In March 2021, Wipro closed the largest acquisition in its history, Capco, a BFSI-focused consulting firm, for $1.45B. HFS wrote glowingly about the transaction, with our positive assessment fueled by a confluence of circumstances including a new, unlikely pick for CEO (Thierry Delaporte) who brought a strong pedigree in integrations of significant acquisitions, driven by his experience of the successful merger of IGATE into Capgemini and his respected leadership within the financial services industry.

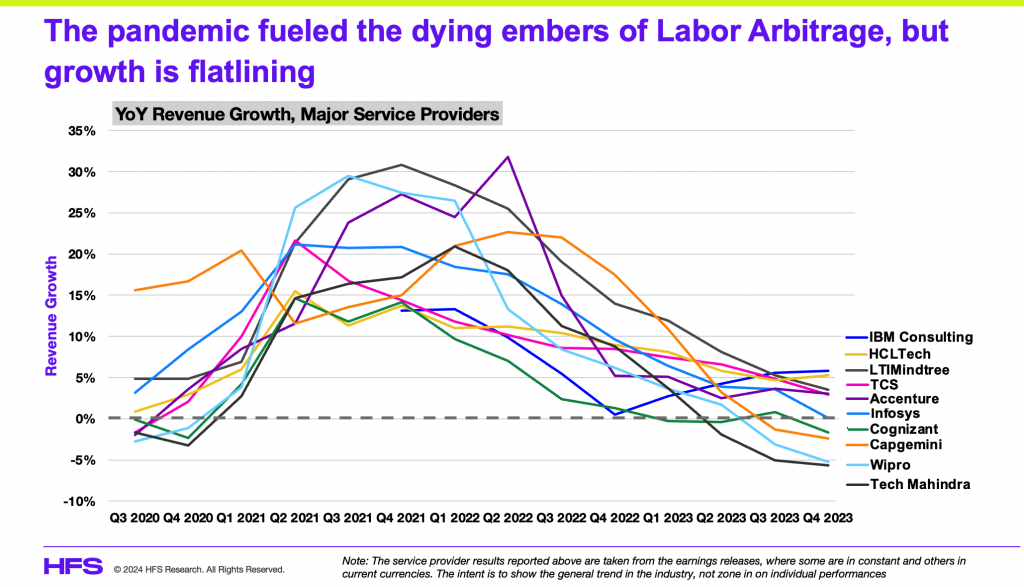

In addition, the IT services industry was enjoying a massive pandemic-fueled spike in digital and modernization spending, and there was some optimism that this acquisition would finally anoint Wipro as a true end-to-end transformation partner.

As we examine what Wipro has achieved in the three years since the acquisition, we regretfully opine that things have not gone well, as clearly outlined here:

What went wrong – market headwinds, culture clashes, and lack of integration

The potential to be a great acquisition was there. “Strategy-led execution” was what the combination of Capco and Wipro could yield. Capco brought deep BFSI consulting capabilities and strong C-Suite relationships outside the CIO’s office, which so many of Wipro’s competitors lack. Wipro brought extensive delivery and execution capabilities in IT services. This limited overlap was viewed as a benefit, with the game plan being to integrate the elements to drive end-to-end services capabilities “from think to design to build to operate”. The integration plans were executed – lots of great and well-intentioned account-specific plans were drawn up. However, Wipro grossly underestimated the cultural differences between their firms, namely Capco’s Western-heritage consulting versus Wipro’s India-heritage delivery mindset. This cultural mismatch was further exacerbated by keeping the brands separate.

Wipro additionally could not have planned for the inflation and associated market headwinds that torched many a bank in 2023. The combined result has been a massively detrimental slide in BFSI revenues which, as its largest reported industry vertical contributing about a third of revenue, has most definitely left a mark.

