So HP acquired EDS. Wow. Biggest services news since HP acquired Compaq a week before 9/11? In my opinion it is, anyway.

We discussed here in January the issue of consolidation among large outsourcing suppliers, and the general view was one that we would be unlikely to see acquisition among services firms that were similar in nature:

Outsourcers like to acquire firms that bring something new to the table to enhance their outsourcing offerings – for example new technologies, or a niche expertise that gives them competitive advantage. Too many large outsourcers are too similar… they overlap too much and a merger would often end up as an unprofitable exercise and result in a mass exodus of key talent.

So the HP / EDS merger goes against the grain. We noted some specific areas where there are some strong complimentary offerings – namely in BPO areas – but the overwhelming motive for the merger is one of scale and going-big to compete more effectively with IBM. The increased BPO delivery capability also puts HP on a firmer footing against the other global BPOs, namely Accenture, ACS, Capgemini, Infosys, Wipro and TCS. The newly-merged entity needs to examine how it builds out its business consulting and transformation expertise further if it wants to challenge the both IBM and Accenture’s BPO market leadership.

This merger-event could change the game considerably, and we could see other BPO suppliers to re-evaluate their acquisition strategies to generate more global scale and increase their client-bases. With the cost of client acquisition becoming increasingly prohibitive, the valuations of services firms decreasing in these market conditions, and the desire of many enterprises to move into more rapid outsourcing engagements, the leading vendors need additional scale and capacity. So this begs the question whether we could see some similar-scale outsourcing services mergers in the near-term?

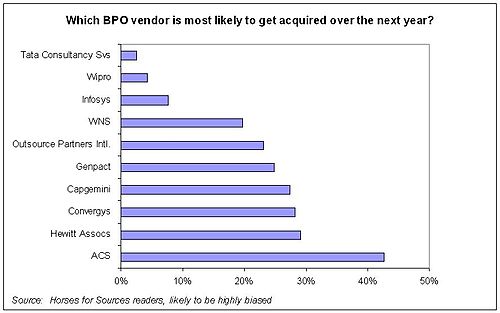

Please vote on the toolbar to the left whom you think is likely to be acquired over the next year – you can have up to three choices. I included major BPO suppliers with revenues under $9 billion and significant BPO client-bases. I would also love to hear your views on how the HP/EDS merger will impact consolidation in the BPO industry.

Update: The polls are now closed: here is how you all voted:

Congrats to ACS, the lucky winner… or should that be TCS?

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, HR Outsourcing, IT Outsourcing / IT Services

It certainly will. A lot of independent BPO advisers have been saying this for a long time. The market situation is changing dramatically. Economies across the globe are growing rapidly. See China, India and even the African continent is beginning to rumble with a annual rate of 5%.

These markets will require the needs ot the rapidly increasing middle-class to explode. We have been able to live a well contained lives in Europe/U.S here but the frenzy there is too hard to ignore. My trips across the world tell me that a lot is going to change.

Indian firms like Tata, Wipro, Satyam, HCL, Infosys etc have been long waiting for a “european hub” and this will trigger a long chain of acquisition spree. Clearly HP wants to go after IBM but a lot of surprise parties like Intel, GE etc will come into the game. A lot of parties are going to go after this market. The HP+EDS merger has made it a strong party that covers the necessary domains of SW/HW/SI to go for the increasingly flattening global market. HP has had troubles of its own, especially in India where they are constantly losing staff and are in dire need of shedding that needs to be shed (or that is unclinging itself from HP) and go after a mature partner that too is seeking a global presence. So EDS rides of HP’s risk-spread ready global market and HP rides on EDS’s services model and maturity, thus not worrying about its ungluing services workforce.

This leaves several parties like IBM, Sun, Dell, Oracle, Microsoft, Google, Intel, GE (Immelt has got to go for new markets as well, so do others BTW), etc go after their game.

HPs move is suddenly changing the eco-system conservationist attitude to a “free-for-all” market. Mark Hurd indeed has done a fast job at securing this acquisition. I think soon IBM is going to make a bold move as well, although they have a sound services model, they might go for Accenture just to keep up the lead. But like I said, the surprise can also come from a totally new direction.

Eventually its all about spreading the risk and have a sustainable global company, you can’t afford to do without it. Expect more big-daddy acquisitions this year.

-Tarry

I think HP is looking for margins. Servers are cheap today for the incredible amount of power you get. Most of our server costs are for memory and hard drives which HP simply rebrands and supports. Proliant DL380 is less than $2000. It will cost more than $10,000 to buy the hard drives and 32GB of RAM for it.

