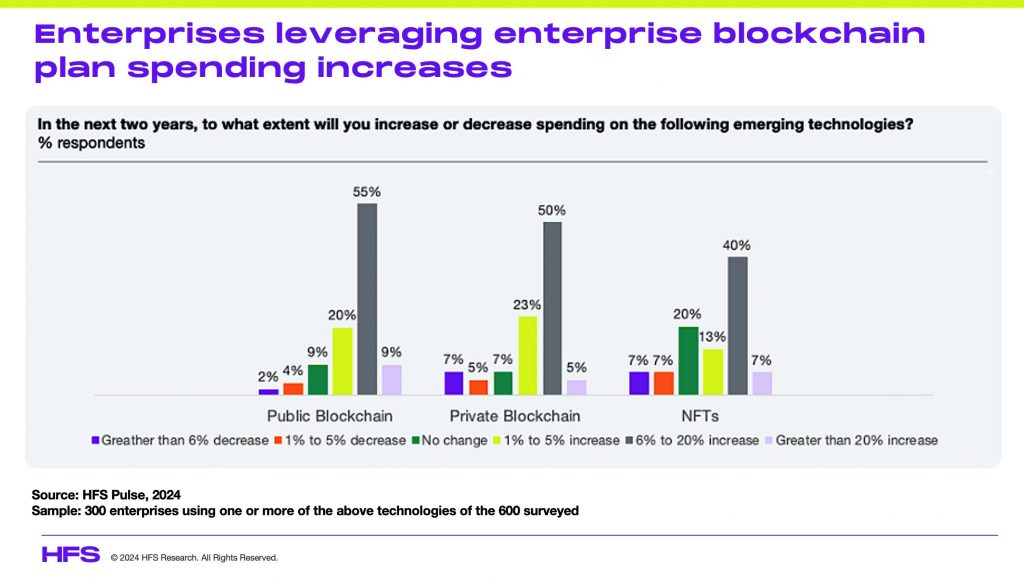

Blockchain was once the shiny object that captivated the tech world, a supposed cure-all that promised to revolutionize everything from finance to food safety. Then came the crash—overhyped promises fizzled, ICOs tanked, and blockchain’s media buzz was silenced except for the speculation around Bitcoin’s value. But guess what? Blockchain isn’t dead. The technology has evolved, grown tougher, and found its niche in critical industries. This is more than just a simple opinion – there’s data to support it. As our HFS Pulse data below reveals, the vast majority of enterprises still using blockchain today plan to increase their spending in the next two years – they wouldn’t do that without experiencing real value:

The Reality Check: Hype is Dead, Blockchain Isn’t

The blockchain hype machine kicked into overdrive around 2017, with headlines screaming about disruption and revolution across industries. Companies scrambled to plaster “blockchain” on every proposal, hoping to ride the wave of optimism. But much of that early enthusiasm was built on shaky foundations. As we pointed out in our infamous Blockchain Bullshit Buster (See our 2018 piece “Is blockchain a giant digital joke?”). Too many businesses leapt in with little understanding of the technology, banking on the promise without considering its practical use cases.

The inevitable happened: projects failed, the ICO bubble burst, and the market came crashing down. The blockchain-is-dead narrative took hold – using blockchain shifted from a badge of honor to one of shame – but it was an oversimplification. The hype died—but the technology didn’t. What came next was an evolution: businesses became smarter about where and how they deployed blockchain, shifting from broad, unrealistic ambitions to specific, high-value applications – all behind closed doors.