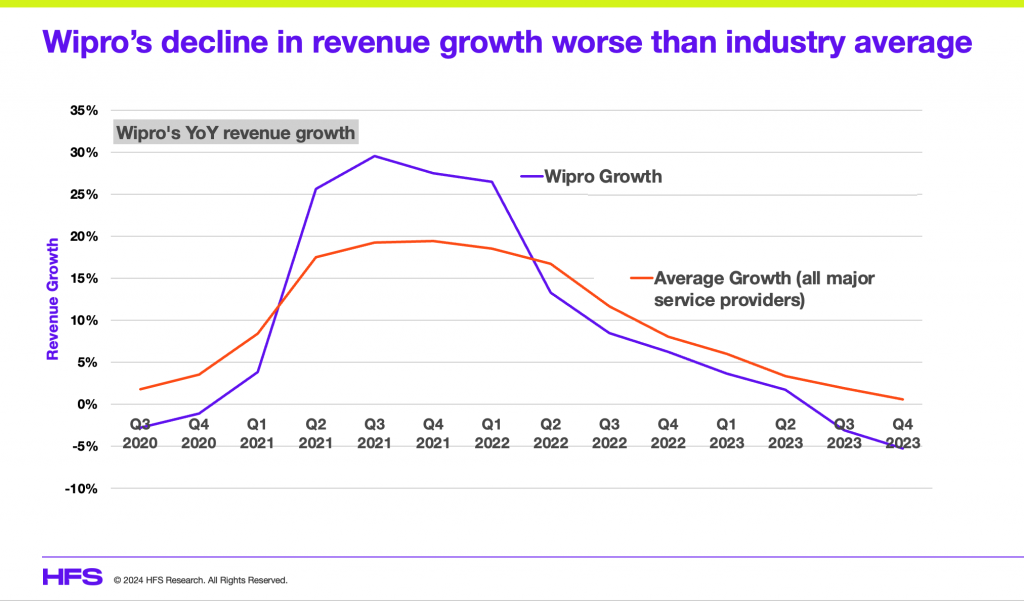

At HFS, we acknowledge Wipro’s revenue challenges are bigger than the Capco conundrum, however this was Thierry’s big bet and it’s clearly struggling. All services firms are battling continued market headwinds and even Accenture sent alarm bells across the industry with its bleak demand forecast for the year.

But the fact remains that Wipro made its largest-ever acquisition and has little to show for it other than the somewhat nominal addition of Capco revenues to its topline.

Despite adding a supposedly margin-rich consulting business, its operating margins are in fact lower than they were pre-pandemic. The following graphic puts a fine point on the state of Wipro vis-à-vis its competitors. Those that are staying above water are doing so due to heavy prioritization of technology arbitrage.

Why large consulting firms and offshore-centric outsourcing providers struggle to blend

There was a cheesy relationship self-help book from the 90s called “Men Are from Mars, and Women Are from Venus – a Guide to Understanding the Opposite Sex.” Apparently, BFSI strategy consultants and IT delivery and execution resources are also creatures from different planets. At least at Capco and Wipro, but the cold reality is there have been few successful large mergers between large onshore consulting firms and India-heritage service providers. The one exception is Capgemini and IGATE, where there was very limited client overlap, and Capgemini already had deep consulting capability. Plus Capgemini had learned from several past acquisitions which hadn’t fared as well.

There is a fundamental underlying reality: strategy consultants are in the business of paid ideation and hand off to execution resources to build and implement their recommendations. Basically, consultants sell the dreams, and service providers provide reality, which is sadly where this Capco/Wipro merger has found itself.

IT delivery and execution resources are paid to build, implement and manage business as usual operations. These should be complementary capabilities, as was the plan for Capco and Wipro, but the breakdown comes from a mismatch of enterprise buyers, Capco’s view of Wipro’s capabilities as commoditized delivery, and Wipro’s view of Capco’s consulting as pre-sales.

1+1 = 1.5

The idea of Capco as the tip of the spear for Wipro’s capabilities fell apart as Capco’s relationships with non-CIO leaders did not translate well to downstream Wipro engagements. HFS heard numerous reports of Capco consultants disparaging Wipro delivery resources as the “C-team”. Wipro in turn has its own cultural challenges – best described as a bad habit of treating consulting as cost of sales investments to land large build and run deals. Neither of these orientations lend themselves well to end-to-end transformation deals.