HP tried to increase margins by selling better support and extra licenses like console like access via it’s Integrated Lights Out feature on servers. Basically it’s a third network connection and as long as there is power to the server you can connect via a web browser and push the power button remotely among other features. We just use the base features.

By buying EDS they are buying a source of recurring revenue and they may even lower their support costs. An HP guy working at a GM site and call for onsite service. No need to pay someone in India to take the call, open a case, route it to a regional team, etc.

We have seen a slow and steady aquisition pattern in the tech sector during recovery from the tech bust of 2000.

Most wall street analysts believe the tech consolidation will continue but at a SLOWER but STEADY pace in years to come.

Amir – if you’d asked me the same question a week ago, I’d have agreed with you. However, the EDS merger may drive two, or even three, large-scale mergers in the medium-term. The pressure on vendors to keep prices down, pursuit costs at a minumum is driving the need for scale. The big question is whether they can achieve that scale organically (i.e. through client acquisition), or whether they will be forced into looking at merger options. In the short-term, I think the large Indian headquartered firms have the cost advantage through sheer scale of offshore staff (this also includes IBM, HP, Accenture), however, as wage-inflation continues, it is going to get harder for the smaller ITO/BPO firms to be competitive against the top tier..

Phil

Phil,

Interesting points here. The valuations of some of these firms are clearly slipping, so I would expect to see some mergers happen in the near-term. You didn’t mention CSC as a possible target, but am sure they must be wondering what is next for their business right now.

Allan Jones

Allan,

I didn’t include CSC as they are not – in essence – a BPO provider, although it does have some unique financial services solutions. They would potentially make an ideal partner to a provider with a strong BPO portfoilio (one of them is listed in the poll). CSC is experiencing some of the similar issues in this market to that of EDS – fending off low-cost aggressive Indian competition, and competing effective for onshore infrastructure business with IBM et al. While the HP deal takes out one of its strongest competitors – especially in the government sector, CSC now has a more daunting competitor in the new HP, while the Indian globals, such as TCS, are getting stronger by the day at winning global financial services clients, and developing their onshore presence.

Phil.

Phil,

I have a few observations. Overall, we will hear talk and discussion, but nothing more that will lead to a merger this large and complex among outsourcing providers.

I returned from China a few weeks ago. On that trip, I had the opportunity to hear IBM’s perspective and to learn from them. This was not a sales call. My conclusion is that HP/EDS has a long way to go before they catch up to the sophistication and capability that IBM has in its global processes. In addition, the culture at IBM is more mature, from an outsourcing perspective, than HP/EDS will have once that acquisition is complete.

Part of the problem with HP/EDS is going to be the diluted focus: do we make PCs and peripherals, or do we solve business problems? In what countries do we compete? These strategies are not something that one can write down and simply execute. If HP/EDS is ruthless and single-minded in their pursuit of IBM, they *might* be able to get onto the same racetrack that IBM is on in 5 to 7 years. But, the race is long and no one can tell whom will ‘beat’ whom.

Back to the merger question. The economic environment in the US and EU is probably best described as mixed, muddied, or muddled. This isn’t the time for many companies to use their liquidity or credit to initiate an acquisition they can ill afford. A few exceptions (banking primarily) will occur which just makes the picture a little muddier.

An outsourcing company must be very nimble and have operations in many locations around the world, not just a single country presence. Outsourcing is primarily used to obtain the same or better quality resources at a better price than in the home country (other reasons, “follow the sun” also exist). Inherent in that nimbleness are two key abilities: the ability of that outsourcing company to say to its resources: “We’ve been operating in Shanghai (for example) as an outsourcer, but a better place for us to operate would be (fill in the blank);” and the ability of its resources to pick up and go. It takes a while to develop the processes and procedures as well as the culture for that sort of nimbleness.

Should that stop HP/EDS? No, and it won’t stop others either. But, it should give the shareholders pause if the two companies are unable or unwilling to make the commitments necessary to achieve the return required from such an expenditure.

joe

Phil,

I agree with what you have said. I also want to add, it has been said that HP’s acquisition is due to its desire to extend reach for its storage business. That said, I would still give some weight to Larger firms being CAUTIOUS in acquisitions just because of acquisition failures like AOL & Time Warner. HP is known for being reasonably savvy though.

