We've had many animated discussions in the past regarding the trials and tribulations of the HRO market.  To cut to the chase, HRO has struggled to live up to expectations as clients struggled with poorly integrated service delivery, overly complex operational issues, the lack of common HR standards and common HR technology platforms. This often resulted in negligible cost savings and fractured service provider relationships. Not to mention some significant write-downs by some of the providers who took on overly complex engagements.

To cut to the chase, HRO has struggled to live up to expectations as clients struggled with poorly integrated service delivery, overly complex operational issues, the lack of common HR standards and common HR technology platforms. This often resulted in negligible cost savings and fractured service provider relationships. Not to mention some significant write-downs by some of the providers who took on overly complex engagements.

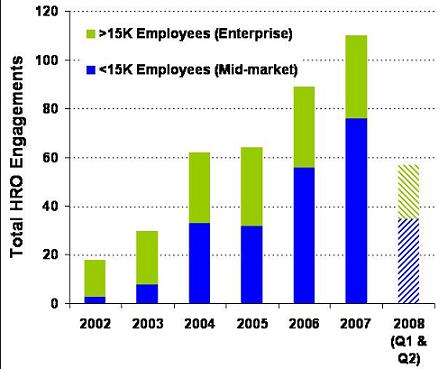

However, new research I've been carrying out in recent weeks

indicates significant recent shifts in this space, which have contributed to a renewed growth in new engagements. The multi-process HRO market grew by 24% in 2007 in new contract signings, and is ontrack to maintain a double-digit growth-rate, when taking into account the number of new contracts signed during the first half of 2008:

Reasons for this renewed growth?

Recent HRO engagements are largely much less complex than the earlier generation of contracts, primarily centered on payroll, contact ctr, workforce admin services

The HRO mid-market has not only arrived, it is now driving the market, spearheaded by a very strong performance by ADP

More efficient deployment of HR technology platforms bundled with HR processes (a dire industry need Naomi Bloom discusses here). 84% of current HRO engagements involved a new system being implemented either concurrently with or just prior to the HRO engagement. In a similar vein, 92% of the current HRO engagements involve the HRO service provider maintaining and supporting the HRO systems

The increased maturity of global outsourcing providers and the rapid deployment of offshore/nearshore HR delivery models

The leading HR services specialists sticking to their knitting

A significant move has come from the India-headquartered global services providers, with Wipro now commanding a 6% market share of the enterprise market with some significant new client engagements, and Infosys and TCS also gaining footholds in the market. IBM has also made some significant traction in the enteprise space.

The industry has gone back-to-basics to provide HRO services that are centered primarily on payroll and workforce admin solutions that are tried and tested, and less complex. The key has been for the service providers to deliver HR services that are based on common standards, common technology platforms, using lower-cost offshore and nearshore resources. Moreover, the entry of aggressive lower-cost competition from the global outsourcing providers has served to create a much more enticing value proposition for today’s buyer.

With a challenging 2009 ahead for enterprises, the availability of maturing HRO models are surely going to be enticing offerings for firms seeing to reduce overhead and move onto a global operating HR services model.

Posted in : Business Process Outsourcing (BPO), HR Outsourcing, HR Strategy

Phil,

Kudos to you for putting out the first balanced analysis on the HRO market in a long while. I am so tired of the constant trashing of HRO by the media, that it’s refreshing to have someone put it into perspective… with a twist of reality and humor,

James

Phil,

I couldn’t agree more with James’ comments. It’s interesting how quickly the India offshore vendors have been moving into this market. Do you see then challenging the traditional payroll services vendors such as ADP, Ceridian, Northgate etc?

Pete Stringer

While there were, indeed some serious service delivery problems, let’s recall that the HR departments that HRO replaces aren’t exaclty very high on the corporate popularity scale (usually just above internal audit and below IT!).

HRO providers inherit an disliked mess in most cases, so I cut them a little slack. There’s no excuse for making commitments they cannot live up to, though.

The next step for HRO providers is to shift from the “necessary evil” perception to “facilitator” or perhaps even “game-changer”. That would bring this segment of the industry to a complete turnaround. Not to mention, if one or more of these providers truly revolutionizes HR, the case for corporations to jump in would be very compelling.

Phil –

Great data and a nice write up as usual.

The only issue I take task with – and I think you’ll agree – is that our definition of what constitutes “HRO” has been modified significantly over the past 8 years. There was a day when one had extremely stringent criteria to ‘qualify’ as a true HRO deal. This often required in excess of six processes, the technology and the people.

Sure the market has evolved to it’s next generation which necessitates an evolution in how HRO is defined. However, I’m afraid that the language of “HRO” has been diluted so significantly that it no longer has meaning in the eyes of the industry. I could probably list 500 vendors who claim to offer HRO and that’s a problem. Perhaps it’s time for you to invent a new term my friend!

Nice work.

Best,

Mark

Mark,

You are dead-on – this type of HRO is very different from the end-to-end blockbuster deals of 2001 – 2005. And this was what the industry had to do to get its act together to start delivering operationally-efficient HR services based on common technology and common HR standards. In reality, these types of “transactional” HRO deals are what we should have started with originally, and the service providers could have then upsold HR transformation services into their clients once they had a trusted and operationally-effective engagement underway. “Big bang” was too messy, too much of a shock, and ultimately, not profitable. It had to change.

I am certain many of these relationships will broaden overtime to include additional HR processes, but this is the “back-to-basics” approach that is saving this market.

Oh – and a new name? How about “Transactional HRO”…

PF