The Capco and Wipro teams were culturally opposed and never found a great working groove. The most damning evidence of this is the various conversations HFS has had with clients of each Capco and Wipro, where we inquired about the impact of the integration. Capco clients generally indicated they are interested in the build and run “bodyshopping” resources of Wipro, but have not been impressed with the caliber of their people. Wipro clients have generally indicated they often work with Capco in other parts of their firms, but have not had the need to bring them in for their IT build and run engagements.

The net-net is Capco and Wipro sell and run separate engagements, usually with different levels of executives on the client-side. Sure, Capco’s revenue accrues to Wipro, but there has been limited exponential impact from combining the two entities. Strategy-led execution deals have not materialized.

Sub-brands are the antithesis of integration

So Wipro basically has a strategy sub-brand. Capco continues to operate as Capco, now branded as a Wipro company. They have lost some of their talent, most recently Lance Levy, the longtime CEO of Capco who will now serve as a “strategic advisor”. But retention bonuses paid early on have helped keep some of their key operators. Although, as with Levy, the three year mark is often when golden handcuffs are released. What is ultimately keeping Wipro from realizing the value of its acquisition of Capco has been the lack of integration.

We truly thought Wipro’s CEO, Thierry Delaporte, understood the criticality of integrating acquisitions. After all he was the maestro behind Capgemini’s successful integration of IGATE, an eerily similar combination of consulting plus Indian IT services capabilities. However it was the reverse order of operations – a consulting company acquiring an execution firm. We’re not sure it matters though. As Capgemini has more recently demonstrated with its 2019 acquisition and integration of Altran, the name of the acquired entity must be put to rest otherwise the master brand loses equity. Altran has been known as Capgemini Engineering since early 2021. Why Delaporte and his team lacked the confidence to roll its newfound consulting skills under its own brand effectively undermines the value of Wipro. And with the announcement of new CEO Annie Rowland as Lance Levy’s replacement you’d have thought this an ideal time to fuse the brands together with the old guard finally leaving the building.

Other proof points include the highly acquisitive Accenture – arguably the master of acquisition integration – nearly 300 of them since it split from Arthur Andersen – with most acquired entities folded in and accruing to the master brand. Although even Accenture struggled with some earlier acquisitions as it was building out its brand as a digital and advertising business.

NTT DATA has finally seen the light after years of fragmented operations and the awkward co-existence of multiple brands. It recently announced the consolidation of all operations outside of Japan. The result is a $30B powerhouse slightly bigger than TCS.

The Bottom Line. The writing is on the wall. The Capco brand needs to be retired if Wipro has any hope of truly integrating and realizing the vision of strategy-led execution

HFS refers to 2023 as the year of the digital dichotomy, where enterprises across all industries struggled to balance market headwinds with the palpable need to drive progress and impact with innovation. No sector was harder hit than banking and financial services. A gigantic entity like Credit Suisse went down. The 2008 financial crisis was a long time ago, but banking is an old industry and everyone still remembers like it was yesterday.

So there was zero confidence in banking investment last year. Every service provider, most of which have BFSI as their largest reported industry group, are feeling the pain of massively elongated sales cycles, teeny contracts, and cut-throat competition. For Wipro, the firm needs to reign in its sub-brands (let us not forget DesignIT and TopCoder) and get down to the business of offering, delivering, and finally realizing its potential of providing end-to-end transformation services. The cost-to-income ratio of banks has been stagnant for twenty years. The need for change is there, and there,is no better time than now to make a bit bet on itself.

Posted in : Banking, BFSI, Consulting, IT Outsourcing / IT Services

Some really interesting observations about the acquisition. I wonder if the results are because of, or despite the the Capco integration? It did seem a bit odd at the time given the (perceived) gulf between the two companies as you allude to.

Who acquires who matters. Because of where the people from each entity see themselves in the pecking order. The consulting firm talent with their C level connects, strategy spurs and higher billing rates see themselves as bringing superior value to the table. The execution oriented largely offshore based services firm employees see themselves as order takers. The latter are not used to challenging client thinking, and that extends to locals close to clients. This natural power relationship is synergistic when the acquirer is the former. When the tables are turned there is confusion. Capco wouldn’t think Wipro can advise them on anything (therefore the C team pejorative) and Wipro managers struggle to culturally summon the conviction to get Capco talent to follow Wipro strategy despite them having “bought” Capco.