I do agree that with continuous consolidation the Opp/time window will keep shrinking and the pace may appear to quicken.

There are so many factors at play here, but the Tech M&A is as strong as ever these days, if not more. I would watch for interesting M&A and patterns in Software and Hardware solutions and not in services as services are becoming homogeneous in offering and need to align better with actual solutions.

Regards

Amir

I would agree with Joe on some aspects. Globalization is in a way a sort of aryanization. It is no different that what the Aryans did, they did it very well.

In fact they were smart consultants. They carried with them not just the great technology but also a very impressive idealogy thus opening doors to new markets/societies and that is what makes a firm a “globalization ready” firm.

To address the new and emerging markets and mesh into its current state, the two prerequisites of a “Global State/Order”, meaning central authority and mature social specialization makes IBM what it is today.

Talking to most of my peers in the outsourcing world and keeping my “dog eyes and ears” open on the web, I am sure that HP would at some time be able to compete globally against the likes of IBM, but the time is not now, not yet. It has its share of challenges as of now.

While these are some of the many techniques that should be coupled with what I call “Estuary-Ocean” Global Delivery Model. This is a sort of harrapanization, that shows exactly the influx-outflux of the typical “Gateway-Hub” sort of model, which should be the foundation of a true global firm. The coming years will tell us that we cannot afford to live in the fact-based management practice (static) but a pattern-based management practice (agile).

That level of sophistication needs time but having said that the M&As will continue as others too will look to ramp up.

As compared to the Compaq merger, this one shows interesting potential, actually. May eventually execute well. It is both about scale & also about complementary fit in capabilities.

Services firms are faced with numerous challenges – how to differentiate, high cost of customer acquisition, changing customer expectations, how to collaborate/innovate with customers, scale etc. Growing more of their offshore capability, like some of them did, is part of the answer. Further, where they focus on also depends on past strengths and track record.

There are also new opportunities/threats in the horizon – different from the traditional models of service delivery – all of which will require investment – new capability, technology etc.- some are better positioned, some are not.

(Given legacy, positioning in marketplace, client profile, opportunity etc.). So different strategies/motivations for M&A come into play in this context.

Valuations are being squeezed, new models/integrations perhaps evolve better when market/economic conditions are not so strong. The bigger players will look for new opportunities-either to grow scale or to set them up well for future needs via complementary fit and ofcourse, the better efficiency benefits aspects.

HP may be unique as far as acquisition bellwethers go. HP is a large company spread thin across many sectors from consumer (PC’s, desktop printers and home photo printers, Snapfish photo processing), to server HW, to gigantic enterprise services and SW contracting, to commercial and industrial graphics HW (Indigo press, Scitex wide format, OEM specialty) and more.

With some recent pull-backs from consumer (e.g. cameras), and recent thrust in enterprise acquisitions (e.g. EDP, Atos, EYP, Neoware, Mercury, etc.) and massive enterprise deals (e.g. Unilever), it seems obvious that HP is in a “re-invent” mode. You can also follow their patterns of layoffs and hiring in the news and on their jobs website to see their shift toward staffing enterprise services globally.

As for the EDP acquisition, scale would be part of the reason. But so is balance in core competencies. Throughout HP’s long history it has been a company of engineers making HW gizmos for other engineers, which is even reflected in many of their consumer products. Also, SW has never been HP’s native strength. However, acquisitions under Mark Hurd have brought in some serious enterprise software and services competency. EDP brings them more. They hook all this high-profit SW/Service stuff around low-margin HP industrial hardware. Expect even their PC’s to gravitate away from the give-an-inch-take-an-inch world vs. Dell on the consumer side in favor of their place as enterprise workstations.

If the integration goes well then HP has strengthened its new and evolving set of core competencies via EDP. Then you may see some shedding at HP rather than acquisitions. Maybe expect them then to consider spin-off of various consumer and creative oriented businesses (arenas in which HP always seemed uncomfortable), just like behemoth GE shedding their consumer appliance business. Other spin-off candidates are highly mechanical product lines – difficult to install and support which offsets supply profits and reliability reputation. They’ll favor the vaporous and profitable SW and services arena.

Bottom line: HP is unique – scaling up but also changing its personality, and expect some shedding, too.

Links:

http://h10055.www1.hp.com/jobsathp/content/search/search.asp?Lang=ENen

http://www.hp.com/hpinfo/newsroom/press/2008/080213a.html

http://www.hp.com/hpinfo/newsroom/press/2007/071107c.html