We thought the Y2K IT spending trigger was one-time bonanza… until we experienced the pandemic trigger, which saw IT investing bulge beyond our wildest dreams. Not only were we blowing cash on any collab app that seemed viable, any overpriced webcam on Amazon that would (surely) make you look amazing, but enterprise heads were also convinced they had to go on an insane rush into the cloud, even though their legacy systems and siloed 1960s processes were nowhere near ready.

Sadly, all good things come to an end as the majority of enterprises tighten their belts

Firstly, appreciate 2021 and 2022… we won’t see the likes of growth like it in IT services again. Or not until another trigger gets pulled, and we don’t know what that will look like – or when it will be. However, 2023 is going to be choppy, uncertain, and complex as we grapple with rampant global inflation and a recession everywhere except the US, which only decides to be in recession when Fox or CNN decides it’s time to be in one, based on whatever numbers can be spun to suit their agenda. Or when the government decides not to keep bailing out inept unregulated banks.

As soon as CFOs hear the “R” word, their hair-trigger response is to freeze all spending and gradually unfreeze items that are “critical” once they realize they were overreacting. Everything gets caught up in their web of austerity (except maybe some nice dinners with the auditors), and the humungous sums being lavished on all these expensive cloud migrations are under intense scrutiny as projects are either scaled back, accelerated to fruition, down-sized or even scrapped altogether.

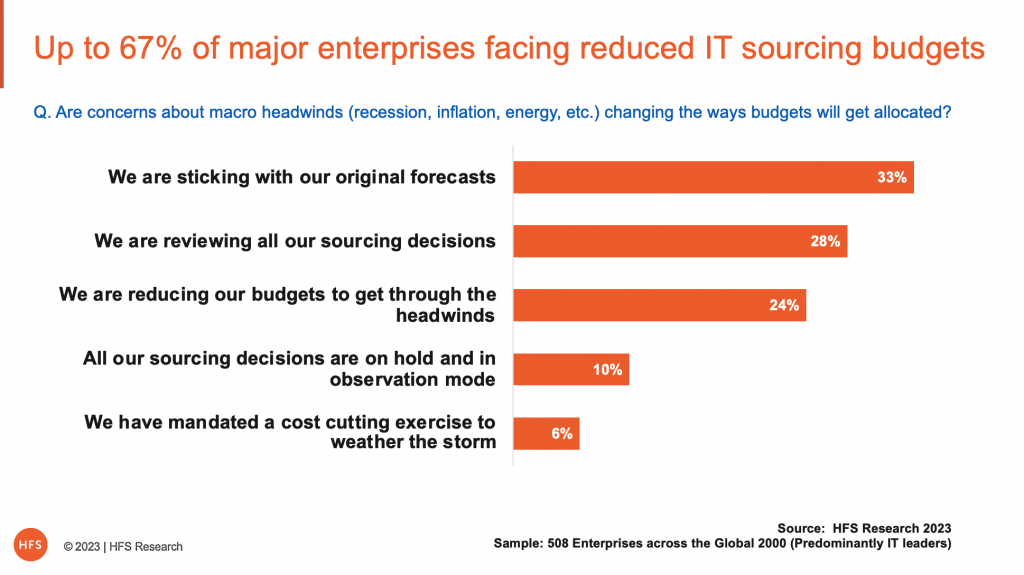

Brand new data from over 500 IT leaders across the global 2000 tells an ugly story of how quickly the cloud bingeing is grinding to a halt, with only a third of enterprises currently staying the course with their current IT sourcing investments:

As startling as these factors are, market indices such as the S&P500 and the FTSE100 continue to trade at record highs. None of the leading service providers or bellwether ISVs like SAP, Salesforce, and ServiceNow have talked about a fundamental change in the market conditions.

Against this backdrop, the data from the survey tells us that discretionary spend is disappearing fast. This is neither the time for fancy innovation projects nor lavish client entertainment. However, spend for managing the core operations of organizations is holding up. We haven’t come across indicators that would suggest a softening in sourcing activities beyond service providers privately complaining deal cycles are lengthening and harder to close. So let’s examine these conflicting views…

We have seen a rapid shift in focus from top-line to bottom-line

One way to read into these data points is that we are seeing a reversal of buying trends triggered by the pandemic, where lengthy project lifecycles with opaque objectives have been billed to enterprises like there is no tomorrow. What has rapidly changed is tech and operations leaders expect a commitment from their service providers to deliver tangible outcomes in clearly defined timeframes. We are seeing an increase in many projects shifting to quarterly budgeting – and being placed under considerable scrutiny to reach their desired conclusions on time and on budget.

The macro headwinds that we did describe will force service providers to deliver outcomes that drive efficiency and automation. They also have to demonstrate an understanding of their clients’ data requirements and processes to ensure workloads can be migrated to the cloud effectively; otherwise, these projects will be expensive, long and painful.

At the same time, those headwinds could spell trouble for innovative startups that require PoCs to show the proof-points of their capabilities. Enterprise leaders want certainty at predictable costs and to minimize their exposure to project failure.

How should both CIOs and cloud providers address this dramatic change in enterprise focus and spending in 2023 and beyond? Can they find new fizz by approaching the cloud differently?

HFS sees the following challenges:

- Hyperscalers must move beyond their obsession with consumption (read our earlier piece on AWS vs Google).

- SaaS providers must show more flexibility in their contractual agreements and go beyond standardized seat-based pricing to support broader transformation initiatives.

- Service providers must align technology with business objectives to (finally) capture business value for their clients

- CIOs must change their mindset from cost to business value. Thus, FinOps must be expanded to governance and, ultimately, business assurance.

- CIOs and Ops leaders much work together to map out their underlying data infrastructure to ensure it is cloud-ready

- The cloud discussion has to shift to business value.

Posted in : Buyers' Sourcing Best Practices, Cloud Computing, IT Outsourcing / IT Services