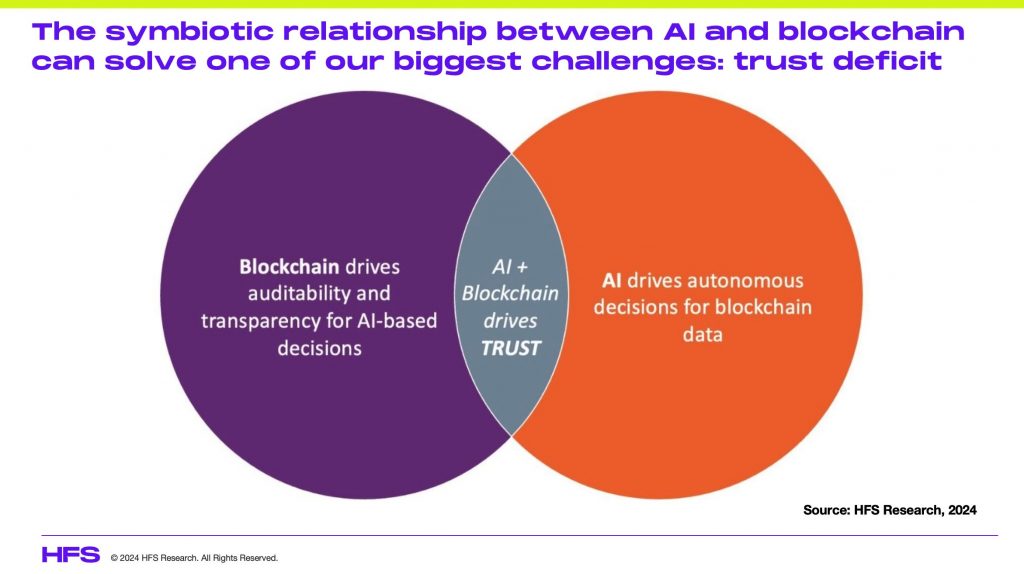

The symbiotic relationship between AI and blockchain can solve one of our biggest challenges: trust deficit

Now we’re almost two years into the GenAI revolution, one of the biggest benefits is the renewal of permission to consider technologies such as blockchain, which lost their way because of trust issues where enterprises simply weren’t prepared to open up their data to new innovative possibilities. Executives were more in fear of getting fired for experimenting with tech than they were in fear of being perceived as rejectors of innovation. AI is changing all of that in many ambitious organizations where C-Suites are challenging their colleagues to embrace a change culture and drive new AI innovation possibilities.

The intersection of AI and blockchain holds incredible potential, particularly in addressing one of society’s biggest challenges: trust. AI’s capabilities to analyze large amounts of blockchain data, paired with blockchain’s decentralized and transparent nature, could significantly reduce the trust deficit between consumers and corporations, as well as citizens and governments. Imagine a world where technology itself fosters greater confidence in systems that have long struggled with credibility issues. However, before we can leverage these advancements to build trust externally, we must first trust the technology itself—ensuring that it’s reliable, secure, and ethical. This is where the true power of this intersection lies:

Blockchain Thrives where Trust, Traceability, and Transparency are non-negotiable

Blockchain has matured, and those in the know recognize that it’s making strategic inroads in industries where trust, transparency, and traceability are non-negotiable. Here are our top 10 favorite real-world examples of how enterprises are deploying blockchain today:

- Walmart & IBM (Supply Chain Transparency): Blockchain’s ability to create transparent, tamper-proof records is revolutionizing supply chains. Walmart has partnered with IBM on its Food Trust blockchain, which tracks the journey of food products from farm to table. The result? In cases of contamination, Walmart can trace the origins of food products like leafy greens in 2.2 seconds, a process that used to take days. This not only enhances food safety but also reduces the impact of recalls, lowering operational costs for Walmart.

- JPMorgan & Liink (Banking & Finance): In the financial sector, JPMorgan’s Liink platform, part of its Onyx blockchain division, connects more than 400 financial institutions to streamline cross-border payments. Liink enables banks to securely exchange payment-related data, reducing delays and improving transparency. This is critical in addressing the inefficiencies in $30 trillion worth of annual cross-border payments.

- Mastercard has launched its Provenance Solution using blockchain to trace the origins of goods along supply chains, ensuring authenticity. Through this platform, Mastercard tracks the source of goods like luxury items and pharmaceuticals, allowing retailers and consumers to verify the legitimacy of the products.

- Ripple (Cross-Border Payments): Ripple’s blockchain technology is used to handle cross-border payments efficiently, challenging the SWIFT network. Banks like Santander and American Express have partnered with Ripple to process payments faster and more cost-effectively. RippleNet, Ripple’s global payment network, allows financial institutions to process international payments in seconds instead of days, reducing operational costs and improving liquidity.

- Pfizer & MediLedger (Pharmaceutical Supply Chain): In healthcare, Pfizer and other pharmaceutical giants are using the MediLedger blockchain platform to improve the transparency and security of the pharmaceutical supply chain. With counterfeit drugs representing a major challenge globally, blockchain ensures the authenticity of drugs from manufacturing to delivery. This guarantees that medicines prescribed to patients are genuine, thereby improving safety and compliance.

- Procter & Gamble & Plastic Bank (Sustainability): Procter & Gamble (P&G) is partnering with Plastic Bank, a blockchain-powered social enterprise, to encourage recycling in coastal communities. Blockchain ensures transparency in the collection and recycling of plastic waste by giving communities access to a digital ledger that tracks plastic collection and recycling rates. Collectors are paid in a digital currency through the blockchain, fostering a circular economy while reducing ocean-bound plastic waste.

- Nestlé & OpenSC (Food Safety): Nestlé uses blockchain to track the entire journey of its sustainably sourced coffee and milk. The company partnered with OpenSC, a blockchain platform, to give consumers visibility into how their food is produced and shipped. Nestlé’s blockchain initiative enables customers to verify the source and sustainability of their products by scanning QR codes on packaging, providing unparalleled transparency in the food industry.

- Siemens (Energy): Siemens is leveraging blockchain technology for energy trading in microgrids. Siemens is piloting a blockchain-based energy trading system that allows decentralized energy producers (such as homeowners with solar panels) to sell excess energy directly to their neighbors. Blockchain simplifies transactions, ensuring transparency and reducing reliance on traditional utilities.

- De Beers (Diamond Tracking): De Beers, the world’s largest diamond producer, uses blockchain to track diamonds from the mine to the consumer. Through its Tracr platform, De Beers guarantees the authenticity and conflict-free status of its diamonds, providing end-to-end visibility in the diamond supply chain. This helps reduce the prevalence of “blood diamonds” and ensures ethical sourcing.

- Unilever (Sustainability and Supply Chains): Unilever has been piloting a blockchain platform to track the sustainability of its palm oil supply chain. The platform ensures that the palm oil it sources comes from sustainable farms and adheres to environmental and ethical standards. Blockchain helps verify that suppliers are compliant with Unilever’s sustainability goals, reducing deforestation and improving transparency for consumers.

Even governments are getting in on the action, exploring blockchain for applications like digital identities, land registries, and voting systems. These are high-stakes use cases that can’t afford failure, and blockchain’s decentralized and transparent nature is exactly what’s needed. The backing of public institutions is further proof that blockchain’s longevity isn’t in question—it’s inevitable.

The hype needed to die so that blockchain could get real.

It’s easy to mistake the cooling hype for blockchain’s failure, but this couldn’t be further from the truth. The technology is now living up to its potential—not as a universal fix, but as a tool with targeted, high-impact applications with trust, traceability, and transparency at the core.

Blockchain’s early downfall came from misaligned expectations—companies that treated blockchain as a solution in search of a problem quickly saw their projects fall apart. But today, we see real deployments that address industry-specific pain points. The so-called “blockchain winter” didn’t kill the tech, it forged it.

One reason blockchain was written off too soon was because of its early scalability and privacy issues. Bitcoin and Ethereum, the poster children of the blockchain movement, struggled to handle high transaction volumes and a perception that a technology built on transparency couldn’t offer any level of privacy. Critics were quick to pounce, labeling the technology impractical for large-scale use. But those issues are fading. Layer 2 solutions (think Ethereum rollups) and cross-chain interoperability protocols have unlocked blockchain’s potential for larger-scale applications and enhanced privacy – we highlighted these innovations here. And it’s happening right under the radar—while the media stopped talking, the developers are still building.

Improved interoperability between different blockchain networks means enterprises no longer need to be shackled to one platform. We’ve seen partnerships between tech giants, including Microsoft and Amazon, offering Blockchain-as-a-Service (BaaS), making it easier for companies to experiment and deploy blockchain in a modular, scalable way.

Failure is a Part of Blockchain’s Evolution

As with any new technology, blockchain has had its share of failures. However, these failures don’t signify the end of blockchain’s potential—they are part of its evolution. High-profile projects may have struggled, but these are valuable lessons that help drive the technology forward. It’s important to understand that blockchain isn’t a magic bullet—it needs to be deployed strategically with realistic expectations and a clear understanding of the problems it solves.

Some high-profile blockchain initiatives, such as TradeLens, have not lived up to their initial expectations – and we covered this specific example in January 2023. In late 2022, Maersk and IBM announced the decision to shut down TradeLens, citing the platform’s failure to achieve the necessary commercial viability and collaboration needed to scale across the industry. The demise of projects like TradeLens sheds light on some critical factors:

- Adoption and Network Effects: One of the biggest challenges for blockchain platforms like TradeLens is achieving widespread industry adoption. While TradeLens signed up some major shipping companies and port authorities, it didn’t bring on enough players to create the necessary network effect. Blockchain, especially in supply chain and logistics, thrives on collaboration between multiple stakeholders. Without critical mass, the benefits of transparency and efficiency diminish, making it harder for the project to sustain itself.

- Legacy Systems and Industry Resistance: Blockchain often has to compete with deeply entrenched legacy systems. In the case of TradeLens, many logistics companies and customs authorities were hesitant to abandon their existing systems, which were highly customized for their needs, in favor of a new technology that required significant changes in infrastructure and operations. The same applies to other industries where blockchain has to integrate with or replace complex legacy systems.

- Cost and Complexity: Implementing blockchain solutions can be costly and complex. TradeLens required significant resources for integration and maintenance. In industries with thin margins, like shipping, companies may be reluctant to make these upfront investments, especially if the long-term value proposition is uncertain. Blockchain platforms also demand interoperability between various players’ technologies, which adds to the implementation burden.

- Ecosystem and Trust: Blockchain projects, especially those like TradeLens that rely on multi-stakeholder participation, can fail when there isn’t enough trust between parties. TradeLens needed buy-in from competitors, governments, and intermediaries, but in many cases, these parties were reluctant to cooperate, citing concerns over data sharing and competitive advantage.

Failures provide insights on what doesn’t work, but they also highlight the areas where blockchain has the potential to thrive. Businesses are learning to focus on practical, industry-specific applications that address real problems, rather than using blockchain just because it’s the trendy thing to do.

Bottomline. Blockchain winter has forged a stronger, more focused technology that is now solving critical challenges across multiple sectors.

The early frenzy around blockchain may have passed, but that’s not a death knell—it’s a sign of the technology’s maturity. Blockchain is now in its proving ground phase, with tangible, transformative use cases emerging across industries like finance, supply chains, and healthcare. The death of hype isn’t the death of blockchain; it’s the beginning of a more grounded, valuable era.

Blockchain isn’t about spectacle. It’s about solving real business challenges, and it’s already doing just that. So, while the headlines may have moved on, blockchain hasn’t—it’s here, it’s scaling, and it’s delivering results.

Posted in : Analytics and Big Data, Artificial Intelligence, Automation, Blockchain, IoT, OT (Operational Technology), Supply Chain